Question

Please, I need correct answers and clear explanation. Thanks. Calculate the net income for the year ended December 31, 2016. Prepare a classified statement of

Please, I need correct answers and clear explanation. Thanks.

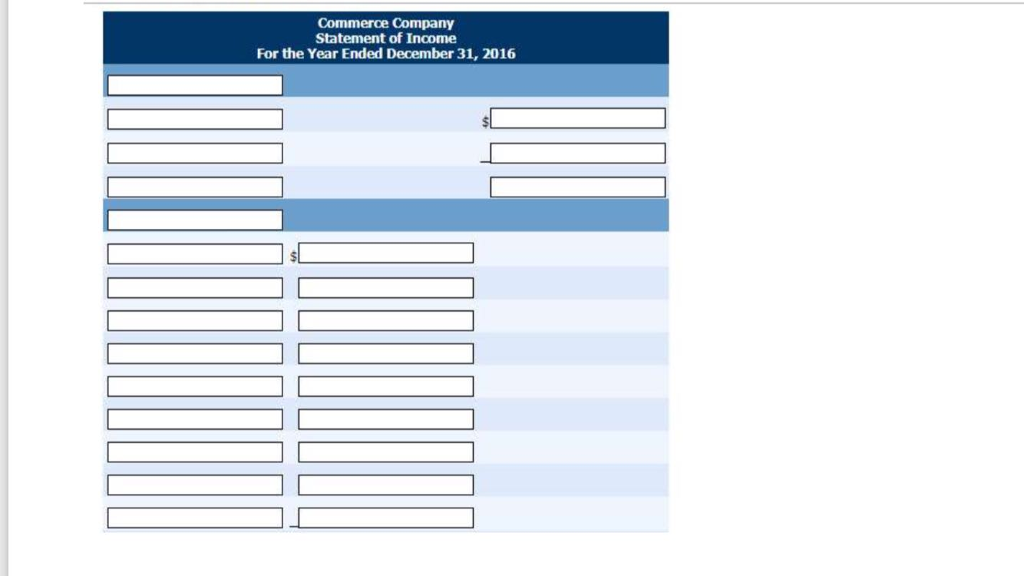

Calculate the net income for the year ended December 31, 2016.

