Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELPPPP 3. (20 points) Choose a company and do a web search to find their stock prices overore past several years. Please do NOT

PLEASE HELPPPP

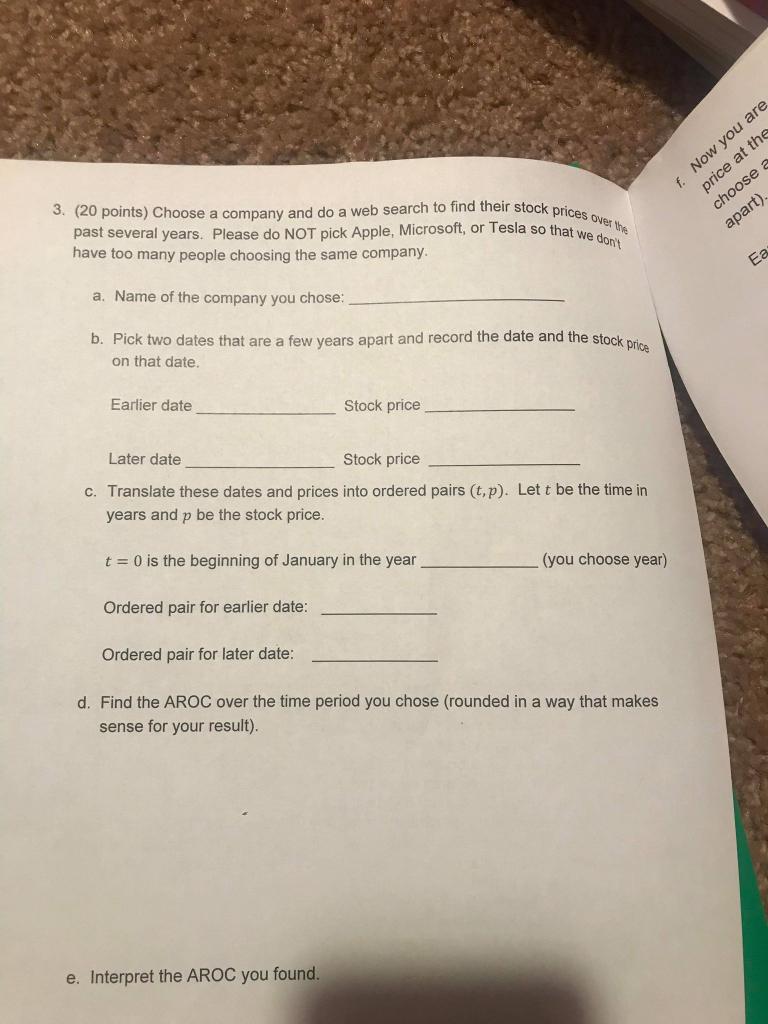

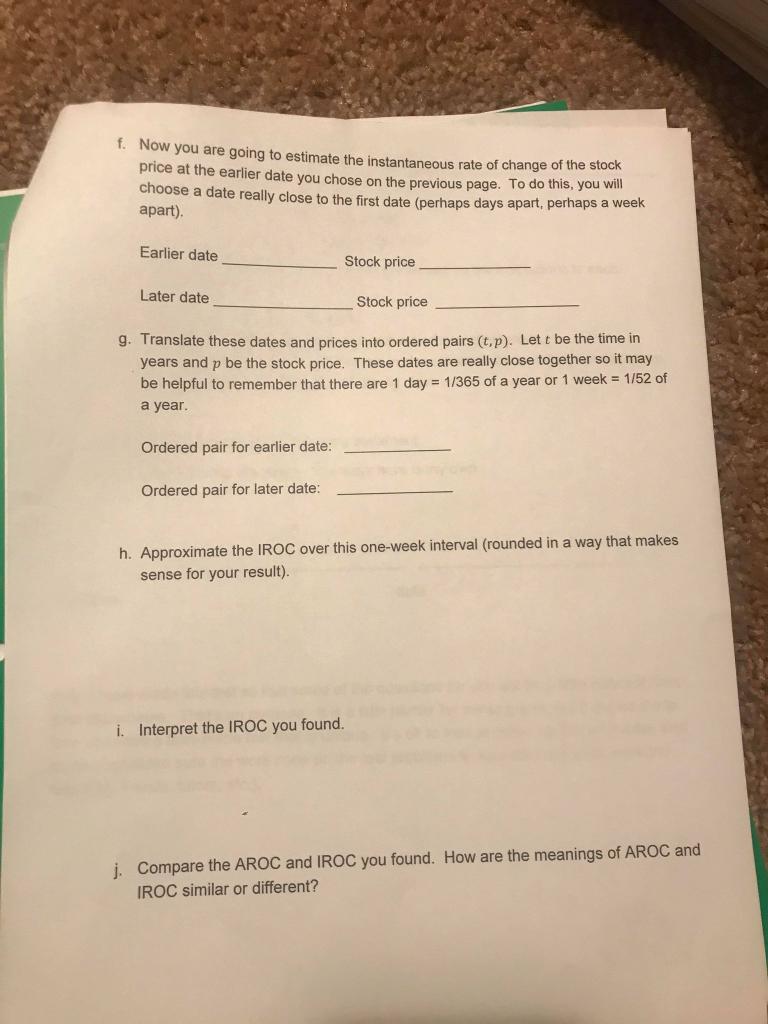

3. (20 points) Choose a company and do a web search to find their stock prices overore past several years. Please do NOT pick Apple, Microsoft, or Tesla so that we dont have too many people choosing the same company. f. Now you are price at the choose a apart) Ea a. Name of the company you chose: b. Pick two dates that are a few years apart and record the date and the stock price on that date. Earlier date Stock price Later date Stock price c. Translate these dates and prices into ordered pairs (t,p). Lett be the time in years and p be the stock price. t = 0 is the beginning of January in the year (you choose year) Ordered pair for earlier date: Ordered pair for later date: d. Find the AROC over the time period you chose (rounded in a way that makes sense for your result). e. Interpret the AROC you found. f. Now you are going to estimate the instantaneous rate of change of the stock price at the earlier date you chose on the previous page. To do this, you will choose a date really close to the first date (perhaps days apart, perhaps a week apart). Earlier date Stock price Later date Stock price g. Translate these dates and prices into ordered pairs (t,p). Let t be the time in years and p be the stock price. These dates are really close together so it may be helpful to remember that there are 1 day = 1/365 of a year or 1 week = 1/52 of a year Ordered pair for earlier date: Ordered pair for later date: h. Approximate the IROC over this one-week interval (rounded in a way that makes sense for your result). i. Interpret the IROC you found. j. Compare the AROC and IROC you found. How are the meanings of AROC and IROC similar or different? 