Answered step by step

Verified Expert Solution

Question

1 Approved Answer

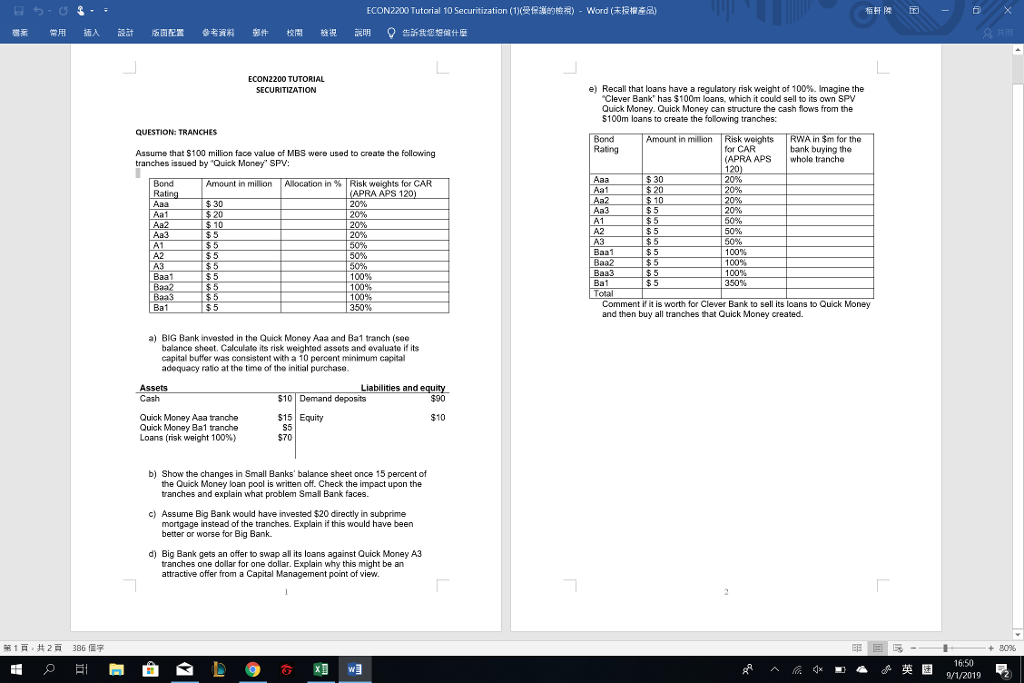

******** Please ignore the question in the photo The risk weighted assets of BIG Bank are ________$ (no rounding!). Therefore its capital ratio is _________(more/less)

-

********Please ignore the question in the photo

********Please ignore the question in the photo - The risk weighted assets of BIG Bank are ________$ (no rounding!). Therefore its capital ratio is _________(more/less) than 10%.

- If 15 percent of Subprime Quick Money loan pool is written off, the value of BIG Bank AAA tranche holding will be $_____ and its Ba1 tranche holding will be valued at $________. Big Bank's Equity will change to $_________. Is this still 10% of its RWA?

- If Big Bank would have invested $20 directly into MBS (the same type of loans as Quick Money) and 15% of the underlying loans would have defaulted, the loss for Big Bank would have been exactly $__________. This would have been ___________(better / worse) than the investment in the tranches.

- Continue with your balance sheet from b) after the losses. If Big Bank would swap all its loans against Quick Money A3 tranches, its RWA would change to $___________ (no rounding!). Check if Big Bank is now achieving its minimum CAR of 10% again.

- If Clever Bank keeps all its loans on its balance sheet, its RWA would be exactly $_________m. However, if it does the deal with Quick Money its RWA would be $____________m. This is an __________ (advantage/disadvantage) for a capital management point of view. Did the actual riskiness of the assets change?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started