Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help.Thank you 1. 2. Question 8 1 pts Over the past five years, a stock returned 6.24 percent, -3.42 percent, 27.58 percent, -8.04 percent,

Please help.Thank you1.  2.

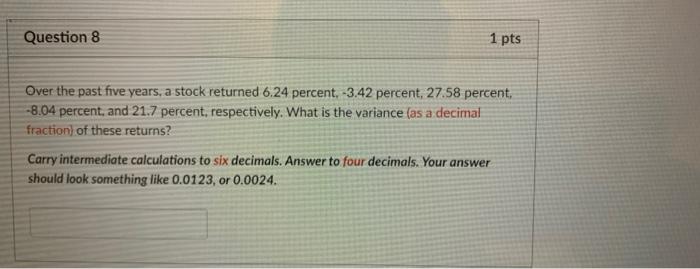

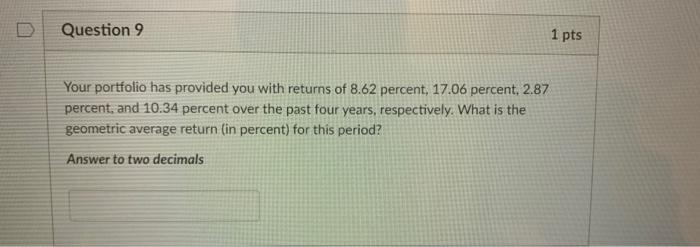

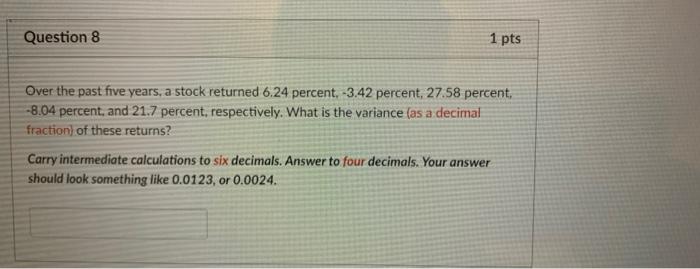

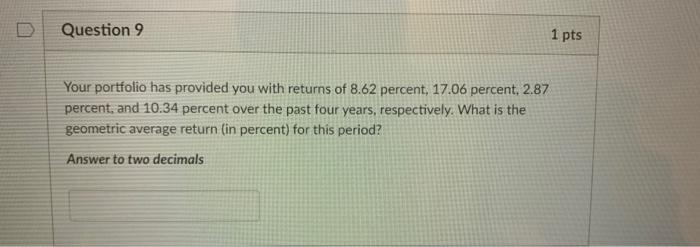

2.  Question 8 1 pts Over the past five years, a stock returned 6.24 percent, -3.42 percent, 27.58 percent, -8.04 percent, and 21.7 percent, respectively. What is the variance (as a decimal fraction) of these returns? Carry intermediate calculations to six decimals. Answer to four decimals. Your answer should look something like 0.0123, or 0.0024. Question 9 1 pts Your portfolio has provided you with returns of 8.62 percent, 17.06 percent, 2.87 percent, and 10.34 percent over the past four years, respectively. What is the geometric average return (in percent) for this period? Answer to two decimals

Question 8 1 pts Over the past five years, a stock returned 6.24 percent, -3.42 percent, 27.58 percent, -8.04 percent, and 21.7 percent, respectively. What is the variance (as a decimal fraction) of these returns? Carry intermediate calculations to six decimals. Answer to four decimals. Your answer should look something like 0.0123, or 0.0024. Question 9 1 pts Your portfolio has provided you with returns of 8.62 percent, 17.06 percent, 2.87 percent, and 10.34 percent over the past four years, respectively. What is the geometric average return (in percent) for this period? Answer to two decimals

1.

2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started