***Please if only helping me through a smaller part of this question is better, I will take it. I just need some guidance on taking the right steps to complete it.***

Dominion, LLC is taxed as a partnership.

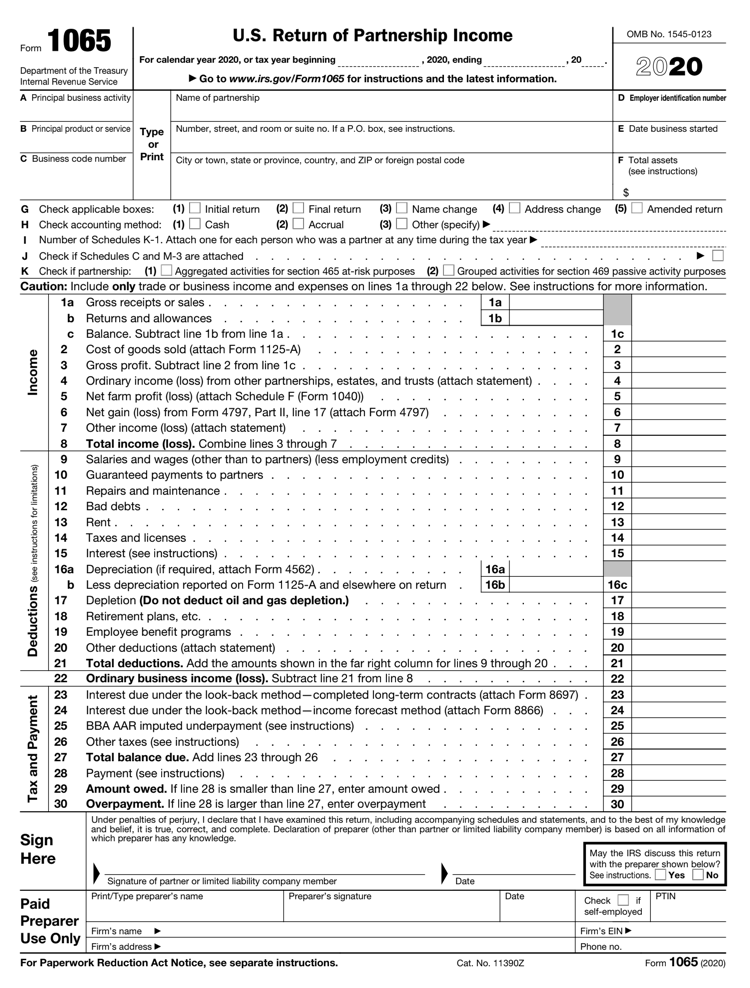

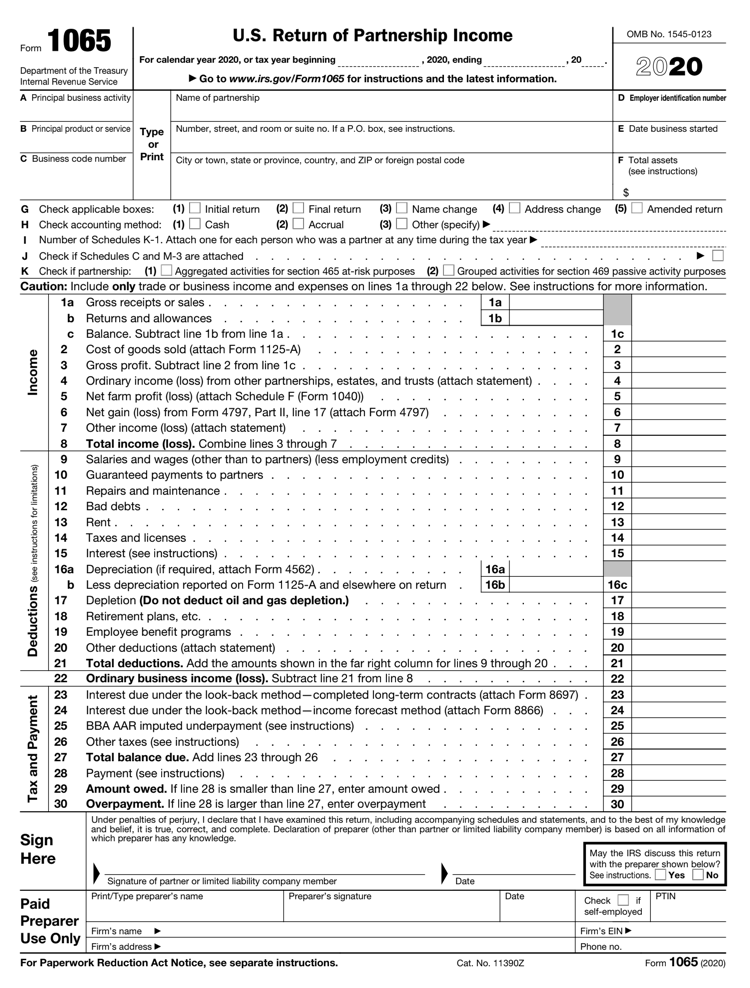

1. Prepare page 1 of Form 1065 for Dominion for tax year 2020.

Recommended forms: Form 1065 (with Schedule D, K, L, M-1, and M-2), Form 8949, and Form 4562.

