Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with this question in an hour, please please. It is really urgent. Course is AFA717 Canadian Income Taxation Question 3 (30 Minutes; 15

Please help with this question in an hour, please please. It is really urgent. Course is AFA717 Canadian Income Taxation

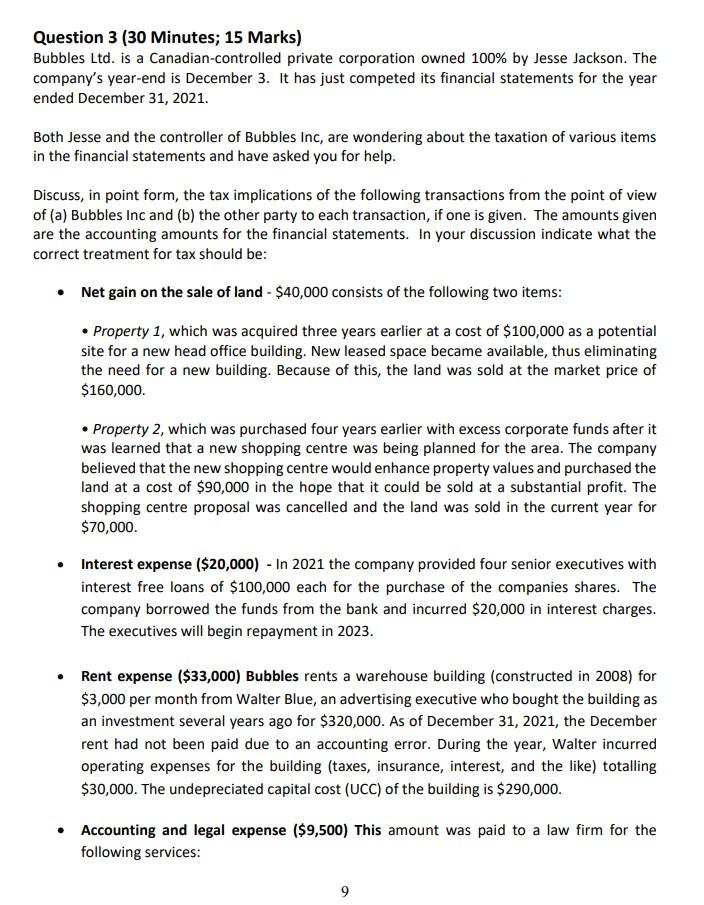

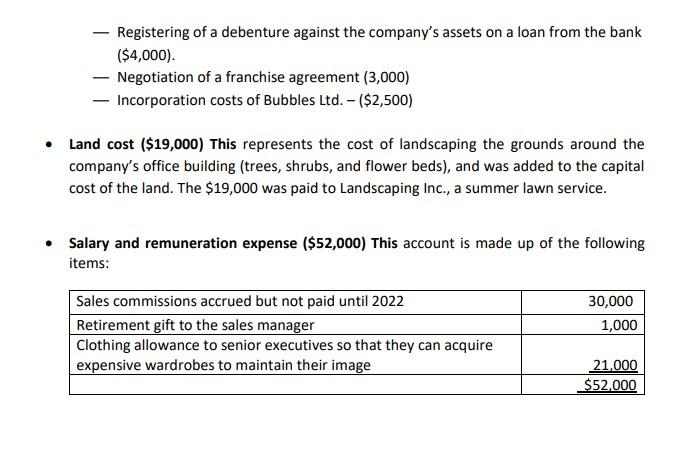

Question 3 (30 Minutes; 15 Marks) Bubbles Ltd. is a Canadian-controlled private corporation owned 100% by Jesse Jackson. The company's year-end is December 3. It has just competed its financial statements for the year ended December 31, 2021. Both Jesse and the controller of Bubbles Inc, are wondering about the taxation of various items in the financial statements and have asked you for help. Discuss, in point form, the tax implications of the following transactions from the point of view of (a) Bubbles Inc and (b) the other party to each transaction, if one is given. The amounts given are the accounting amounts for the financial statements. In your discussion indicate what the correct treatment for tax should be: Net gain on the sale of land - $40,000 consists of the following two items: Property 1, which was acquired three years earlier at a cost of $100,000 as a potential site for a new head office building. New leased space became available, thus eliminating the need for a new building. Because of this, the land was sold at the market price of $160,000 Property 2, which was purchased four years earlier with excess corporate funds after it was learned that a new shopping centre was being planned for the area. The company believed that the new shopping centre would enhance property values and purchased the land at a cost of $90,000 in the hope that it could be sold at a substantial profit. The shopping centre proposal was cancelled and the land was sold in the current year for $70,000 Interest expense ($20,000) - In 2021 the company provided four senior executives with interest free loans of $100,000 each for the purchase of the companies shares. The company borrowed the funds from the bank and incurred $20,000 in interest charges. The executives will begin repayment in 2023. Rent expense ($33,000) Bubbles rents a warehouse building (constructed in 2008) for $3,000 per month from Walter Blue, an advertising executive who bought the building as an investment several years ago for $320,000. As of December 31, 2021, the December rent had not been paid due to an accounting error. During the year, Walter incurred operating expenses for the building (taxes, insurance, interest, and the like) totalling $30,000. The undepreciated capital cost (UCC) of the building is $290,000. Accounting and legal expense ($9,500) This amount was paid to a law firm for the following services: 9 Registering of a debenture against the company's assets on a loan from the bank ($4,000). - Negotiation of a franchise agreement (3,000) - Incorporation costs of Bubbles Ltd. - ($2,500) Land cost ($19,000) This represents the cost of landscaping the grounds around the company's office building (trees, shrubs, and flower beds), and was added to the capital cost of the land. The $19,000 was paid to Landscaping Inc., a summer lawn service. Salary and remuneration expense ($52,000) This account is made up of the following items: 30,000 1,000 Sales commissions accrued but not paid