Please I really need help! I really need this done today help is appreciated! Thank you and I will upvote!

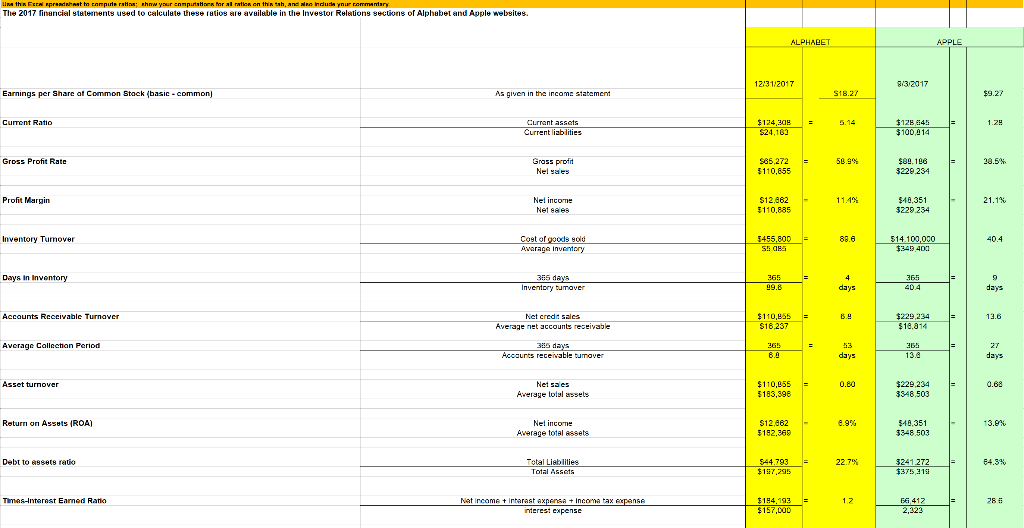

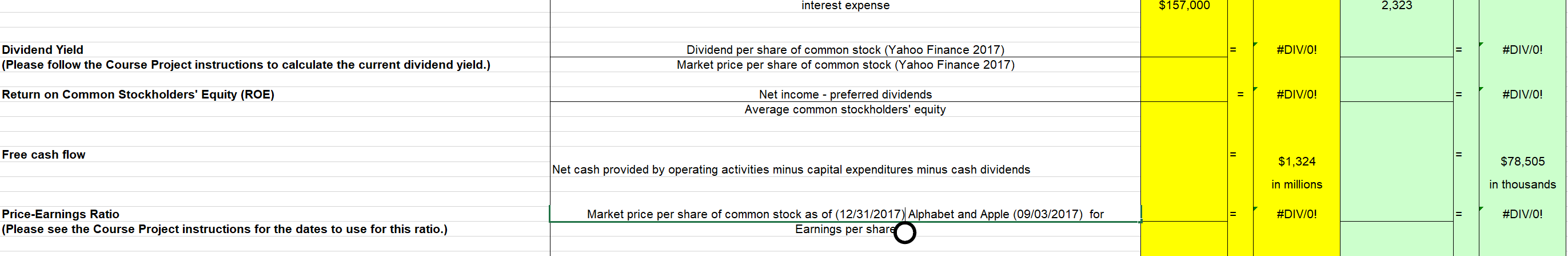

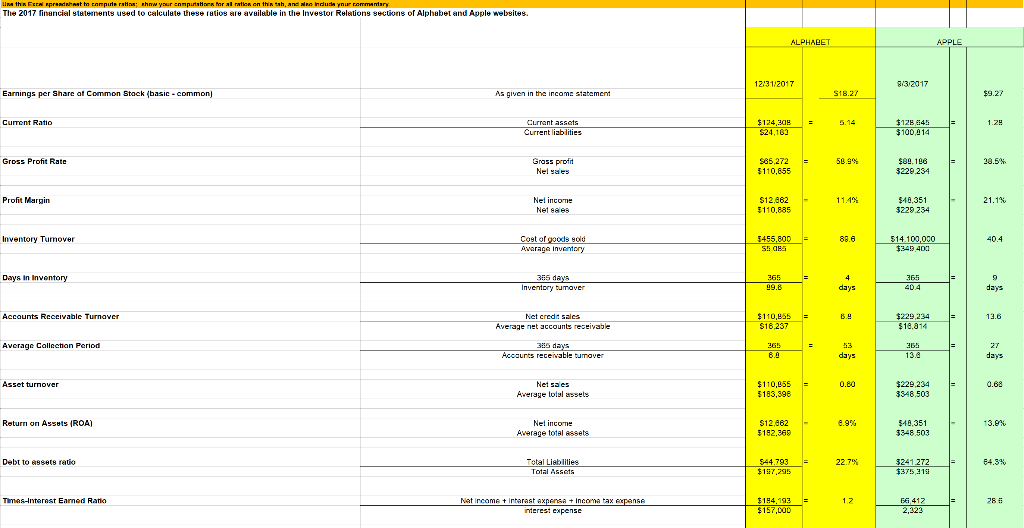

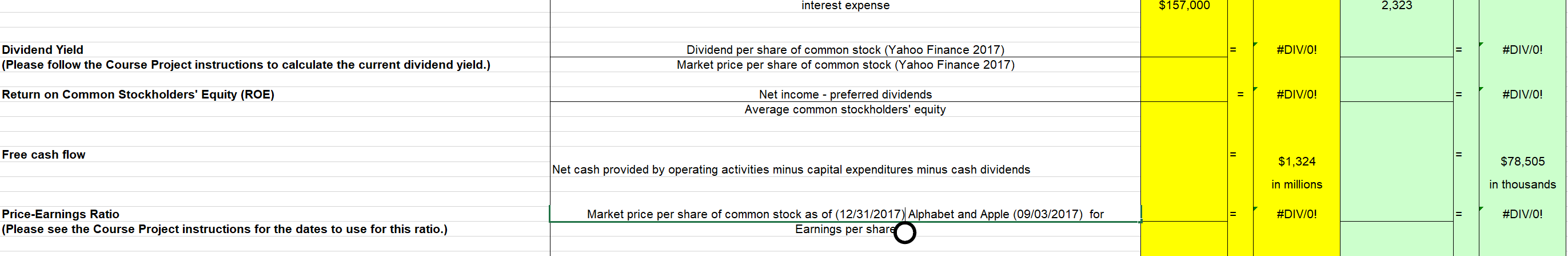

I just need the times interest earned ratio, Dividend yield, free cash flow ratio, and price earning ratio for both Apple and Google using their 2017 10K Sec form. Please also, I do not know if calculated the times interest earned ratio correct so I included it just in case. Thank you very much!

Urathix Ferpreads to computer show your computation for alration on this ah, and no dude ynur rammentary The 2017 financial statements used to calculate these ratios are available in the Investor Relations sections of Alphabet and Apple websites. ALPHABET APPLE 12/31/2017 8/3/2017 Earnings per Share of Common Stack (basic-common) As given in the income statement S18.27 $9.27 Cument Ratio 5.14 1.24 Current assets Current liabilities $124,308 S24.163 $128 645 $100,014 Gross Profit Rate 58.9% 28.57% Grass profit Nel vales $85,272 5110,855 $89.106 3229.234 Profit Margin $12.862 5110,885 11.1% Net income Net sales $40,351 3229.234 21.1% Inventory Tumover 88.6 40.4 old Average Inventory 5455,800 S! CHS $14.100,000 $349 400 Days In Inventory 356 days Inventory burraver 365 99.8 4 days 365 40.4 9 days Accounts Receivable Turnaver 13.6 Net credt sales Average net accounts receivable $110,855 $16.237 $18,314 Average Collection Period 335 days Accounts receivable tumraver 26. 3155 13.8 days days Asset turnover 0.80 0.88 Net sales Average Lolal assets $110,655 $183,896 $229,234 3848,503 Return on Assuts (ROA) 8.9% Net income Average total assets 13.0N $12,062 5192,369 348,351 3348.503 Debt to assete ratio 22.79 64.3% Total Liablities Total Assets $44.793 $ 197,295 3241.272 $375,219 $ Times-interest Earned Ratio 1.2 288 Net income interest Axent + Income tax expense interest expense $184,193 $ $157,000 56 412 2,323 interest expense $157,000 2,323 #DIV/0! = #DIV/0! Dividend Yield (Please follow the Course Project instructions to calculate the current dividend yield.) Dividend per share of common stock (Yahoo Finance 2017) Market price per share of common stock (Yahoo Finance 2017) Return on Common Stockholders' Equity (ROE) #DIV/0! #DIV/0! Net income - preferred dividends Average common stockholders' equity Free cash flow $1,324 $78,505 Net cash provided by operating activities minus capital