3. (20 points) Choose a company and do a web search to find their stock prices overore past several years. Please do NOT pick Apple, Microsoft, or Tesla so that we dont have too many people choosing the same company. f. Now you are price at the choose a apart) Ea a. Name of the company you chose: b. Pick two dates that are a few years apart and record the date and the stock price on that date. Earlier date Stock price Later date Stock price c. Translate these dates and prices into ordered pairs (t,p). Lett be the time in years and p be the stock price. t = 0 is the beginning of January in the year (you choose year) Ordered pair for earlier date: Ordered pair for later date: d. Find the AROC over the time period you chose (rounded in a way that makes sense for your result). e. Interpret the AROC you found. f. Now you are going to estimate the instantaneous rate of change of the stock price at the earlier date you chose on the previous page. To do this, you will choose a date really close to the first date (perhaps days apart, perhaps a week apart). Earlier date Stock price Later date Stock price g. Translate these dates and prices into ordered pairs (t,p). Let t be the time in years and p be the stock price. These dates are really close together so it may be helpful to remember that there are 1 day = 1/365 of a year or 1 week = 1/52 of a year Ordered pair for earlier date: Ordered pair for later date: h. Approximate the IROC over this one-week interval (rounded in a way that makes sense for your result). i. Interpret the IROC you found. j. Compare the AROC and IROC you found. How are the meanings of AROC and IROC similar or differentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started