please help year 1-6

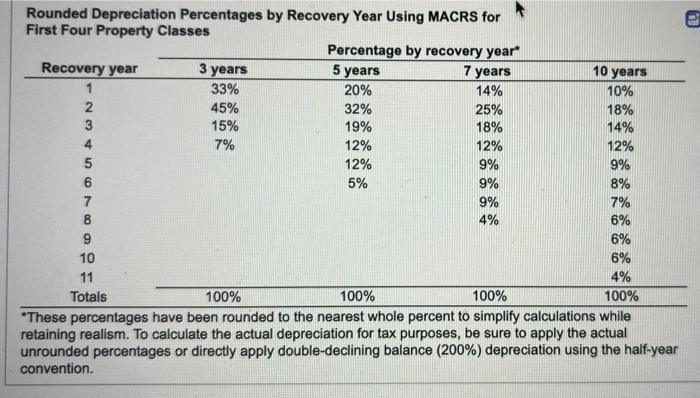

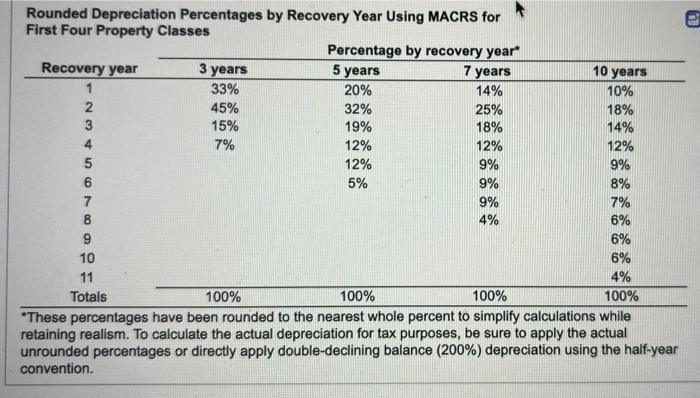

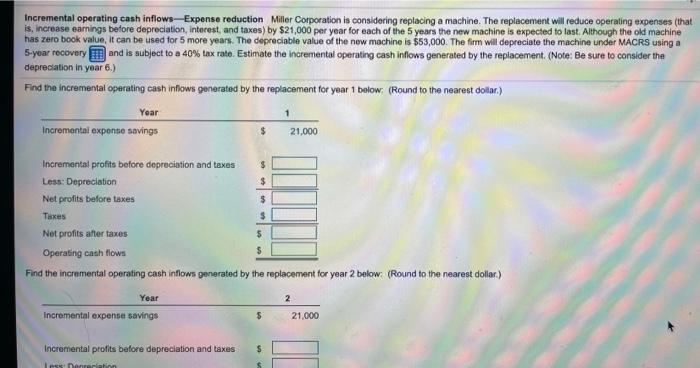

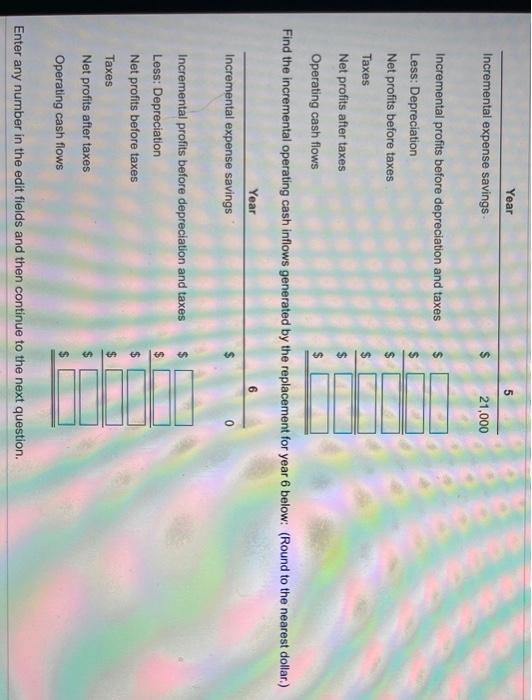

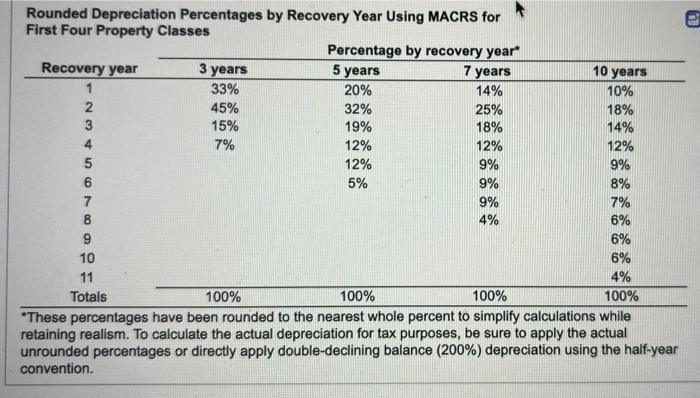

Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 7% 8 6% 9 10 6% 11 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention. 4% 6% Incremental operating cash inflows-Expense reduction Miller Corporation is considering replacing a machine. The replacement will reduce operating expenses (that is, increase earnings before depreciation, interest and taxes) by $21,000 per year for each of the 5 years the new machine is expected to last Although the old machine has zero book value, it can be used for 5 more years. The depreciable value of the new machine is $53,000. The firm will depreciate the machine under MACRS using a 5-year recovery and is subject to a 40% tax rate. Estimate the incremental operating cash inflows generated by the replacement. (Note: Be sure to consider the depreciation in year 6.) Find the incremental operating cash inflows generated by the replacement for year 1 below: (Round to the nearest dollar) Year 1 Incremental exponse savings $ 21.000 $ $ $ $ Incremental profits before depreciation and taxes Less: Depreciation Net profits before taxes Taxes Net profits after taxes Operating cash flows Find the incremental operating cash inflows generated by the replacement for year 2 below: (Round to the nearest dollar.) Year 2 incremental expense savings 5 21.000 S Incremental profits before depreciation and taxes Less Donnerstin Year 5 Incremental expense savings 21,000 Incremental profits before depreciation and taxes Less: Depreciation Net profits before taxes Taxes $ $ $ $ Net profits after taxes Operating cash flows Find the incremental operating cash inflows generated by the replacement for year 6 below: (Round to the nearest dollar) Year Incremental expense savings 0 Incremental profits before depreciation and taxes Less: Depreciation Net profits before taxes Taxes Net profits after taxes Operating cash flows Enter any number in the edit fields and then continue to the next