Please help.Thanks a lot.

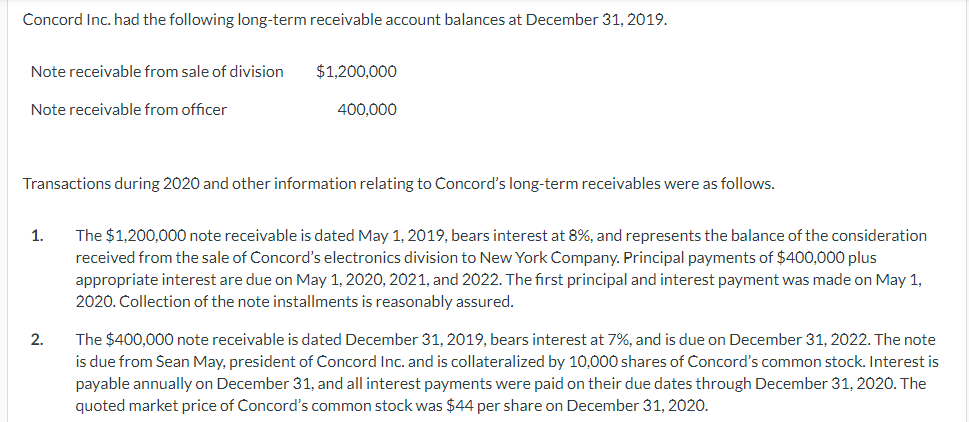

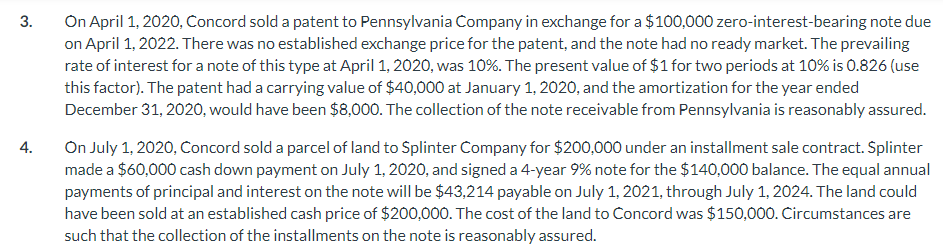

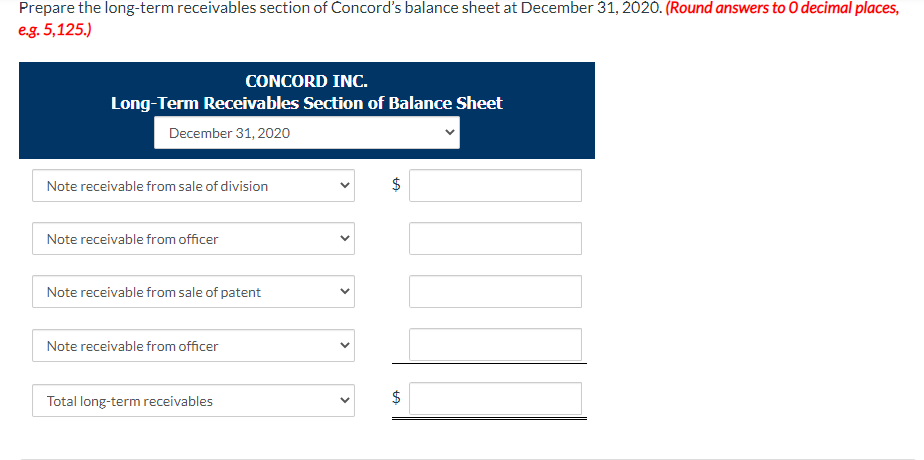

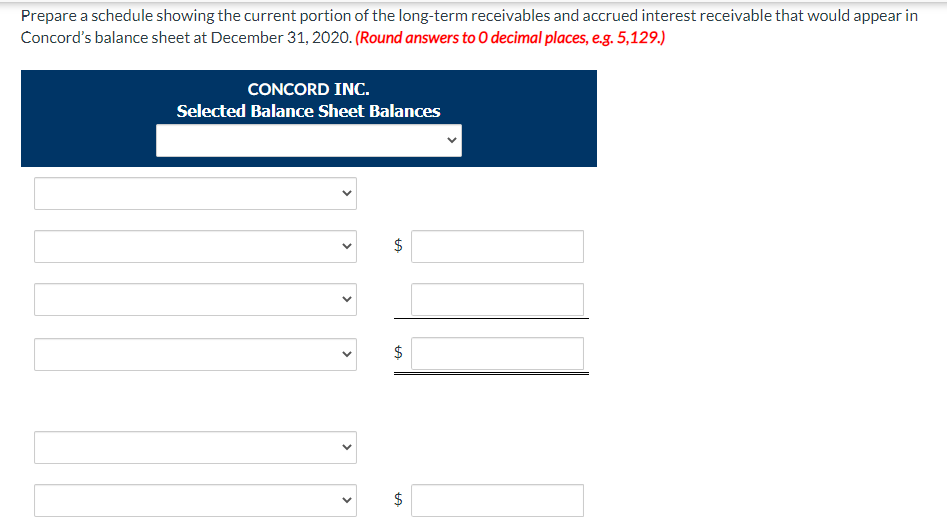

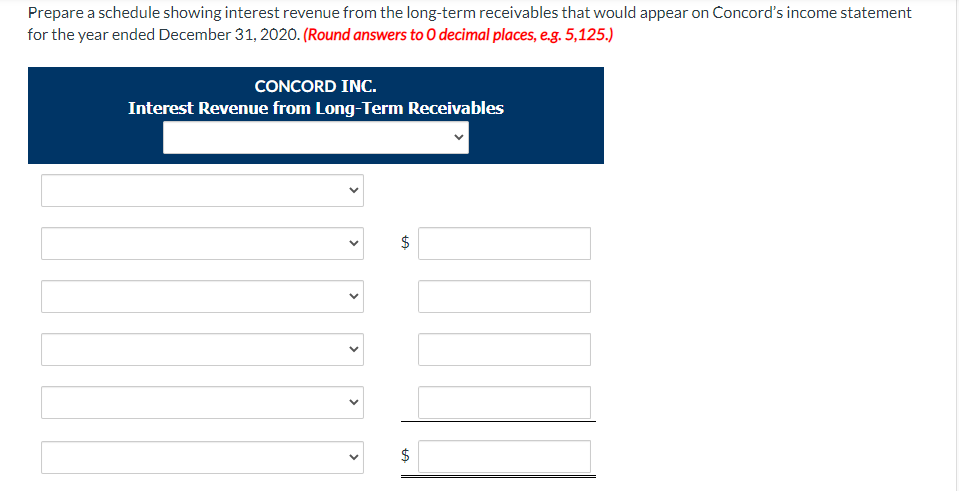

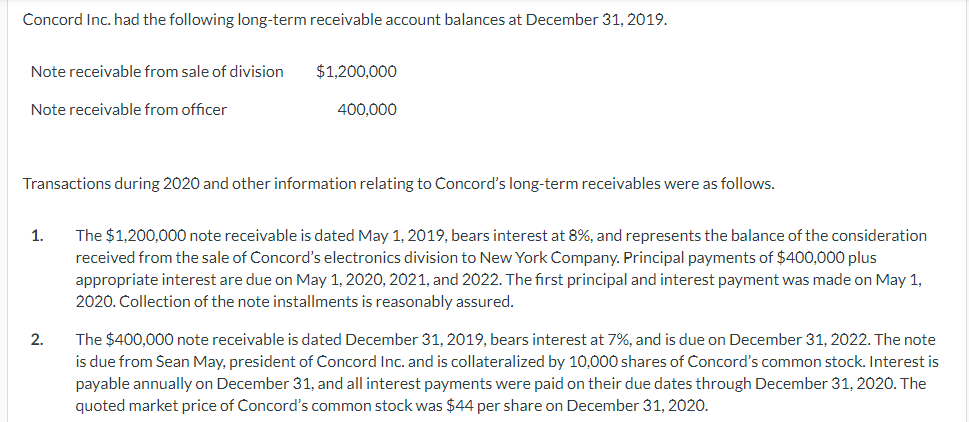

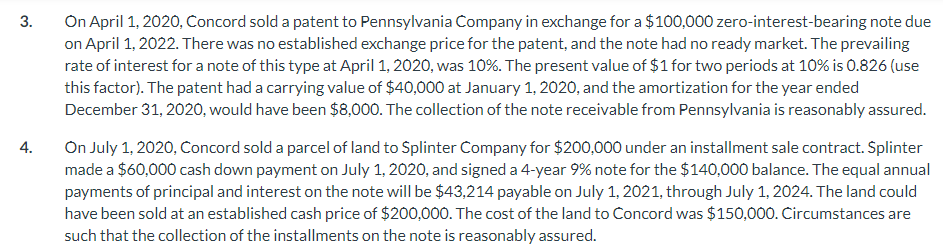

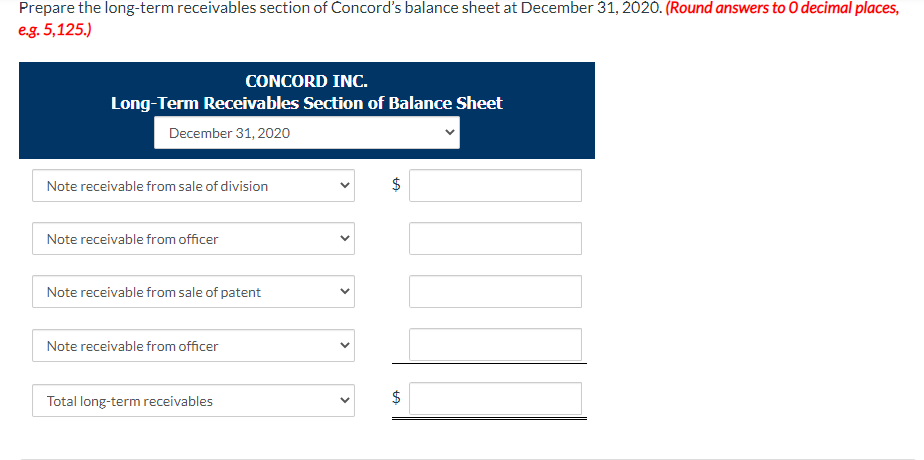

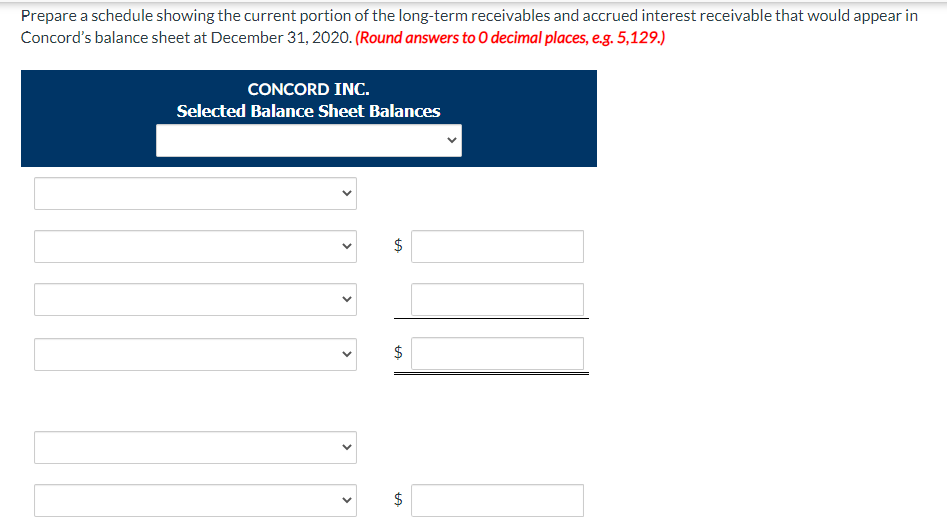

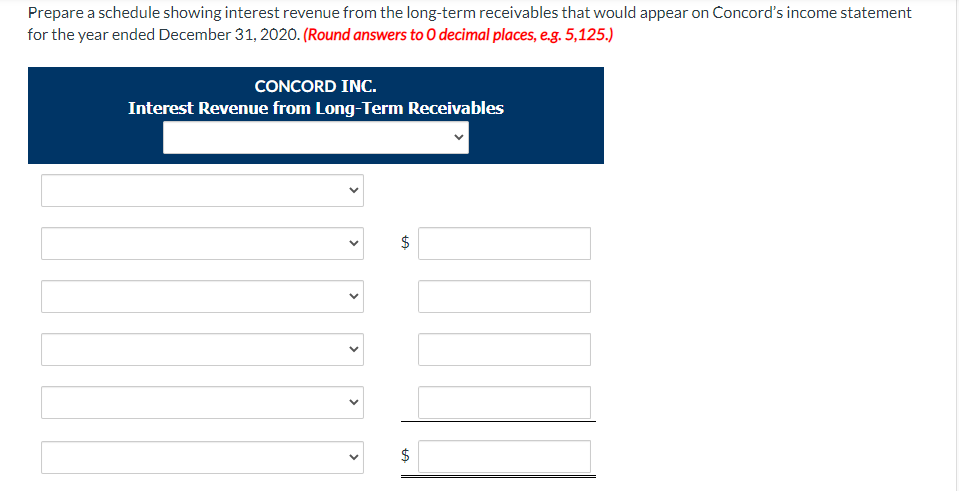

Concord Inc. had the following long-term receivable account balances at December 31, 2019. Transactions during 2020 and other information relating to Concord's long-term receivables were as follows. 1. The $1,200,000 note receivable is dated May 1,2019 , bears interest at 8%, and represents the balance of the consideration received from the sale of Concord's electronics