Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with work shown so i can try as well, please and thank you Management expects that it will take 50 hours of direct

please help with work shown so i can try as well, please and thank you

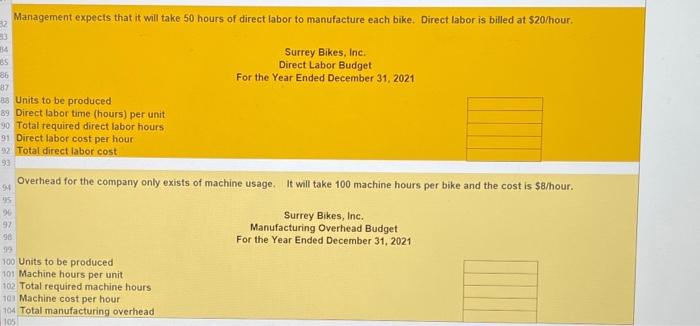

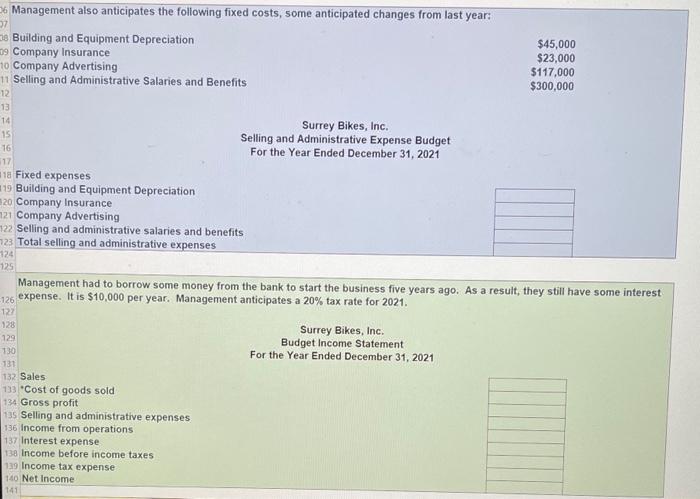

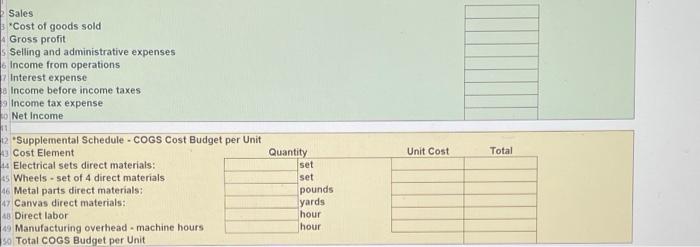

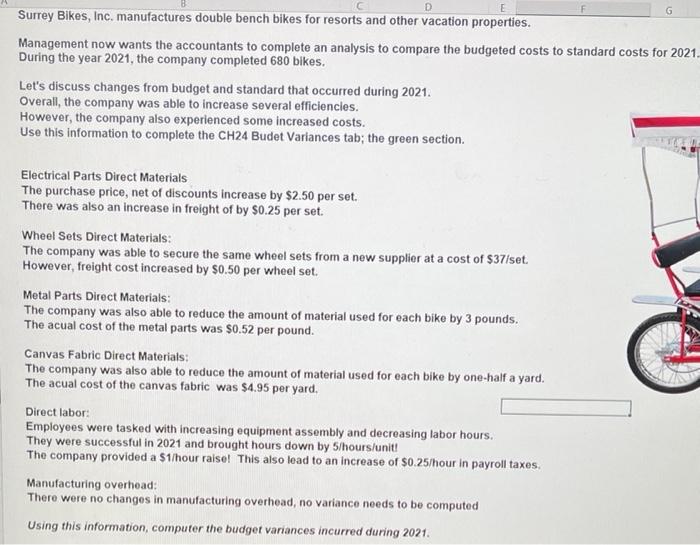

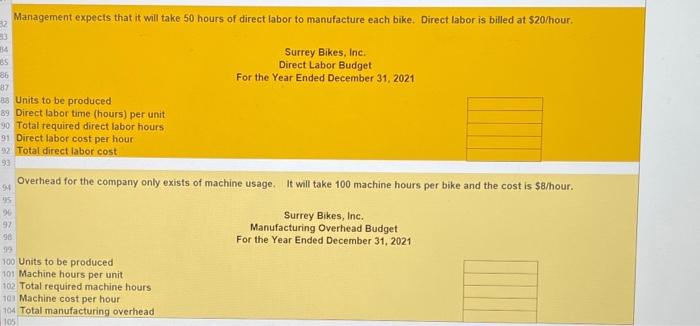

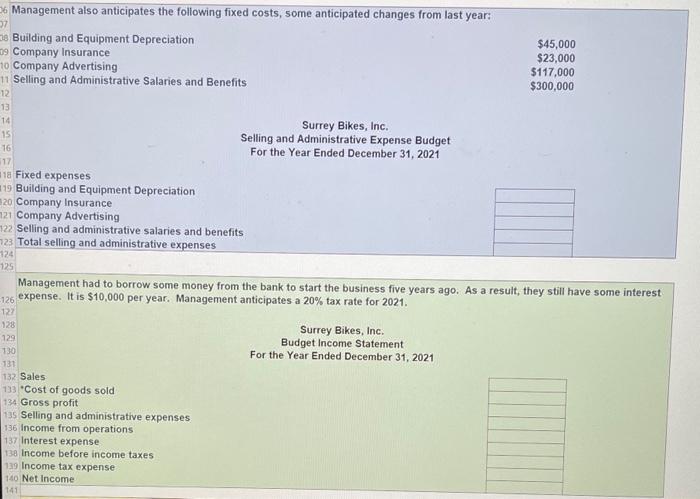

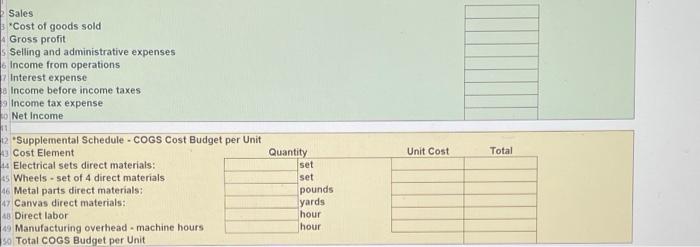

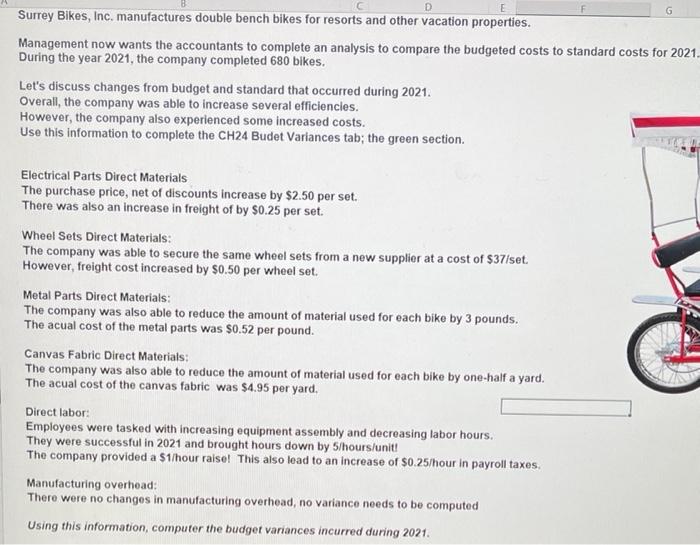

Management expects that it will take 50 hours of direct labor to manufacture each bike. Direct labor is billed at $20/hour. 134 Surrey Bikes, Inc. ES Direct Labor Budget 86 For the Year Ended December 31, 2021 87 B Units to be produced 89 Direct labor time (hours) per unit 90 Total required direct labor hours 91 Direct labor cost per hour 92 Total direct labor cost 93 Overhead for the company only exists of machine usage. It will take 100 machine hours per bike and the cost is $8/hour. 9 97 90 Surrey Bikes, Inc. Manufacturing Overhead Budget For the Year Ended December 31, 2021 100 Units to be produced 101 Machine hours per unit 102 Total required machine hours 101 Machine cost per hour 104 Total manufacturing overhead 105 6 Management also anticipates the following fixed costs, some anticipated changes from last year: 37 me Building and Equipment Depreciation $45,000 o Company Insurance $23,000 10 Company Advertising $117.000 11 Selling and Administrative Salaries and Benefits $300,000 12 13 14 Surrey Bikes, Inc. 15 Selling and Administrative Expense Budget 16 For the Year Ended December 31, 2021 117 1a Fixed expenses 19 Building and Equipment Depreciation 20 Company Insurance 21 Company Advertising 122 Selling and administrative salaries and benefits 723 Total selling and administrative expenses 124 125 Management had to borrow some money from the bank to start the business five years ago. As a result, they still have some interest 126 expense. It is $10,000 per year. Management anticipates a 20% tax rate for 2021 127 128 Surrey Bikes, Inc. Budget Income Statement 130 For the Year Ended December 31, 2021 737 132 Sales 133 Cost of goods sold 134 Gross profit 135 Selling and administrative expenses 136 Income from operations 137 Interest expense 