please Hurry

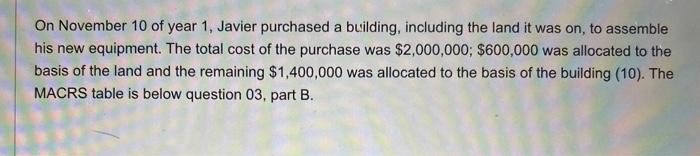

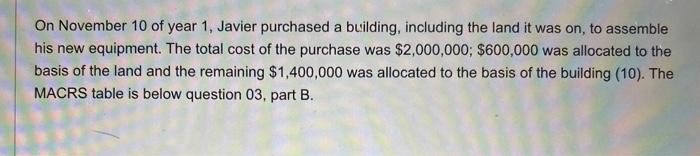

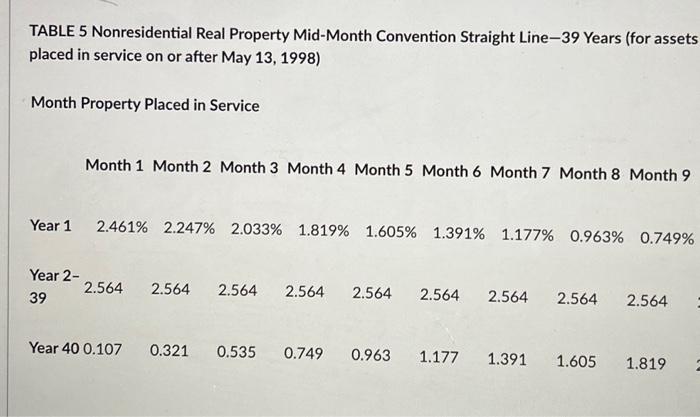

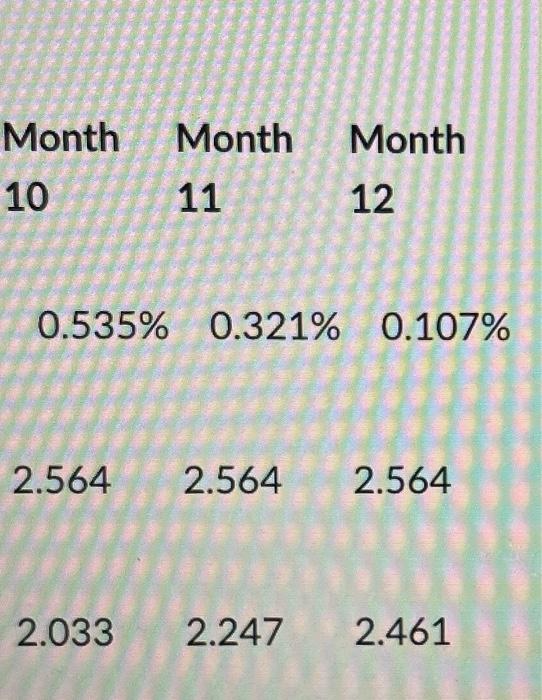

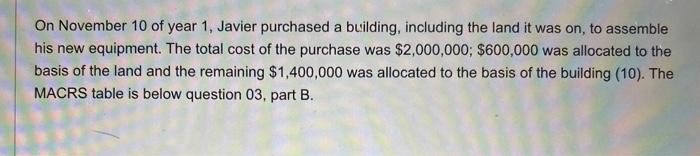

\begin{tabular}{|c|c|c|} \hline Month & Month & Month \\ \hline 10 & 11 & 12 \\ \hline 0.535% & 0.321% & 0.107% \\ \hline 564 & 2.564 & 2.564 \\ \hline & & 113 \\ \hline 2.033 & 2.247 & 2.461 \\ \hline \end{tabular} TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line- 39 Years (for assets placed in service on or after May 13, 1998) Month Property Placed in Service Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \begin{tabular}{ll} 39 & 2.564 \end{tabular} & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 \\ \hline Year 400.107 & 0.321 & 0.535 & 0.749 & 0.963 & 1.177 & 1.391 & 1.605 & 1.81 \\ \hline \end{tabular} On November 10 of year 1 , Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $2,000,000; $600,000 was allocated to the basis of the land and the remaining $1,400,000 was allocated to the basis of the building (10). The MACRS table is below question 03, part B. What is the first year depreciation if the building was placed in service in January of that year (10)? What is the depreciation deduction in the year the building is sold (5)? \begin{tabular}{|c|c|c|} \hline Month & Month & Month \\ \hline 10 & 11 & 12 \\ \hline 0.535% & 0.321% & 0.107% \\ \hline 564 & 2.564 & 2.564 \\ \hline & & 113 \\ \hline 2.033 & 2.247 & 2.461 \\ \hline \end{tabular} TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line- 39 Years (for assets placed in service on or after May 13, 1998) Month Property Placed in Service Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \begin{tabular}{ll} 39 & 2.564 \end{tabular} & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 \\ \hline Year 400.107 & 0.321 & 0.535 & 0.749 & 0.963 & 1.177 & 1.391 & 1.605 & 1.81 \\ \hline \end{tabular} On November 10 of year 1 , Javier purchased a building, including the land it was on, to assemble his new equipment. The total cost of the purchase was $2,000,000; $600,000 was allocated to the basis of the land and the remaining $1,400,000 was allocated to the basis of the building (10). The MACRS table is below question 03, part B. What is the first year depreciation if the building was placed in service in January of that year (10)? What is the depreciation deduction in the year the building is sold