please help with this!!

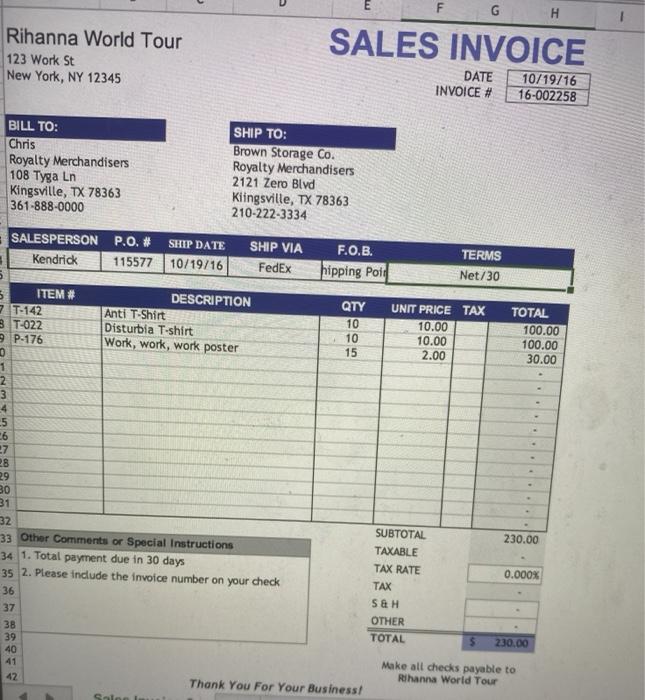

There are two journal entries described below. Use the Blank journal page provided to fill in the correct journal entries. Then upload the journal page using the Lab 18 Upload link. The invoice provided with this lab is the original source document for the Sales Entry. Journal entry 1: This is a sale journal entry 10/19. Sent Invoice 16-002258 along with merchandise. Analyze and journalize the sale. The customer has not paid for this merchandise yet; so, this is not a cash sale; it is an account receivable. The Sales Revenue is $230.00. The COGS for this sale is $115.00. Shipping is paid in a separate transaction by the customer directly to FedEx; so shipping expense for us is not a part of the sale; the customer will take care of that part. There is no sales discount. You can verify this information on the sales invoice. Journal entry 2: This is an allowance method write off journal entry 11/20. Receive a letter from the law firm, Dewey, Cheatham, & Howe. The letter states that their client, Royalty Merchandisers, has declared Bankruptcy and will not be paying the account associated with Invoice #16-002258 dated 10/19. You decide to go ahead and write off the entire balance of this account using the Allowance Write Off method. You can assume the allowance account has already been set up. So just the write off portion is needed. G H Rihanna World Tour 123 Work St New York, NY 12345 SALES INVOICE DATE INVOICE # 10/19/16 16-002258 BILL TO: Chris Royalty Merchandisers 108 Tyga Ln Kingsville, TX 78363 361-888-0000 SHIP TO: Brown Storage Co. Royalty Merchandisers 2121 Zero Blvd Kiingsville, TX 78363 210-222-3334 F.O.B. hipping Poit TERMS Net/30 SALESPERSON P.O. # SHIP DATE SHIP VIA Kendrick 115577 10/19/16 FedEx 5 ITEM # DESCRIPTION 7 T-142 Anti T-Shirt B T-022 Disturbia T-shirt P-176 Work, work, work poster QTY 10 10 15 UNIT PRICE TAX 10.00 10.00 2.00 TOTAL 100.00 100.00 30.00 1 2 3 4 5 26 27 28 29 30 31 32 33 Other Comments or Special Instructions 34 1. Total payment due in 30 days 35 2. Please include the invoice number on your check 36 37 38 39 40 41 42 Thank You For Your Business! 230.00 0.000% SUBTOTAL TAXABLE TAX RATE TAX S&H OTHER TOTAL 230.00 Make all checks payable to Rihanna World Tour