138 Income before income taxes 139 Income tax expense 140 Net Income 141 129 Sales *Cost of goods sold Gross profit Selling and administrative expenses Income from operations Interest expense a Income before income taxes Income tax expense ho Net Income Unit Cost Total set 12 Supplemental Schedule - COGS Cost Budget per Unit Cost Element Quantity 14 Electrical sets direct materials: Wheels - set of 4 direct materials set 46 Metal parts direct materials: pounds 47 Canvas direct materials: yards 48 Direct labor hour 9 Manufacturing overhead - machine hours hour so Total COGS Budget per Unit D G Surrey Bikes, Inc. manufactures double bench bikes for resorts and other vacation properties. Management now wants the accountants to complete an analysis to compare the budgeted costs to standard costs for 2021 During the year 2021, the company completed 680 bikes. Let's discuss changes from budget and standard that occurred during 2021. Overall, the company was able to increase several efficiencies. However, the company also experienced some increased costs. Use this information to complete the CH24 Budet Variances tab; the green section. Electrical Parts Direct Materials The purchase price, net of discounts increase by $2.50 per set. There was also an increase in freight of by $0.25 per set. Wheel Sets Direct Materials: The company was able to secure the same wheel sets from a new supplier at a cost of $371set. However, freight cost increased by $0.50 per wheel set. Metal Parts Direct Materials: The company was also able to reduce the amount of material used for each bike by 3 pounds. The acual cost of the metal parts was $0.52 per pound. Canvas Fabric Direct Materials: The company was also able to reduce the amount of material used for each bike by one-half a yard. The acual cost of the canvas fabric was $4.95 per yard. Direct labor: Employees were tasked with increasing equipment assembly and decreasing labor hours. They were successful in 2021 and brought hours down by 5/hours/unit! The company provided a $1/hour raise! This also lead to an increase of $0.25/hour in payroll taxes. Manufacturing overhoad: There were no changes in manufacturing overhead, no variance needs to be computed Using this information, computer the budget variances incurred during 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started