Please, I need the answer for this before 10 hours from now

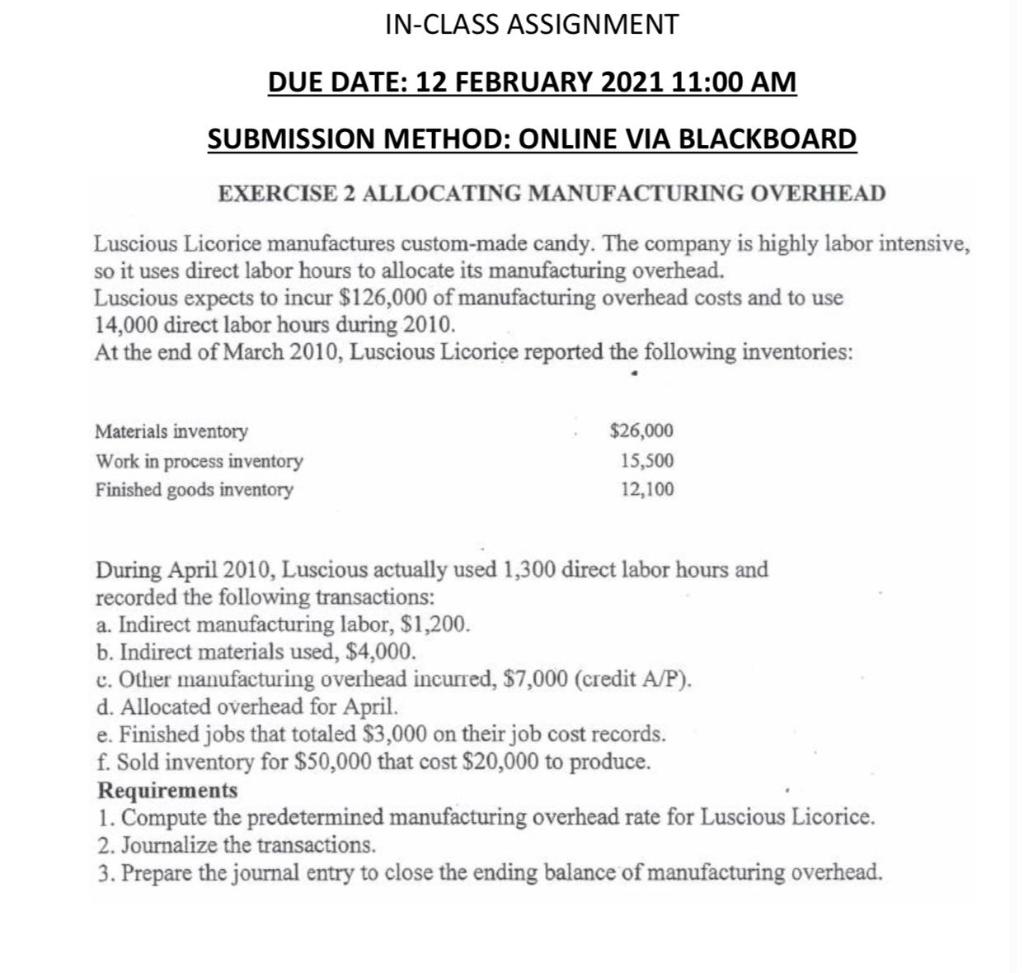

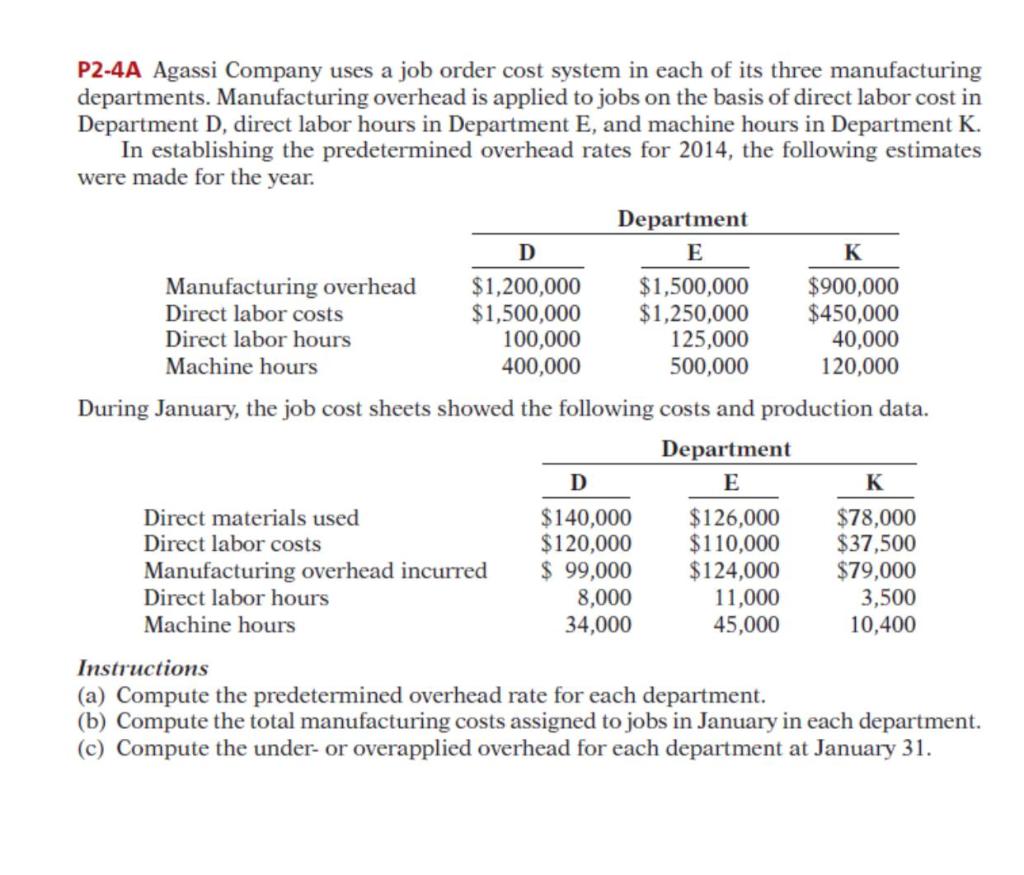

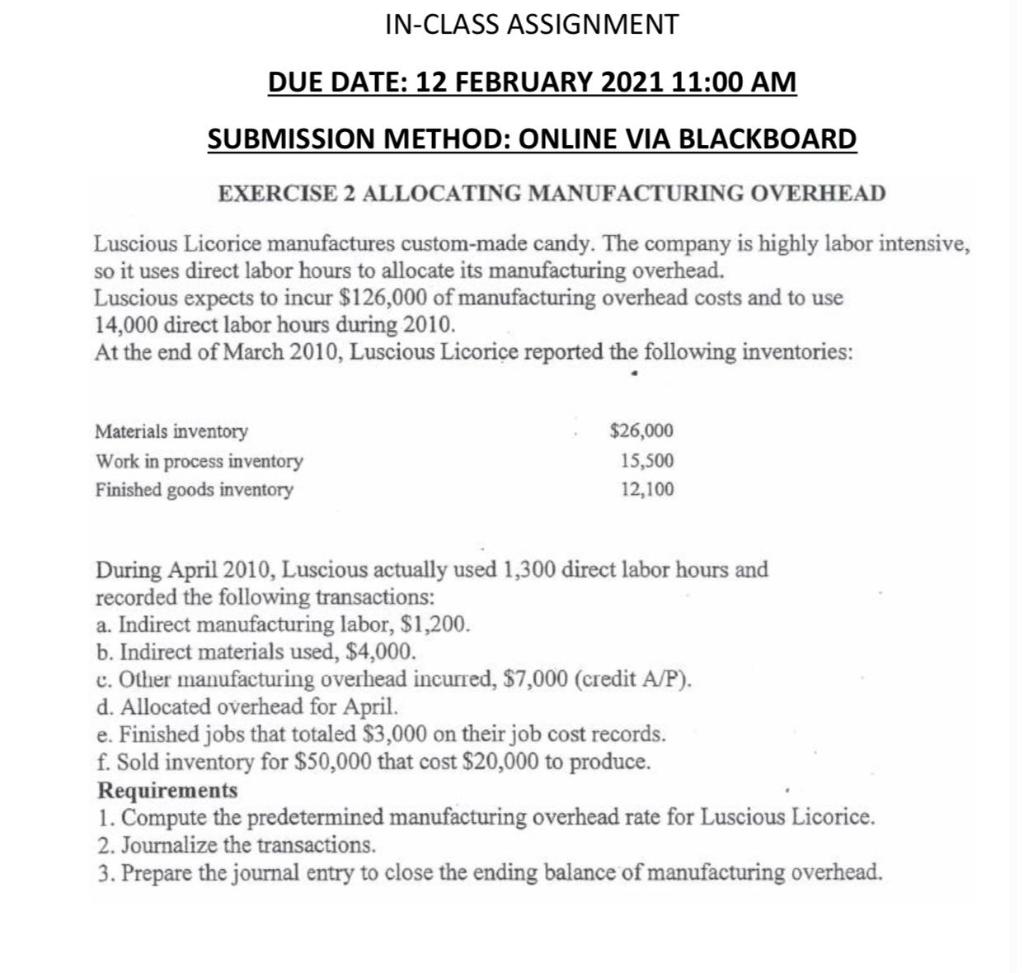

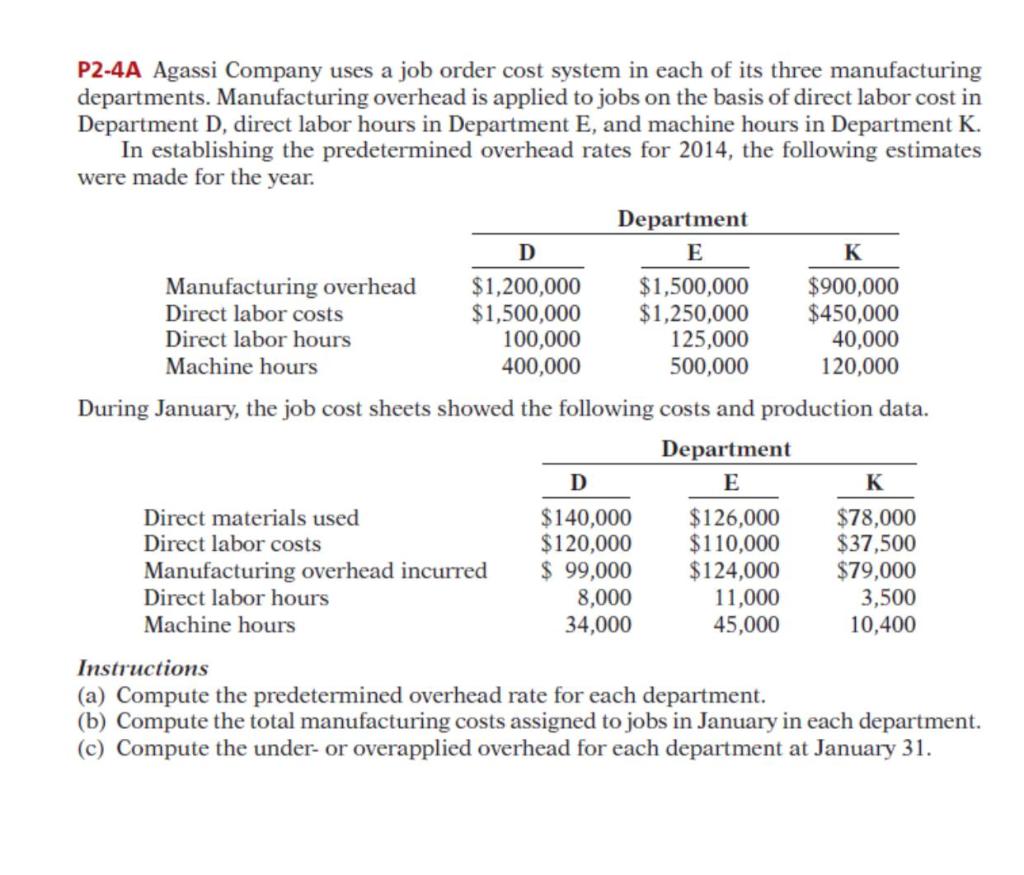

IN-CLASS ASSIGNMENT DUE DATE: 12 FEBRUARY 2021 11:00 AM SUBMISSION METHOD: ONLINE VIA BLACKBOARD EXERCISE 2 ALLOCATING MANUFACTURING OVERHEAD Luscious Licorice manufactures custom-made candy. The company is highly labor intensive, so it uses direct labor hours to allocate its manufacturing overhead. Luscious expects to incur $126,000 of manufacturing overhead costs and to use 14,000 direct labor hours during 2010. At the end of March 2010, Luscious Licorice reported the following inventories: Materials inventory Work in process inventory Finished goods inventory $26,000 15,500 12,100 During April 2010, Luscious