Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please I need it urgent thanks 12. If the expected return is below the required return on an asset, rational investors will A. sell the

please I need it urgent thanks

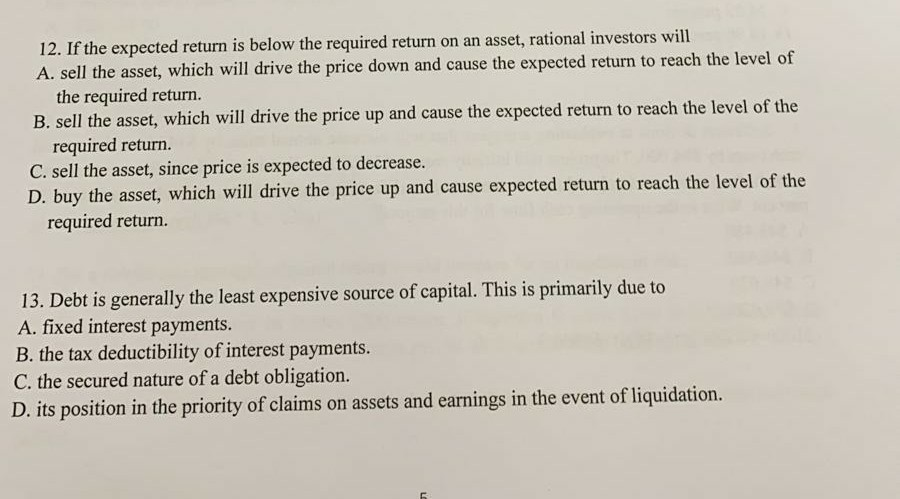

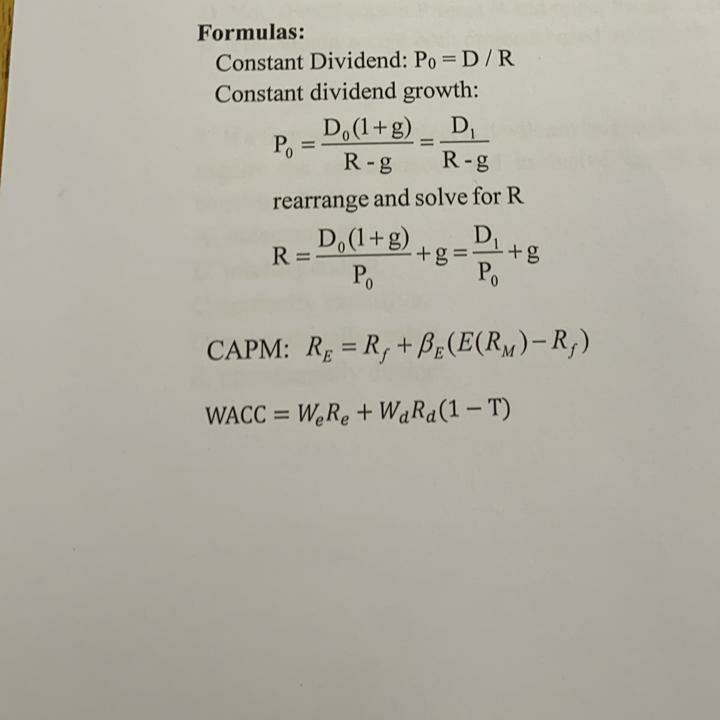

12. If the expected return is below the required return on an asset, rational investors will A. sell the asset, which will drive the price down and cause the expected return to reach the level of the required return. B. sell the asset, which will drive the price up and cause the expected return to reach the level of the required return. C. sell the asset, since price is expected to decrease. D. buy the asset, which will drive the price up and cause expected return to reach the level of the required return. 13. Debt is generally the least expensive source of capital. This is primarily due to A. fixed interest payments. B. the tax deductibility of interest payments. C. the secured nature of a debt obligation. D. its position in the priority of claims on assets and earnings in the event of liquidation. Formulas: Constant Dividend: Po D/R Constant dividend growth: D,(1+g) D, Po %3D R-g R-g rearrange and solve for R Do(1+g) +g%=D R = %3D Po Po CAPM: R; = R, +BE(E(RM)-R;) WACC = W.Re + WaRa(1-T) %3DStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started