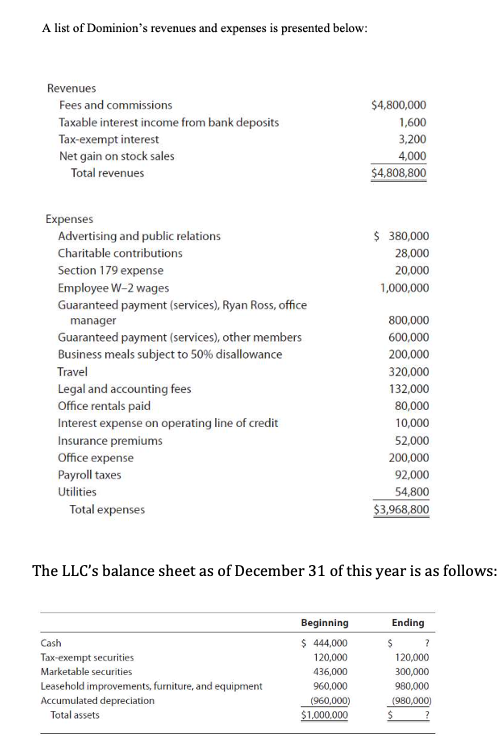

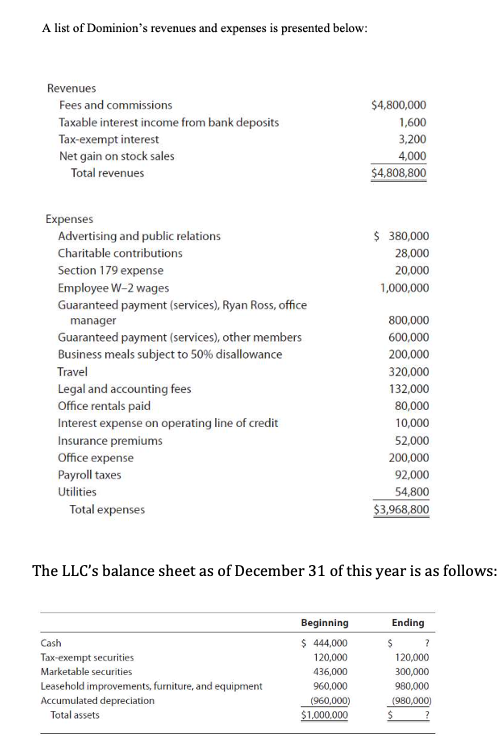

A list of Dominions revenues and expenses is presented in the images:

Additional Information:

-

Good Investor owns a 35% partnership interest in Dominion.

-

A purchase of $20,000 of office furniture will be deducted via a 179 deduction. (For simplicity, assume that Dominion uses the same cost recovery methods for both tax and financial purposes.) There is no depreciation adjustment for alternative minimum tax purposes.

-

During the year, the LLC sold two securities. On June 15, Dominion purchased 1,000 shares of Tree, Inc. stock for $100,000; it sold those shares on December 15 for $80,000. On March 15 of last year, ROCK purchased 2,000 shares of FunBio, Inc. stock for $136,000; it sold those shares for $160,000 on December 15 of the current year. These transactions were reported to the IRS on Forms 1099B; ROCKs basis in these shares was reported.

-

Net income per books is $840,000.

-

On January 1, the members capital accounts equaled $200,000 each. No additional capital contributions

were made this year.

-

Each member withdrew $250,000 cash during the year. All contributions and distributions have been in cash, so the LLC has no net unrecognized 704(c) gain or loss.

-

The LLCs Federal ID number is 55-5555556.

-

It uses the cash basis and the calendar year and began operations on January 1, 2007.

-

All debt is shared equally by the members. Each member has personally guaranteed the debt of the LLC.

-

All members are active in LLC operations.

-

For our purposes, assume the LLC is not considered an SSTB, and Dominions operations constitute one active trade or business for purposes of the passive activity and at-risk limitations. (Note that the 179 deduction is a business-related expense.)

