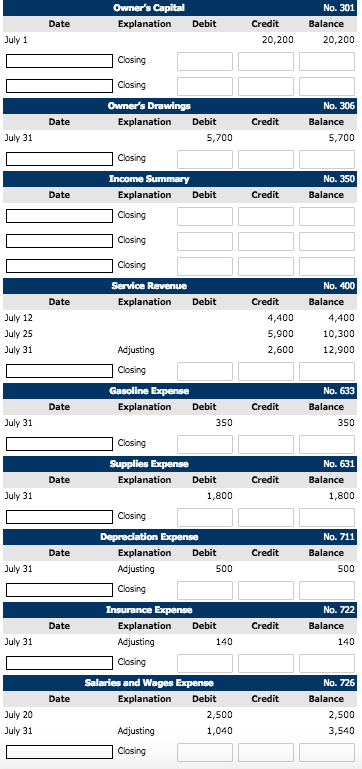

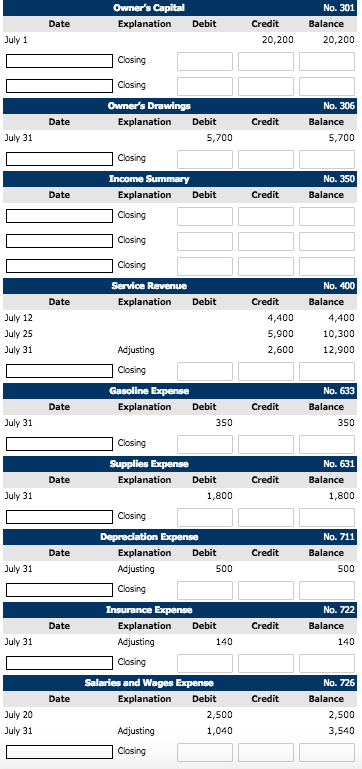

PLEASE I NEED HELP WITH THE CLOSING ENTIRES -- THE LAST TWO PICTURES--

Problem 4-05A a-g (Part Level Submission) (Video)

Oriole Clark opened Orioles Cleaning Service on July 1, 2020. During July, the following transactions were completed.

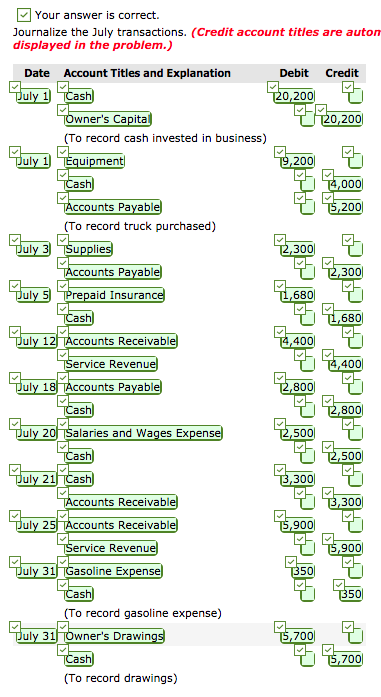

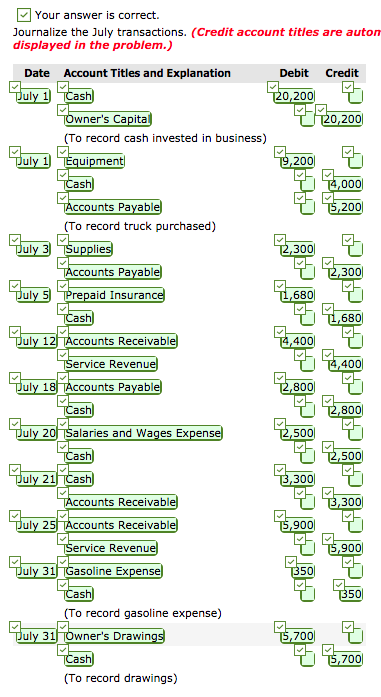

| July 1 | | Oriole invested $20,200 cash in the business. |

| 1 | | Purchased used truck for $9,200, paying $4,000 cash and the balance on account. |

