Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please I need help with parts a through h Question 3. Make the appropriate journal entries for each part, assuming the company uses the accrual

please I need help with parts a through h

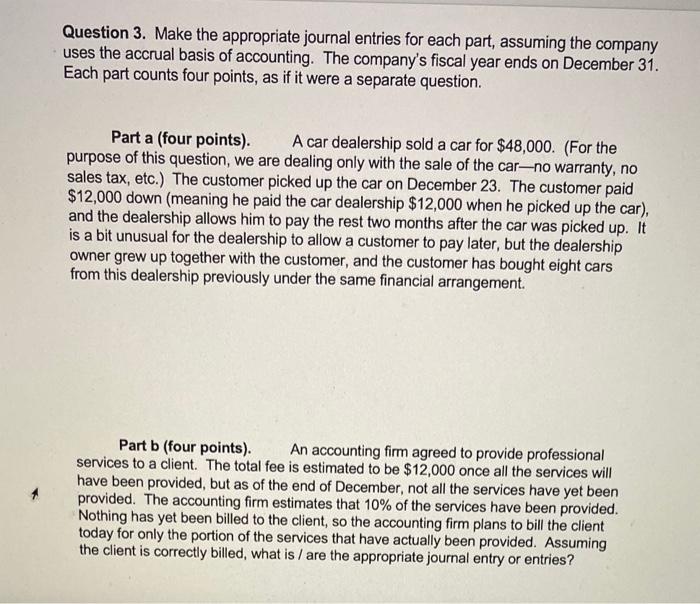

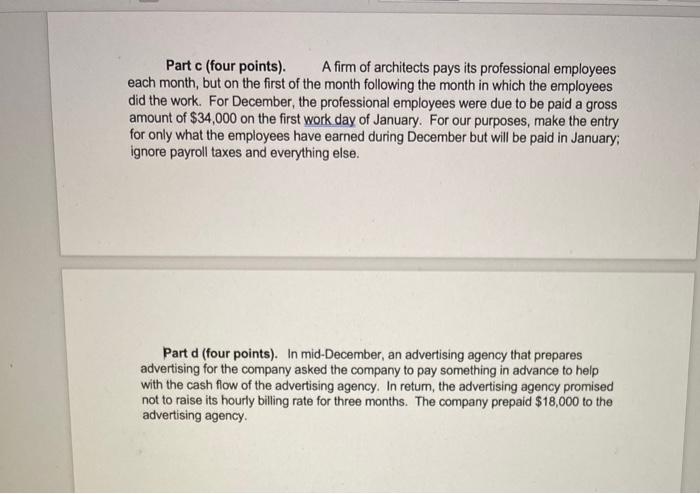

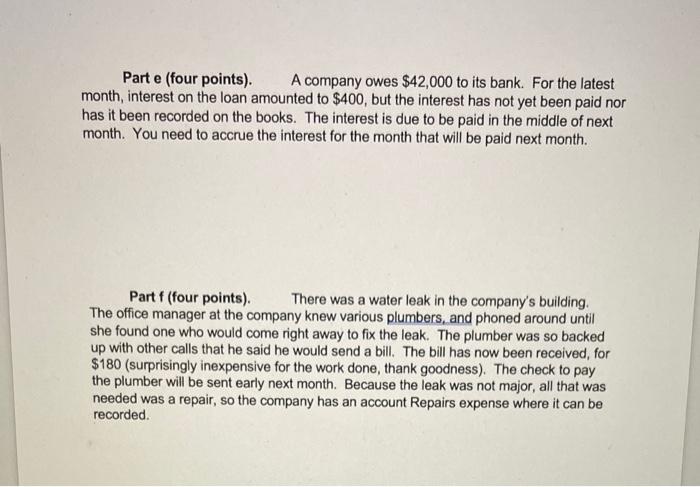

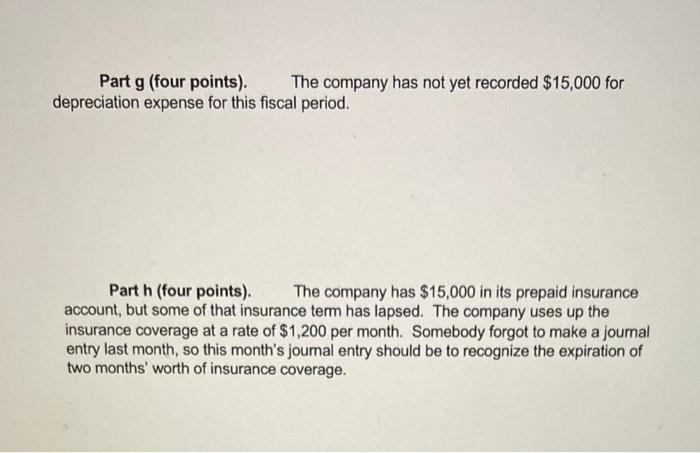

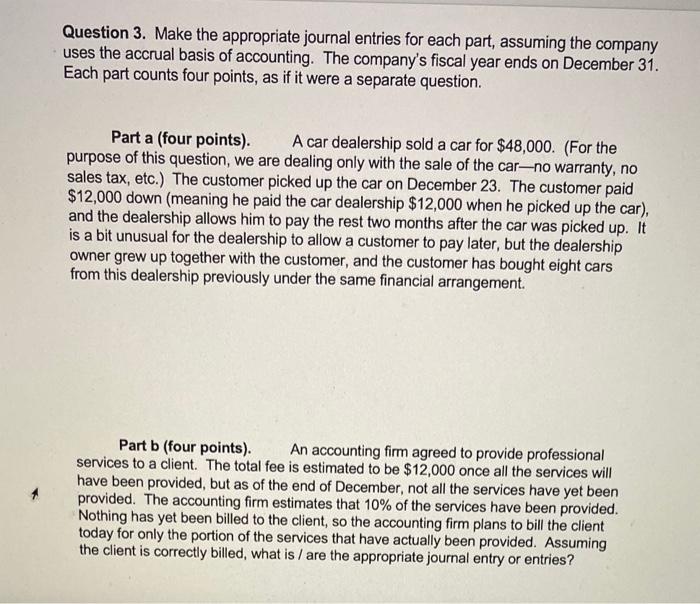

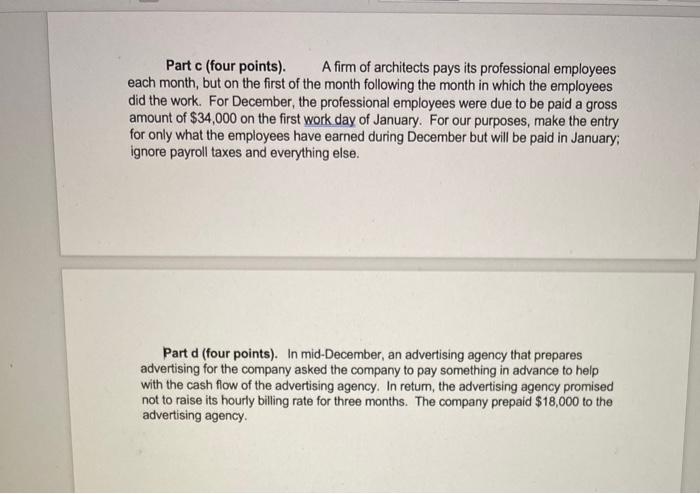

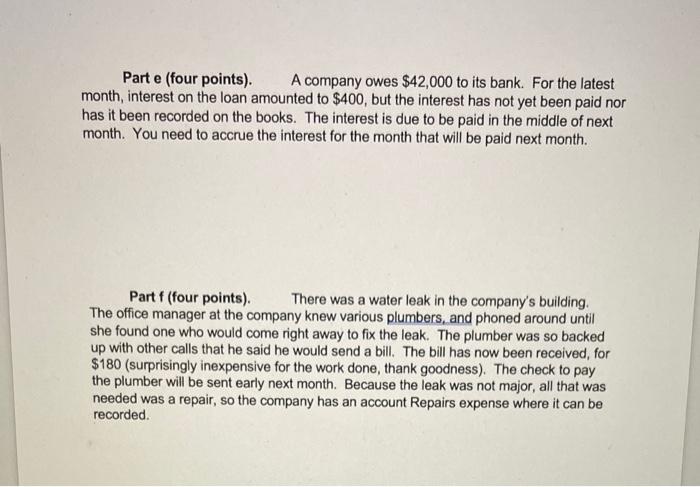

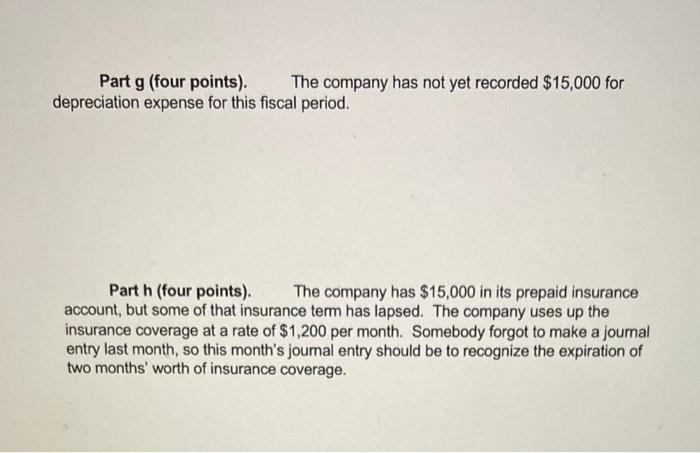

Question 3. Make the appropriate journal entries for each part, assuming the company uses the accrual basis of accounting. The company's fiscal year ends on December 31. Each part counts four points, as if it were a separate question. Part a (four points). A car dealership sold a car for $48,000. (For the purpose of this question, we are dealing only with the sale of the car-no warranty, no sales tax, etc.) The customer picked up the car on December 23. The customer paid $12,000 down (meaning he paid the car dealership $12,000 when he picked up the car), and the dealership allows him to pay the rest two months after the car was picked up. It is a bit unusual for the dealership to allow a customer to pay later, but the dealership owner grew up together with the customer, and the customer has bought eight cars from this dealership previously under the same