Answered step by step

Verified Expert Solution

Question

1 Approved Answer

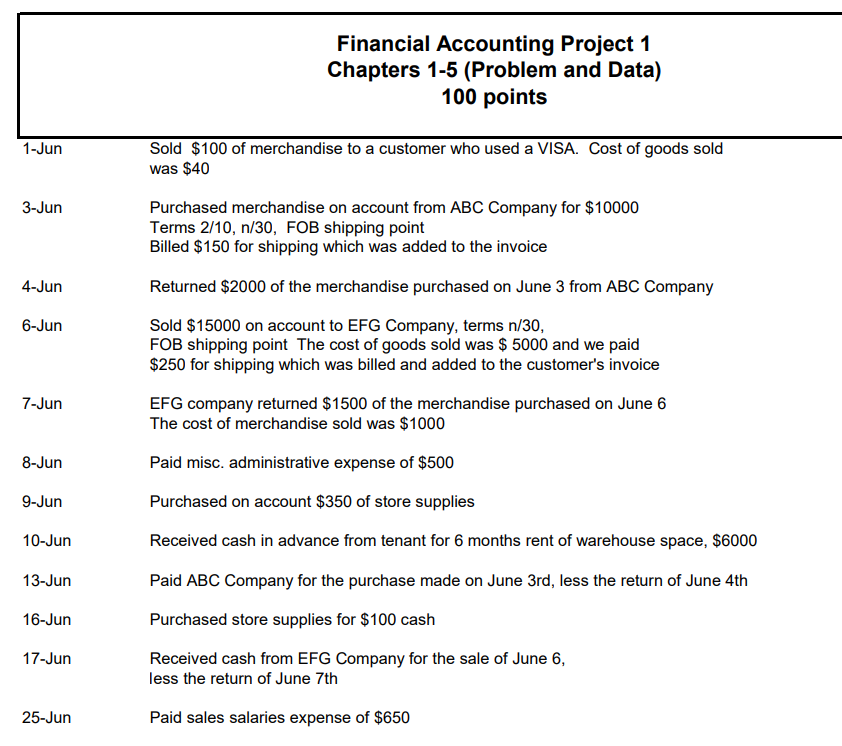

Please include a Journal Entry, as well as fill out the Worksheet Thank you! Sold $100 of merchandise to a customer who used a VISA.

Please include a Journal Entry, as well as fill out the Worksheet

Thank you!

