Answered step by step

Verified Expert Solution

Question

1 Approved Answer

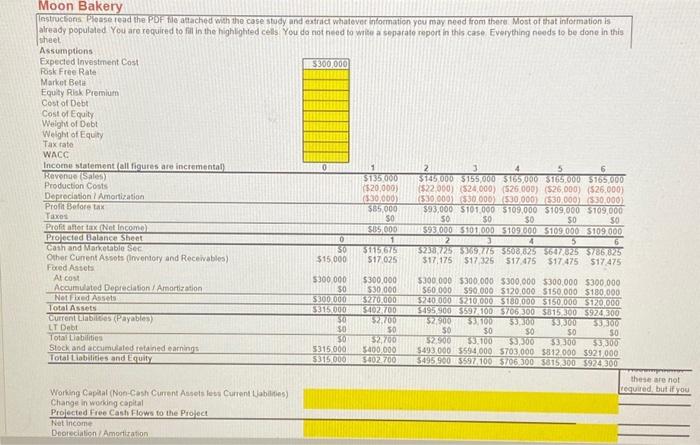

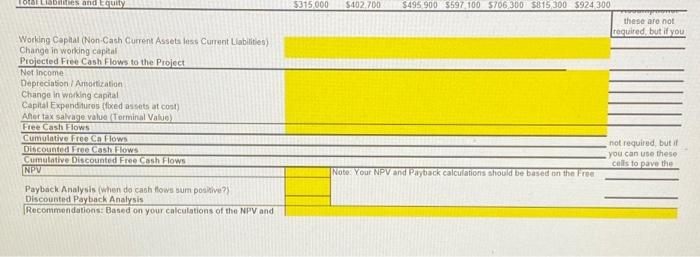

please I need the formla and the solution for Depreciation/Amortization, change in working capital, and capital expenditures. Working Capaat (Non-Cash Current Assets less Current Liablities)

please I need the formla and the solution for Depreciation/Amortization, change in working capital, and capital expenditures.

