Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please I need all answer Question 1 CBA is a division of Flynn, Inc. The division manufactures and sells a pump that is used in

please I need all answer

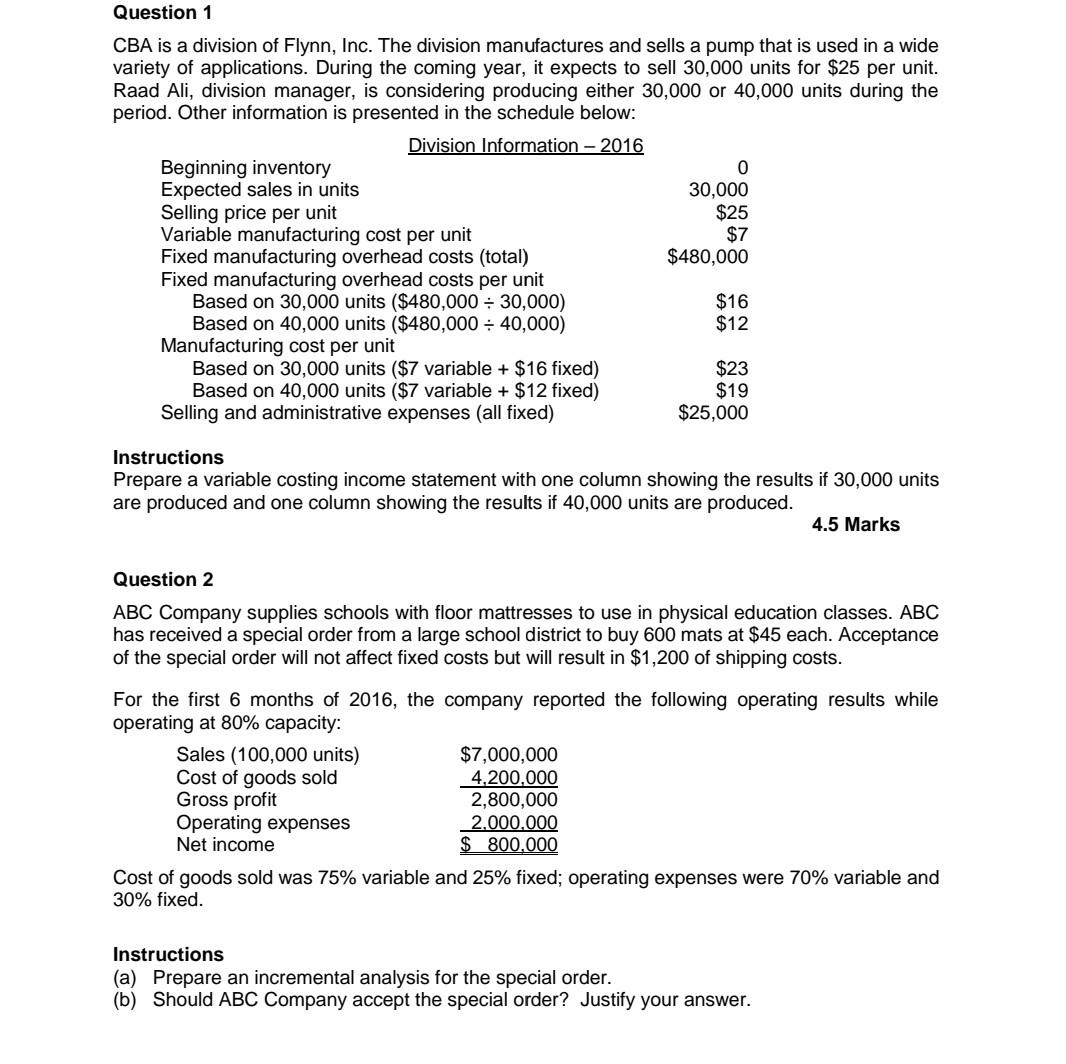

Question 1 CBA is a division of Flynn, Inc. The division manufactures and sells a pump that is used in a wide variety of applications. During the coming year, it expects to sell 30,000 units for $25 per unit. Raad Ali, division manager, is considering producing either 30,000 or 40,000 units during the period. Other information is presented in the schedule below: Division Information - 2016 Beginning inventory 0 Expected sales in units 30,000 Selling price per unit $25 Variable manufacturing cost per unit $7 Fixed manufacturing overhead costs (total) $480,000 Fixed manufacturing overhead costs per unit Based on 30,000 units ($480,000 - 30,000) $16 Based on 40,000 units ($480,000 = 40,000) $12 Manufacturing cost per unit Based on 30,000 units ($7 variable + $16 fixed) $23 Based on 40,000 units ($7 variable + $12 fixed) $19 Selling and administrative expenses (all fixed) $25,000 Instructions Prepare a variable costing income statement with one column showing the results if 30,000 units are produced and one column showing the results if 40,000 units are produced. 4.5 Marks Question 2 ABC Company supplies schools with floor mattresses to use in physical education classes. ABC has received a special order from a large school district to buy 600 mats at $45 each. Acceptance of the special order will not affect fixed costs but will result in $1,200 of shipping costs. For the first 6 months of 2016, the company reported the following operating results while operating at 80% capacity: Sales (100,000 units) $7,000,000 Cost of goods sold 4,200,000 Gross profit 2,800,000 Operating expenses 2.000.000 Net income $ 800.000 Cost of goods sold was 75% variable and 25% fixed; operating expenses were 70% variable and 30% fixed. Instructions (a) Prepare an incremental analysis for the special order. (b) Should ABC Company accept the special order? Justify yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started