Question

Please help with this question. Is my third time posting for help TABLE 2 Present Value of $1 $1 PV (1+ i) /i 1.0% 1.5%

Please help with this question. Is my third time posting for help

TABLE 2 Present Value of $1 $1 PV (1+ i)" /i 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 20.0% 1 0.99010 0.98522 0.98039 0.97561 0.97087 0.96618 0.96154 0.95694 0.95238 0.94787 0.94340 0.93458 0.92593 0.91743 0 90909 0 90090 0.89286 083333 2 0.98030 0.97066 0.96117 0.95181 0.94260 0.93351 0.92456 0.91573 0.90703 0.89845 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.69444 3 0.97059 0.95632 0.94232 0.92860 0.91514 0 90194 0.88900 0.87630 0.86384 0.85161 0.83962 0.81630 0.79383 0.77218 0.75131 0.73119 0.71178 0 57870 4 0.96098 0.94218 0.92385 0.90595 0.88849 0.87144 0.85480 0.83856 0.82270 0.80722 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 0 48225 5 0 95147 0.92826 0.90573 0.88385 0.86261 0.84197 0.82193 0.80245 0.78353 0.76513 0.74726 0.71299 0.68058 0.64993 0.62092 0 59345 0 56743 0 40188 6 0.94205 0.91454 0.88797 0.86230 0.83748 0.81350 0.79031 0.76790 0.74622 0.72525 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 0.50663 0.33490 7 0.93272 0.90103 0.87056 0.84127 0.81309 0.78599 0.75992 0.73483 0.71068 0.68744 0.66506 0.62275 058349 0.54703 051316 048166 0.45235 0.27908 8 092348 088771 085349 0.82075 0.78941 0.75941 0.73069 0.70319 0.67684 0.65160 0.62741 0.58201 0 54027 0.50187 046651 043393 0 40388 023257 9 0.91434 0.87459 0.83676 0.80073 0.76642 0.73373 0.70259 0.67290 0.64461 0.61763 0.59190 0.54393 0.50025 0.46043 0.42410 0.39092 0.36061 0.19381 10 090529 0.86167 0.82035 0.78120 0.74409 0.70892 0.67556 0.64393 0.61391 0.58543 0.55839 0.50835 046319 0 42241 038554 035218 0.32197 016151 11 0.89632 0.84893 0.80426 0.76214 0.72242 0.68495 0.64958 0.61620 0.58468 0.55491 0.52670 0.47500 0.42888 0.38753 0.35049 0.31728 0.28748 0.13450 12 0.88745 0.83639 0.78849 0.74356 0.70138 0.66178 0.62460 0.58966 0.55684 0.52598 0.49697 0.44401 0.39711 0 35553 031863 0.28584 0.25668 0 11216 13 0.87866 0.82403 0.77303 0.72542 0.68095 0.63940 0.60057 0.56427 0.53032 0.49856 0.46884 0.41496 0.36770 0 32618 0.28966 0.25751 0.22917 0 09346 14 0.86996 0.81185 0.75788 0.70773 0.66112 0.61778 0.57748 0.53997 0.50507 0.47257 0.44230 0.38782 0.34046 0 29925 026333 0.23199 0.20462 0 07789 15 0.86135 0.79985 0.74301 0.69047 0.64186 0 59689 0.55526 0.51672 0.48102 0.44793 0.41727 0.36245 0.31524 0 27454 023939 020900 0 18270 0 06491 16 0.85282 0.78803 0.72845 0.67362 0.62317 0.57671 0.53301 0.40447 045811 0.42458 0.30365 0.33873 0.20189 0.25187 0.21763 0.18829 0.16312 0.05409 17 0.84438 0.77639 0.71416 0.65720 0.60502 0.55720 0.51337 0.47318 0.43630 0.40245 0.37136 0.31657 0.27027 0.23107 0.19784 0 16963 0 14564 0 04507 18 0 83602 0 76491 070016 064117 0 58739 0 53836 049363 045280 041552 0 38147 0 35034 029586 025025 021199 0 17986 0.15282 0 13004 0.03756 19 082774 0 75361 068643 062553 0 57029 0 52016 047464 043330 039573 036158 0 33051 027651 023171 019449 016351 013768 011611 003130 20 081954 0 74247 0 67297 061027 055368 0 50257 045639 0 41464 0 37689 0 34273 031180 025842 021455 0 17843 014864 0 12403 0 10367 0 02608 21 0.81143 0.73150 0.65078 050530 0.53755 0.48557 043883 0.30679 0.35804 0.32486 0.20416 0.24151 0.19866 0.16370 0.13513 0.11174 0.00256 0.02174 24 0.78757 0.69954 0.62172 0.55288 0.49193 0.43796 039012 034770 031007 0.27666 024698 0.19715 0.15770 0.12640 0.10153 0.08170 0.06588 0.01258 25 0 7977 0.68921 0.60953 0 53939 0 47761 042315 0.37512 033273 029530 0.26223 0.23300 0.18425 0.14602 0.11597 0.09230 0.07361 0.05882 0.01048 28 0.75684 0.65910 0.57437 0.50088 0.43708 038165 033348 0.29157 025509 0.22332 0.19563 0.15040 011591 0.08955 0.06934 0.05382 0.04187 0.00607 29 0 74934 0 64936 0 56311 0 48866 0 47435 036875 0 32065 0.27902 024205 021168 0 18456 0 14056 0 10733 008215 006304 004849 0 03738 0 00506 30 0.74192 0.63076 0.55207 0.47674 0.41199 0.35628 0.30832 0.26700 0.23138 0.20064 0.17411 0.13137 0.09938 0.07537 0.05731 0.04368 0.03338 0.00421