financial arrangement. Part b (four points). An accounting firm agreed to provide professional services to a client. The total fee is estimated to be $12,000 once all the services will have been provided, but as of the end of December, not all the services have yet been provided. The accounting firm estimates that 10% of the services have been provided. Nothing has yet been billed to the client, so the accounting firm plans to bill the client today for only the portion of the services that have actually been provided. Assuming the client is correctly billed, what is / are the appropriate journal entry or entries? Part c (four points). A firm of architects pays its professional employees each month, but on the first of the month following the month in which the employees did the work. For December, the professional employees were due to be paid a gross amount of $34,000 on the first work day of January. For our purposes, make the entry for only what the employees have earned during December but will be paid in January ignore payroll taxes and everything else. Part d (four points). In mid-December, an advertising agency that prepares advertising for the company asked the company to pay something in advance to help with the cash flow of the advertising agency. In retum, the advertising agency promised not to raise its hourly billing rate for three months. The company prepaid $18,000 to the advertising agency Parte (four points) A company owes $42,000 to its bank. For the latest month, interest on the loan amounted to $400, but the interest has not yet been paid nor has it been recorded on the books. The interest is due to be paid in the middle of next month. You need to accrue the interest for the month that will be paid next month. Part f (four points). There was a water leak in the company's building. The office manager at the company knew various plumbers, and phoned around until she found one who would come right away to fix the leak. The plumber was so backed up with other calls that he said he would send a bill. The bill has now been received, for $180 (surprisingly inexpensive for the work done, thank goodness). The check to pay the plumber will be sent early next month. Because the leak was not major, all that was needed was a repair, so the company has an account Repairs expense where it can be recorded Part g (four points). The company has not yet recorded $15,000 for depreciation expense for this fiscal period. Part h (four points) The company has $15,000 in its prepaid insurance account, but some of that insurance term has lapsed. The company uses up the insurance coverage at a rate of $1,200 per month. Somebody forgot to make a journal entry last month, so this month's joumal entry should be to recognize the expiration of two months' worth of insurance coverage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started