Please, if you cannot answer questions A to M, let someone else answer this post.

Thank you

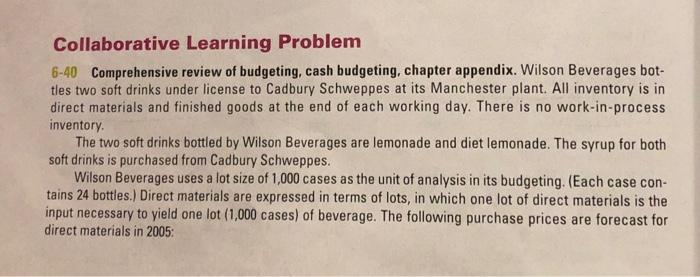

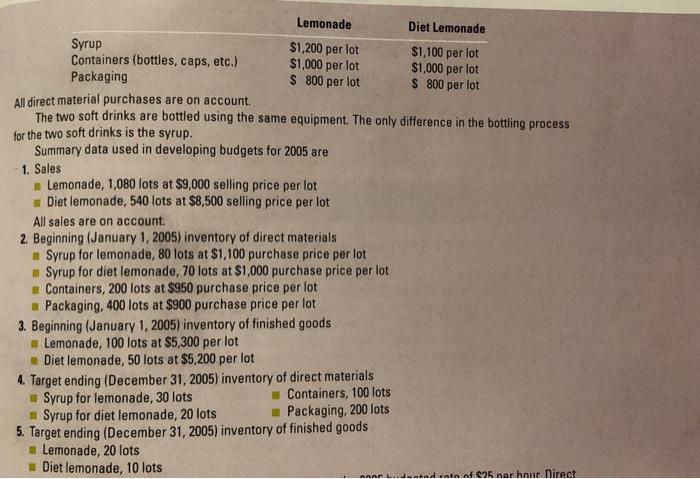

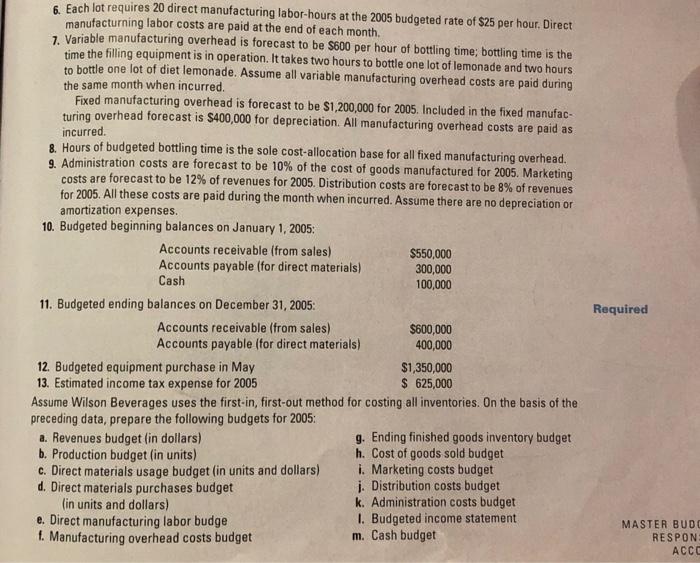

Collaborative Learning Problem 6-40 Comprehensive review of budgeting, cash budgeting, chapter appendix. Wilson Beverages bottles two soft drinks under license to Cadbury Schweppes at its Manchester plant. All inventory is in direct materials and finished goods at the end of each working day. There is no work-in-process inventory. The two soft drinks bottled by Wilson Beverages are lemonade and diet lemonade. The syrup for both soft drinks is purchased from Cadbury Schweppes. Wilson Beverages uses a lot size of 1,000 cases as the unit of analysis in its budgeting. (Each case contains 24 bottles.) Direct materials are expressed in terms of lots, in which one lot of direct materials is the input necessary to yield one lot (1,000 cases) of beverage. The following purchase prices are forecast for direct materials in 2005: Ali direct material purchases are on account. The two soft drinks are bottled using the same equipment. The only difference in the bottling process for the two soft drinks is the syrup. Summary data used in developing budgets for 2005 are 1. Sales Lemonade, 1,080 lots at $9,000 selling price per lot Diet lemonade, 540 lots at $8,500 selling price per lot All sales are on account. 2. Beginning (January 1, 2005) inventory of direct materials Syrup for lemonade, 80 lots at $1,100 purchase price per lot Syrup for diet lemonade, 70 lots at $1,000 purchase price per lot Containers, 200 lots at $950 purchase price per lot Packaging, 400 lots at $900 purchase price per lot 3. Beginning (January 1, 2005) inventory of finished goods ar. Lemonade, 100 lots at $5,300 per lot - Diet lemonade, 50 lots at $5,200 per lot 4. Target ending (December 31,2005 ) inventory of direct materials Syrup for lemonade, 30 lots Containers, 100 lots Syrup for diet lemonade, 20 lots Packaging, 200 lots 5. Target ending (December 31, 2005) inventory of finished goods Lemonade, 20 lots 6. Each lot requires 20 direct manufacturing labor-hours at the 2005 budgeted rate of $25 per hour. Direct manufacturning labor costs are paid at the end of each month. 7. Variable manufacturing overhead is forecast to be S600 per hour of bottling time; bottling time is the time the filling equipment is in operation. It takes two hours to bottle one lot of lemonade and two hours to bottle one lot of diet lemonade. Assume all variable manufacturing overhead costs are paid during the same month when incurred. Fixed manufacturing overhead is forecast to be $1,200,000 for 2005 . Included in the fixed manufacturing overhead forecast is $400,000 for depreciation. All manufacturing overhead costs are paid as incurred. 8. Hours of budgeted bottling time is the sole cost-allocation base for all fixed manufacturing overhead. 9. Administration costs are forecast to be 10% of the cost of goods manufactured for 2005. Marketing costs are forecast to be 12% of revenues for 2005 . Distribution costs are forecast to be 8% of revenues for 2005. All these costs are paid during the month when incurred. Assume there are no depreciation or amortization expenses. 10. Budgeted beginning balances on January 1, 2005: 11. Budgeted ending balances on December 31,2005 : Accountsreceivable(fromsales)Accountspayable(fordirectmaterials)entpurchaseinMaytaxexpensefor2005$600,000400,000$1,350,000$625,000 12. Budgeted equipment purchase in May 13. Estimated income tax expense for 2005