please I need it

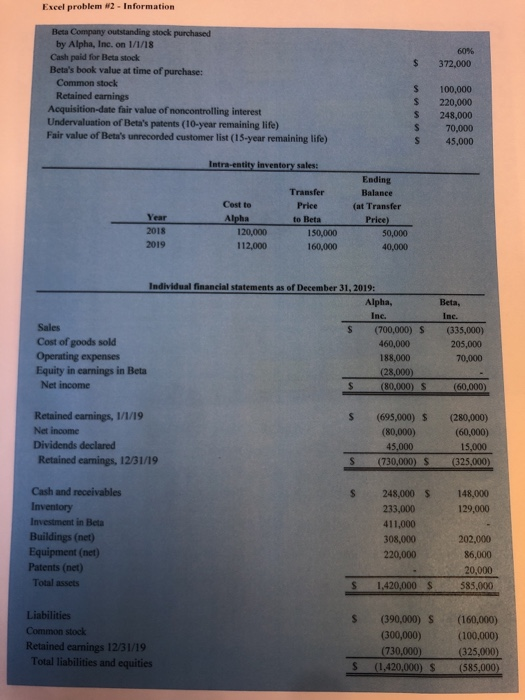

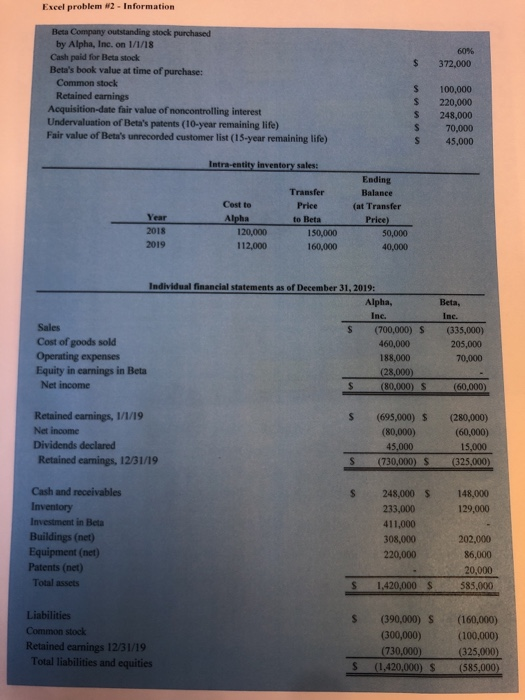

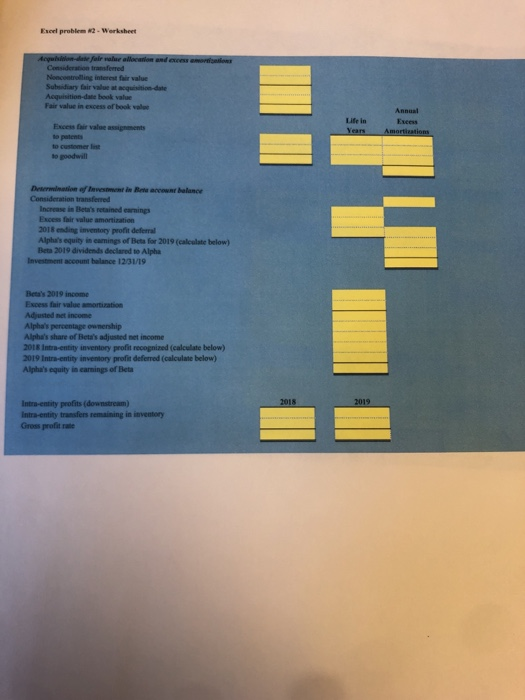

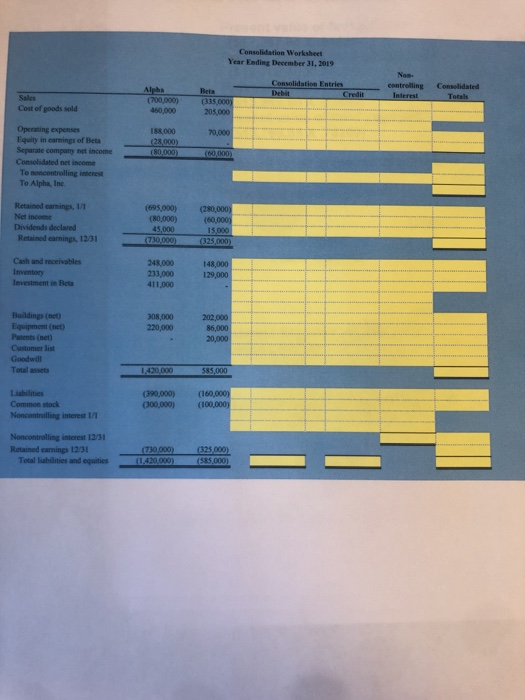

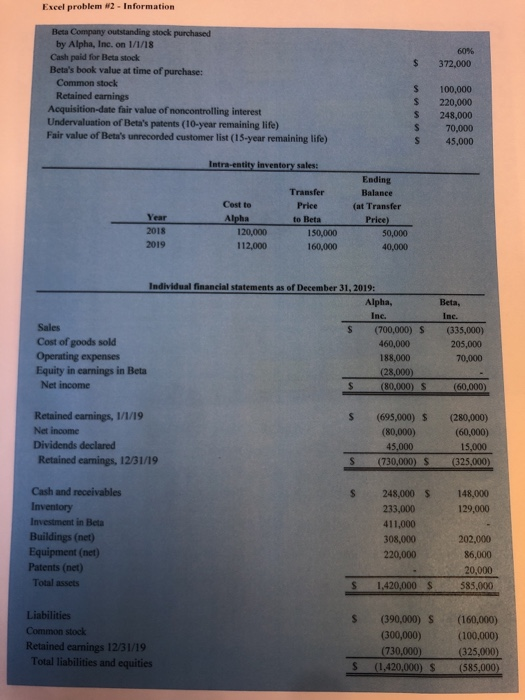

Excel problem #2- Information by Alpha, Inc. on 1/1/18 Cash paid for Beta stock Beta's book value at time of purchase: 60% $ 372,000 Common stock S 100,000 S 220,000 S 248,000 S 70,000 S 45,000 Retained earnings Acquisition-date fair value of noncontrolling interest Undervaluation of Beta's patents (10-year remaining life) Fair value of Beta's unrecorded customer list (13-year remaining life) Intra-entity inventory sales: Ending Balance (at Transfer Price Transfer Price to Beta Cost to 2018 2019 150,000 50,000 40,000 112,000 Individual financial statements as of December 31, 2019: Alpha, Inc. Sales Cost of goods sold Operating expenses Equity in earnings in Beta Net income S (700,000) S(335,000) 205,000 70,000 460,000 188,000 (80,000) S (60,000) Retained earnings, 1/1/19 Net income Dividends declared S (695,000) $ (280,000) (60,000) 15,000 S (730,000) (325,000) (80,000) 45,000 Retained earmings, 12/31/19 Cash and receivables Inventory Investment in Beta Buildings (net) Equipment (net) Patents (net) Total assets s 248,000 S 148,000 129,000 233,000 411,000 308,000 202,000 86,000 S 1,420,000 S 585,000 Liabilities Common stock Retained earnings 12/31/19 Total liabilities and equities S (390,000) S (160,000) (100,000) (300,000) S (1,420,000 S (585.000) Escet problem #2 w erksheet book value Fair value in excess of book valo Annual Excess Life in Excess Eair valoe assignments to customer lit to goodwill Consideration transferred Increase in Beta's retained earnings Excess fair value amortization 2018endng inventory profit dde Alpha's equity in eamings of Beta for 2019 (calculate below) Beta 2019 dividends declared to Alpha Investment account bailance 12/31/19 Beta's 2019 income Excess fair value amortization Adjusted net income Alpha's percentage ownership Alpha's share of Beta's adjusted net income 2018 Intra-entity inventory profit recognized (calculate below) 2019 Intra-entity inventory profis deferred (calculate below) Alpha's equity in earnings of Beta Intra-entity transfers remaining in inventory Gross profit rate Consolidation Worksheet Year Ending December 31, 2019 Consolidation Entries Alpha Beta Sales Cost of goods sold 700,000) (335,000) 460,000 205,000 Operating expenses 188,000 70,000 Separate company net income Consolidated net income To noncontrolling interest To Alpha, Inc Retained earnings, 1/ Net income (80,000) 45,000 Dividends declared Retained earnings, 1231 Cash and receivables Inventory Ievestment in Beta 248,000 233,000 411,000 14 129,000 Buildings (net) Equipment (net) Patents (net Customer list 308,000202,000 220,000 Total assets (390,000) (300,000)( Common stock Noncontrolling interest 1 Noncontrolling interest 12/31 Retained earnings 12/31 (730,000) (325,000) Total liabilities and equities