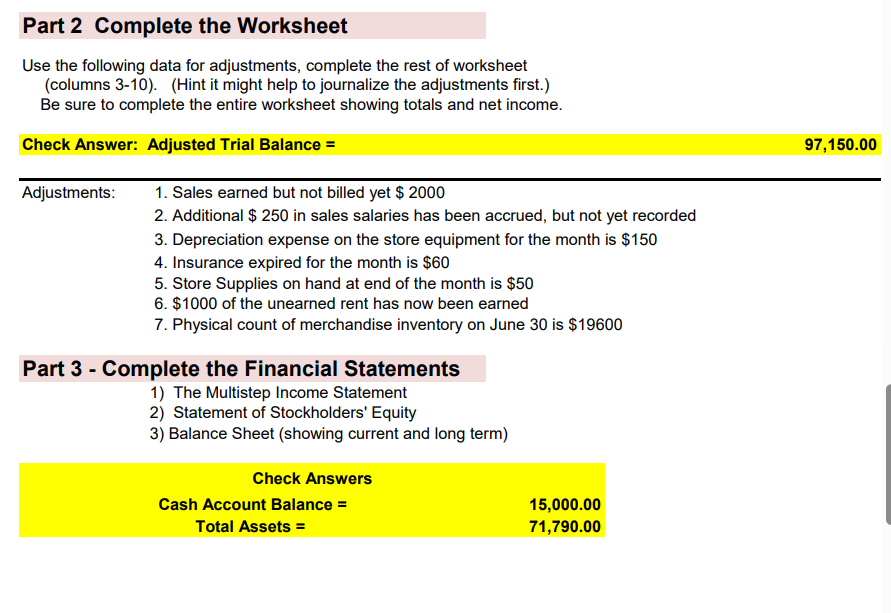

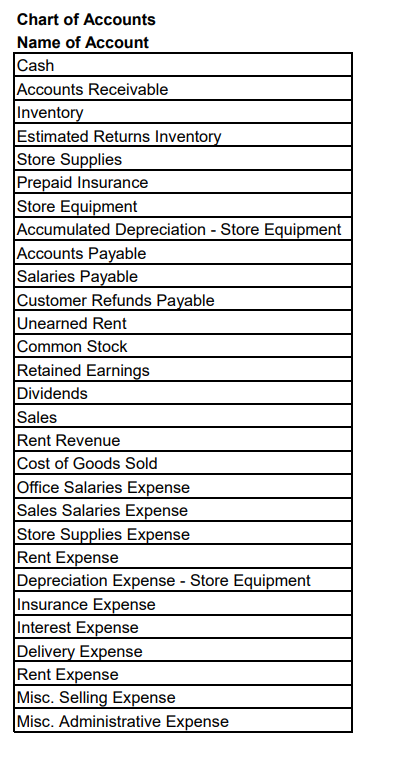

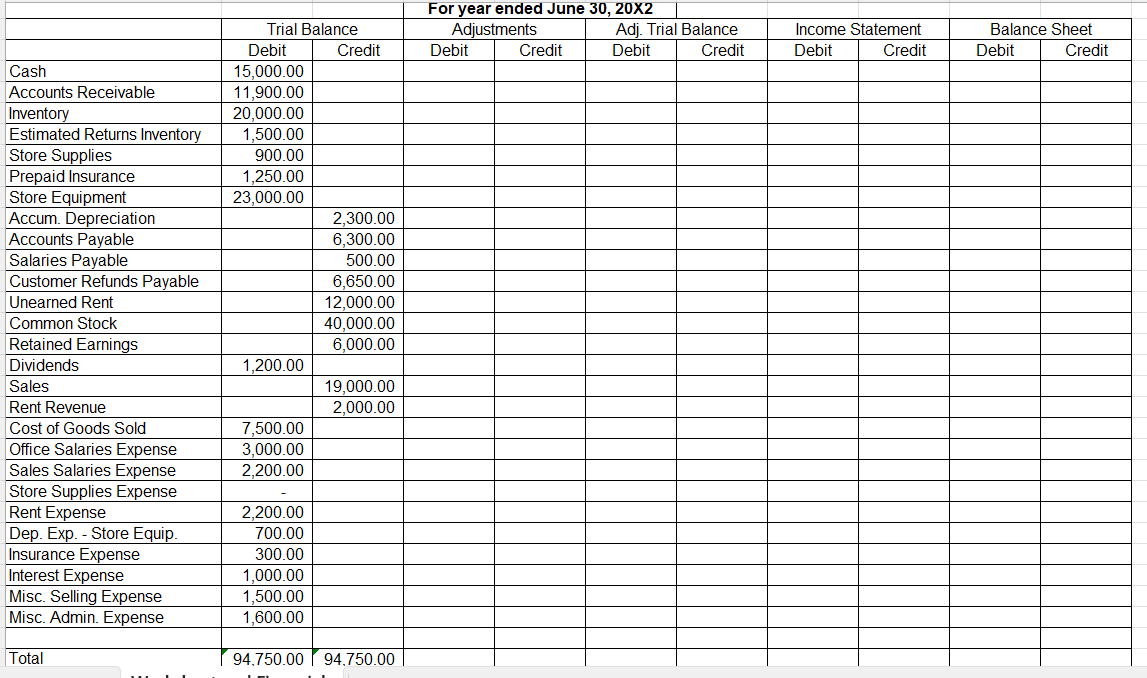

Sold $100 of merchandise to a customer who used a VISA. Cost of goods sold was $40 Purchased merchandise on account from ABC Company for $10000 Terms 2/10, n/30, FOB shipping point Billed $150 for shipping which was added to the invoice Returned $2000 of the merchandise purchased on June 3 from ABC Company Sold $15000 on account to EFG Company, terms n/30, FOB shipping point The cost of goods sold was $5000 and we paid $250 for shipping which was billed and added to the customer's invoice EFG company returned $1500 of the merchandise purchased on June 6 The cost of merchandise sold was $1000 Paid misc. administrative expense of $500 Purchased on account $350 of store supplies Received cash in advance from tenant for 6 months rent of warehouse space, $6000 Paid ABC Company for the purchase made on June 3rd, less the return of June 4th Purchased store supplies for $100 cash Received cash from EFG Company for the sale of June 6, less the return of June 7 th Paid sales salaries expense of $650 Part 2 Complete the Worksheet Use the following data for adjustments, complete the rest of worksheet (columns 3-10). (Hint it might help to journalize the adjustments first.) Be sure to complete the entire worksheet showing totals and net income. Check Answer: Adjusted Trial Balance = Adjustments: 1. Sales earned but not billed yet $2000 2. Additional $250 in sales salaries has been accrued, but 3. Depreciation expense on the store equipment for the mc 4. Insurance expired for the month is $60 5. Store Supplies on hand at end of the month is $50 6. $1000 of the unearned rent has now been earned 7. Physical count of merchandise inventory on June 30 is Part 3 - Complete the Financial Statements 1) The Multistep Income Statement 2) Statement of Stockholders' Equity 3) Balance Sheet (showing current and long term) Chart of Accounts Name of Account \begin{tabular}{|l|} \hline Cash \\ \hline Accounts Receivable \\ \hline Inventory \\ \hline Estimated Returns Inventory \\ \hline Store Supplies \\ \hline Prepaid Insurance \\ \hline Store Equipment \\ \hline Accumulated Depreciation - Store Equipment \\ \hline Accounts Payable \\ \hline Salaries Payable \\ \hline Customer Refunds Payable \\ \hline Unearned Rent \\ \hline Common Stock \\ \hline Retained Earnings \\ \hline Dividends \\ \hline Sales \\ \hline Rent Revenue \\ \hline Cost of Goods Sold \\ \hline Office Salaries Expense \\ \hline Sales Salaries Expense \\ \hline Store Supplies Expense \\ \hline Rent Expense \\ \hline Depreciation Expense - Store Equipment \\ \hline Insurance Expense \\ \hline Interest Expense \\ \hline Delivery Expense \\ \hline Rent Expense \\ \hline Misc. Selling Expense \\ \hline Misc. Administrative Expense \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline & & & \multicolumn{3}{|c|}{ For year ended June 30,202} & & \multirow{2}{*}{\multicolumn{2}{|c|}{ Income Statement }} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Balance Sheet }} \\ \hline & \multicolumn{2}{|c|}{ Trial Balance } & \multicolumn{2}{|c|}{ Adjustments } & Adj. Trial Balance & & & & & \\ \hline & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit \\ \hline