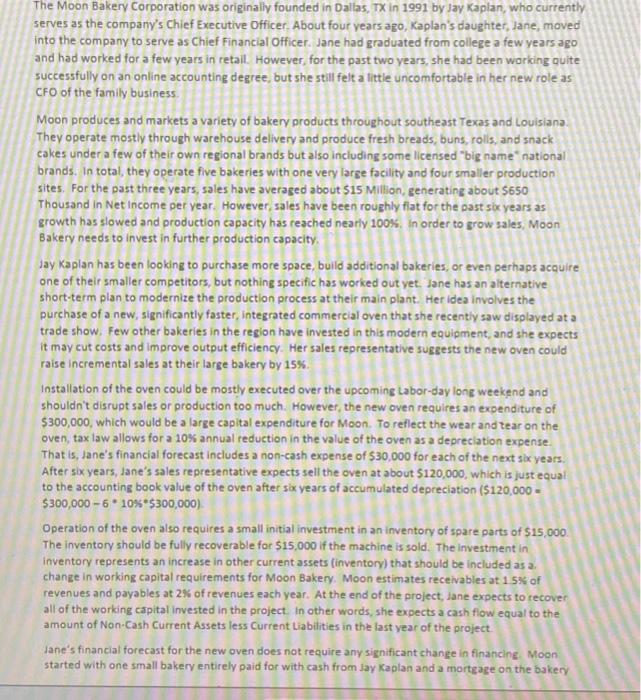

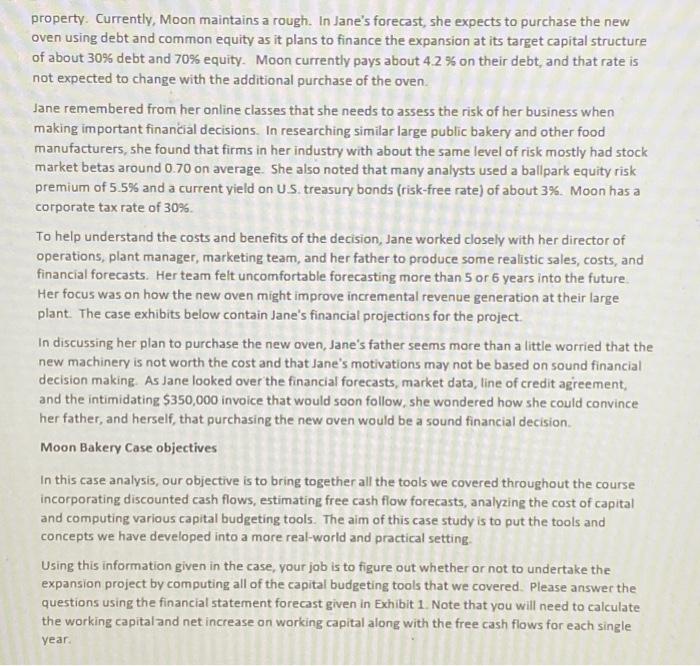

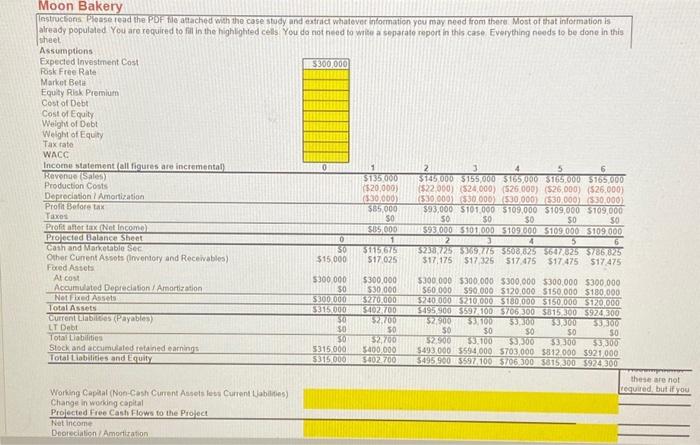

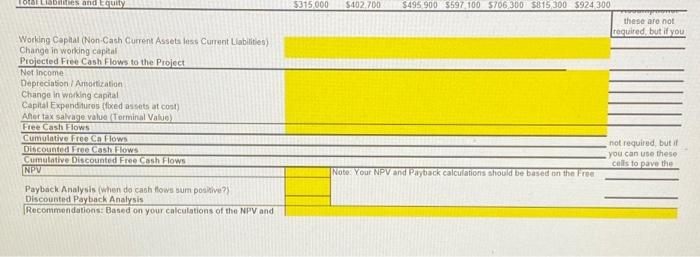

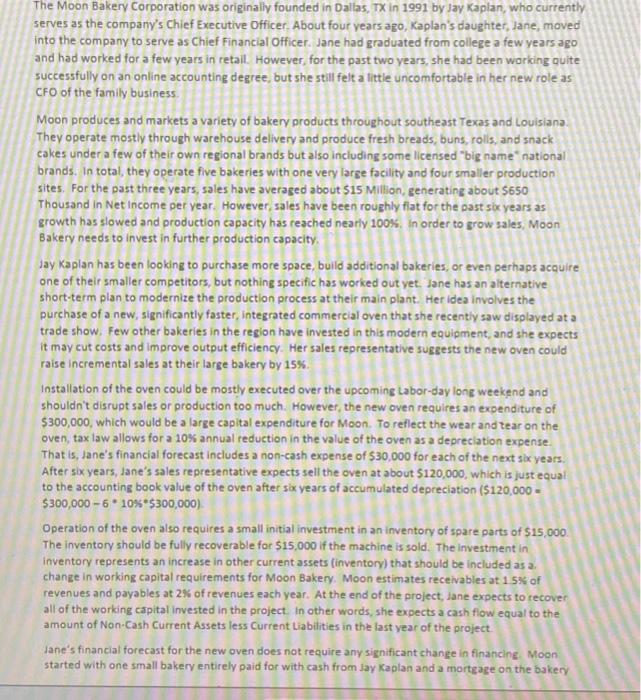

Working Capaat (Non-Cash Current Assets less Current Liablities) Change in working cepital Projected Free Cash Flows to the Project Net income Depreciation I Amportication Change in weiking capital Capital Expendituros \{foxed as sets at cost) Aaer tox sakrige value (Torminal Value) FreeCash Hlows Cumulative Free Ca flows Discounted Free Cash Flows Cumelative Discounted Free Cash flows these are not required, but if you NPVPaybackAnalysis(WhendocachfowssumposBhe?DiscountedPaybackAnalysis Discounted Payback Analysis Recommendations: Based on your calculations of the NPV and The Moon Bakery Corporation was originally founded in Dallas, TX in 1991 by Jay Kaplan, who currently serves as the company's Chief Executive Officer. About four vears ago, Kaplan's daughter, Jane, moved into the company to serve as Chief Financial Officer. Jane had graduated from college a few years ago and had worked for a few years in retail. However, for the past two years, she had been working quite successfully on an online accounting degree, but she still felt a little uncomfortable in her new role as CFO of the family business. Moon produces and markets a variety of bakery products throughout southeast Texas and Loulsiana. They operate mostly through warehouse delivery and produce fresh breads, buns, rolls, and snack cakes under a few of their own regional brands but also including some licensed "big name" national brands. In total, they operate five bakeries with one very large facility and four smaller production sites. For the past three years, sales have averaged about $15 Million, generating about $650 Thousand in Net income per vear. However, sales have been roughly fiat for the past six years as growth has slowed and production capacity has reached nearly 100\%, In order to grow sales, Moon Bakery needs to invest in further production capacity. Jay Kaplan has been looking to purchase more space, build additional bakeries, or even perhaps acquire one of their smaller competitors, but nothing specific has worked out yet. Jane has an alternative short-term plan to modernize the production process at their main plant. Her idea involves the purchase of a new, significantly faster, integrated commercial oven that she recently saw displayed at a trade show. Few other bakeries in the recion have invested in this modern equipment, and she expects it may cut costs and improve output efficiency. Her sales representative suggests the new oven could raise incremental sales at their large bakery by 15%. Installation of the oven could be mostly executed over the upcoming Labor-day long weekend and shouldn't disrupt sales or production too much. However, the new oven requires an expenditure of $300,000, which would be a large capital expenditure for Moon. To reflect the wear and tear on the oven, tax law allows for a 10% annual reduction in the value of the oven as a depreclation expense. That is, Jane's financial forecast includes a non-cash expense of $30,000 for each of the next six years. After six years, lane's sales representative expects sell the oven at about $120,000, which is just equal to the accounting book value of the oven after six years of accumulated depreciation ($120,000= $300,000610%5300,000) Operation of the oven also requires a small initial investment in an inventory of spare parts of $15,000. The inventory should be fully recoverable for $15,000 if the machine is sold. The investment in Inventory represents an increase in other current assets (inventory) that should be included as a. change in working capital requirements for Moon Bakery. Moon estimates receivables at 1.5% of revenues and payables at 2% of revenues each year. At the end of the project, lane expects to recover all of the working capital invested in the project. in other words, she expects a cash flow equal to the amount of Non-Cash Current Assets fess Current tiabifities in the last year of the project. Jane's financial forecast for the new oven does not require any significant change in financing. Moon started with one small bakery entirely paid for with cash from Jay Kaplan and a mortgage on the bakery already populated You are required to fal in the highlighted cells You do not need to wile a separato report in this case. Everything needs to be done in this theet property. Currently, Moon maintains a rough. In Jane's forecast, she expects to purchase the new oven using debt and common equity as it plans to finance the expansion at its target capital structure of about 30% debt and 70% equity. Moon