Question

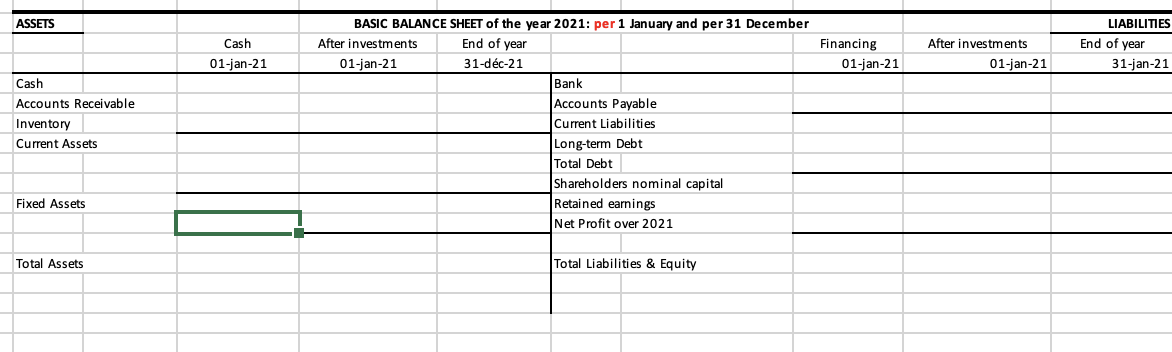

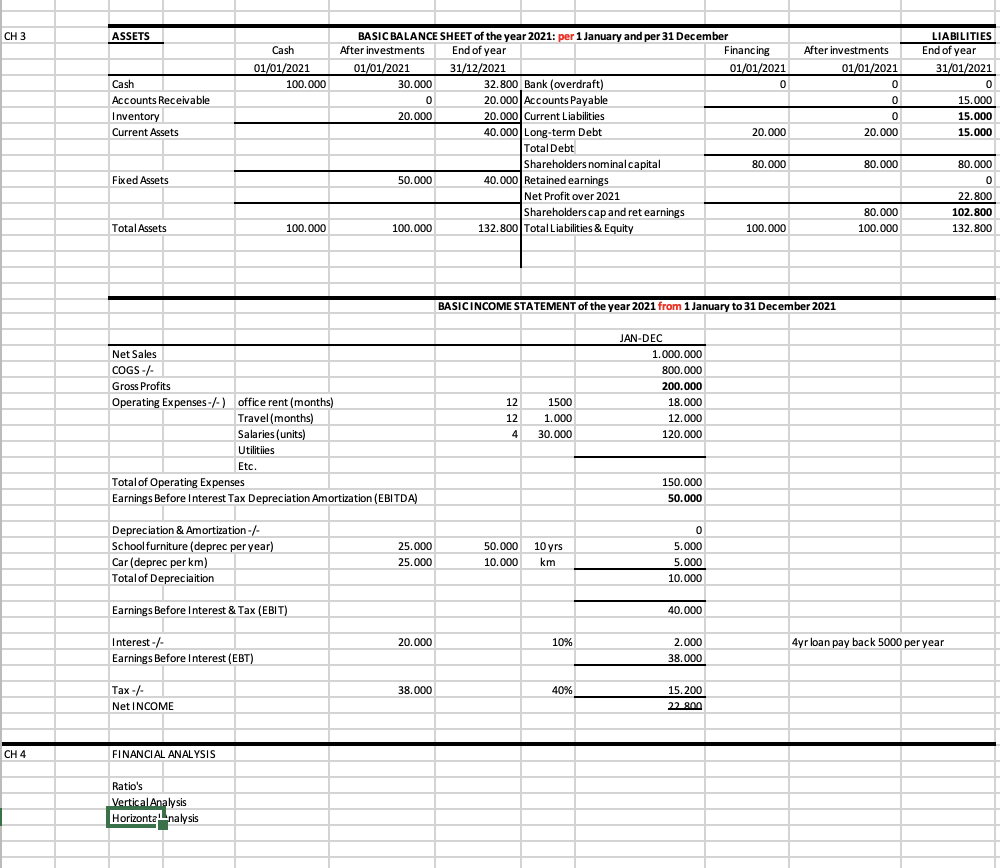

please i want ypu to complete the balance sheet and the income statement its really important Human Resource Management o Operational Manager It depends on

please i want ypu to complete the balance sheet and the income statement its really important

Human Resource Management

o Operational Manager

It depends on this worker for the company to develop with logistical efficiency, thus, he/she is involved in all operational processes to achieve objectives. Is directly in charge of ensuring that the export, import and distribution process is properly carried out under legal regulations.