| 3 | | Purchased cleaning supplies for $2,300 on account. |

| 5 | | Paid $1,680 cash on 1-year insurance policy effective July 1. |

| 12 | | Billed customers $4,400 for cleaning services. |

| 18 | | Paid $1,400 cash on amount owed on truck and $1,400 on amount owed on cleaning supplies. |

| 20 | | Paid $2,500 cash for employee salaries. |

| 21 | | Collected $3,300 cash from customers billed on July 12. |

| 25 | | Billed customers $5,900 for cleaning services. |

| 31 | | Paid $350 for the monthly gasoline bill for the truck. |

| 31 | | Withdraw $5,700 cash for personal use. |

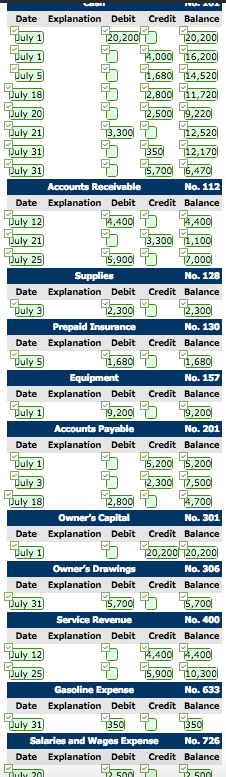

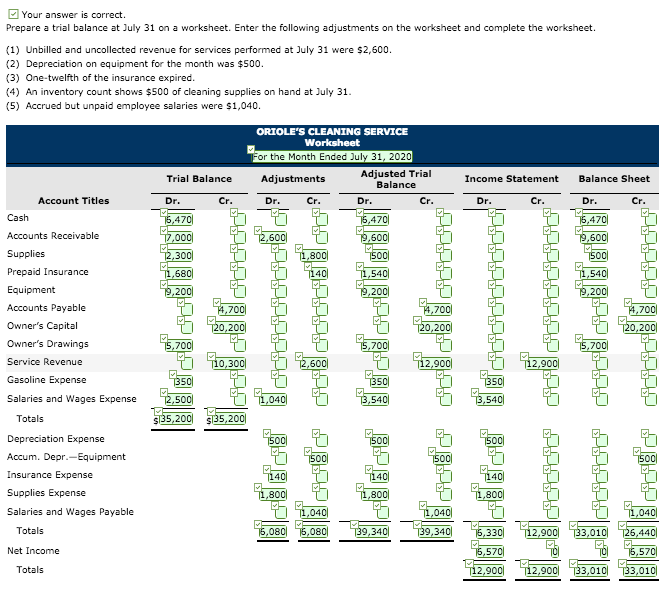

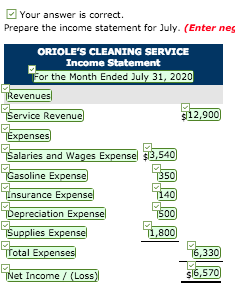

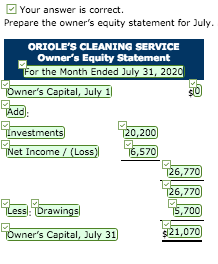

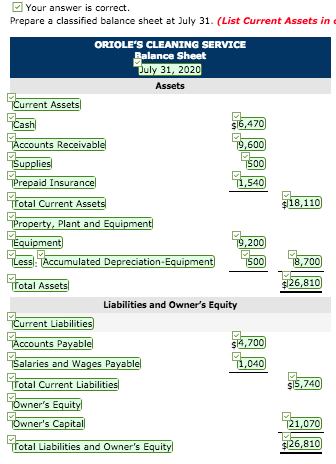

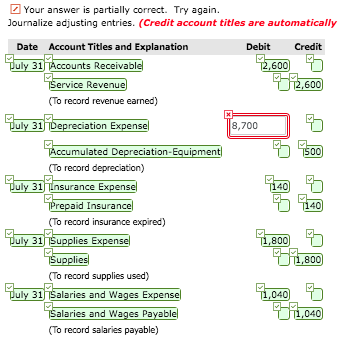

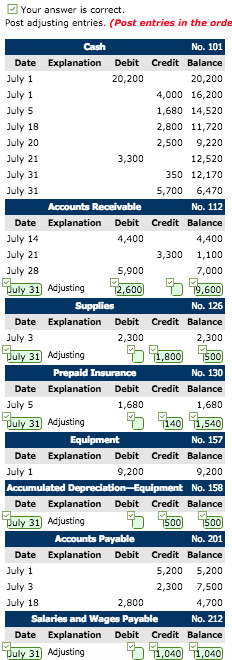

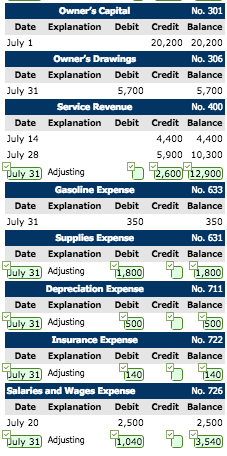

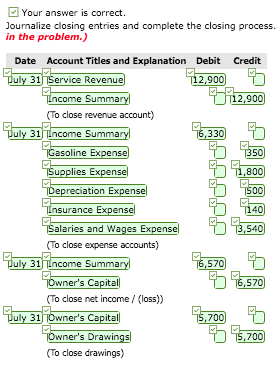

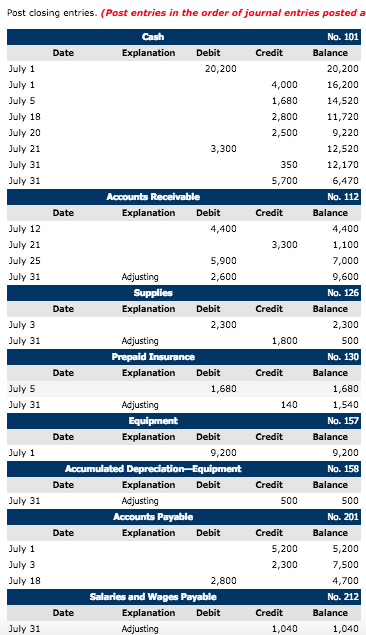

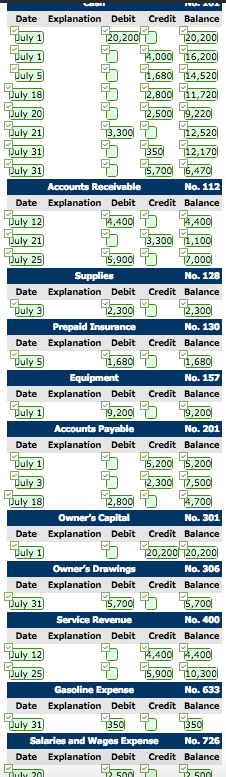

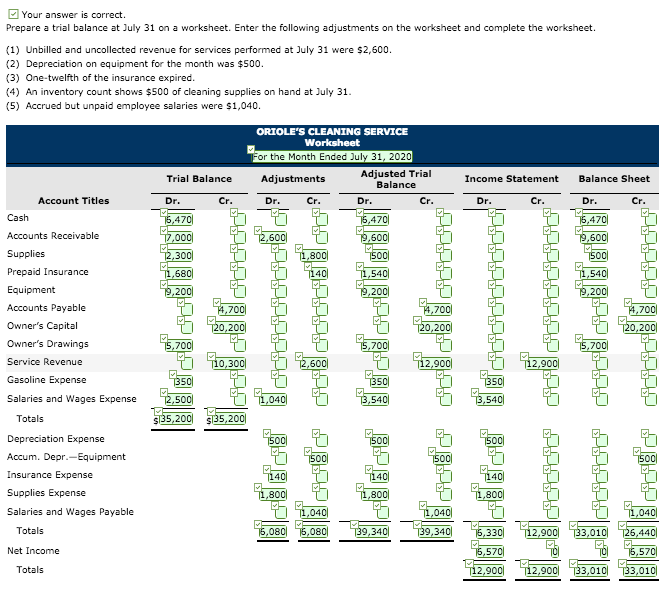

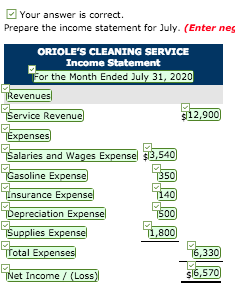

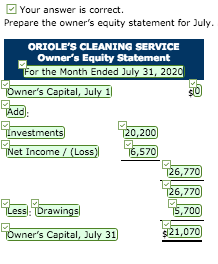

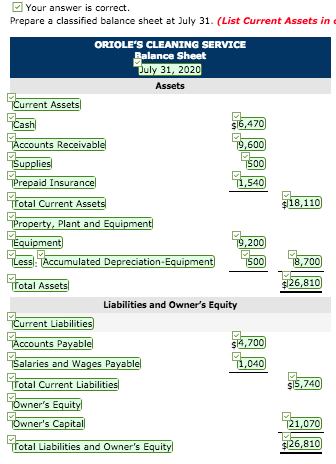

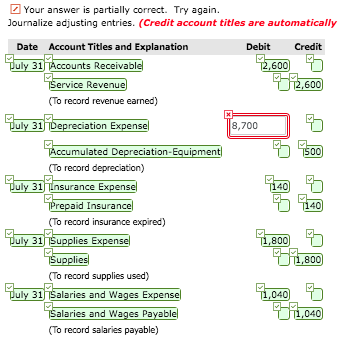

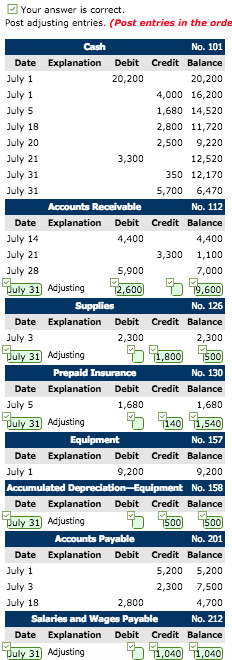

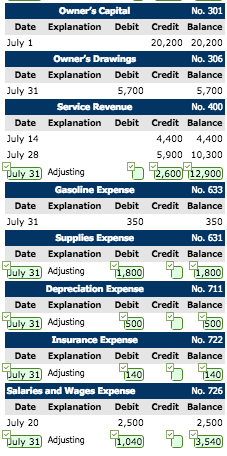

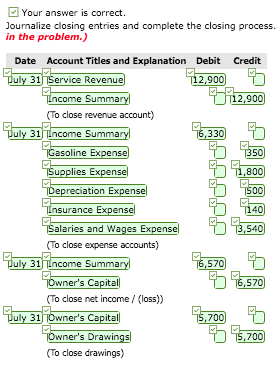

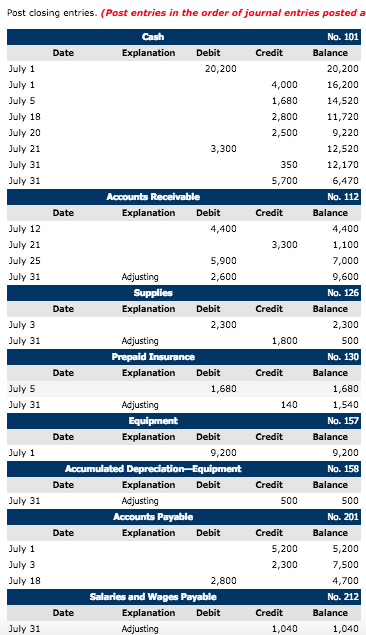

Your answer is correct. Journalize the July transactions. (Credit account titles are auton displayed in the problem.) Date Account Titles and Explanation Debit Credit ul as 0,200 ner's Capita 0,200 (To record cash invested in business) ul 20 as ccounts Payabl 20 (To record truck purchased) ul ie 30 counts Payabl 30 ul Prepaid Insuranc 68 as 68 counts Receivable ervice Revenu ccounts Payabl