Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please i need this answers, thanks! Black-Scholes-Merton Option Valuation Model You would like to use an alternative methodolgy, therefore you will value options on Dunder

please i need this answers, thanks!

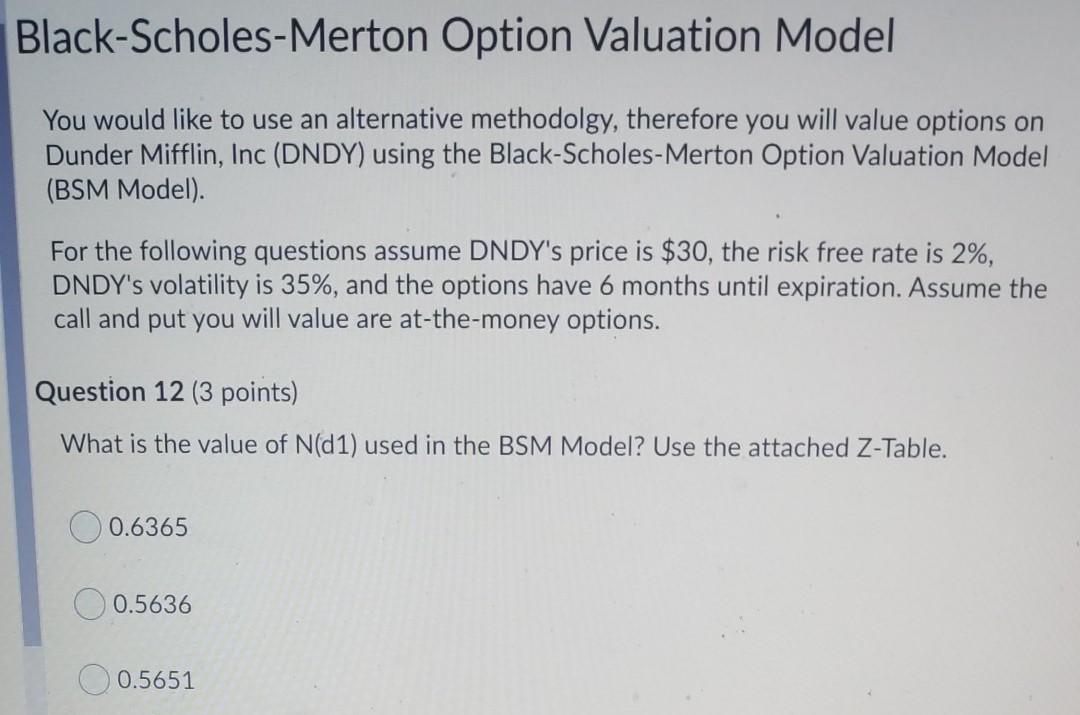

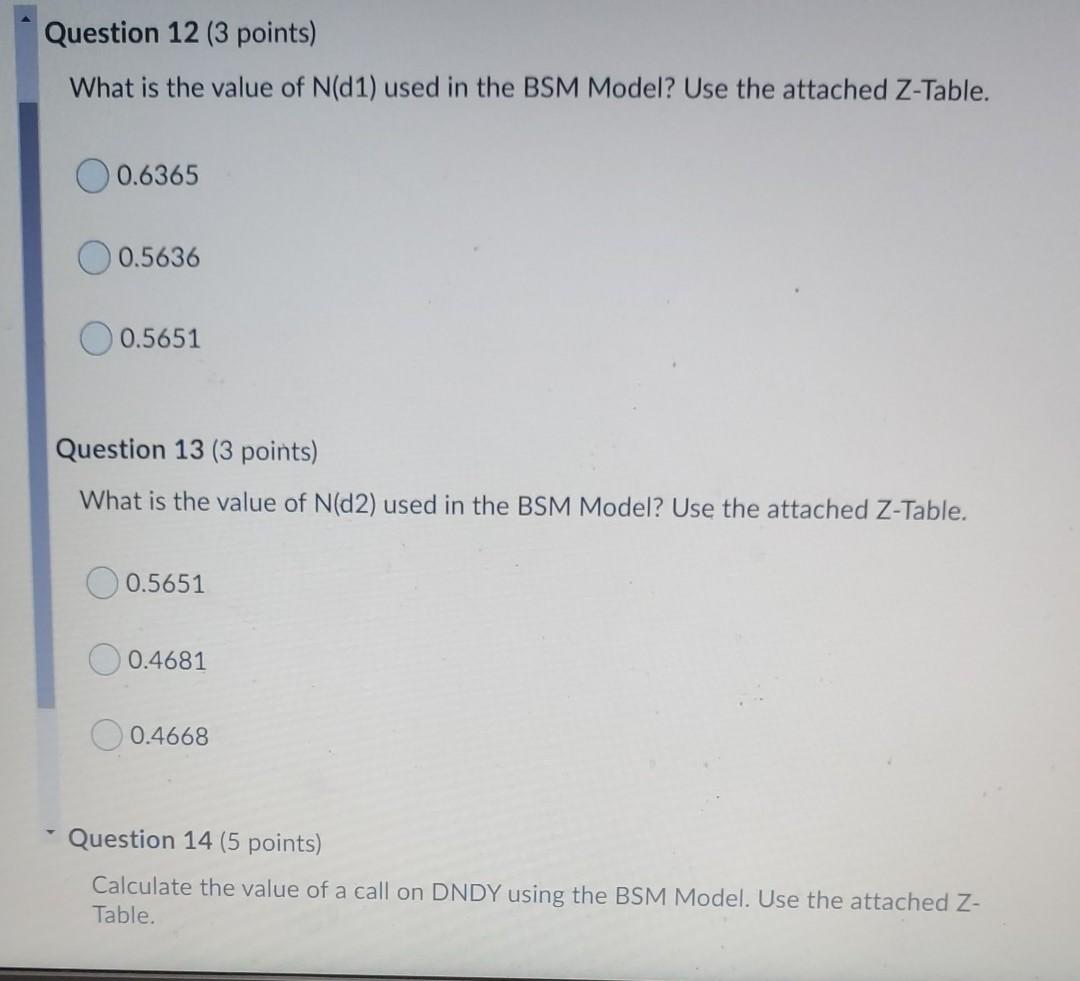

Black-Scholes-Merton Option Valuation Model You would like to use an alternative methodolgy, therefore you will value options on Dunder Mifflin, Inc (DNDY) using the Black-Scholes-Merton Option Valuation Model (BSM Model). For the following questions assume DNDY's price is $30, the risk free rate is 2%, DNDY's volatility is 35%, and the options have 6 months until expiration. Assume the call and put you will value are at-the-money options. Question 12 (3 points) What is the value of N(d1) used in the BSM Model? Use the attached Z-Table. 0.6365 0.5636 0.5651 Question 12 (3 points) What is the value of N(d1) used in the BSM Model? Use the attached Z-Table. 0.6365 0.5636 0.5651 Question 13 (3 points) What is the value of N(D2) used in the BSM Model? Use the attached Z-Table. 0.5651 O 0.4681 0.4668 Question 14 (5 points) Calculate the value of a call on DNDY using the BSM Model. Use the attached Z- TableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started