Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please, I seriously need with these jounal entries I'm having issues. Most of them are giving me ateuggles. Thank you!!! File Home Insert Design Layout

Please, I seriously need with these jounal entries I'm having issues. Most of them are giving me ateuggles.

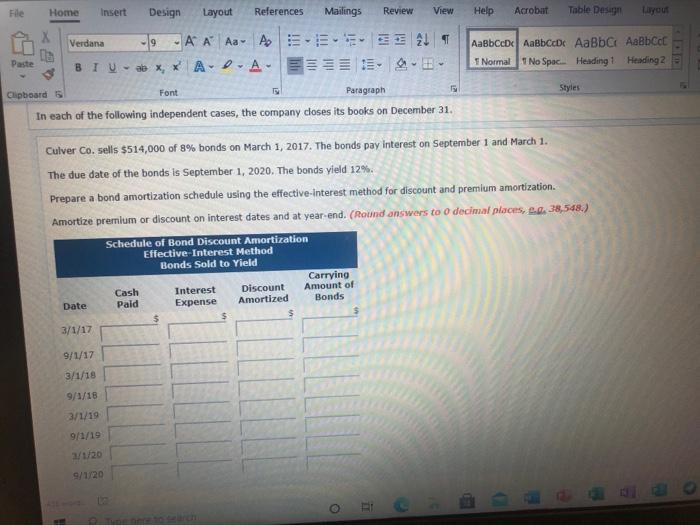

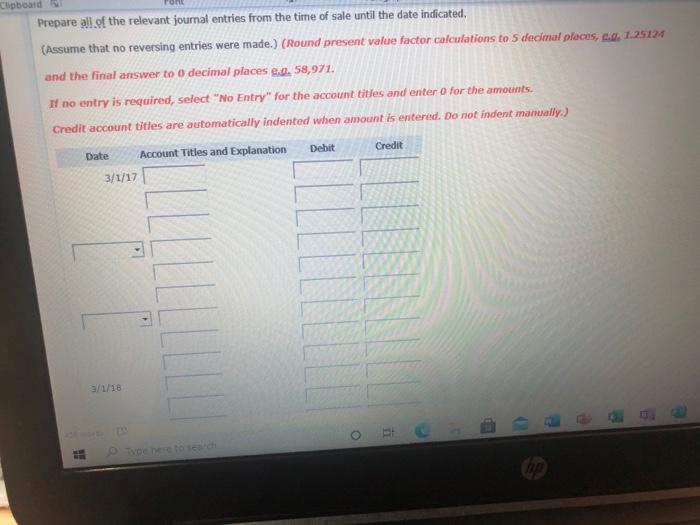

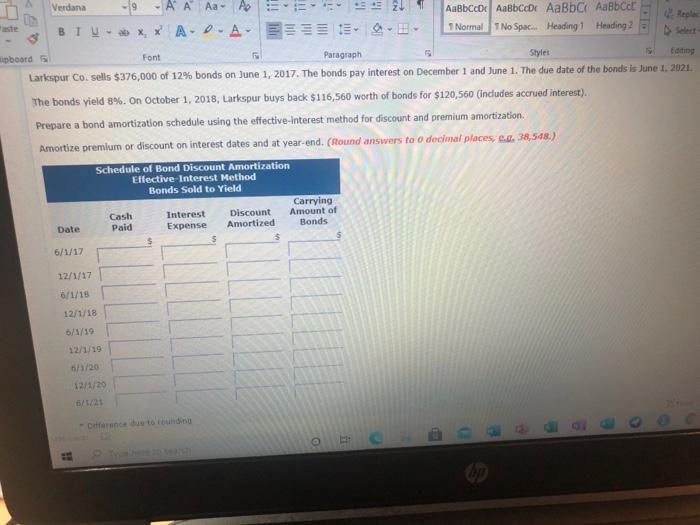

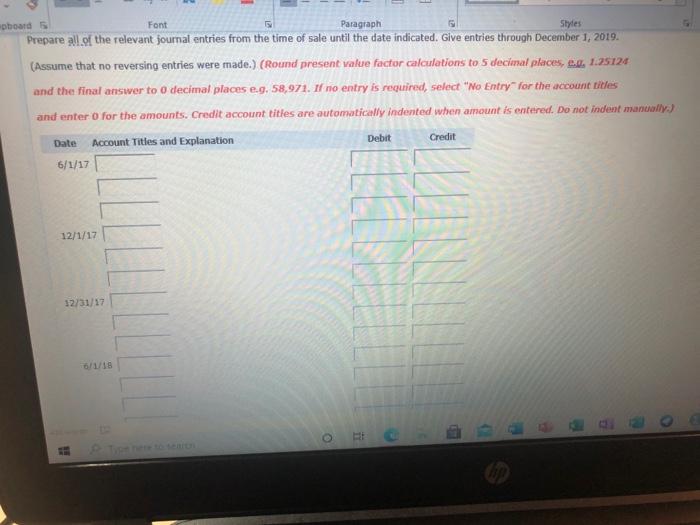

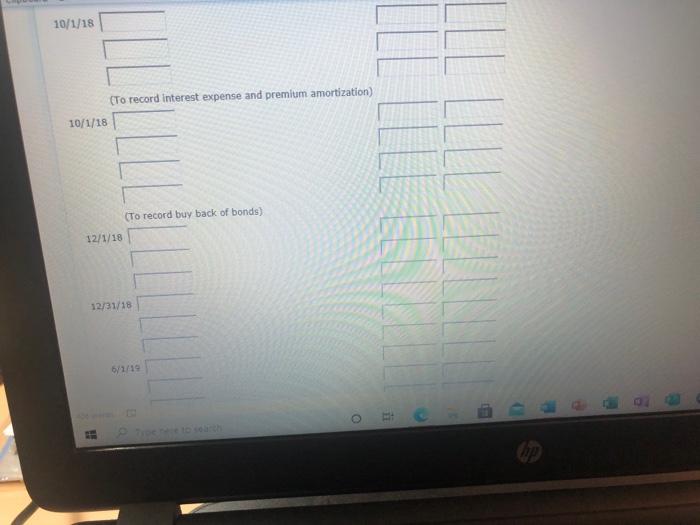

File Home Insert Design Layout References Mailings Review View Help Acrobat Table Design Layout Verdana -9 A A Aa A ... 21 BIU-a X, * A-DA- EE AaBbCcDc AaBbccDc AaBbc AaBbcc I Normal 1 No Spac. Heading 1 Heading 2 Paste Font Clipboard 5 Paragraph Styles In each of the following independent cases, the company closes its books on December 31. Culver Co. sells $514,000 of 8% bonds on March 1, 2017. The bonds pay interest on September 1 and March 1. The due date of the bonds is September 1, 2020. The bonds yield 12%. Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to o decimal places, ... 38,548.) Schedule of Bond Discount Amortization Effective Interest Method Bonds Sold to Yield Carrying Cash Interest Discount Amount of Date Pald Expense Amortized Bonds $ 3/1/17 9/1/17 3/1/18 9/1/18 3/1/19 9/1/19 1/1/20 9/1/20 EI Clipboard Prepare all of the relevant journal entries from the time of sale until the date indicated. (Assume that no reversing entries were made.) (Round present value factor calculations to 5 decimal places, .. 1.25124 and the final answer to o decimal places e.0, 58,971. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit 3/1/17 Verdana - A A A A AaBbCcDx AaBbCCD AaBbq AaBbCct BIU XX A.D.A. Ele Normal No Spac.. Heading 1 Heading 2 board 5 Font Paragraph Stylet Editing Larkspur Co. sells $376,000 of 12% bonds on June 1, 2017. The bonds pay interest on December 1 and June 1. The due date of the bonds is June 1, 2021 The bonds yield 8%. On October 1, 2018, Larkspur buys back $116,560 worth of bonds for $120,560 (includes accrued interest). Prepare a bond amortization schedule using the effective-interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Sound answers to decimal places, 2.8. 38,548.) Schedule of Bond Discount Amortization Effective Interest Method Bonds Sold to Yield Carrying Cash Interest Discount Amount of Date Expense Amortized Bonds Paid 6/1/17 12/1/17 6/1/15 12/1/18 3/1/19 12/1/19 citrarance is to rounding . pboard 5 Font Paragraph Styles Prepare all of the relevant journal entries from the time of sale until the date indicated. Give entries through December 1, 2019. (Assume that no reversing entries were made.) (Round present value factor calculations to 5 decimal places, a 1.25124 and the final answer to o decimal places e.g. 58,971. If no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit 6/1/17 12/1/17 12/31/17 10/1/18 (To record interest expense and premium amortization) 10/1/18 (To record buy back of bonds) 12/1/18 12/31/18 6/1/19 O 12/1/19 Type here to search op 104 0 & 7 % 9 00 6 4 5 un # 3 2 1 Y T R w E Thank you!!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started