Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please I need it urgent thanks 10. You are analyzing the following two mutually exclusive projects and have developed the following information. What is the

please I need it urgent thanks

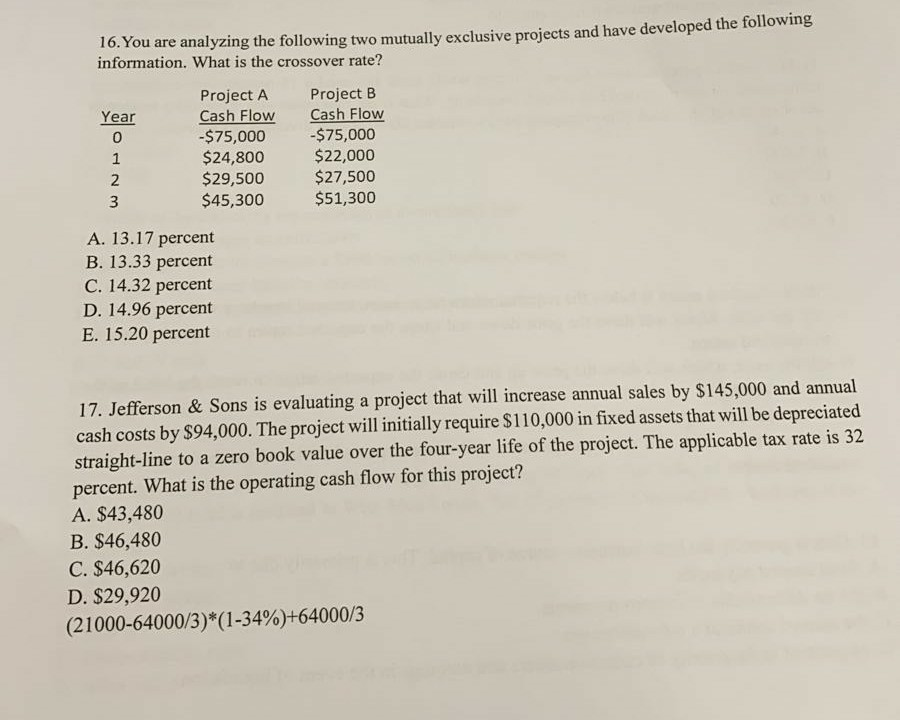

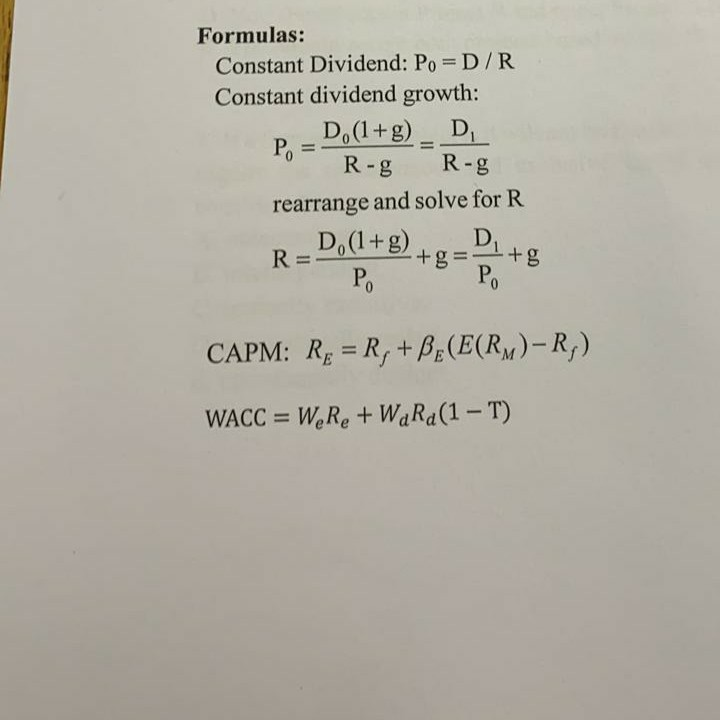

10. You are analyzing the following two mutually exclusive projects and have developed the following information. What is the crossover rate? Project A Project B Year Cash Flow Cash Flow -$75,000 -$75,000 $24,800 $22,000 $29,500 $27,500 $45,300 $51,300 WN A. 13.17 percent B. 13.33 percent C. 14.32 percent D. 14.96 percent E. 15.20 percent 17. Jefferson & Sons is evaluating a project that will increase annual sales by $145,000 and annual cash costs by $94,000. The project will initially require $110,000 in fixed assets that will be depreciated straight-line to a zero book value over the four-year life of the project. The applicable tax rate is 32 percent. What is the operating cash flow for this project? A. $43,480 B. $46,480 C. $46,620 D. $29,920 (21000-64000/3)*(1-34%)+64000/3 Formulas: Constant Dividend: Po=D/R Constant dividend growth: P _D,(1+g)_D I-R-g R-g rearrange and solve for R R_D,(1+g) -Di+g Po CAPM: Rp = R, +BE(E(RM)-R,) WACC = W Re + WaRa(1 - T)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started