Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please i want this ASAP Question 3 (6 points): SWMD Corporation has: 400,000 common shares outstanding ($ 1 par), 30,000 preferred Non-Cumulative shares outstanding ($

please i want this ASAP

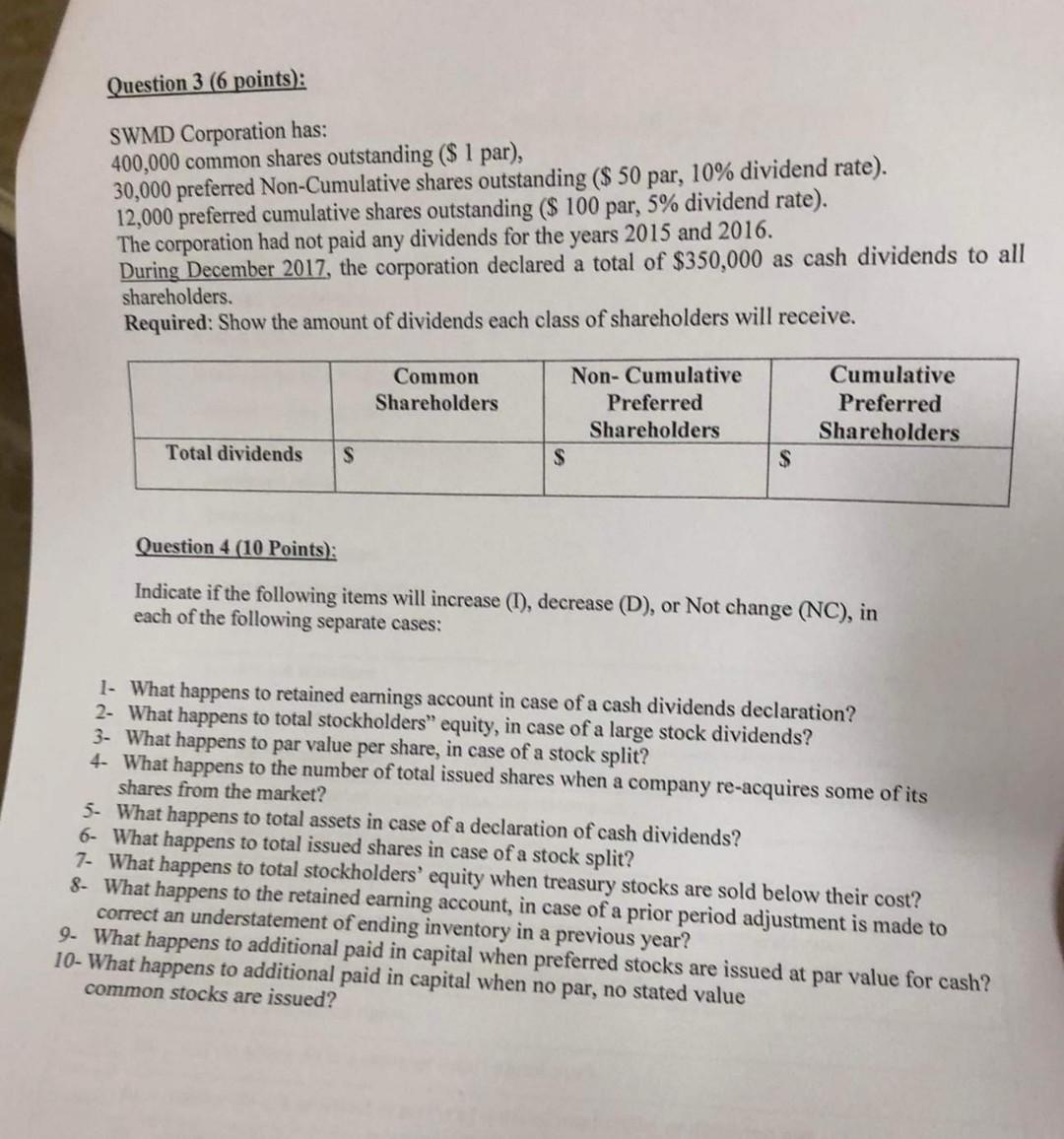

Question 3 (6 points): SWMD Corporation has: 400,000 common shares outstanding ($ 1 par), 30,000 preferred Non-Cumulative shares outstanding ($ 50 par, 10% dividend rate). 12,000 preferred cumulative shares outstanding ($ 100 par, 5% dividend rate). The corporation had not paid any dividends for the years 2015 and 2016. During December 2017, the corporation declared a total of $350,000 as cash dividends to all shareholders. Required: Show the amount of dividends each class of shareholders will receive. Non- Cumulative Common Shareholders Preferred Shareholders Cumulative Preferred Shareholders Total dividends S $ $ Question 4 (10 Points): Indicate if the following items will increase (1), decrease (D), or Not change (NC), in each of the following separate cases: 1- What happens to retained earnings account in case of a cash dividends declaration? 2- What happens to total stockholders" equity, in case of a large stock dividends? 3- What happens to par value per share, in case of a stock split? 4- What happens to the number of total issued shares when a company re-acquires some of its shares from the market? 5- What happens to total assets in case of a declaration of cash dividends? 6- What happens to total issued shares in case of a stock split? 7- What happens to total stockholders' equity when treasury stocks are sold below their cost? 8- What happens to the retained earning account, in case of a prior period adjustment is made to correct an understatement of ending inventory in a previous year? 9- What happens to additional paid in capital when preferred stocks are issued at par value for cash? 10- What happens to additional paid in capital when no par, no stated value common stocks are issuedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started