Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please , I need help with this QUESTION 5 (35 MARKS) James Bond, aged 40, is about to sign to revised employment agreement and has

please , I need help with this

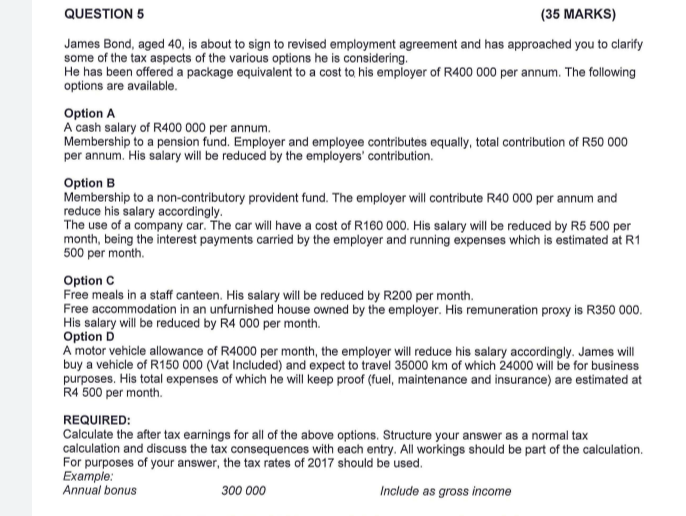

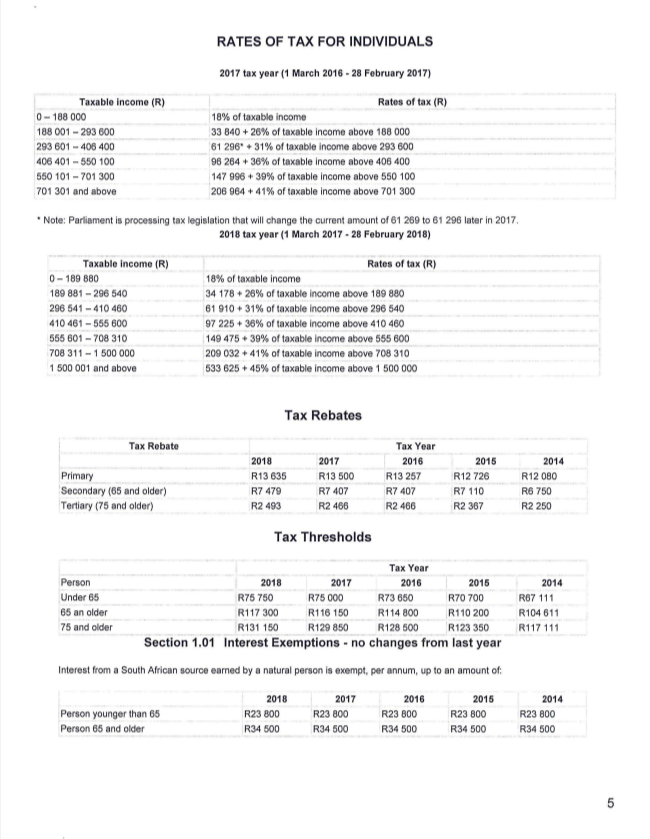

QUESTION 5 (35 MARKS) James Bond, aged 40, is about to sign to revised employment agreement and has approached you to clarify some of the tax aspects of the various options he is considering. He has been offered a package equivalent to a cost to his employer of R400 000 per annum. The following options are available. Option A A cash salary of R400 000 per annum. Membership to a pension fund. Employer and employee contributes equally, total contribution of R50 000 per annum. His salary will be reduced by the employers' contribution Option B Membership to a non-contributory provident fund. The employer will contribute R40 000 per annum and reduce his salary accordingly The use of a company car. The car will have a cost of R160 000. His salary will be reduced by R5 500 per month, being the interest payments carried by the employer and running expenses which is estimated at R1 500 per month Option C Free meals in a staff canteen. His salary will be reduced by R200 per month. Free accommodation in an unfurnished house owned by the employer. His remuneration proxy is R350 000 His salary will be reduced by R4 000 per month Option D A motor vehicle allowance of R4000 per month, the employer will reduce his salary accordingly. James will buy a vehicle of R150 000 (Vat Included) and expect to travel 35000 km of which 24000 will be for business purposes. His total expenses of which he will keep proof (fuel, maintenance and insurance) are estimated at R4 500 per month REQUIRED: Calculate the after tax earnings for all of the above options. Structure your answer as a normal tax calculation and discuss the tax consequences with each entry. All workings should be part of the calculation For purposes of your answer, the tax rates of 2017 should be used. Example: Annual bonus 300 000 Include as gross income RATES OF TAX FOR INDIVIDUALS 2017 tax year (1 March 2016 - 28 February 2017) Taxable income (R) Rates of tax (R) 0 -188 000 18% of taxable income 188001 - 293 600 33 840 + 26% of taxable income above 188 000 293 601 - 406 400 61 296 +31% of taxable income above 293 600 406 401 - 550 100 96 264 + 36% of taxable income above 406 400 560 101 - 701 300 147 996 + 39% of taxable income above 550 100 701 301 and above 206 964 + 41% of taxable income above 701 300 Note: Parliament is processing tax legislation that will change the current amount of 61 289 to 61 296 later in 2017. 2018 tax year (1 March 2017 - 28 February 2018) Taxable income (R) 0-189 880 189 881 - 296 540 296 541 - 410 460 410 461 - 565 600 555 601 - 708 310 708 311 - 1 500 000 1 500 001 and above Rates of tax (R) 18% of taxable income 34 178 + 26% of taxable income above 189 880 61 910 + 31% of taxable income above 296 540 97 225 + 38% of taxable income above 410 460 149 475 + 39% of taxable income above 565 600 209 032 + 41% of taxable income above 708 310 533 625 + 45% of taxable income above 1 500 000 Tax Rebates Tax Rebate Primary Secondary (65 and older) Tertiary (75 and older) 2018 R13 635 R7 479 R2 493 2017 R13 500 R7 407 R2 466 Tax Year 2016 R13 257 R7 407 R2 466 2015 R12 726 R7 110 R2 367 2014 R12 080 R6 750 R2 250 Tax Thresholds 2014 R67 111 R104611 R117 111 Tax Year Person 2018 2017 2016 2015 Under 65 R75 750 R75 000 R73 650 R70 700 65 an older R117300 R116 150 R114 800 R110 200 75 and older R131 150 R129 850 R128 500 R123 350 Section 1.01 Interest Exemptions - no changes from last year Interest from a South African source earned by a natural person is exempt, per annum, up to an amount of: 2018 2017 2016 2015 Person