Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE INCLUDE ALL CALCULATIONS. NOT JUST ANSWERS. THANK YOU. Three Bears Inc. produces various components used by many industries in the production of medical equipment.

PLEASE INCLUDE ALL CALCULATIONS. NOT JUST ANSWERS. THANK YOU.

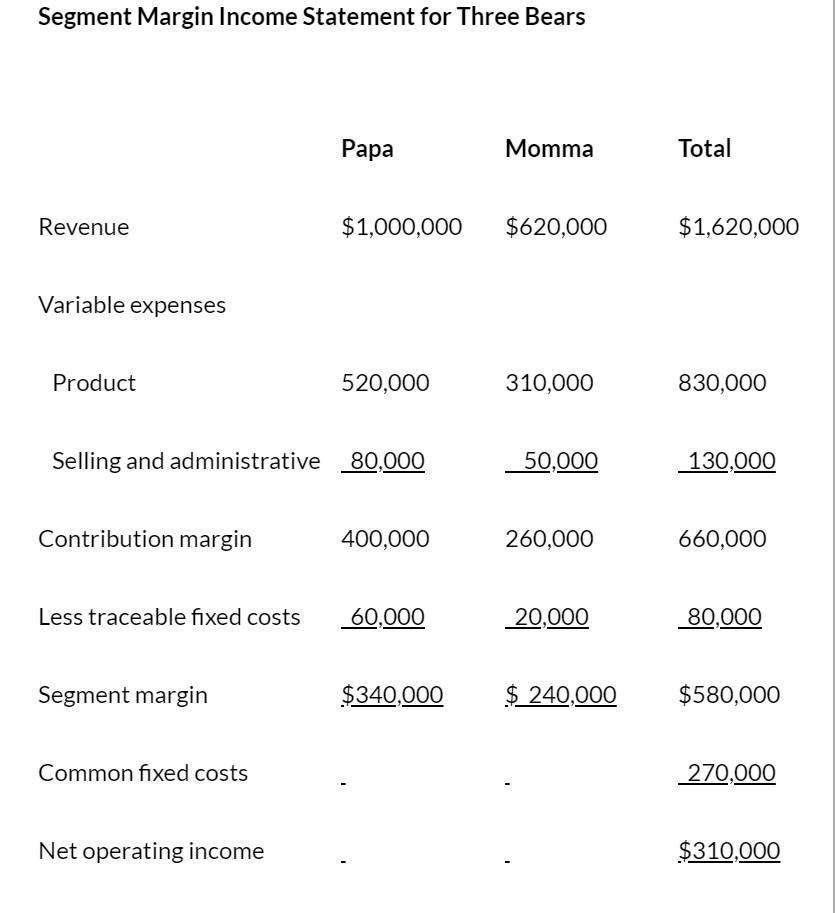

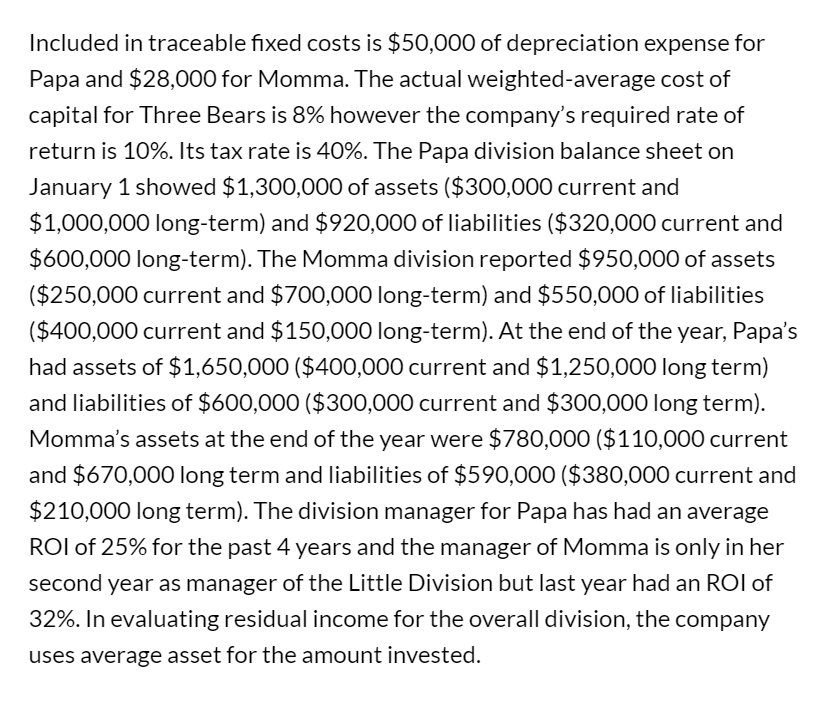

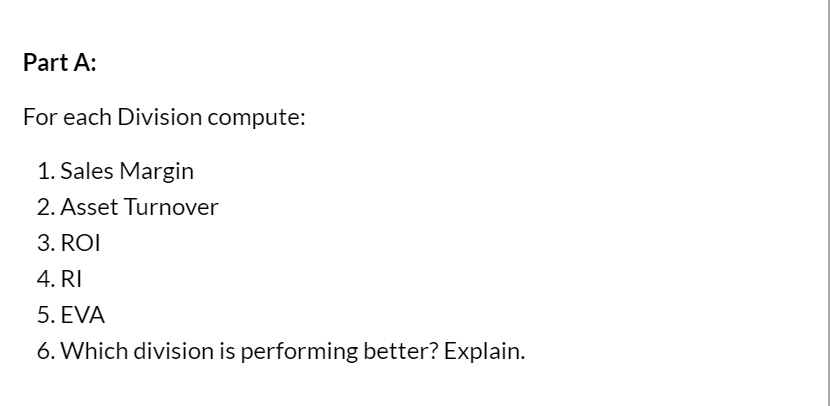

Three Bears Inc. produces various components used by many industries in the production of medical equipment. They currently have two divisions - Papa Bear which manufactures components for large scale medical equipment such as MRI and X-ray machines; and Momma Bear which manufactures components for medium scale medical equipment such as centrifuges and ultrasound machines. They are preparing to open their third division - Baby Bear Division which will produce manufacturing components for small scale medical equipment such as microscopes and sphygmomanometers. Three Bears, provided the following income statement for its current divisions: Papa and Momma Segment Margin Income Statement for Three Bears Papa Momma Total Revenue $1,000,000 $620,000 $1,620,000 Variable expenses Product 520,000 310,000 830,000 Selling and administrative 80,000 50,000 | 130,000 Contribution margin 400,000 260,000 660,000 Less traceable fixed costs 60,000 20,000 | 80,000 Segment margin $340,000 $ 240,000 $580,000 Common fixed costs | 270,000 Net operating income $310,000 Included in traceable fixed costs is $50,000 of depreciation expense for Papa and $28,000 for Momma. The actual weighted-average cost of capital for Three Bears is 8% however the company's required rate of return is 10%. Its tax rate is 40%. The Papa division balance sheet on January 1 showed $1,300,000 of assets ($300,000 current and $1,000,000 long-term) and $920,000 of liabilities ($320,000 current and $600,000 long-term). The Momma division reported $950,000 of assets ($250,000 current and $700,000 long-term) and $550,000 of liabilities ($400,000 current and $150,000 long-term). At the end of the year, Papa's had assets of $1,650,000 ($400,000 current and $1,250,000 long term) and liabilities of $600,000 ($300,000 current and $300,000 long term). Momma's assets at the end of the year were $780.000 ($110.000 current and $670,000 long term and liabilities of $590,000 ($380,000 current and $210,000 long term). The division manager for Papa has had an average Rol of 25% for the past 4 years and the manager of Momma is only in her second year as manager of the Little Division but last year had an Rol of 32%. In evaluating residual income for the overall division, the company uses average asset for the amount invested. Part A: For each Division compute: 1. Sales Margin 2. Asset Turnover 3. ROI 4. RI 5. EVA 6. Which division is performing better? ExplainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started