expenditures minus cash dividends in millions in thousands #DIV/0! #DIV/0! Price-Earnings Ratio (Please see the Course Project instructions for the dates to use for this ratio.) Market price per share of common stock as of (12/31/2017) Alphabet and Apple (09/03/2017) for Earnings per share TO Urathix Ferpreads to computer show your computation for alration on this ah, and no dude ynur rammentary The 2017 financial statements used to calculate these ratios are available in the Investor Relations sections of Alphabet and Apple websites. ALPHABET APPLE 12/31/2017 8/3/2017 Earnings per Share of Common Stack (basic-common) As given in the income statement S18.27 $9.27 Cument Ratio 5.14 1.24 Current assets Current liabilities $124,308 S24.163 $128 645 $100,014 Gross Profit Rate 58.9% 28.57% Grass profit Nel vales $85,272 5110,855 $89.106 3229.234 Profit Margin $12.862 5110,885 11.1% Net income Net sales $40,351 3229.234 21.1% Inventory Tumover 88.6 40.4 old Average Inventory 5455,800 S! CHS $14.100,000 $349 400 Days In Inventory 356 days Inventory burraver 365 99.8 4 days 365 40.4 9 days Accounts Receivable Turnaver 13.6 Net credt sales Average net accounts receivable $110,855 $16.237 $18,314 Average Collection Period 335 days Accounts receivable tumraver 26. 3155 13.8 days days Asset turnover 0.80 0.88 Net sales Average Lolal assets $110,655 $183,896 $229,234 3848,503 Return on Assuts (ROA) 8.9% Net income Average total assets 13.0N $12,062 5192,369 348,351 3348.503 Debt to assete ratio 22.79 64.3% Total Liablities Total Assets $44.793 $ 197,295 3241.272 $375,219 $ Times-interest Earned Ratio 1.2 288 Net income interest Axent + Income tax expense interest expense $184,193 $ $157,000 56 412 2,323 interest expense $157,000 2,323 #DIV/0! = #DIV/0! Dividend Yield (Please follow the Course Project instructions to calculate the current dividend yield.) Dividend per share of common stock (Yahoo Finance 2017) Market price per share of common stock (Yahoo Finance 2017) Return on Common Stockholders' Equity (ROE) #DIV/0! #DIV/0! Net income - preferred dividends Average common stockholders' equity Free cash flow $1,324 $78,505 Net cash provided by operating activities minus capital expenditures minus cash dividends in millions in thousands #DIV/0! #DIV/0! Price-Earnings Ratio (Please see the Course Project instructions for the dates to use for this ratio.) Market price per share of common stock as of (12/31/2017) Alphabet and Apple (09/03/2017) for Earnings per share TO