Inventory Manager

In charge of enforcing inventory targets in terms of quality and quantity standards. Will be able to offer recommendations to guarantee ideal inventory levels depending on demand and the state of the food.

Financial Manager

Will have to perform managerial tasks, handle financial information, develop reports, analyze products with higher and lower demand and evaluate the performance of the company, including the operational cost of the port-port process, warehouse and distributors.

Foreign Relation Manager

Planner, organizer, executor, controller and evaluator of every particular detail about the trade process. Maintain and promote the public image of Transatlantic Express with its distributors, current customers and potential customers.

Legal Advisor

Will propose legal advice to the company's managers after studying, analyzing and understanding solutions to legal situations that are directly, indirectly, nationally and internationally related to Transatlantic Express, thus, keeping all issues regarding legality under control.

Distribution Driver

Personally in charge of transporting the merchandise with the greatest possible delicacy in the expected time range. Will have to consider very closely that the list of products given, perfectly matches the quantity and type of products expected for transportation.

Distribution Supervisor

Direct inspector and guide of the distribution of merchandise so that the products in quantity and type expected by local markets reach their destination.

Ports Representatives and Shipping Agencies

From port, guide the merchandise to keep under control, make sure that all legal regulations of entry and exit from open sea are met, and verify that all standards of sanitation for the export and import of food.

Financial Summary

Capital

TAE first capital is 500.000, which are taken from Dutch Government $ 250.000 with interest of 7.75% and another 250.000 from angel investors. The loans taken from the government are scheduled to be paid monthly for the next 36 month. For the angel investor we assume that we would pay them after 36 month.

Expenses

TAE would spend the first capital for buying Goods, Shipping Services, renting warehouse, office and truck. We also would use the money to buy Generator and

truck in St Maarten for logistic purpose. Therefore, the total monthly expenses would be around 170.000 for the first years.

Revenue

Our Revenue is 150.000 from selling the all the product with the assumption that we sell everything we ship within 1 month. This would be a deficit, however, we forecast that Transatlantic Express would break even in the 2nd year. This surplus is due to our high expenses and low profit, because we wanted to reduce the market price and remove monopoly in St. Maarten.

Selling Price

Monopoly of goods in st. Maarten is really high, therefore, we wanted to try to sell the same product at a cheaper price. We try to sell 30% below the average market, but at the same time we try to get enough profit for our company to work.

Annexes

o Insurance in NL

Since Transatlantic Express does not have a location in The Netherlands, then the CIF (Twin, 2020) is considered which is an expense paid by De Ruiters and Gwoon, this covers the Cost, Insurance, and freight of the Transatlantic Express order while in transmit. The transit will be in charge of exporting to the port stipulated in the sales contract, this will be the port of Sint Maarten. Until the products are properly loaded into the container and onto the shipping vessel, De Ruiters and Gwoon will bear the costs of any loss or damage to the products. Regarding additional customs duties, export paperwork, inspections or change of route, De Ruiters and Gwoon will be responsible for all expenses. The moment that the container arrives at the port of Sint Maarten,

Transatlantic Express will be responsible for all the cost and transportation.

Insurance in Saint Marteen

The NAGICO group is well known as a preferred provider in the region, disposing solutions in terms of property, victims, life products, and risk insurance to its clients located along the Caribbean, including San Martn. Its objective, to offer a fast, adequate and loyal service.