-

The LLCs UBIA (unadjusted basis immediately after acquisition) equals the total original cost of all leasehold improvements, or $980,000.

-

The appropriate business code for the entity is 711410.

-

For the Form 1065, page 5, Analysis of Net Income, put all partners allocations in cell 2(b)(ii), per IRS

instructions for an LLC.

-

Other than Good Investor, there are two other owners: Hard Worker with a 20% ownership, and Rich Investor that has a 45% ownership.

A list of Dominion's revenues and expenses is presented below: Revenues Fees and commissions Taxable interest income from bank deposits Tax-exempt interest Net gain on stock sales Total revenues $4,800,000 1,600 3,200 4,000 $4,808,800 $ 380,000 28,000 20,000 1,000,000 Expenses Advertising and public relations Charitable contributions Section 179 expense Employee W-2 wages Guaranteed payment services), Ryan Ross, office manager Guaranteed payment services), other members Business meals subject to 50% disallowance Travel Legal and accounting fees Office rentals paid Interest expense on operating line of credit Insurance premiums Office expense Payroll taxes Utilities Total expenses 800,000 600,000 200,000 320,000 132,000 80,000 10,000 52,000 200,000 92,000 54,800 $3,968,800 The LLC's balance sheet as of December 31 of this year is as follows: Cash Tax-exempt securities Marketable securities Leasehold improvements, furniture, and equipment Accumulated depreciation Total assets Beginning $444,000 120,000 436,000 960,000 (960,000 $1,000,000 Ending $ ? 120,000 300,000 980,000 (980,000) $ OMB No. 1545-0123 1065 Form U.S. Return of Partnership Income For calendar year 2020, or tax year beginning , 2020, ending Go to www.irs.gov/Form 1065 for instructions and the latest information. 20 2020 Department of the Treasury Internal Revenue Service A Principal business activity Name of partnership D Employer identification number B Principal product or service Type Number, street, and room or suite no. If a P.O.box, see instructions. E Date business started or C Business code number Print City or town, state or province, country, and ZIP or foreign postal code F Total assets (see instructions) Income $ G Check applicable boxes: (1) (1) Initial return (2) Final return (3) Name change (4) Address change (5) Amended return H Check accounting method: (1) Cash (2) Accrual (3) Other (specify) ......... Number of Schedules K-1. Attach one for each person who was a partner at any time during the tax year J Check if Schedules C and M-3 are attached........... K Check if partnership: (1) Aggregated activities for section 465 at-risk purposes (2) Grouped activities for section 469 passive activity purposes Caution: Include only trade or business income and expenses on lines 1a through 22 below. See instructions for more information. 1a Gross receipts or sales 1a alde... b Returns and allowances 1b c Balance. Subtract line 1b from line 1a 1c 2 Cost of goods sold (attach Form 1125-A) 2 3 Gross profit. Subtract line 2 from line 1c 3 4 Ordinary income (loss) from other partnerships, estates, and trusts (attach statement) 4 - 5 Net farm profit (loss) (attach Schedule F (Form 1040)) 5 . 6 Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) 6 7 Other income (loss) (attach statement) 7 8 Total income (loss). Combine lines 3 through 7 8 9 Salaries and wages (other than to partners) (less employment credits) 9 10 Guaranteed payments to partners 10 1 11 Repairs and maintenance 11 12 Bad debts 12 " 13 Rent. 13 . 14 Taxes and licenses 14 15 Interest (see instructions) 15 16a Depreciation (if required, attach Form 4562) 16a b Less depreciation reported on Form 1125-A and elsewhere on return 16b 16c 17 Depletion (Do not deduct oil and gas depletion.) 18 Retirement plans, etc. 18 El 19 Employee benefit programs 19 20 Other deductions (attach statement) 20 21 Total deductions. Add the amounts shown in the far right column for lines 9 through 20 21 22 Ordinary business income (loss). Subtract line 21 from line 8 23 Interest due under the look back method - completed long-term contracts (attach Form 8697) 24 24 Interest due under the look-back method-income forecast method (attach Form 8866) 24 25 25 BBA AAR imputed underpayment (see instructions) 25 ne 26 Other taxes (see instructions) 26 27 Total balance due. Add lines 23 through 26 27 28 Payment (see instructions)... 