Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please i need help 13.5 Use Table 13-2 to create a questionnaire checklist that can be used to evaluate controls for each of the basic

please i need help

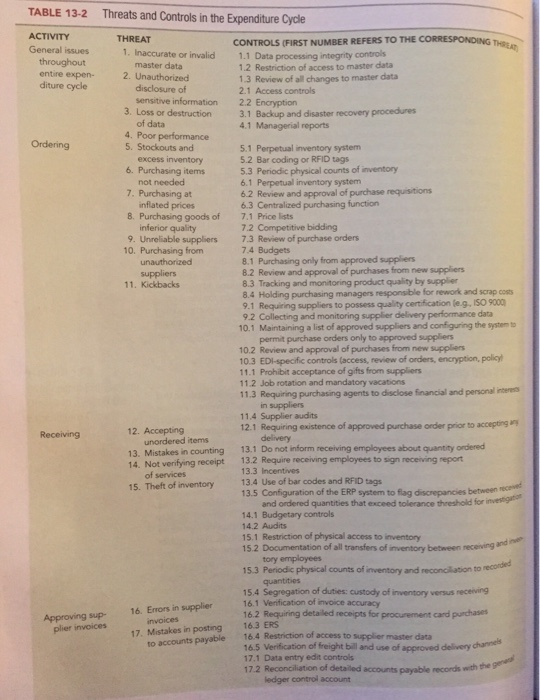

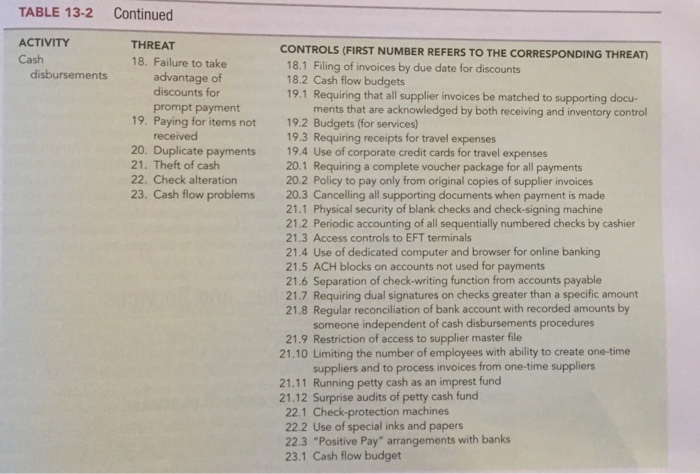

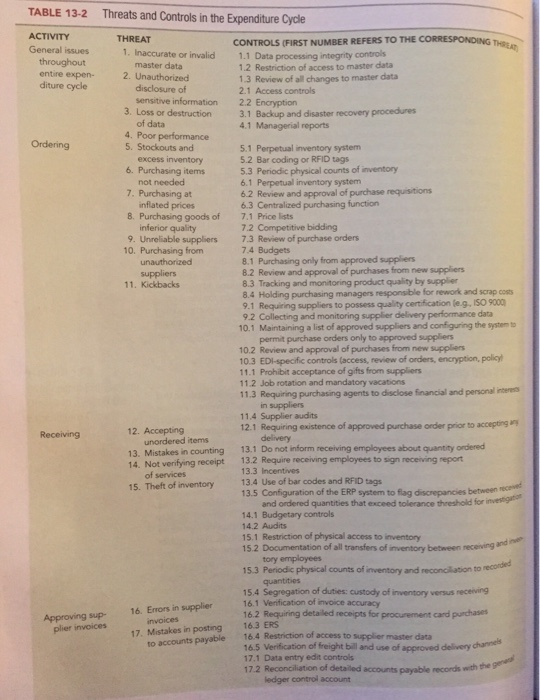

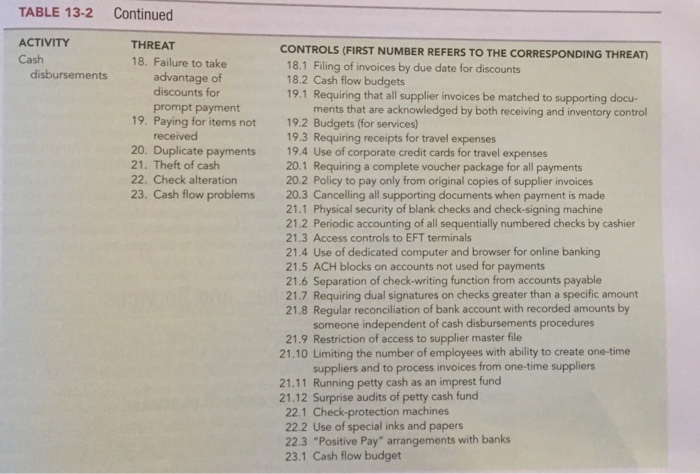

13.5 Use Table 13-2 to create a questionnaire checklist that can be used to evaluate controls for each of the basic activities in the expenditure cycle (ordering goods, receiving, ap- proving supplier invoices, and cash disbursements). REQUIRED a. For each control issue, write a Yes/No question such that a "No" answer represents a control weakness. For example, one question might be "Are supporting documents, such as purchase orders and receiving reports, marked "paid' when a check is issued to the vendor?" b. For each Yes/No question, write a brief explanation of why a "No" answer repre- sents a control weakness. Ordering TABLE 13-2 Threats and Controls in the Expenditure Cycle ACTIVITY THREAT General issues CONTROLS (FIRST NUMBER REFERS TO THE CORRESPONDING THE 1. Inaccurate or invalid 1.1 Data processing integrity controls throughout master data 1.2 Restriction of access to master data entire expen 2. Unauthorized 1.3 Review of all changes to master data diture cycle disclosure of 2.1 Access controls sensitive information 2.2 Encryption 3. Loss or destruction 3.1 Backup and disaster recovery procedures of data 4.1 Managerial reports 4. Poor performance 5. Stockouts and 5.1 Perpetual inventory system excess inventory 5.2 Bar coding or RFID tags 6. Purchasing items 5.3 Periodic physical counts of inventory not needed 6.1 Perpetual inventory system 7. Purchasing at 6.2 Review and approval of purchase requisitions inflated prices 6.3 Centralized purchasing function 8. Purchasing goods of 7.1 Price lists inferior quality 7.2 Competitive bidding 9. Unreliable suppliers 7.3 Review of purchase orders 10. Purchasing from 7.4 Budgets unauthorized 8.1 Purchasing only from approved suppliers suppliers 8.2 Review and approval of purchases from new suppliers 11. Kickbacks 8.3 Tracking and monitoring product quality by supplier 8.4 Holding purchasing managers responsible for rework and scrap costs 9.1 Requiring suppliers to possess quality certification (e.g. ISO 9000 9.2 Collecting and monitoring supplier delivery performance data 10.1 Maintaining a list of approved suppliers and configuring the system to permit purchase orders only to approved suppliers 10.2 Review and approval of purchases from new suppliers 10.3 EDI-specific controls (access, review of orders, encryption policy 11.1 Prohibit acceptance of gifts from suppliers 11.2 Job rotation and mandatory vacations 11.3 Requiring purchasing agents to disclose financial and personal interes in suppliers 11.4 Supplier audits 12.1 Requiring existence of approved purchase order prior to accepting Receiving 12. Accepting unordered items