younger than 65 R23 800 R23 800 R23 800 R23 B00 Person 65 and older R34 500 R34 500 R34 500 R34 500 2014 R23 800 R34 500 QUESTION 5 (35 MARKS) James Bond, aged 40, is about to sign to revised employment agreement and has approached you to clarify some of the tax aspects of the various options he is considering. He has been offered a package equivalent to a cost to his employer of R400 000 per annum. The following options are available. Option A A cash salary of R400 000 per annum. Membership to a pension fund. Employer and employee contributes equally, total contribution of R50 000 per annum. His salary will be reduced by the employers' contribution Option B Membership to a non-contributory provident fund. The employer will contribute R40 000 per annum and reduce his salary accordingly The use of a company car. The car will have a cost of R160 000. His salary will be reduced by R5 500 per month, being the interest payments carried by the employer and running expenses which is estimated at R1 500 per month Option C Free meals in a staff canteen. His salary will be reduced by R200 per month. Free accommodation in an unfurnished house owned by the employer. His remuneration proxy is R350 000 His salary will be reduced by R4 000 per month Option D A motor vehicle allowance of R4000 per month, the employer will reduce his salary accordingly. James will buy a vehicle of R150 000 (Vat Included) and expect to travel 35000 km of which 24000 will be for business purposes. His total expenses of which he will keep proof (fuel, maintenance and insurance) are estimated at R4 500 per month REQUIRED: Calculate the after tax earnings for all of the above options. Structure your answer as a normal tax calculation and discuss the tax consequences with each entry. All workings should be part of the calculation For purposes of your answer, the tax rates of 2017 should be used. Example: Annual bonus 300 000 Include as gross income RATES OF TAX FOR INDIVIDUALS 2017 tax year (1 March 2016 - 28 February 2017) Taxable income (R) Rates of tax (R) 0 -188 000 18% of taxable income 188001 - 293 600 33 840 + 26% of taxable income above 188 000 293 601 - 406 400 61 296 +31% of taxable income above 293 600 406 401 - 550 100 96 264 + 36% of taxable income above 406 400 560 101 - 701 300 147 996 + 39% of taxable income above 550 100 701 301 and above 206 964 + 41% of taxable income above 701 300 Note: Parliament is processing tax legislation that will change the current amount of 61 289 to 61 296 later in 2017. 2018 tax year (1 March 2017 - 28 February 2018) Taxable income (R) 0-189 880 189 881 - 296 540 296 541 - 410 460 410 461 - 565 600 555 601 - 708 310 708 311 - 1 500 000 1 500 001 and above Rates of tax (R) 18% of taxable income 34 178 + 26% of taxable income above 189 880 61 910 + 31% of taxable income above 296 540 97 225 + 38% of taxable income above 410 460 149 475 + 39% of taxable income above 565 600 209 032 + 41% of taxable income above 708 310 533 625 + 45% of taxable income above 1 500 000 Tax Rebates Tax Rebate Primary Secondary (65 and older) Tertiary (75 and older) 2018 R13 635 R7 479 R2 493 2017 R13 500 R7 407 R2 466 Tax Year 2016 R13 257 R7 407 R2 466 2015 R12 726 R7 110 R2 367 2014 R12 080 R6 750 R2 250 Tax Thresholds 2014 R67 111 R104611 R117 111 Tax Year Person 2018 2017 2016 2015 Under 65 R75 750 R75 000 R73 650 R70 700 65 an older R117300 R116 150 R114 800 R110 200 75 and older R131 150 R129 850 R128 500 R123 350 Section 1.01 Interest Exemptions - no changes from last year Interest from a South African source earned by a natural person is exempt, per annum, up to an amount of: 2018 2017 2016 2015 Person younger than 65 R23 800 R23 800 R23 800 R23 B00 Person 65 and older R34 500 R34 500 R34 500 R34 500 2014 R23 800 R34 500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started