Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please if possible answer both questions. I'll be giving a like to whomever helps me out. thanks 1. Let us assume that an investor has

please if possible answer both questions. I'll be giving a like to whomever helps me out. thanks

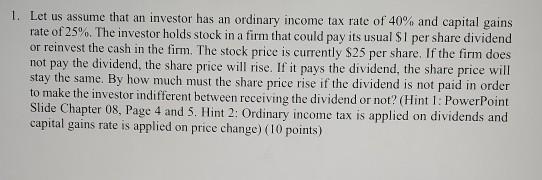

1. Let us assume that an investor has an ordinary income tax rate of 40% and capital gains rate of 25%. The investor holds stock in a firm that could pay its usual $1 per share dividend or reinvest the cash in the firm. The stock price is currently $25 per share. If the firm does not pay the dividend, the share price will rise. If it pays the dividend, the share price will stay the same. By how much must the share price rise if the dividend is not paid in order to make the investor indifferent between receiving the dividend or not? (Hint 1: PowerPoint Slide Chapter 08, Page 4 and 5. Hint 2: Ordinary income tax is applied on dividends and capital gains rate is applied on price change) (10 points) 14. ABC Bank has the interest expense of S120 million, earning assets of $1.200 million and a NIM (Net Interest Margin) of 6,00 percent. This bank also has interest-bearing liabilities of $1,000 million. ABC Bank's spread is (4 points) A) 1.05% B) 2.08% C) 3.89% D) 4.00%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started