Question

**PLEASE, IF YOU ARE NOT ABLE TO ANSWER THEM ALL. SKIP** 1) Nathan T Corporation is comparing two different options. Nathan T currently uses Option

**PLEASE, IF YOU ARE NOT ABLE TO ANSWER THEM ALL. SKIP**

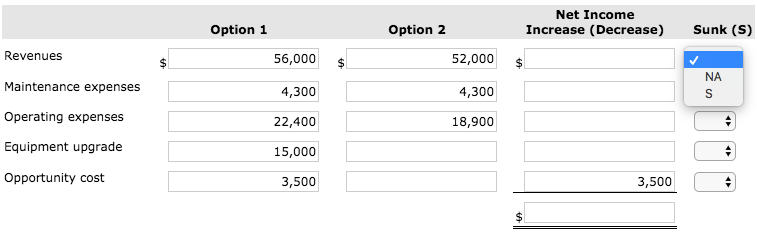

1) Nathan T Corporation is comparing two different options. Nathan T currently uses Option 1, with revenues of $56,000 per year, maintenance expenses of $4,300 per year, and operating expenses of $22,400 per year. Option 2 provides revenues of $52,000 per year, maintenance expenses of $4,300 per year, and operating expenses of $18,900 per year. Option 1 employs a piece of equipment which was upgraded 2 years ago at a cost of $15,000. If Option 2 is chosen, it will free up resources that will bring in an additional $3,500 of revenue. Complete the following table to show the change in income from choosing Option 2 versus Option 1. Designate Sunk costs with an S otherwise select "NA".

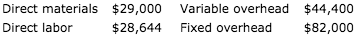

2) Wilma Company must decide whether to make or buy some of its components. The costs of producing 62,600 switches for its generators are as follows.

Prepare an incremental analysis showing whether the company should buy the switches. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

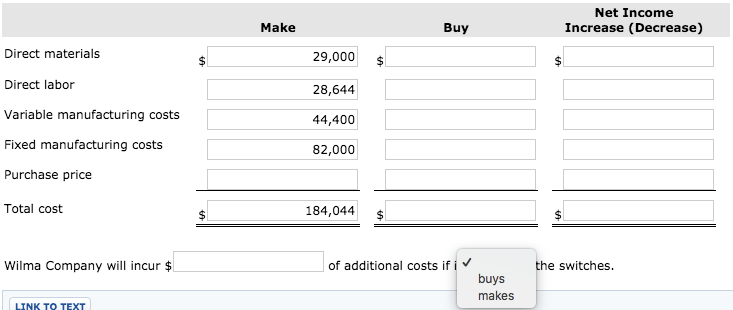

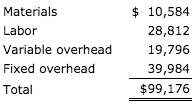

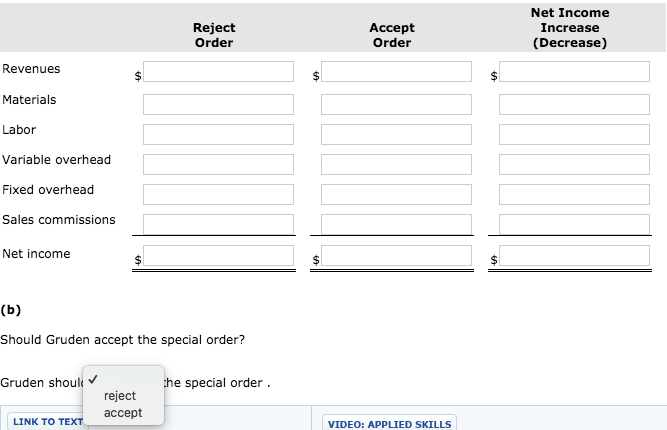

3) Gruden Company produces golf discs which it normally sells to retailers for $7 each. The cost of manufacturing 19,600 golf discs is:

Gruden also incurs 8% sales commission ($0.56) on each disc sold. McGee Corporation offers Gruden $4.77 per disc for 5,610 discs. McGee would sell the discs under its own brand name in foreign markets not yet served by Gruden. If Gruden accepts the offer, its fixed overhead will increase from $39,984 to $46,134 due to the purchase of a new imprinting machine. No sales commission will result from the special order. (a) Prepare an incremental analysis for the special order. (Round computations for per unit cost to 4 decimal places, e.g. 15.2500 and all other computations and final answers to the nearest whole dollar, e.g. 5,725. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started