Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with this signed to calculate Net Pay for the Nova Scotia Provincial GST Audit Department, you have been e payroll period for this

please help with this

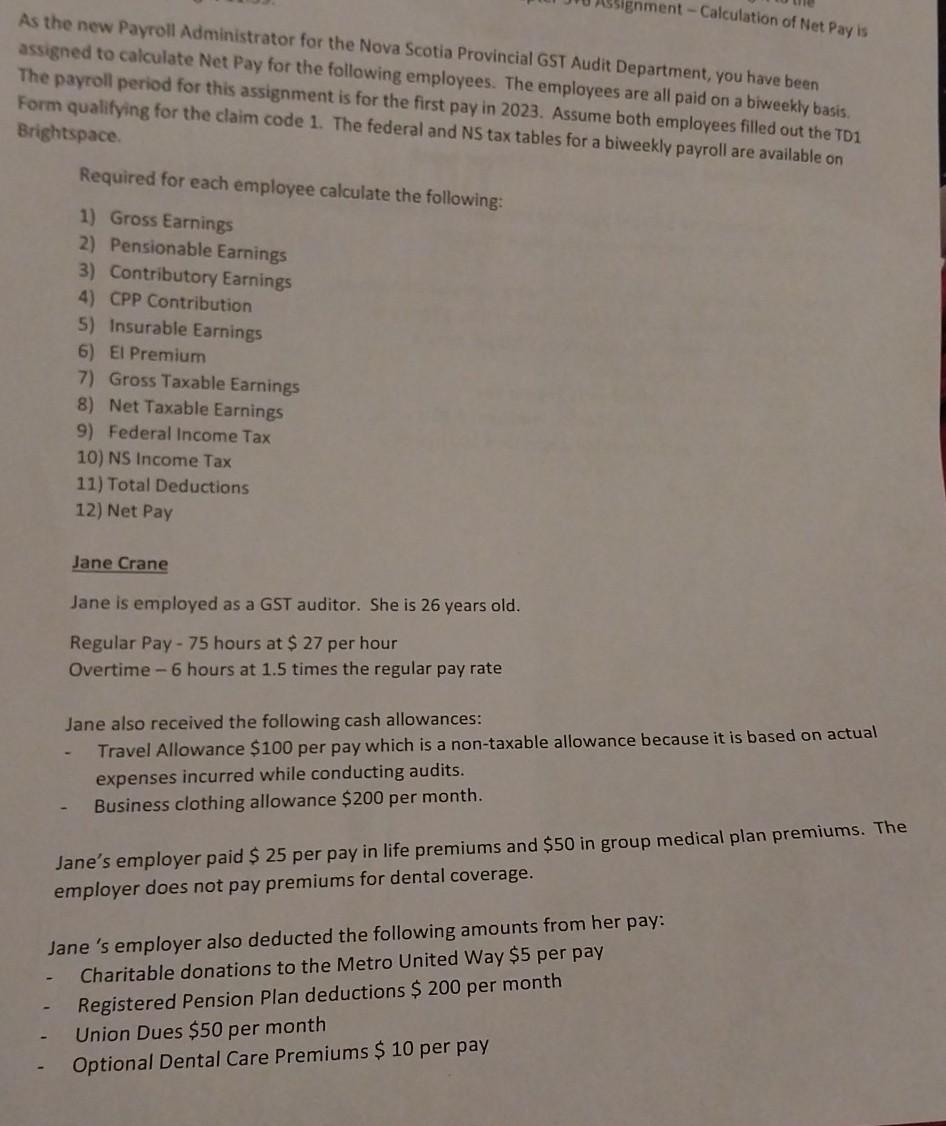

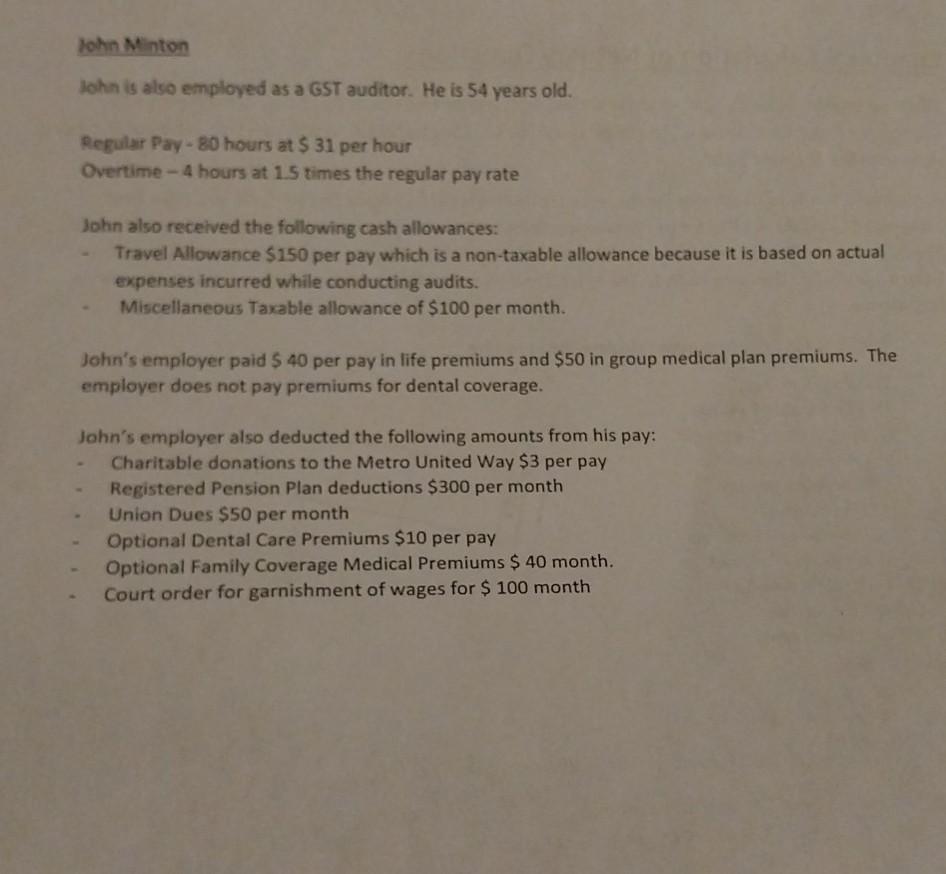

signed to calculate Net Pay for the Nova Scotia Provincial GST Audit Department, you have been e payroll period for this assignment is for employees. The employees are all paid on a biweekly basis. irm qualifying for the claim code 1 . The for the first pay in 2023. Assume both employees filled out the TD1 ightspace. Required for each employee calculate the following: 1) Gross Earnings 2) Pensionable Earnings 3) Contributory Earnings 4) CPP Contribution 5) Insurable Earnings 6) El Premium 7) Gross Taxable Earnings 8) Net Taxable Earnings 9) Federal Income Tax 10) NS Income Tax 11) Total Deductions 12) Net Pay Jane Crane Jane is employed as a GST auditor. She is 26 years old. Regular Pay - 75 hours at $27 per hour Overtime -6 hours at 1.5 times the regular pay rate Jane also received the following cash allowances: - Travel Allowance $100 per pay which is a non-taxable allowance because it is based on actual expenses incurred while conducting audits. - Business clothing allowance $200 per month. Jane's employer paid $25 per pay in life premiums and $50 in group medical plan premiums. The employer does not pay premiums for dental coverage. Jane 's employer also deducted the following amounts from her pay: - Charitable donations to the Metro United Way $5 per pay - Registered Pension Plan deductions $200 per month - Union Dues $50 per month - Optional Dental Care Premiums $10 per pay John is also employed as a GST auditor. He is 54 years old. Regular Pay-80 hours at $31 per hour Overtime -4 hours at 1.5 times the regular pay rate John also received the following cash allowances: - Travel Allowance $150 per pay which is a non-taxable allowance because it is based on actual expenses incurred while conducting audits. - Miscellaneous Taxable allowance of $100 per month. John's employer paid $40 per pay in life premiums and $50 in group medical plan premiums. The employer does not pay premiums for dental coverage. John's employer also deducted the following amounts from his pay: - Charitable donations to the Metro United Way $3 per pay - Registered Pension Plan deductions $300 per month - Union Dues $50 per month - Optional Dental Care Premiums $10 