as 40 40 80 80 ly 20 Salaries and Wages Expense 50 as 50 Duly 21Cash 30 ccounts Receivable 30 uly 25 counts Receivable 90 ervice Revenu 90 uly 31Gasoline Expens as (To record gasoline expense) uly 31 Towner's Drawin 70 as 70 (To record drawings) Date Explanation Debit Credit Balance 20,2002,200 RA001 1,720 300 12,520 14,520 buly 18 Buly 20 50 T12,170 uly 31 No. 112 Date Explanation Debit Credit Balance 400 T,400 3.300 1100 5.900.000 Supplies No. 128 Date Explanation Debit Credit Balance 30 30 No. 130 Date Explanation Debit Credit Balance uly 5 No. 157 Date Explanation Debit Credit Balance Accounts Payable No. 201 Date Explanation Debit Credit Balance uly 18 Owner's Capital No. 301 Date Explanation Debit Credit Balance No. 306 Date Explanation Debit Credit Balance Owner's Drawings No. 400 Date Explanation Debit Credit Balance 400! 4001 Service Revenue No. 633 Date Explanation Debit Credit Balance uly 31 Salaries and Wages Expense No. 726 Date Explanation Debit Credit Balance Your answer is correct. Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet and complete the worksheet. (1) Unbilled and uncollected revenue for services performed at July 31 were $2,600. (2) Depreciation on equipment for the month was $500 (3) One-twelfth of the insurance expired (4) An inventory count shows $500 of cleaning supplies on hand at July 31 (5) Accrued but unpaid employee salaries were $1,040. ORTOLE'S CLEANING SERVICE or the Month Ended July 31, 2020 Adjusted Trial Balance Trial Balance Adjustments Income Statement Balance Sheet Account Titles Cr. Dr. Cr. Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Owner's Capital Owner's Drawings Service Revenue Gasoline Expense 47 47 47 60 60 60 300 68 200 800 540 54 200 200 70 70 70 0,200 0,200 0,200 70 70 70 0,300 60 2,900 2,900 Salaries and Wages Expense2500 135,200| 040 540 54 Sl35,20 Totals Depreciation Expense Accum. Depr.