Please help with this. Steps shown

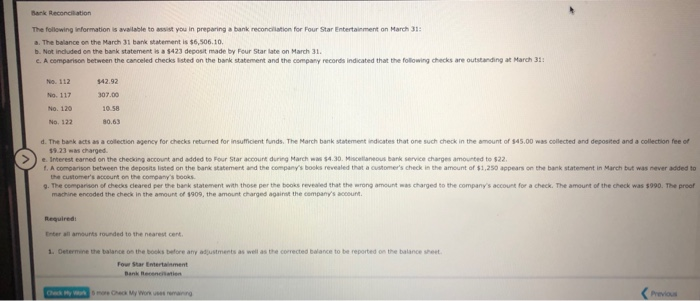

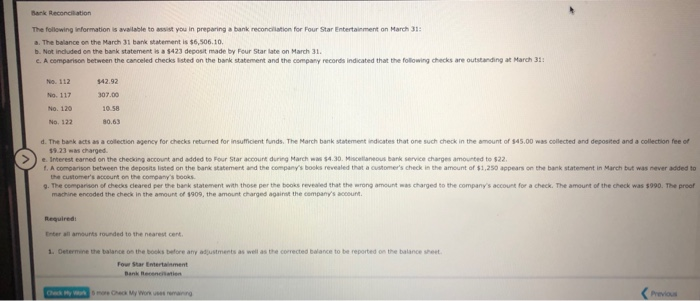

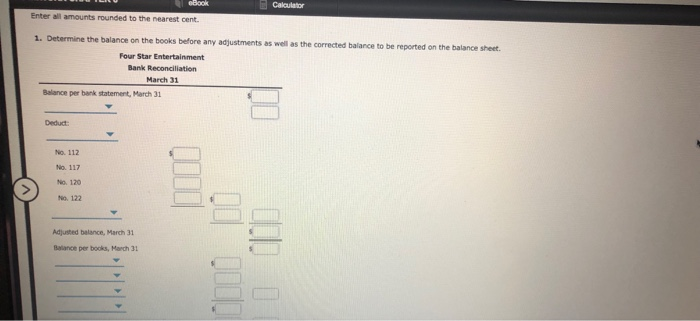

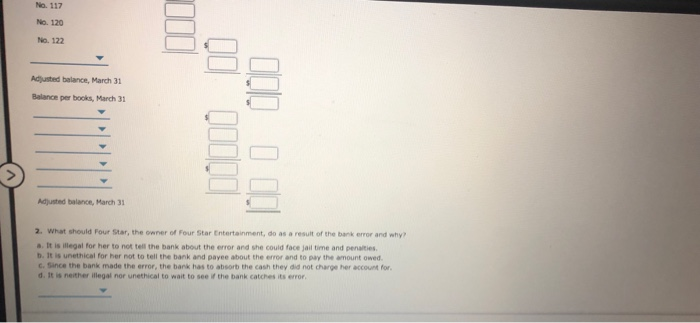

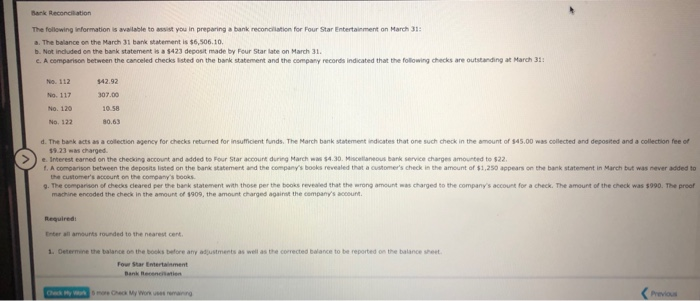

The following ieformation is avallable to assist you in preparing a bank reconcilation for Four Star Entertairment on March 33 a. The balance on the March 31 bank statement is $6,506.10 b. Not indluded on the bank statement is a $423 deposit made by Four Star late on March 31 c. A comparison between the canceled checks Iisted on the bank statement and the company records indicated that the following checks are outstanding at March 31 No. 112$42.92 No. 117307.00 0.58 d. The bank acts as a collection agency for checks returned for insufmicient funds. The March bank statement indicates that one such check in the amount of $45.00 was collected and deposited and a collection fee of 923 ws charged f. A comparison between the deposits listed on the bank statement and the company's bosks revealed that a custome's check in the amount of $1,250 appears on the bank statement in March but was never added to g. The eerperson er eheckS cleared per bank statement with those per the books reveuid that the wrong amount was charged to the company's accourt for a check. The amount of the deck was $990. The proof eInterest earned on the checking account and added to Four Star account during March was $4.30. Miscellaneous bank service charges amounted to $22. on the company's books machine encoded the check in the amount of $909, the amount charged against the company's accourn. Required Enter all amourts rounded to the nearest cent Determine the balance os the books before any adjustments as well as the corrected balance to be reported on the balance sheet Four Star Emtertainment Calculator all amounts rounded to the nearest cent. 1. Determine the balance on the book s before any adjustments as well as the corrected balance to be reported on the balance sheet. Four Star Entertainment Bank Reconciliation March 31 Balance per bank statement,March 31 Deduct: No. 112 No. 120 NO. 122 Adjusted balance, March 31 Balance per books, March 31 No. 120 No. 122 Adjusted balance, March 31 Balance per books, March 31 Adjusted balance, March 31 2. What should Four Star, the owner of Four Star Entertainment, do as a result of the bank error and why a. It is illegal for her to not tell the bank about the error and she could face jail time and penalities b. It is unethical for her not to tell the bank and payee about the error and to pay the amount owed C. Since the bank made the error, the bank has to absorb the cash they did not charge her account for d. It is neither illegal nor unethical to wait to see if the bank catches its error