currently pays about 4.2% on their debt, and that rate is not expected to change with the additional purchase of the oven. Jane remembered from her online classes that she need's to assess the risk of her business when making important financial decisions. In researching similar large public bakery and other food manufacturers, she found that firms in her industry with about the same level of risk mostly had stock market betas around 0.70 on average. She also noted that many analysts used a ballpark equity risk premium of 5.5% and a current yield on US. treasury bonds (risk-free rate) of about 3%. Moon has a corporate tax rate of 30%. To help understand the costs and benefits of the decision, Jane worked closely with her director of operations, plant manager, marketing team, and her father to produce some realistic sales, costs, and financial forecasts. Her team felt uncomfortable forecasting more than 5 or 6 years into the future Her focus was on how the new oven might improve incremental revenue generation at their large plant. The case exhibits below contain Jane's financial projections for the project. In discussing her plan to purchase the new oven, Jane's father seems more than a little worried that the new machinery is not worth the cost and that Jane's motivations may not be based on sound financial decision making. As Jane looked over the financial forecasts, market data, line of credit agreement, and the intimidating $350,000 invoice that would soon follow, she wondered how she could convince her father, and herself, that purchasing the new oven would be a sound financial decision. Moon Bakery Case objectives In this case analysis, our objective is to bring together all the tools we covered throughout the course incorporating discounted cash flows, estimating free cash flow forecasts, analyzing the cost of capital and computing various capital budgeting tools. The aim of this case study is to put the tools and concepts we have developed into a more real-world and practical setting. Using this information given in the case, your job is to figure out whether or not to undertake the expansion project by computing all of the capital budgeting tools that we covered. Please answer the questions using the financial statement forecast given in Exhibit 1. Note that you will need to calculate the working capital and net increase on working capital along with the free cash flows for each single year. Working Capaat (Non-Cash Current Assets less Current Liablities) Change in working cepital Projected Free Cash Flows to the Project Net income Depreciation I Amportication Change in weiking capital Capital Expendituros \{foxed as sets at cost) Aaer tox sakrige value (Torminal Value) FreeCash Hlows Cumulative Free Ca flows Discounted Free Cash Flows Cumelative Discounted Free Cash flows these are not required, but if you NPVPaybackAnalysis(WhendocachfowssumposBhe?DiscountedPaybackAnalysis Discounted Payback Analysis Recommendations: Based on your calculations of the NPV and The Moon Bakery Corporation was originally founded in Dallas, TX in 1991 by Jay Kaplan, who currently serves as the company's Chief Executive Officer. About four vears ago, Kaplan's daughter, Jane, moved into the company to serve as Chief Financial Officer. Jane had graduated from college a few years ago and had worked for a few years in retail. However, for the past two years, she had been working quite successfully on an online accounting degree, but she still felt a little uncomfortable in her new role as CFO of the family business. Moon produces and markets a variety of bakery products throughout southeast Texas and Loulsiana. They operate mostly through warehouse delivery and produce fresh breads, buns, rolls, and snack cakes under a few of their own regional brands but also including some licensed "big name" national brands. In total, they operate five bakeries with one very large facility and four smaller production sites. For the past three years, sales have averaged about $15 Million, generating about $650 Thousand in Net income per vear. However, sales have been roughly fiat for the past six years as growth has slowed and production capacity has reached nearly 100\%, In order to grow sales, Moon Bakery needs to invest in further production capacity. Jay Kaplan has been looking to purchase more space, build additional bakeries, or even perhaps acquire one of their smaller competitors, but nothing specific has worked out yet. Jane has an alternative short-term plan to modernize the production process at their main plant. Her idea involves the purchase of a new, significantly faster, integrated commercial oven that she recently saw displayed at a trade show. Few other bakeries in