-Equipment Insurance Expense Supplies Expense Salaries and Wages Payable 800 800 800 040 Totals Net Income Totals 08 ,0801 340 330 2,900 3,010 6,44 57 570 12,9001 12,90033,010 33,010 Your answer is correct Prepare the income statement for July. (Enter nes ORTOLE'S CLEANING SERVICE Income or the Month Ended July 31, 2020 evenu Service Revenue Expenses 12,900 asoline Expense Linsurance Expense Depreciation Expense Salaries and Wages Expense $13.540 50 40 500 Supplies Expensel 800 otal Expenses 330 let Income / (Loss) Your answer is correct Prepare the owner's equity statement for July. ORIOLE'S CLEANING SERVICE Owner's Equity Statement or the Month Ended July 31, 202 wner's Capital, July 1 investments 20,200 let Income / (Loss) 570 26,770 26,770 5,700 ess: brawings wner's Capital, July 31 21,070 Your answer is correct. Prepare a classified balance sheet at July 31. (List Current Assets in o ORTOLE'S CLEANING SERVICE Sheet 31, 2020 Assets urrent As 516,470 9.600 500 unts Receivab repaid Insuran 540 18,110 otal Current Plant and Equ 200 500 8,700 umulated De ation-Equ Total Assets 26,810 Liabilities and Owner's Equity urrent Liabilities unts Payable 4,700 alaries and Wages Payab 040 otal Current Liabilit ner's Equit 21.070 wner's Ca rotal Liabilities and Owner's Eit 26,810 Your answer is partially correct. Try again. Journalize adjusting entries. (Credit account titles are automatically Date Account Titles and Explanation Debit Credit 2600 31 unts Receivabl Service Revenue (To record revenue earned) 31 reciation 8,700 umulated De ation-Equ (To record depreciation) 31 Lnsurance Expense 1800 repaid Insuran (To record insurance expired) 31Supplies (To record supplies used) 1.050 .040 31Salaries and Wages alaries and Wages Payab (To