Cash & 15,000.00 & & & & & & & & & \\ \hline Accounts Receivable & 11,900.00 & & & & & & & & & \\ \hline Inventory & 20,000.00 & & & & & & & & & \\ \hline Estimated Returns Inventory & 1,500.00 & & & & & & & & & \\ \hline Store Supplies & 900.00 & & & & & & & & & \\ \hline Prepaid Insurance & 1,250.00 & & & & & & & & & \\ \hline Store Equipment & 23,000.00 & & & & & & & & & \\ \hline Accum. Depreciation & & 2,300.00 & & & & & & & & \\ \hline Accounts Payable & & 6,300.00 & & & & & & & & \\ \hline Salaries Payable & & 500.00 & & & & & & & & \\ \hline Customer Refunds Payable & & 6,650.00 & & & & & & & & \\ \hline Unearned Rent & & 12,000.00 & & & & & & & & \\ \hline Common Stock & & \begin{tabular}{|l|} 40,000.00 \\ \end{tabular} & & & & & & & & \\ \hline Retained Earnings & & 6,000.00 & & & & & & & & \\ \hline Dividends & 1,200.00 & & & & & & & & & \\ \hline Sales & & \begin{tabular}{|l|} 19,000.00 \\ \end{tabular} & & & & & & & & \\ \hline Rent Revenue & & 2,000.00 & & & & & & & & \\ \hline Cost of Goods Sold & 7,500.00 & & & & & & & & & \\ \hline Office Salaries Expense & 3,000.00 & & & & & & & & & \\ \hline Sales Salaries Expense & 2,200.00 & & & & & & & & & \\ \hline Store Supplies Expense & & & & & & & & & & \\ \hline Rent Expense & 2,200.00 & & & & & & & & & \\ \hline Dep. Exp. - Store Equip. & 700.00 & & & & & & & & & \\ \hline Insurance Expense & 300.00 & & & & & & & & & \\ \hline Interest Expense & 1,000.00 & & & & & & & & & \\ \hline Misc. Selling Expense & 1,500.00 & & & & & & & & & \\ \hline Misc. Admin. Expense & 1,600.00 & & & & & & & & & \\ \hline & & & & & & & & & & \\ \hline Total & 94.750 .00 & 94.750 .00 & & & & & & & & \\ \hline \end{tabular} Sold $100 of merchandise to a customer who used a VISA. Cost of goods sold was $40 Purchased merchandise on account from ABC Company for $10000 Terms 2/10, n/30, FOB shipping point Billed $150 for shipping which was added to the invoice Returned $2000 of the merchandise purchased on June 3 from ABC Company Sold $15000 on account to EFG Company, terms n/30, FOB shipping point The cost of goods sold was $5000 and we paid $250 for shipping which was billed and added to the customer's invoice EFG company returned $1500 of the merchandise purchased on June 6 The cost of merchandise sold was $1000 Paid misc. administrative expense of $500 Purchased on account $350 of store supplies Received cash in advance from tenant for 6 months rent of warehouse space, $6000 Paid ABC Company for the purchase made on June 3rd, less the return of June 4th Purchased store supplies for $100 cash Received cash from EFG Company for the sale of June 6, less the return of June 7 th Paid sales salaries expense of $650 Part 2 Complete the Worksheet Use the following data for adjustments, complete the rest of worksheet (columns 3-10). (Hint it might help to journalize the adjustments first.) Be sure to complete the entire worksheet showing totals and net income. Check Answer: Adjusted Trial Balance = Adjustments: 1. Sales earned but not billed yet $2000 2. Additional $250 in sales salaries has been accrued, but 3. Depreciation expense on the store equipment for the mc 4. Insurance expired for the month is $60 5. Store Supplies on hand at end of the month is $50 6. $1000 of the unearned rent has now