until 2022 Retirement gift to the sales manager Clothing allowance to senior executives so that they can acquire expensive wardrobes to maintain their image 21.000 $52.000 Question 3 (30 Minutes; 15 Marks) Bubbles Ltd. is a Canadian-controlled private corporation owned 100% by Jesse Jackson. The company's year-end is December 3. It has just competed its financial statements for the year ended December 31, 2021. Both Jesse and the controller of Bubbles Inc, are wondering about the taxation of various items in the financial statements and have asked you for help. Discuss, in point form, the tax implications of the following transactions from the point of view of (a) Bubbles Inc and (b) the other party to each transaction, if one is given. The amounts given are the accounting amounts for the financial statements. In your discussion indicate what the correct treatment for tax should be: Net gain on the sale of land - $40,000 consists of the following two items: Property 1, which was acquired three years earlier at a cost of $100,000 as a potential site for a new head office building. New leased space became available, thus eliminating the need for a new building. Because of this, the land was sold at the market price of $160,000 Property 2, which was purchased four years earlier with excess corporate funds after it was learned that a new shopping centre was being planned for the area. The company believed that the new shopping centre would enhance property values and purchased the land at a cost of $90,000 in the hope that it could be sold at a substantial profit. The shopping centre proposal was cancelled and the land was sold in the current year for $70,000 Interest expense ($20,000) - In 2021 the company provided four senior executives with interest free loans of $100,000 each for the purchase of the companies shares. The company borrowed the funds from the bank and incurred $20,000 in interest charges. The executives will begin repayment in 2023. Rent expense ($33,000) Bubbles rents a warehouse building (constructed in 2008) for $3,000 per month from Walter Blue, an advertising executive who bought the building as an investment several years ago for $320,000. As of December 31, 2021, the December rent had not been paid due to an accounting error. During the year, Walter incurred operating expenses for the building (taxes, insurance, interest, and the like) totalling $30,000. The undepreciated capital cost (UCC) of the building is $290,000. Accounting and legal expense ($9,500) This amount was paid to a law firm for the following services: 9 Registering of a debenture against the company's assets on a loan from the bank ($4,000). - Negotiation of a franchise agreement (3,000) - Incorporation costs of Bubbles Ltd. - ($2,500) Land cost ($19,000) This represents the cost of landscaping the grounds around the company's office building (trees, shrubs, and flower beds), and was added to the capital cost of the land. The $19,000 was paid to Landscaping Inc., a summer lawn service. Salary and remuneration expense ($52,000) This account is made up of the following items: 30,000 1,000 Sales commissions accrued but not paid until 2022 Retirement gift to the sales manager Clothing allowance to senior executives so that they can acquire expensive wardrobes to maintain their image 21.000 $52.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started