Answered step by step

Verified Expert Solution

Question

1 Approved Answer

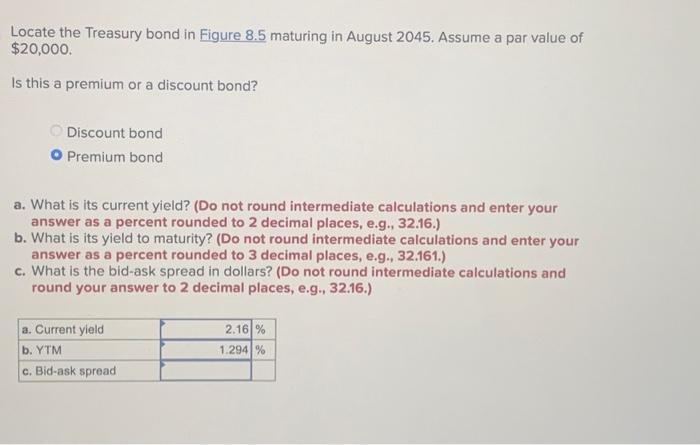

Please hep me with letter c and pleas eshow calculations. Please help me to answer letter c and please show calculations. Attached please find 2

Please hep me with letter c and pleas eshow calculations.

Please help me to answer letter c and please show calculations. Attached please find 2 screenshots of this problem.

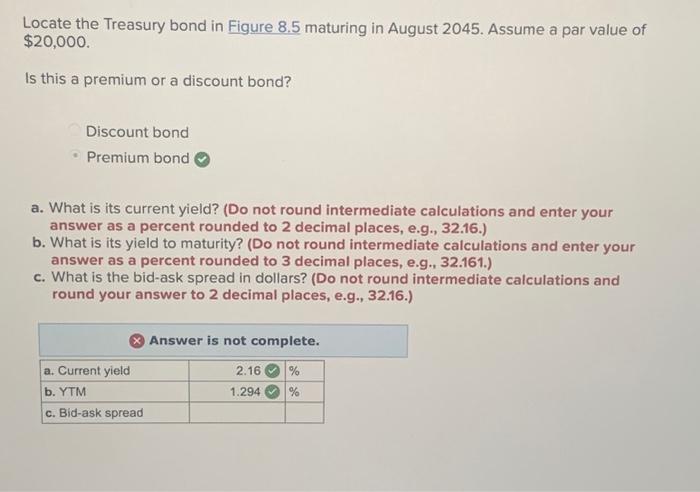

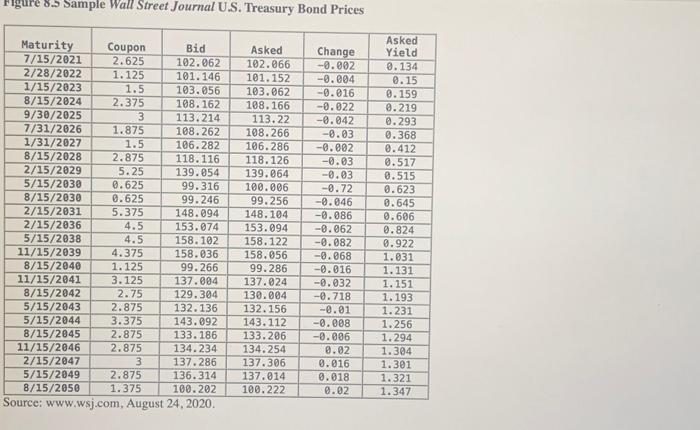

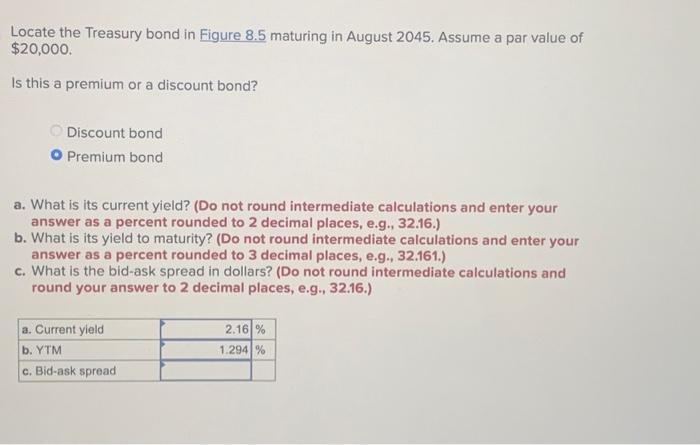

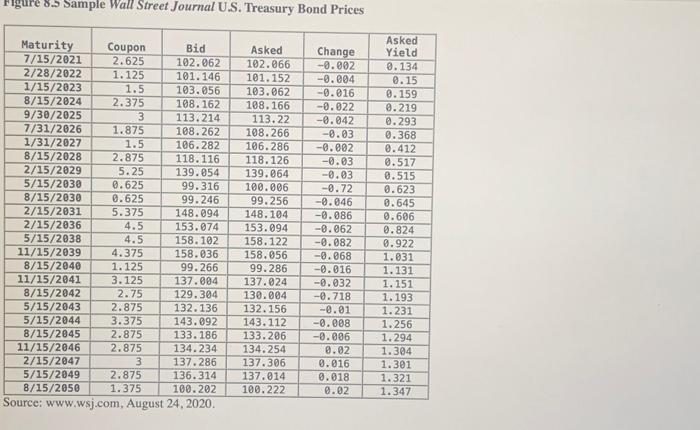

Locate the Treasury bond in Figure 8.5 maturing in August 2045. Assume a par value of $20,000. Is this a premium or a discount bond? Discount bond Premium bond a. What is its current yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is its yield to maturity? (Do not round intermediate calculations and enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) c. What is the bid-ask spread in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Locate the Treasury bond in Figure 8.5 maturing in August 2045. Assume a par value of $20,000. Is this a premium or a discount bond? Discount bond Premium bond a. What is its current yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is its yield to maturity? (Do not round intermediate calculations and enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) c. What is the bid-ask spread in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Fugure 8 Sample Wall Street Journal U.S. Treasury Bond Prices Locate the Treasury bond in Figure 8.5 maturing in August 2045. Assume a par value of $20,000. Is this a premium or a discount bond? Discount bond Premium bond a. What is its current yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is its yield to maturity? (Do not round intermediate calculations and enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) c. What is the bid-ask spread in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started