record salaries payable) Your answer is correct Post adjusting entries. (Post entries in the orde No. 101 Date Explanation Debit Credit Balance 20,200 4,000 16,200 1,680 14,520 2,800 11,720 2,500 9,220 12,520 350 12,170 5,700 6,470 No. 112 Date Explanation Debit Credit Balance 4,400 ,300 1,100 7,000 Cash 20,200 July 1 July 1 July 5 July 18 July 20 July 21 July 31 July 31 3,300 4,400 July 14 July 21 July 28 5,900 uly 31 Adjusting 0,60 No. 126 Date Explanation Debit Credit Balance 2,300 D 00 i500 No. 130 Date Explanation Debit Credit Balance 1,680 40 1,540 No. 157 Date Explanation Debit Credit Balance 9,200 Equipment No. 158 Date Explanation Debit Credit Balance July 3 2,300 July 31) Adjusting July 5 1,680 uly 31 Adjusting July 1 Accumulated Deprec 9,200 uly 31 Adjusting 'E00 is00 Accounts Payable No. 201 Date Explanation Debit Credit Balance ,200 5,200 2,300 7,500 4,700 No. 212 Date Explanation Debit Credit Balance July 1 July 3 July 18 2,800 Salaries and Wages Payable uly 31 Adjusting1.040 .0 Owner's Capital No. 301 Date Explanation Debit Credit Balance 20,200 20,200 No. 306 Date Explanation Debit Credit Balance 5,700 No. 400 Date Explanation Debit Credit Balance 4,400 4,400 5,900 10,300 uly 1 Owner's Drawings July 31 5,700 Service Revenue July 14 July 28 uly 31 Adjusting600 22,900 No. 633 Date Explanation Debit Credit Balance 350 No. 631 Date Explanation Debit Credit Balance Gasoline Expense July 31 350 Supplies Expense uly 31) Adjusting 80.800 Depreciation Expense Date Explanation Debit Credit Balance D ly31 Adjusting Insurance Expense No. 722 Date Explanation Debit Credit Balance T40) ly31 Adjusting Salaries and Wages Expense D No. 726 Date Explanation Debit Credit Balance 2,500 July 20 2,500 uly 31 Adjusting 3540 Your answer is correct. Journalize closing entries and complete the closing