Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please I need help, Thank you Set out below are the individual statements of comprehensive income of Ante and Post together with the consolidated statement

Please I need help,

Thank you

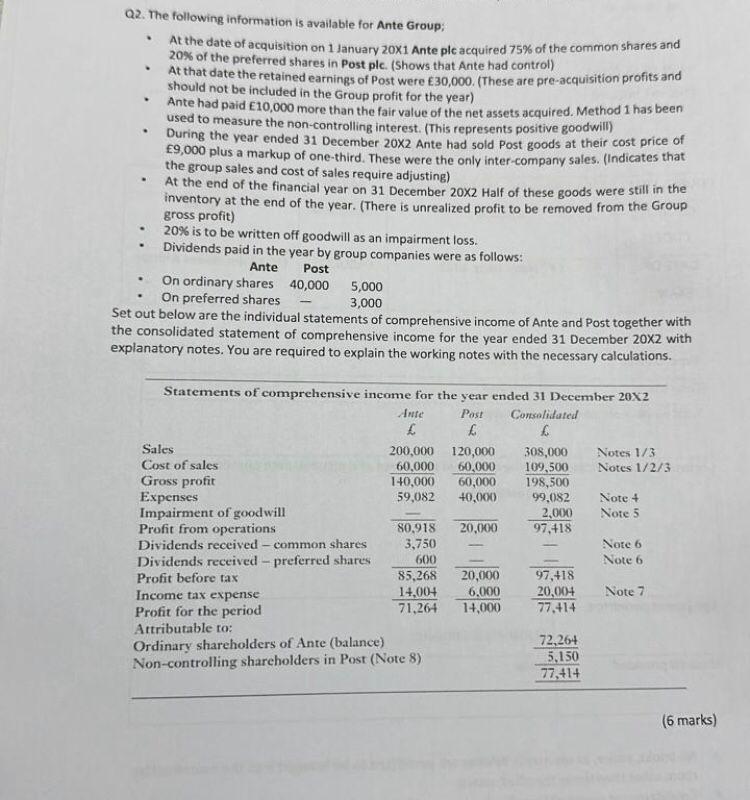

Set out below are the individual statements of comprehensive income of Ante and Post together with

the consolidated statement of comprehensive income for the year ended 31 December 20X2 with

explanatory notes. You are required to explain the working notes with the necessary calculations. There is Note 1, Note 2, .... etc on the table

Please as soon as possible

Q2. The following information is available for Ante Group; - At the date of acquisition on 1 1anuary 20x1 Ante ple acquired 75% of the common shares and 20% of the preferred shares in Post ple. (Shows that Ante had control) - At that date the retained earnings of Post were 30,000. (These are pre-acquisition profits and should not be included in the Group profit for the year) - Ante had paid E10,000 more than the fair value of the net assets acquired. Method 1 has been used to measure the non-controlling interest. (This represents positive goodwill) - During the year ended 31 December 202 Ante had sold Post goods at their cost price of E9,000 plus a markup of one-third. These were the only inter-company sales. (Indicates that the group sales and cost of sales require adjusting) - At the end of the financial year on 31 December 202 Half of these goods were still in the inventory at the end of the year. (There is unrealized profit to be removed from the Group gross profit) - 20% is to be written off goodwill as an impairment loss. - Dividends paid in the year by group companies were as follows: Set out below are the individual statements of comprehensive income of Ante and Post together with the consolidated statement of comprehensive income for the year ended 31 December 202 with explanatory notes. You are required to explain the working notes with the necessary calculations. Q2. The following information is available for Ante Group; - At the date of acquisition on 1 1anuary 20x1 Ante ple acquired 75% of the common shares and 20% of the preferred shares in Post ple. (Shows that Ante had control) - At that date the retained earnings of Post were 30,000. (These are pre-acquisition profits and should not be included in the Group profit for the year) - Ante had paid E10,000 more than the fair value of the net assets acquired. Method 1 has been used to measure the non-controlling interest. (This represents positive goodwill) - During the year ended 31 December 202 Ante had sold Post goods at their cost price of E9,000 plus a markup of one-third. These were the only inter-company sales. (Indicates that the group sales and cost of sales require adjusting) - At the end of the financial year on 31 December 202 Half of these goods were still in the inventory at the end of the year. (There is unrealized profit to be removed from the Group gross profit) - 20% is to be written off goodwill as an impairment loss. - Dividends paid in the year by group companies were as follows: Set out below are the individual statements of comprehensive income of Ante and Post together with the consolidated statement of comprehensive income for the year ended 31 December 202 with explanatory notes. You are required to explain the working notes with the necessary calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started