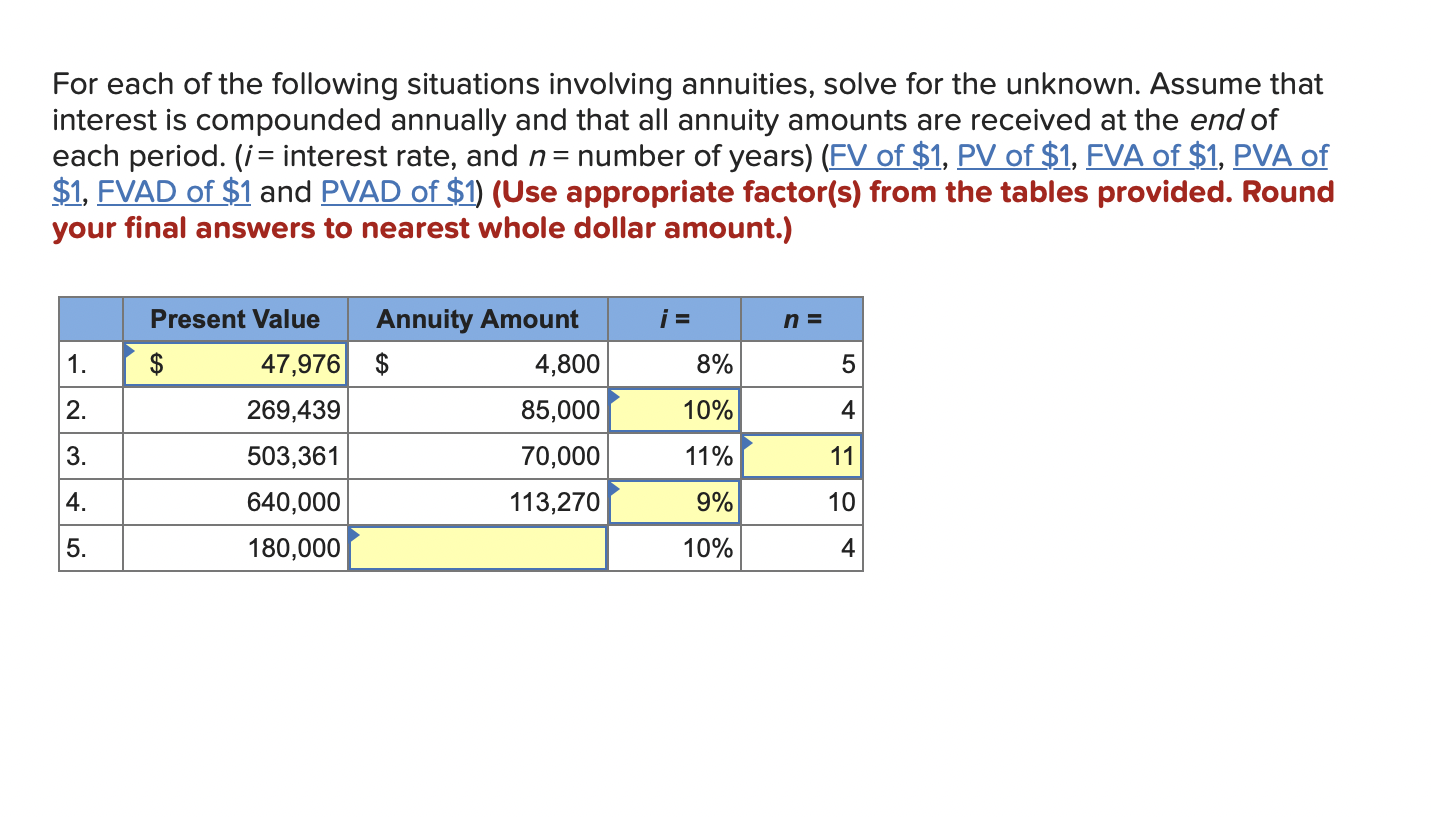

For each of the following situations involving annuities, solve for the unknown. Assume that interest is compounded annually and that all annuity amounts are received at the end of each period. ( i interest rate, and n= number of years) (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 ) (Use appropriate factor(s) from the tables provided. Round your final answers to nearest whole dollar amount.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started