Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please I will upvote! 1. For incentive stock options, the value of the options that vest in a given year always creates a permanent, unfavorable

Please I will upvote!

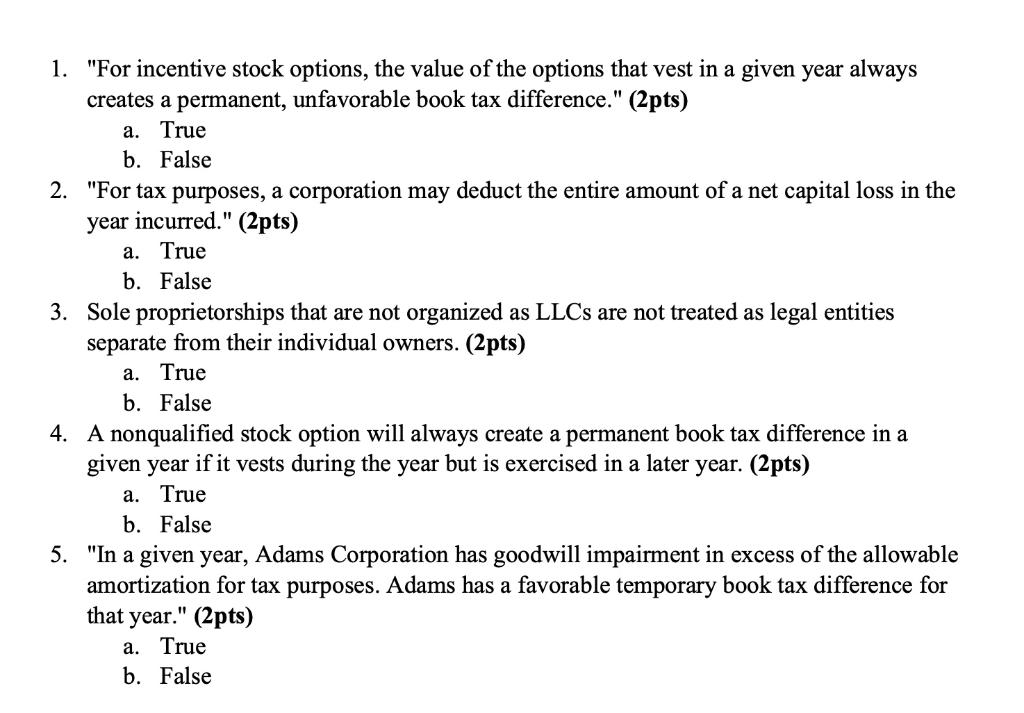

1. "For incentive stock options, the value of the options that vest in a given year always creates a permanent, unfavorable book tax difference." (2pts) a. True b. False 2. "For tax purposes, a corporation may deduct the entire amount of a net capital loss in the year incurred." (2pts) a. True b. False 3. Sole proprietorships that are not organized as LLCs are not treated as legal entities separate from their individual owners. (2pts) a. True b. False 4. A nonqualified stock option will always create a permanent book tax difference in a given year if it vests during the year but is exercised in a later year. (2pts) a. True b. False 5. "In a given year, Adams Corporation has goodwill impairment in excess of the allowable amortization for tax purposes. Adams has a favorable temporary book tax difference for that year." (2pts) a. True b. FalseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started