actually used 1,300 direct labor hours and recorded the following transactions: a. Indirect manufacturing labor, $1,200. b. Indirect materials used, $4,000. c. Other manufacturing overhead incurred, $7,000 (credit A/P). d. Allocated overhead for April. e. Finished jobs that totaled $3,000 on their job cost records. f. Sold inventory for $50,000 that cost $20,000 to produce. Requirements 1. Compute the predetermined manufacturing overhead rate for Luscious Licorice. 2. Journalize the transactions. 3. Prepare the journal entry to close the ending balance of manufacturing overhead. D P2-4A Agassi Company uses a job order cost system in each of its three manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labor cost in Department D, direct labor hours in Department E, and machine hours in Department K. In establishing the predetermined overhead rates for 2014, the following estimates were made for the year. Department E K Manufacturing overhead $1,200,000 $1,500,000 $900,000 Direct labor costs $1,500,000 $1,250,000 $450,000 Direct labor hours 100,000 125,000 40,000 Machine hours 400,000 500,000 120,000 During January, the job cost sheets showed the following costs and production data. Department E Direct materials used $140,000 $126,000 $78,000 Direct labor costs $120,000 $110,000 $37,500 Manufacturing overhead incurred $ 99,000 $124,000 $79,000 Direct labor hours 8,000 11,000 3,500 Machine hours 34,000 45,000 10,400 Instructions (a) Compute the predetermined overhead rate for each department. (b) Compute the total manufacturing costs assigned to jobs in January in each department. (c) Compute the under- or overapplied overhead for each department at January 31. D K