division to New York Company. Principal payments of $400,000 plus appropriate interest are due on May 1, 2020, 2021, and 2022. The first principal and interest payment was made on May 1 , 2020. Collection of the note installments is reasonably assured. 2. The $400,000 note receivable is dated December 31,2019 , bears interest at 7%, and is due on December 31 , 2022. The note is due from Sean May, president of Concord Inc. and is collateralized by 10,000 shares of Concord's common stock. Interest is payable annually on December 31 , and all interest payments were paid on their due dates through December 31 , 2020. The quoted market price of Concord's common stock was $44 per share on December 31,2020. On April 1, 2020, Concord sold a patent to Pennsylvania Company in exchange for a $100,000 zero-interest-bearing note due on April 1, 2022. There was no established exchange price for the patent, and the note had no ready market. The prevailing rate of interest for a note of this type at April 1, 2020, was 10\%. The present value of $1 for two periods at 10% is 0.826 (use this factor). The patent had a carrying value of $40,000 at January 1,2020 , and the amortization for the year ended December 31,2020 , would have been $8,000. The collection of the note receivable from Pennsylvania is reasonably assured. On July 1, 2020, Concord sold a parcel of land to Splinter Company for $200,000 under an installment sale contract. Splinter made a $60,000 cash down payment on July 1, 2020, and signed a 4-year 9% note for the $140,000 balance. The equal annual payments of principal and interest on the note will be $43,214 payable on July 1,2021 , through July 1 , 2024. The land could have been sold at an established cash price of $200,000. The cost of the land to Concord was $150,000. Circumstances are such that the collection of the installments on the note is reasonably assured. Prepare the long-term receivables section of Concord's balance sheet at December 31,2020 . (Round answers to 0 decimal places, e.g. 5,125.) Prepare a schedule showing the current portion of the long-term receivables and accrued interest receivable that would appear in Concord's balance sheet at December 31, 2020. (Round answers to 0 decimal places, e.g. 5,129.) Prepare a schedule showing interest revenue from the long-term receivables that would appear on Concord's income statement for the year ended December 31, 2020. (Round answers to 0 decimal places, e.g. 5,125.)