please help (within the next hour)

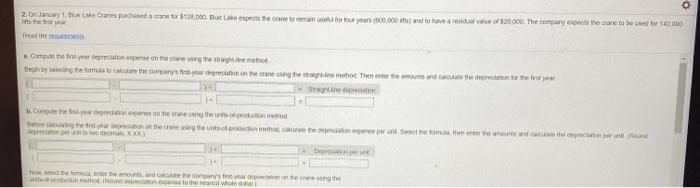

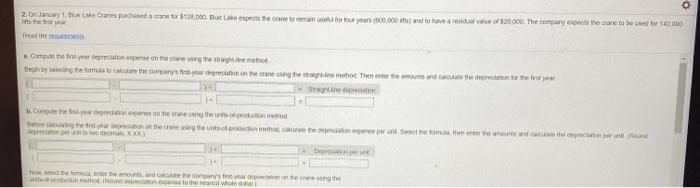

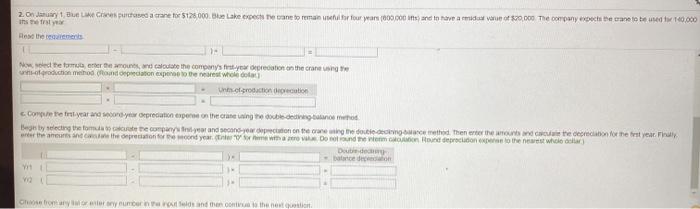

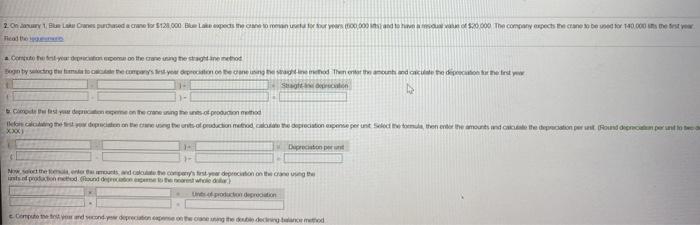

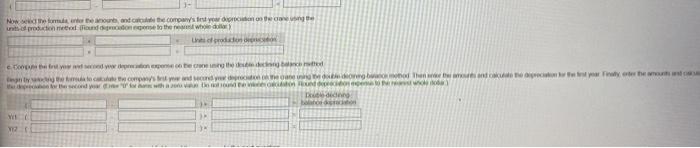

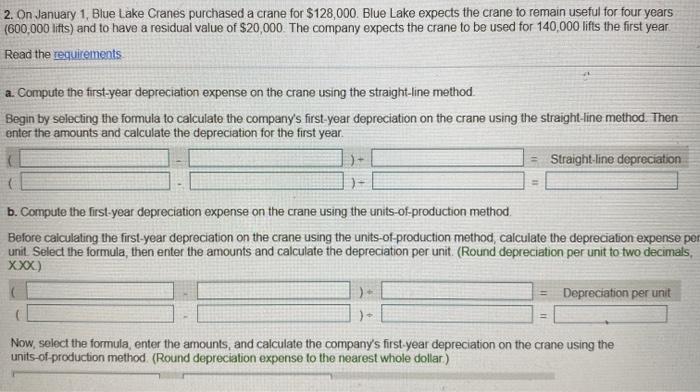

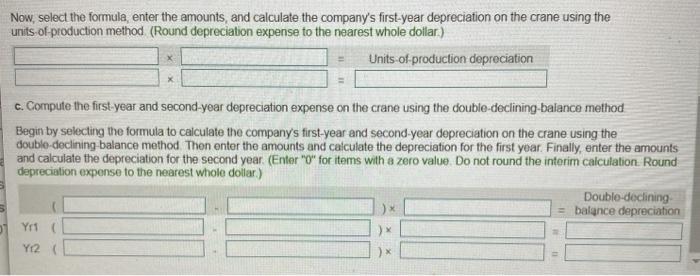

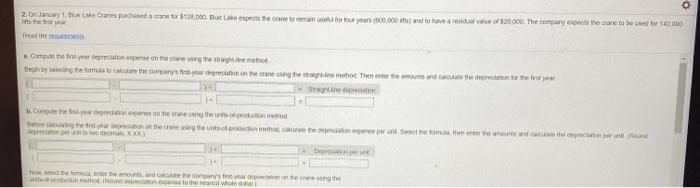

0 Zondary Files Lakers purchased a care $28.000. Blue Lake expecte care se for our years (100,000 ite and to have a de 20.000. The company expecte care to be the 48.00 Computeration expert on the sot Den en het them your one can get to the remote contre la D. mestring the words Gestert. Beim there was perox Thermocontain the 200 Les pucrosed a crane for $128.000 Lake expech e trane to remain weiter four years door de and to have a mix van of 20.000 The company expect the came to be used to 100.000 Nowed the formertere calculate the companys syaration on the crane radition ho adoration expert whole ola unt.crodaction lection compreenstyear and secondo precation expert on the craving the bodem Best selecting the tomate company and section on the went out the then there the corection for the best year. The on the neanche per on your wa Dodoma Reprodonepelthen who Dot Ghoomar uma menco the next 2. Onuary 1 color 5121000 Bluspects of 600.000 stand to $20.000 The company expects the cranber 190.000 stew * Contoh year the contestino Bened to the comes your precione cened there the amount and culte the diction of the testy Sagt 1- Cosy po there the phone Icong the units of production method to gente per un content the amounts opciones (Roudierunt Deco watermache contesterton on the fonteder Wide) condition Como consecindeid Now come on, and the company's first year in the mutana was Isai Conate aayal pture oringtonal y rate ) den a 2. On January 1, Blue Lake Cranes purchased a crane for $128,000. Blue Lake expects the crane to remain useful for four years (600.000 lifts) and to have a residual value of $20,000. The company expects the crane to be used for 140,000 lifts the first year Read the requirements a Compute the first-year depreciation expense on the crane using the straight-line method. Begin by selecting the formula to calculate the company's first-year depreciation on the crane using the straight-line method. Then enter the amounts and calculate the depreciation for the first year Straight-line depreciation b. Compute the first-year depreciation expense on the crane using the units-of-production method Before calculating the first-year depreciation on the crane using the units-of-production method calculate the depreciation expense per unit. Select the formula, then enter the amounts and calculate the depreciation per unit. (Round depreciation per unit to two decimals, XXX) Depreciation per unit Now, select the formula, enter the amounts, and calculate the company's first year depreciation on the crane using the units-of-production method (Round depreciation expense to the nearest whole dollar) Now, select the formula, enter the amounts, and calculate the company's first-year depreciation on the crane using the units-of-production method (Round depreciation expense to the nearest whole dollar) Units of production depreciation c. Compute the first year and second year depreciation expense on the crane using the double-declining balance method Begin by selecting the formula to calculate the company's first-year and second-year depreciation on the crane using the double-declining balance method Then enter the amounts and calculate the depreciation for the first year. Finally, enter the amounts and calculate the depreciation for the second year (Enter "O" for items with a zero value. Do not round the interim calculation. Round depreciation expense to the nearest whole dollar) Double-declining = balance depreciation Yr ) Y12