Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please helpp To begin your assignment you gather the following financial data and ratios that are typical of companies in Lydex Company's industry: ratios that

please helpp

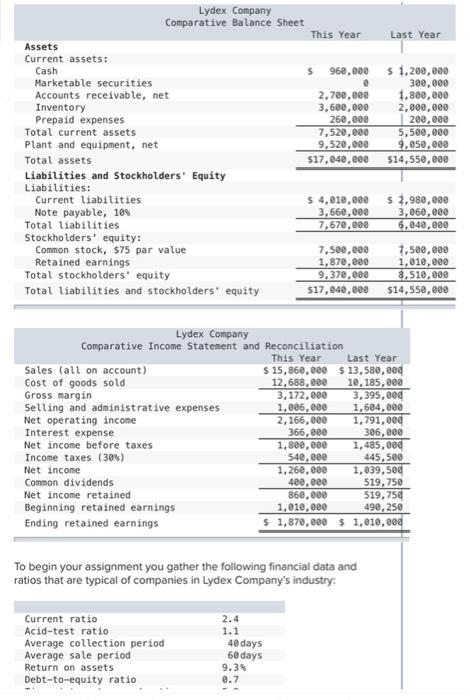

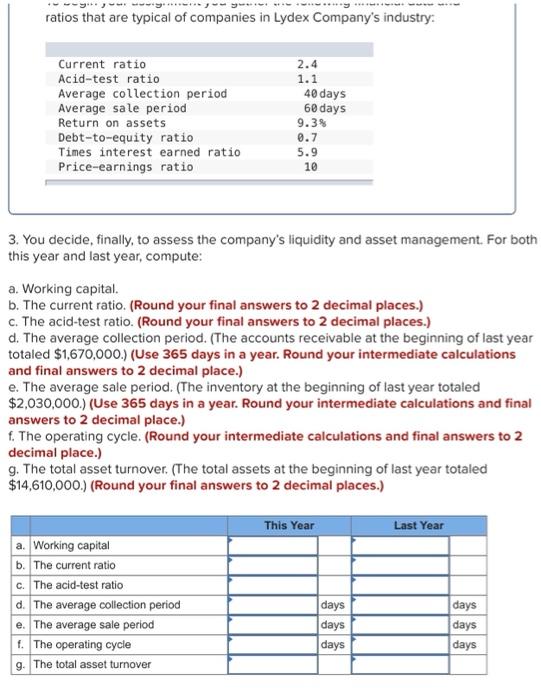

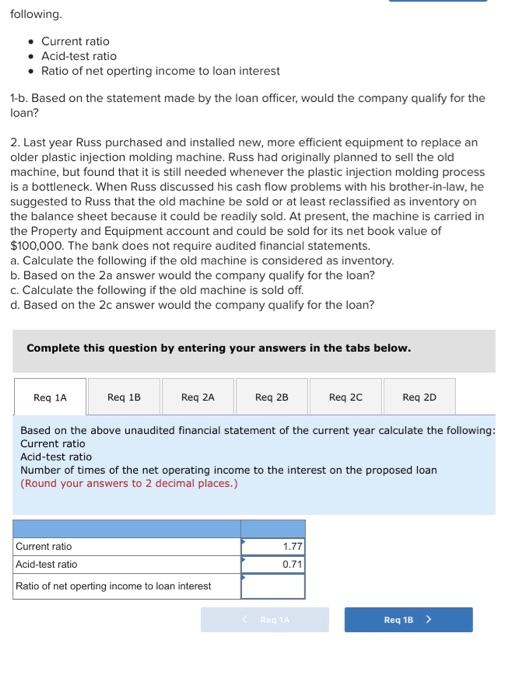

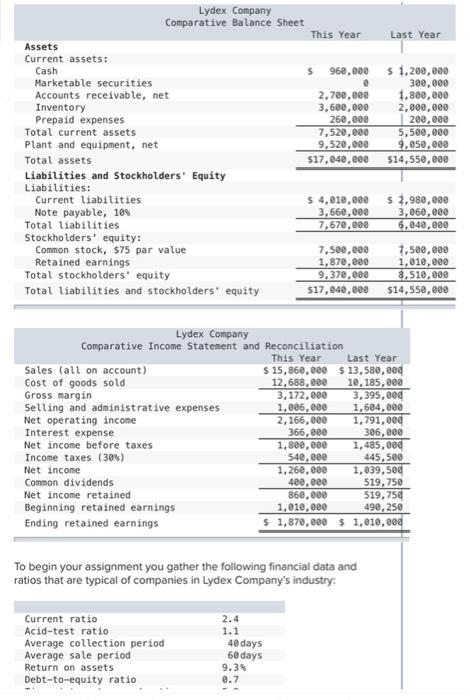

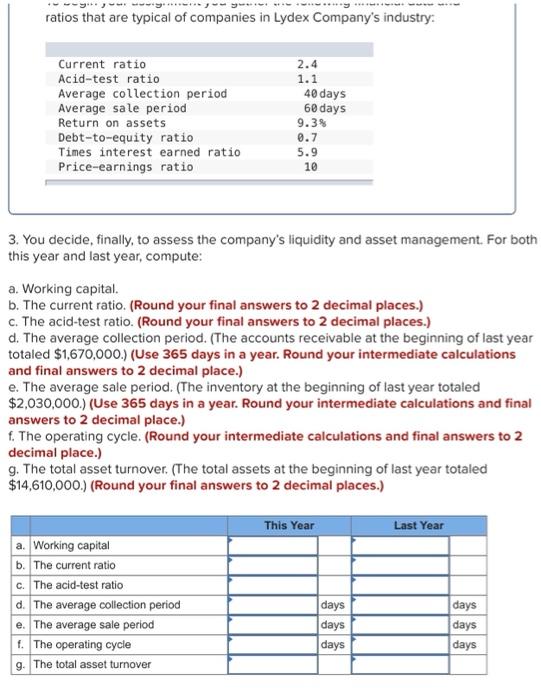

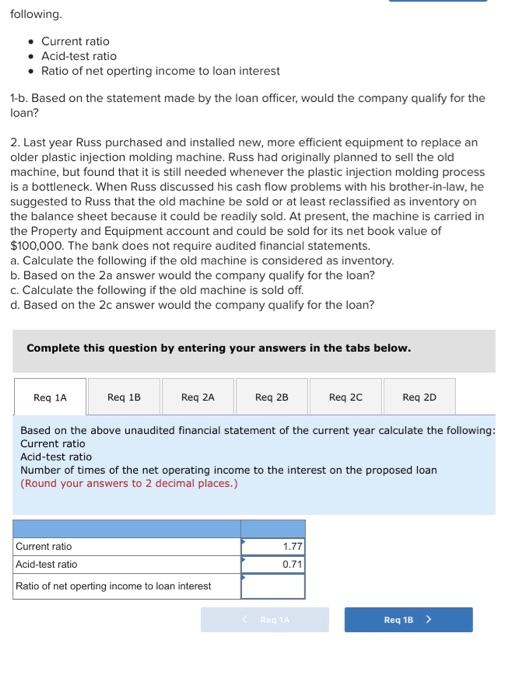

To begin your assignment you gather the following financial data and ratios that are typical of companies in Lydex Company's industry: ratios that are typical of companies in Lydex Company's industry: 3. You decide, finally, to assess the company's liquidity and asset management. For both this year and last year, compute: a. Working capital. b. The current ratio. (Round your final answers to 2 decimal places.) c. The acid-test ratio. (Round your final answers to 2 decimal places.) d. The average collection period. (The accounts receivable at the beginning of last year totaled $1,670,000.) (Use 365 days in a year. Round your intermediate calculations and final answers to 2 decimal place.) e. The average sale period. (The inventory at the beginning of last year totaled $2,030,000.) (Use 365 days in a year. Round your intermediate calculations and final answers to 2 decimal place.) f. The operating cycle. (Round your intermediate calculations and final answers to 2 decimal place.) g. The total asset turnover. (The total assets at the beginning of last year totaled $14,610,000.) (Round your final answers to 2 decimal places.) following. - Current ratio - Acid-test ratio - Ratio of net operting income to loan interest 1-b. Based on the statement made by the loan officer, would the company qualify for the loan? 2. Last year Russ purchased and installed new, more efficient equipment to replace an older plastic injection molding machine. Russ had originally planned to sell the old machine, but found that it is still needed whenever the plastic injection molding process is a bottleneck. When Russ discussed his cash flow problems with his brother-in-law, he suggested to Russ that the old machine be sold or at least reclassified as inventory on the balance sheet because it could be readily sold. At present, the machine is carried in the Property and Equipment account and could be sold for its net book value of $100,000. The bank does not require audited financial statements. a. Calculate the following if the old machine is considered as inventory. b. Based on the 2a answer would the company qualify for the loan? c. Calculate the following if the old machine is sold off. d. Based on the 2c answer would the company qualify for the loan? Complete this question by entering your answers in the tabs below. Based on the above unaudited financial statement of the current year calculate the following: Current ratio Acid-test ratio Number of times of the net operating income to the interest on the proposed loan (Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started