Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please hurry there are three question answers for the question PART A (8 marks) April receives $60 every six months in interest income from her

please hurry there are three question answers for the question

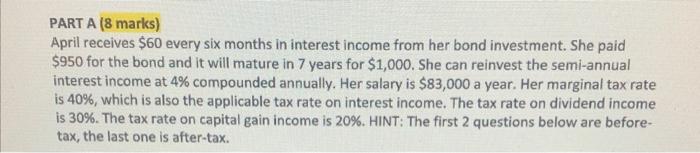

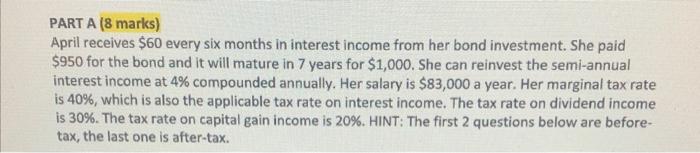

PART A (8 marks) April receives $60 every six months in interest income from her bond investment. She paid $950 for the bond and it will mature in 7 years for $1,000. She can reinvest the semi-annual interest income at 4% compounded annually. Her salary is $83,000 a year. Her marginal tax rate is 40%, which is also the applicable tax rate on interest income. The tax rate on dividend income is 30%. The tax rate on capital gain income is 20%. HINT: The first 2 questions below are beforetax, the last one is after-tax. 1. What is her annualized HPR if she does not reinvest the interest income? (2 marks) 2. What is her annualized HPR If she reinvests the interest income? (2 marks) 3. What is her annualized HPR swww if she reinvests the interest income and taxes are paid annually? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started