28 29 Amount owed. If line 28 is smaller than line 27, enter amount owed 29 30 Overpayment. If line 28 is larger than line 27, enter overpayment 30 Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than partner or limited liability company member) is based on all information of Sign which preparer has any knowledge. Here May the IRS discuss this return with the preparer shown below? Signature of partner or limited liability company member Date See instructions. Yes No Print/Type preparer's name Preparer's signature Date Paid Check it PTIN self-employed Preparer Firm's name Firm's EIN Use Only Firm's address Phone no. For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 1139OZ Form 1065 (2020) Deductions (see instructions for lim 17 22 23 Tax and Payment A list of Dominion's revenues and expenses is presented below: Revenues Fees and commissions Taxable interest income from bank deposits Tax-exempt interest Net gain on stock sales Total revenues $4,800,000 1,600 3,200 4,000 $4,808,800 $ 380,000 28,000 20,000 1,000,000 Expenses Advertising and public relations Charitable contributions Section 179 expense Employee W-2 wages Guaranteed payment services), Ryan Ross, office manager Guaranteed payment services), other members Business meals subject to 50% disallowance Travel Legal and accounting fees Office rentals paid Interest expense on operating line of credit Insurance premiums Office expense Payroll taxes Utilities Total expenses 800,000 600,000 200,000 320,000 132,000 80,000 10,000 52,000 200,000 92,000 54,800 $3,968,800 The LLC's balance sheet as of December 31 of this year is as follows: Cash Tax-exempt securities Marketable securities Leasehold improvements, furniture, and equipment Accumulated depreciation Total assets Beginning $444,000 120,000 436,000 960,000 (960,000 $1,000,000 Ending $ ? 120,000 300,000 980,000 (980,000) $ OMB No. 1545-0123 1065 Form U.S. Return of Partnership Income For calendar year 2020, or tax year beginning , 2020, ending Go to www.irs.gov/Form 1065 for instructions and the latest information. 20 2020 Department of the Treasury Internal Revenue Service A Principal business activity Name of partnership D Employer identification number B Principal product or service Type Number, street, and room or suite no. If a P.O.box, see instructions. E Date business started or C Business code number Print City or town, state or province, country, and ZIP or foreign postal code F Total assets (see instructions) Income $ G Check applicable boxes: (1) (1) Initial return (2) Final return (3) Name change (4) Address change (5) Amended return H Check accounting method: (1) Cash (2) Accrual (3) Other (specify) ......... Number of Schedules K-1. Attach one for each person who was a partner at any time during the tax year J Check if Schedules C and M-3 are attached........... K Check if partnership: (1) Aggregated activities for section 465 at-risk purposes (2) Grouped activities for section 469 passive activity purposes Caution: Include only trade or business income and expenses on lines 1a through 22 below. See instructions for more information. 1a Gross receipts or sales 1a alde... b Returns and allowances 1b c Balance. Subtract line 1b from line 1a 1c 2 Cost of goods sold (attach Form 1125-A) 2 3 Gross profit. Subtract line 2 from line 1c 3 4 Ordinary income (loss) from other partnerships, estates, and trusts (attach statement) 4 - 5 Net farm profit (loss) (attach Schedule F (Form 1040)) 5 . 6 Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) 6 7 Other income (loss) (attach statement) 7 8 Total income (loss). Combine lines 3 through 7 8 9 Salaries and wages (other than to partners) (less employment credits) 9 10 Guaranteed payments to partners 10 1 11 Repairs and maintenance 11 12 Bad debts 12 " 13 Rent. 13 . 14 Taxes and licenses 14 15 Interest (see instructions) 15 16a Depreciation (if required, attach Form 4562) 16a b Less depreciation reported on Form 1125-A and elsewhere on return 16b 16c 17 Depletion (Do not deduct oil and gas depletion.) 18 Retirement plans, etc. 18 El 19 Employee benefit programs 19 20 Other deductions (attach statement) 20 21 Total deductions. Add the amounts shown in the far right column for lines 9 through 20 21 22 Ordinary business income (loss). Subtract line 21 from line 8 23 Interest due under the look back method - completed long-term contracts (attach Form 8697) 24 24 Interest due under the look-back method-income forecast method (attach Form 8866) 24 25 25 BBA AAR imputed underpayment (see instructions) 25 ne 26 Other taxes (see instructions) 26 27 Total balance due. Add lines 23 through 26 27 28 Payment (see instructions)... 28 29 Amount owed. If line 28 is smaller than line 27, enter amount owed 29 30 Overpayment. If line 28 is larger than line 27, enter overpayment 30 Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than partner or limited liability company member) is based on all information of Sign which preparer has any knowledge. Here May the IRS discuss this return with the preparer shown below? Signature of partner or limited liability company member Date See instructions. Yes No Print/Type preparer's name Preparer's signature Date Paid Check it PTIN self-employed Preparer Firm's name Firm's EIN Use Only Firm's address Phone no. For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 1139OZ Form 1065 (2020) Deductions (see instructions for lim 17 22 23 Tax and Payment