Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please i meed help with number 5 , need specific formulas to calculate the answer using excel i am very stuck your answer. b. s

please i meed help with number 5 , need specific formulas to calculate the answer using excel i am very stuck

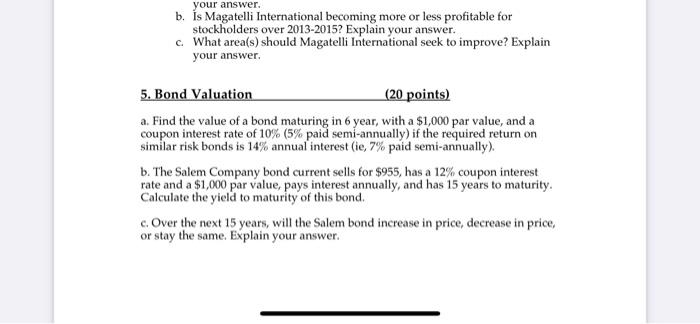

your answer. b. s Magatelli International becoming more or less profitable for stockholders over 2013-2015? Explain your answer. c. What area(s) should Magatelli International seek to improve? Explain your answer. 5. Bond Valuation (20 points) a. Find the value of a bond maturing in 6 year, with a $1,000 par value, and a coupon interest rate of 10% (5% paid semi-annually) if the required return on similar risk bonds is 14% annual interest (ie, 7% paid semi-annually). b. The Salem Company bond current sells for $955, has a 12% coupon interest rate and a $1,000 par value, pays interest annually, and has 15 years to maturity. Calculate the yield to maturity of this bond. c. Over the next 15 years, will the Salem bond increase in price, decrease in price or stay the same. Explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started