per pay - Optional Family Coverage Medical Premiums $40 month. - Court order for garnishment of wages for $100 month signed to calculate Net Pay for the Nova Scotia Provincial GST Audit Department, you have been e payroll period for this assignment is for employees. The employees are all paid on a biweekly basis. irm qualifying for the claim code 1 . The for the first pay in 2023. Assume both employees filled out the TD1 ightspace. Required for each employee calculate the following: 1) Gross Earnings 2) Pensionable Earnings 3) Contributory Earnings 4) CPP Contribution 5) Insurable Earnings 6) El Premium 7) Gross Taxable Earnings 8) Net Taxable Earnings 9) Federal Income Tax 10) NS Income Tax 11) Total Deductions 12) Net Pay Jane Crane Jane is employed as a GST auditor. She is 26 years old. Regular Pay - 75 hours at $27 per hour Overtime -6 hours at 1.5 times the regular pay rate Jane also received the following cash allowances: - Travel Allowance $100 per pay which is a non-taxable allowance because it is based on actual expenses incurred while conducting audits. - Business clothing allowance $200 per month. Jane's employer paid $25 per pay in life premiums and $50 in group medical plan premiums. The employer does not pay premiums for dental coverage. Jane 's employer also deducted the following amounts from her pay: - Charitable donations to the Metro United Way $5 per pay - Registered Pension Plan deductions $200 per month - Union Dues $50 per month - Optional Dental Care Premiums $10 per pay John is also employed as a GST auditor. He is 54 years old. Regular Pay-80 hours at $31 per hour Overtime -4 hours at 1.5 times the regular pay rate John also received the following cash allowances: - Travel Allowance $150 per pay which is a non-taxable allowance because it is based on actual expenses incurred while conducting audits. - Miscellaneous Taxable allowance of $100 per month. John's employer paid $40 per pay in life premiums and $50 in group medical plan premiums. The employer does not pay premiums for dental coverage. John's employer also deducted the following amounts from his pay: - Charitable donations to the Metro United Way $3 per pay - Registered Pension Plan deductions $300 per month - Union Dues $50 per month - Optional Dental Care Premiums $10 per pay - Optional Family Coverage Medical Premiums $40 month. - Court order for garnishment of wages for $100 monthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started