Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with this question. Mike Ryan is the owner of Ryan Contractors, a successful small construction company. He spends most of his time out

please help with this question.

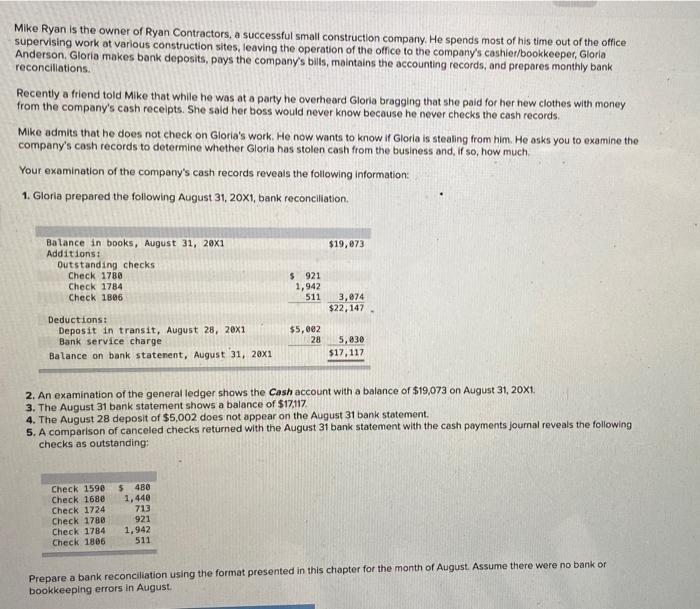

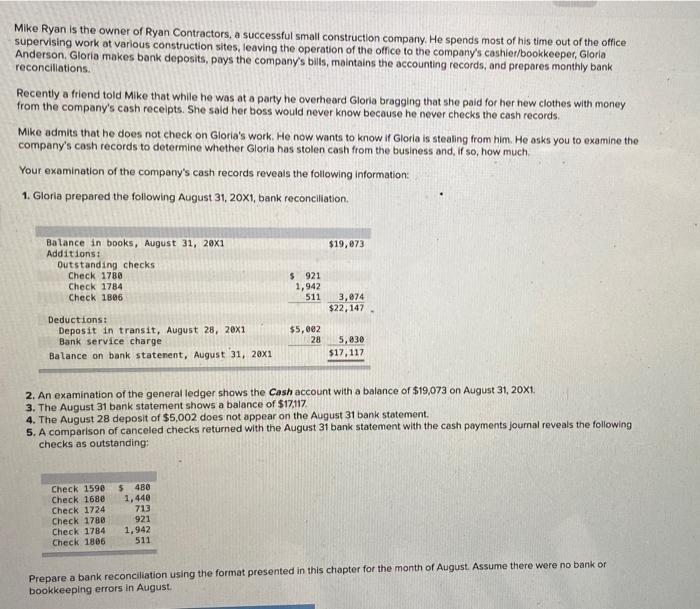

Mike Ryan is the owner of Ryan Contractors, a successful small construction company. He spends most of his time out of the office supervising work at various construction sites, leaving the operation of the office to the company's cashier/bookkeeper, Gloria Anderson. Gloria makes bank deposits, pays the company's bills, maintains the accounting records, and prepares monthly bank reconciliations Recently a friend told Mike that while he was at a party he overheard Gloria bragging that she paid for her new clothes with money from the company's cash receipts. She said her boss would never know because he never checks the cash records, Mike admits that he does not check on Gloria's work. He now wants to know if Gloria is stealing from him. He asks you to examine the company's cash records to determine whether Gloria has stolen cash from the business and, if so, how much Your examination of the company's cash records reveals the following information: 1. Gloria prepared the following August 31, 20x1, bank reconciliation. $19,073 Balance in books, August 31, 20X1 Additions: Outstanding checks Check 1780 Check 1784 Check 1886 $ 921 1,942 511 3,874 $22,147 Deductions: Deposit in transit, August 28, 20X1 Bank service charge Balance on bank statement, August 31, 20X1 $5,002 28 5,830 $17,117 2. An examination of the general ledger shows the Cash account with a balance of $19,073 on August 31, 20x1. 3. The August 31 bank statement shows a balance of $17.117. 4. The August 28 deposit of $5,002 does not appear on the August 31 bank statement. 5. A comparison of canceled checks returned with the August 31 bank statement with the cash payments Journal reveals the following checks as outstanding: Check 1590 Check 1680 Check 1724 Check 1788 Check 1784 Check 1886 $ 480 1,440 713 921 1,942 511 Prepare a bank reconciliation using the format presented in this chapter for the month of August. Assume there were no bank or bookkeeping errors in August

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started