delivery 13. Mistakes in counting 13.1 Do not inform receiving employees about quantity ordered 14. Not verifying receipt 13.2 Require receiving employees to sign receiving report of services 13.3 Incentives 15. Theft of inventory 13.4 Use of bar codes and RFID tags 13.5 Configuration of the ERP system to flag discrepancies between rece and ordered quantities that exceed tolerance threshold for investigate 14.1 Budgetary controls 142 Audits 15.1 Restriction of physical access to inventory 15.2 Documentation of all transfers of inventory between receiving and tory employees 15 3 Periodic physical counts of inventory and reconciation to recor quantities 15.4 Segregation of duties: custody of inventory versus receiving 16.1 Verification of invoice accuracy Approving sup- 16.2 Requiring detailed receipts for procurement card purchases plier invoices 163 ERS 16.4 Restriction of access to supplier master data 16.5 Verification of freight bill and use of accred delivery channes 17.1 Data entry edit controls 17.2 Reconciliation of detailed accountsvable records with the ledger control account 16. Errors in supplier invoices 17. Mistakes in posting to accounts payable TABLE 13-2 Continued ACTIVITY Cash disbursements THREAT 18. Failure to take advantage of discounts for prompt payment 19. Paying for items not received 20. Duplicate payments 21. Theft of cash 22. Check alteration 23. Cash flow problems CONTROLS (FIRST NUMBER REFERS TO THE CORRESPONDING THREAT) 18.1 Filing of invoices by due date for discounts 18.2 Cash flow budgets 19.1 Requiring that all supplier invoices be matched to supporting docu- ments that are acknowledged by both receiving and inventory control 19.2 Budgets (for services) 19.3 Requiring receipts for travel expenses 19.4 Use of corporate credit cards for travel expenses 20.1 Requiring a complete voucher package for all payments 20.2 Policy to pay only from original copies of supplier invoices 20.3 Cancelling all supporting documents when payment is made 21.1 Physical security of blank checks and check-signing machine 21.2 Periodic accounting of all sequentially numbered checks by cashier 21.3 Access controls to EFT terminals 21.4 Use of dedicated computer and browser for online banking 21.5 ACH blocks on accounts not used for payments 21.6 Separation of check-writing function from accounts payable 21.7 Requiring dual signatures on checks greater than a specific amount 21.8 Regular reconciliation of bank account with recorded amounts by someone independent of cash disbursements procedures 21.9 Restriction of access to supplier master file 21.10 Limiting the number of employees with ability to create one-time suppliers and to process invoices from one-time suppliers 21.11 Running petty cash as an imprest fund 21.12 Surprise audits of petty cash fund 22.1 Check-protection machines 22.2 Use of special inks and papers 22.3 "Positive Pay" arrangements with banks 23.1 Cash flow budget

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started