Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please if yiu can give the steps in answering the questions 1. David, age 25, plans to invest $3,000 real dollars per year into his

please if yiu can give the steps in answering the questions

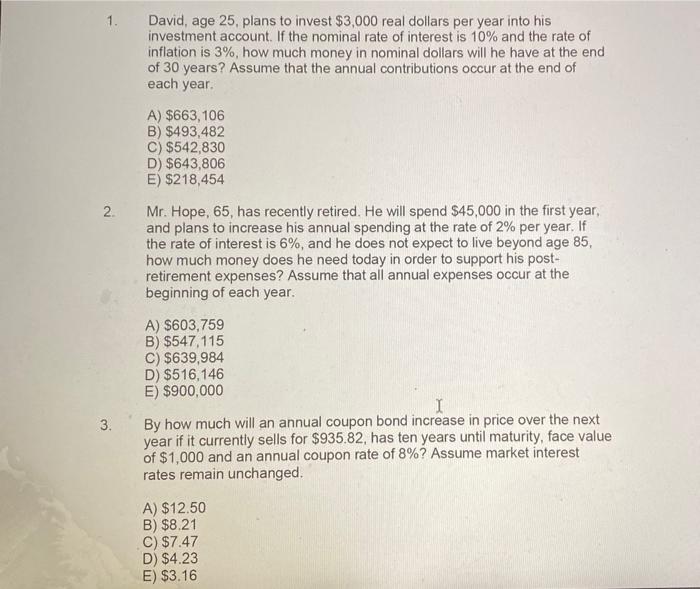

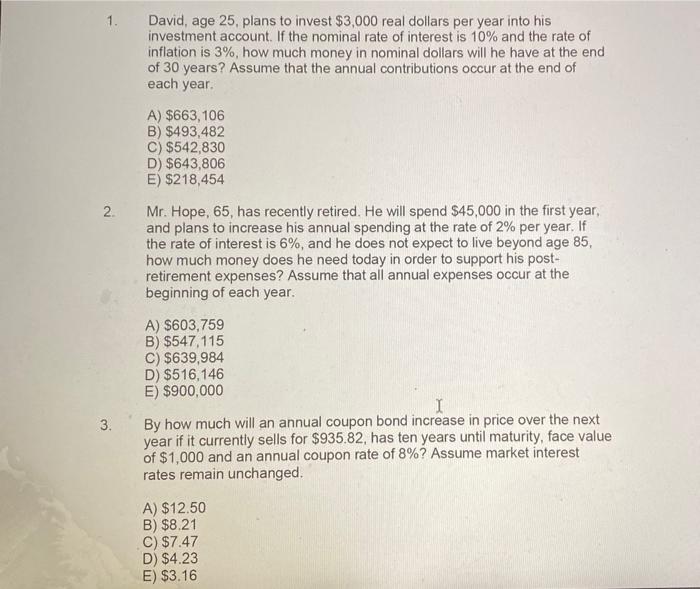

1. David, age 25, plans to invest $3,000 real dollars per year into his investment account. If the nominal rate of interest is 10% and the rate of inflation is 3%, how much money in nominal dollars will he have at the end of 30 years? Assume that the annual contributions occur at the end of each year. A) $663,106 B) $493,482 C) $542,830 D) $643,806 E) $218,454 2. Mr. Hope, 65 , has recently retired. He will spend $45,000 in the first year, and plans to increase his annual spending at the rate of 2% per year. If the rate of interest is 6%, and he does not expect to live beyond age 85 . how much money does he need today in order to support his postretirement expenses? Assume that all annual expenses occur at the beginning of each year. A) $603,759 B) $547,115 C) $639,984 D) $516,146 E) $900,000 3. By how much will an annual coupon bond increase in price over the next year if it currently sells for $935.82, has ten years until maturity, face value of $1,000 and an annual coupon rate of 8% ? Assume market interest rates remain unchanged. A) $12.50 B) $8.21 C) $7.47 D) $4.23 E) $3.16

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started