Transatlantic Express will work with NAGICO as an insurer, which will cover accidents on Sint Maarten.

i just want you to complete the balance sheet and the income statement plkease

please its really important

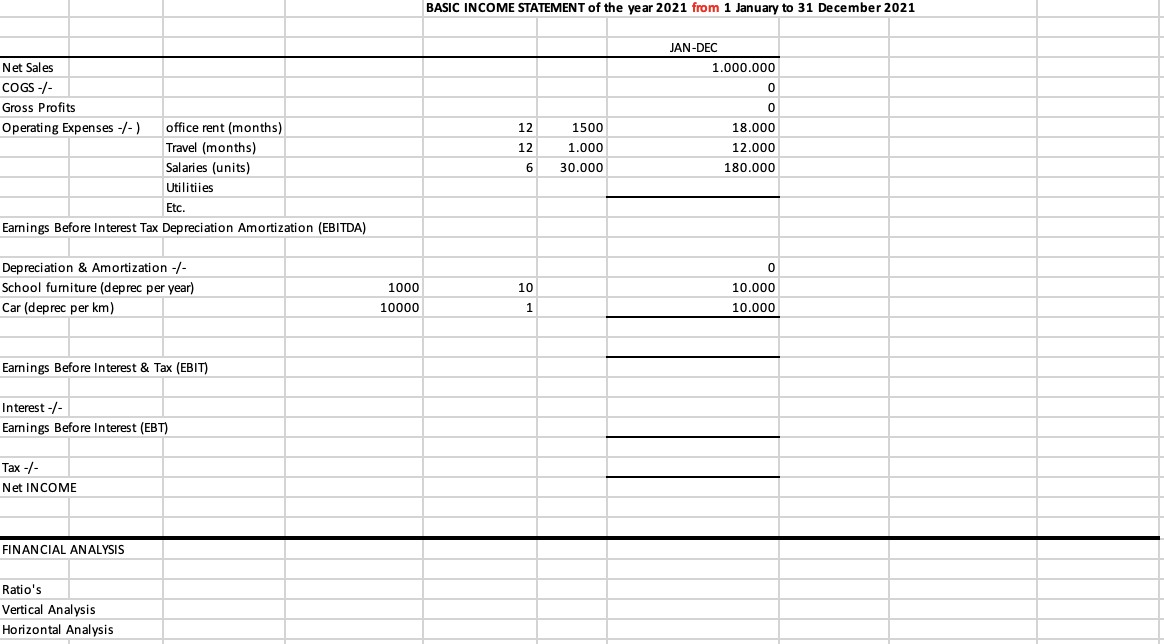

ASSETS Cash 01-jan-21 Financing 01-jan-21 After investments 01-jan-21 LIABILITIES End of year 31-jan-21 Cash Accounts Receivable Inventory Current Assets BASIC BALANCE SHEET of the year 2021: per 1 January and per 31 December After investments End of year 01-jan-21 31-dc-21 Bank Accounts Payable Current Liabilities Long-term Debt Total Debt Shareholders nominal capital Retained earnings Net Profit over 2021 Fixed Assets Total Assets Total Liabilities & Equity BASIC INCOME STATEMENT of the year 2021 from 1 January to 31 December 2021 JAN-DEC 1.000.000 0 0 Net Sales COGS -/- Gross Profits Operating Expenses -/- ) office rent (months) Travel (months) Salaries (units) Utilities Etc. Earnings Before Interest Tax Depreciation Amortization (EBITDA) 12 12 6 1500 1.000 30.000 18.000 12.000 180.000 Depreciation & Amortization -/- School furniture (deprec per year) Car (deprec per km) 10 1000 10000 0 10.000 10.000 1 Earnings Before Interest & Tax (EBIT) Interest -/- Earnings Before Interest (EBT) Tax -/- Net INCOME FINANCIAL ANALYSIS Ratio's Vertical Analysis Horizontal Analysis CH 3 ASSETS Cash 01/01/2021 100.000 Cash Accounts Receivable Inventory Current Assets BASIC BALANCE SHEET of the year 2021: per 1 January and per 31 December After investments End of year Financing 01/01/2021 31/12/2021 01/01/2021 30.000 32.800 Bank (overdraft) 0 0 20.000 Accounts Payable 20.000 20.000 Current Liabilities 40.000 Long-term Debt 20.000 Total Debt Shareholders nominal capital 80.000 50.000 40.000 Retained earnings Net Profit over 2021 Shareholders cap and ret earnings 100.000 132.800 Total Liabilities & Equity 100.000 After investments 01/01/2021 0 0 0 20.000 LIABILITIES End of year 31/01/2021 0 15.000 15.000 15.000 80.000 Fixed Assets 80.000 0 22.800 102.800 132.800 80.000 100.000 Total Assets 100.000 BASICINCOME STATEMENT of the year 2021 from 1 January to 31 December 2021 JAN-DEC 1.000.000 800.000 200.000 Net Sales COGS-/- Gross Profits Operating Expenses-/-) office rent (months) Travel (months) Salaries (units) Utilities Etc. Total of Operating Expenses Earnings Before Interest Tax Depreciation Amortization (EBITDA) 12 12 4 1500 1.000 30.000 18.000 12.000 120.000 150.000 50.000 Depreciation & Amortization -- School furniture (deprec per year) Car (deprec per km) Total of Depreciation 25.000 25.000 50.000 10.000 10 yrs km 0 5.000 5.000 10.000 Earnings Before Interest & Tax (EBIT) 40.000 20.000 10% 4yr loan pay back 5000 per year Interest -- - Earnings Before Interest (EBT) 2.000 38.000 38.000 