been earned 7. Physical count of merchandise inventory on June 30 is Part 3 - Complete the Financial Statements 1) The Multistep Income Statement 2) Statement of Stockholders' Equity 3) Balance Sheet (showing current and long term) Chart of Accounts Name of Account \begin{tabular}{|l|} \hline Cash \\ \hline Accounts Receivable \\ \hline Inventory \\ \hline Estimated Returns Inventory \\ \hline Store Supplies \\ \hline Prepaid Insurance \\ \hline Store Equipment \\ \hline Accumulated Depreciation - Store Equipment \\ \hline Accounts Payable \\ \hline Salaries Payable \\ \hline Customer Refunds Payable \\ \hline Unearned Rent \\ \hline Common Stock \\ \hline Retained Earnings \\ \hline Dividends \\ \hline Sales \\ \hline Rent Revenue \\ \hline Cost of Goods Sold \\ \hline Office Salaries Expense \\ \hline Sales Salaries Expense \\ \hline Store Supplies Expense \\ \hline Rent Expense \\ \hline Depreciation Expense - Store Equipment \\ \hline Insurance Expense \\ \hline Interest Expense \\ \hline Delivery Expense \\ \hline Rent Expense \\ \hline Misc. Selling Expense \\ \hline Misc. Administrative Expense \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline & & & \multicolumn{3}{|c|}{ For year ended June 30,202} & & \multirow{2}{*}{\multicolumn{2}{|c|}{ Income Statement }} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Balance Sheet }} \\ \hline & \multicolumn{2}{|c|}{ Trial Balance } & \multicolumn{2}{|c|}{ Adjustments } & Adj. Trial Balance & & & & & \\ \hline & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit \\ \hline Cash & 15,000.00 & & & & & & & & & \\ \hline Accounts Receivable & 11,900.00 & & & & & & & & & \\ \hline Inventory & 20,000.00 & & & & & & & & & \\ \hline Estimated Returns Inventory & 1,500.00 & & & & & & & & & \\ \hline Store Supplies & 900.00 & & & & & & & & & \\ \hline Prepaid Insurance & 1,250.00 & & & & & & & & & \\ \hline Store Equipment & 23,000.00 & & & & & & & & & \\ \hline Accum. Depreciation & & 2,300.00 & & & & & & & & \\ \hline Accounts Payable & & 6,300.00 & & & & & & & & \\ \hline Salaries Payable & & 500.00 & & & & & & & & \\ \hline Customer Refunds Payable & & 6,650.00 & & & & & & & & \\ \hline Unearned Rent & & 12,000.00 & & & & & & & & \\ \hline Common Stock & & \begin{tabular}{|l|} 40,000.00 \\ \end{tabular} & & & & & & & & \\ \hline Retained Earnings & & 6,000.00 & & & & & & & & \\ \hline Dividends & 1,200.00 & & & & & & & & & \\ \hline Sales & & \begin{tabular}{|l|} 19,000.00 \\ \end{tabular} & & & & & & & & \\ \hline Rent Revenue & & 2,000.00 & & & & & & & & \\ \hline Cost of Goods Sold & 7,500.00 & & & & & & & & & \\ \hline Office Salaries Expense & 3,000.00 & & & & & & & & & \\ \hline Sales Salaries Expense & 2,200.00 & & & & & & & & & \\ \hline Store Supplies Expense & & & & & & & & & & \\ \hline Rent Expense & 2,200.00 & & & & & & & & & \\ \hline Dep. Exp. - Store Equip. & 700.00 & & & & & & & & & \\ \hline Insurance Expense & 300.00 & & & & & & & & & \\ \hline Interest Expense & 1,000.00 & & & & & & & & & \\ \hline Misc. Selling Expense & 1,500.00 & & & & & & & & & \\ \hline Misc. Admin. Expense & 1,600.00 & & & & & & & & & \\ \hline & & & & & & & & & & \\ \hline Total & 94.750 .00 & 94.750 .00 & & & & & & & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started