the recion have invested in this modern equipment, and she expects it may cut costs and improve output efficiency. Her sales representative suggests the new oven could raise incremental sales at their large bakery by 15%. Installation of the oven could be mostly executed over the upcoming Labor-day long weekend and shouldn't disrupt sales or production too much. However, the new oven requires an expenditure of $300,000, which would be a large capital expenditure for Moon. To reflect the wear and tear on the oven, tax law allows for a 10% annual reduction in the value of the oven as a depreclation expense. That is, Jane's financial forecast includes a non-cash expense of $30,000 for each of the next six years. After six years, lane's sales representative expects sell the oven at about $120,000, which is just equal to the accounting book value of the oven after six years of accumulated depreciation ($120,000= $300,000610%5300,000) Operation of the oven also requires a small initial investment in an inventory of spare parts of $15,000. The inventory should be fully recoverable for $15,000 if the machine is sold. The investment in Inventory represents an increase in other current assets (inventory) that should be included as a. change in working capital requirements for Moon Bakery. Moon estimates receivables at 1.5% of revenues and payables at 2% of revenues each year. At the end of the project, lane expects to recover all of the working capital invested in the project. in other words, she expects a cash flow equal to the amount of Non-Cash Current Assets fess Current tiabifities in the last year of the project. Jane's financial forecast for the new oven does not require any significant change in financing. Moon started with one small bakery entirely paid for with cash from Jay Kaplan and a mortgage on the bakery already populated You are required to fal in the highlighted cells You do not need to wile a separato report in this case. Everything needs to be done in this theet property. Currently, Moon maintains a rough. In Jane's forecast, she expects to purchase the new oven using debt and common equity as it plans to finance the expansion at its target capital structure of about 30% debt and 70% equity. Moon currently pays about 4.2% on their debt, and that rate is not expected to change with the additional purchase of the oven. Jane remembered from her online classes that she need's to assess the risk of her business when making important financial decisions. In researching similar large public bakery and other food manufacturers, she found that firms in her industry with about the same level of risk mostly had stock market betas around 0.70 on average. She also noted that many analysts used a ballpark equity risk premium of 5.5% and a current yield on US. treasury bonds (risk-free rate) of about 3%. Moon has a corporate tax rate of 30%. To help understand the costs and benefits of the decision, Jane worked closely with her director of operations, plant manager, marketing team, and her father to produce some realistic sales, costs, and financial forecasts. Her team felt uncomfortable forecasting more than 5 or 6 years into the future Her focus was on how the new oven might improve incremental revenue generation at their large plant. The case exhibits below contain Jane's financial projections for the project. In discussing her plan to purchase the new oven, Jane's father seems more than a little worried that the new machinery is not worth the cost and that Jane's motivations may not be based on sound financial decision making. As Jane looked over the financial forecasts, market data, line of credit agreement, and the intimidating $350,000 invoice that would soon follow, she wondered how she could convince her father, and herself, that purchasing the new oven would be a sound financial decision. Moon Bakery Case objectives In this case analysis, our objective is to bring together all the tools we covered throughout the course incorporating discounted cash flows, estimating free cash flow forecasts, analyzing the cost of capital and computing various capital budgeting tools. The aim of this case study is to put the tools and concepts we have developed into a more real-world and practical setting. Using this information given in the case, your job is to figure out whether or not to undertake the expansion project by computing all of the capital budgeting tools that we covered. Please answer the questions using the financial statement forecast given in Exhibit 1. Note that you will need to calculate the working capital and net increase on working capital along with the free cash flows for each single year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started