40% Tax- Net INCOME 15.200 22 900 CH4 FINANCIAL ANALYSIS Ratio's Vertical Analysis Horizontanalysis T ASSETS Cash 01-jan-21 Financing 01-jan-21 After investments 01-jan-21 LIABILITIES End of year 31-jan-21 Cash Accounts Receivable Inventory Current Assets BASIC BALANCE SHEET of the year 2021: per 1 January and per 31 December After investments End of year 01-jan-21 31-dc-21 Bank Accounts Payable Current Liabilities Long-term Debt Total Debt Shareholders nominal capital Retained earnings Net Profit over 2021 Fixed Assets Total Assets Total Liabilities & Equity BASIC INCOME STATEMENT of the year 2021 from 1 January to 31 December 2021 JAN-DEC 1.000.000 0 0 Net Sales COGS -/- Gross Profits Operating Expenses -/- ) office rent (months) Travel (months) Salaries (units) Utilities Etc. Earnings Before Interest Tax Depreciation Amortization (EBITDA) 12 12 6 1500 1.000 30.000 18.000 12.000 180.000 Depreciation & Amortization -/- School furniture (deprec per year) Car (deprec per km) 10 1000 10000 0 10.000 10.000 1 Earnings Before Interest & Tax (EBIT) Interest -/- Earnings Before Interest (EBT) Tax -/- Net INCOME FINANCIAL ANALYSIS Ratio's Vertical Analysis Horizontal Analysis CH 3 ASSETS Cash 01/01/2021 100.000 Cash Accounts Receivable Inventory Current Assets BASIC BALANCE SHEET of the year 2021: per 1 January and per 31 December After investments End of year Financing 01/01/2021 31/12/2021 01/01/2021 30.000 32.800 Bank (overdraft) 0 0 20.000 Accounts Payable 20.000 20.000 Current Liabilities 40.000 Long-term Debt 20.000 Total Debt Shareholders nominal capital 80.000 50.000 40.000 Retained earnings Net Profit over 2021 Shareholders cap and ret earnings 100.000 132.800 Total Liabilities & Equity 100.000 After investments 01/01/2021 0 0 0 20.000 LIABILITIES End of year 31/01/2021 0 15.000 15.000 15.000 80.000 Fixed Assets 80.000 0 22.800 102.800 132.800 80.000 100.000 Total Assets 100.000 BASICINCOME STATEMENT of the year 2021 from 1 January to 31 December 2021 JAN-DEC 1.000.000 800.000 200.000 Net Sales COGS-/- Gross Profits Operating Expenses-/-) office rent (months) Travel (months) Salaries (units) Utilities Etc. Total of Operating Expenses Earnings Before Interest Tax Depreciation Amortization (EBITDA) 12 12 4 1500 1.000 30.000 18.000 12.000 120.000 150.000 50.000 Depreciation & Amortization -- School furniture (deprec per year) Car (deprec per km) Total of Depreciation 25.000 25.000 50.000 10.000 10 yrs km 0 5.000 5.000 10.000 Earnings Before Interest & Tax (EBIT) 40.000 20.000 10% 4yr loan pay back 5000 per year Interest -- - Earnings Before Interest (EBT) 2.000 38.000 38.000 40% Tax- Net INCOME 15.200 22 900 CH4 FINANCIAL ANALYSIS Ratio's Vertical Analysis Horizontanalysis TStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started