process in the problem.) Date Account Titles and Explanation Debit Credit 31 ice Revenue come Summa (To close revenue account) 31Lncome Summa 50) 000 ation 50 alaries and Wages To close expense accounts) 6570 31 ncome Summa wner's Capital (To close net income / (loss)) 8200 31Owner's Capital ner's Drawi To close drawings) Post closing entries. (Post entries in the order of journal entries posted a Cash No. 101 Date Explanation Debit Credit Balance July 1 July 1 July 5 July 18 July 20 July 21 July 31 uly 31 20,200 20,200 16,200 14,520 11,720 9,220 12,520 12,170 6,470 No. 112 4,000 1,680 2,800 2,500 3,300 350 5,700 Date Explanation Debit Credit Balance July 12 July 21 July 25 uly 31 4,400 1,100 7,000 9,600 No. 126 4,400 3,300 5,900 2,600 Date Explanation Debit Credit Balance 2,300 July 3 uly 31 2,300 500 No. 130 Adjusting 1,800 Date Explanation Debit Credit Balance July 5 uly 31 1,680 1,540 No. 157 1,680 140 Date Explanation Debit Credit Balance uly 1 9,200 9,200 No. 158 Date Explanation Debit Credit Balance uly 31 500 500 Accounts Payable No. 201 Date Explanation Debit Credit Balance July 1 July 3 uly 18 5,200 2,300 5,200 7,500 4,700 No. 212 2,800 Salaries and Wages Payable Explanation Debit Date Credit Balance July 31 1,040 1,040 Owner's Capital No. 301 Date Explanation Debit Credit July 1 20,200 20,200 Owner's Drawings No. 306 Date Explanation Debit Credit July 31 5,700 5,700 Income Summary No. 350 Date Explanation Debit Credit Service Revenue No. 400 Date Explanation Debit Credit 4,400 5,900 4,400 10,300 12,900 Adjusting No. 633 Date Credit July 31 350 350 Supplies Expense No. 631 Date Credit July 31 1,800 1,800 Date Credit July 31 Adjusting 500 500 No. 722 Date Credit July 31 Adjusting 140 140 Salaries and Wages Expense No. 726 Date Credit July 20 July 31 2,500 1,040 2,500 Adjusting 3,540