please i only have 40 mintues to solve this homework

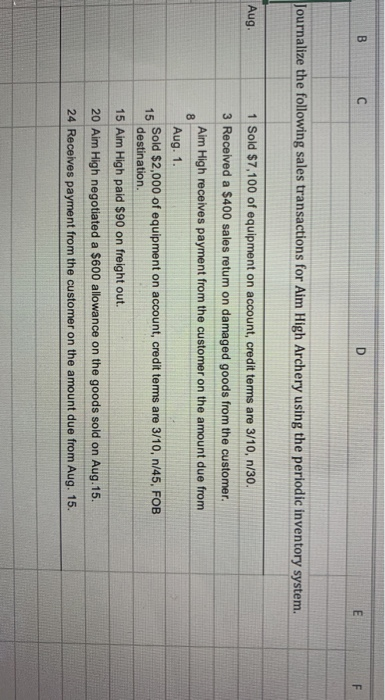

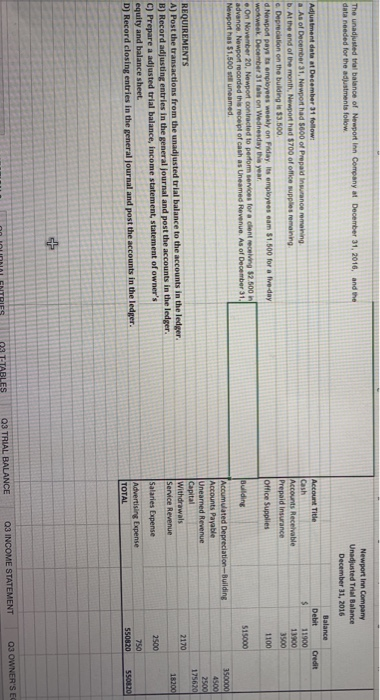

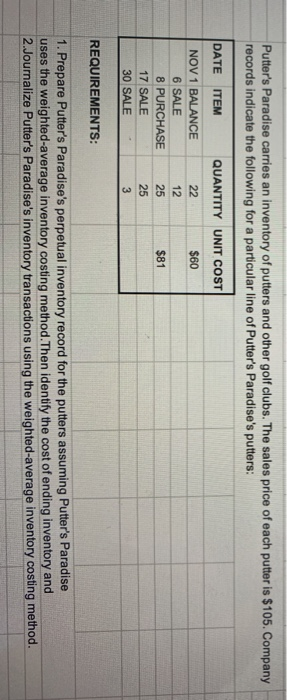

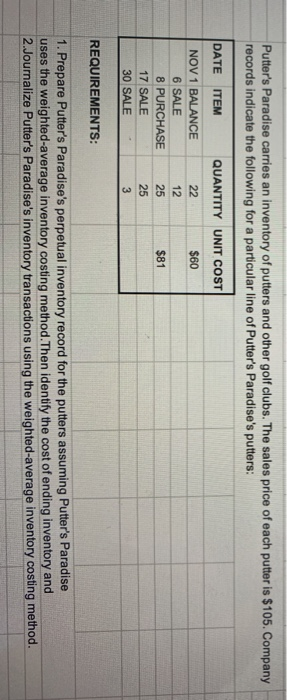

Putter's Paradise carries an inventory of putters and other golf clubs. The sales price of each putter is $105. Company records indicate the following for a particular line of Putter's Paradise's putters: DATE ITEM QUANTITY UNIT COST $60 NOV 1 BALANCE 6 SALE 8 PURCHASE 17 SALE 30 SALE 22 12 25 25 3 $81 REQUIREMENTS: 1. Prepare Putter's Paradise's perpetual inventory record for the putters assuming Putter's Paradise uses the weighted average inventory costing method. Then identify the cost of ending inventory and 2.Journalize Putter's Paradise's inventory transactions using the weighted average inventory costing method. B D E Journalize the following sales transactions for Aim High Archery using the periodic inventory system. Aug 1 Sold $7,100 of equipment on account, credit terms are 3/10, n/30. 3 Received a $400 sales retum on damaged goods from the customer. Aim High receives payment from the customer on the amount due from 8 Aug. 1. 15 Sold $2,000 of equipment on account, credit terms are 3/10, n/45, FOB destination, 15 Aim High paid $90 on freight out. 20 Aim High negotiated a $600 allowance on the goods sold on Aug.15. 24 Receives payment from the customer on the amount due from Aug. 15. The unadjusted trial balance of Newport Inn Company at December 31, 2016, and the data needed for the adjustments follow Newport Inn Company Unadjusted Trial Balance December 31, 2016 Balance Debit Credit 11900 1140 $ Adjustment data at December 31 follow As of December 31, Newport had 5600 of Prepaid insurance remaining b. At the end of the month, Newport had $700 of office supplies remaining e Depreciation on the building is $3.500 d. Newport pays to employees weekly on Friday, its employees cam $1.500 for a live-day workweek. December 31 fals on Wednesday this year ..On November 20, Newport contracted to perform services for a client receiving $2.500 advance, Newport recorded this receipt of cash as Uneamed Revenue. As of December 31. Newport has $1.500 stiuneamed. Account Title Cash Accounts Receivable Prepaid Insurance Office Supplies 1100 515000 350000 Building Accumulated Depreciation-Building Accounts Payable Uneamed Revenue Capital Withdrawals Service Revenue 2500 175620 2170 18200 REQUIREMENTS A) Post the transactions from the unadjusted trial balance to the accounts in the ledger B) Record adjusting entries in the general journal and post the accounts in the ledger C) Prepare a adjusted trial balance, income statement, statement of owner's equity and balance sheet. D) Record closing entries in the general journal and post the accounts in the ledger. Salaries Expense 2500 Advertising Expense TOTAL 750 550820 550820 03 OWNER'S E TABLES 03 INCOME STATEMENT Q3 TRIAL BALANCE

please i only have 40 mintues to solve this homework

please i only have 40 mintues to solve this homework