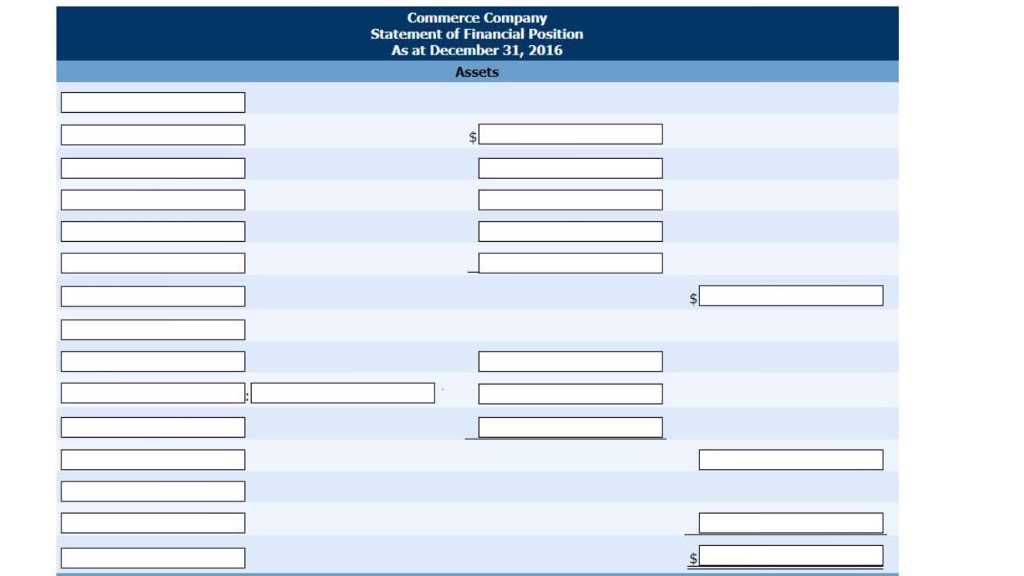

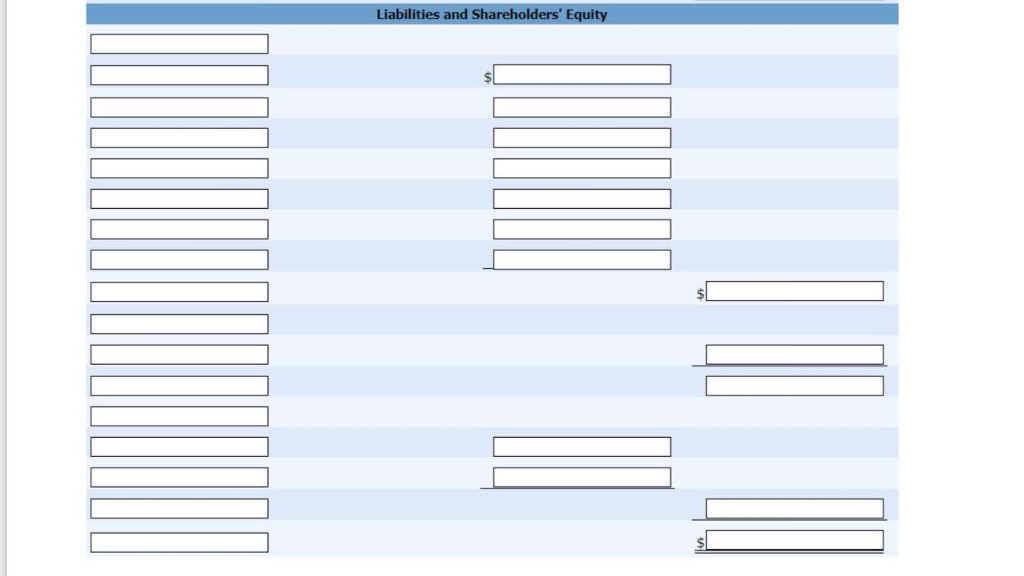

Prepare a classified statement of financial position as at December 31, 2016. The note payable is due in 6 months. (List Current Assets in order of liquidity. List Capital Assets in order of Buildings and Land.)

list of accounts are:

Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accumulated Depreciation-Vehicles Advertising Expense Buildings Cash Common Shares Cost of Goods Sold Depreciation Expense Dividends Payable Equipment Income Tax Payable Interest Expense Interest Payable Inventory Land Miscellaneous Expense Notes Payable Operating Expense Other Expenses Prepaid Insurance Prepaid Rent Rent Expense Rent Revenue Retained Earnings Selling and Administrative Expenses Supplies Expense Wages Payable Wages Expense Advances to Employees Bank Loan Payable Deposits Dividend Revenue Dividends Declared Income Tax Expense Income Summary Insurance Expense Interest Revenue Interest Receivable License Expense Long-Term Investments Mortgage Payable No Entry Notes Receivable Supplies Prepaid Expenses Prepaid License Prepaid Property Tax Property Tax Expense Repair and Maintenance Expense Salaries Payable Salaries Expense Sales Revenue Service Revenue Short-Term Investments Telephone Expense Unearned Rent Revenue Unearned Revenue Utilities Expense Vehicles

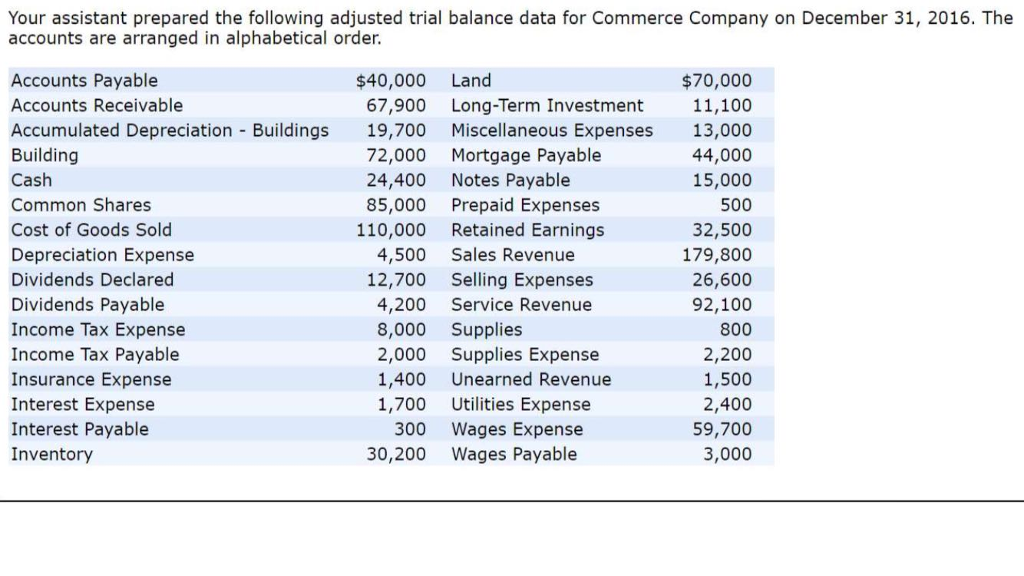

Your assistant prepared the following adjusted trial balance data for Commerce Company on December 31, 2016. The accounts are arranged in alphabetical order. $70,000 11,100 $40,000 Land Accounts Payable Accounts Receivable Accumulated Depreciation Buildings 19,700 Miscellaneous Expenses 13,000 Building Cash Common Shares Cost of Goods Sold Depreciation Expense Dividends Declared Dividends Payable Income Tax Expense Income Tax Payable Insurance Expense Interest Expense Interest Payable Inventory 67,900 Long-Term Investment 44,000 15,000 500 32,500 179,800 26,600 92,100 800 2,200 1,500 2,400 59,700 3,000 72,000 Mortgage Payable 24,400 Notes Payable 85,000 Prepaid Expenses 110,000 Retained Earnings 4,500 Sales Revenue 12,700 Selling Expenses 4,200 Service Revenue 8,000 Supplies 2,000 Supplies Expense 1,400 Unearned Revenue 1,700 Utilities Expense 300 Wages Expense 30,200 Wages PayableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started