please include all decimals

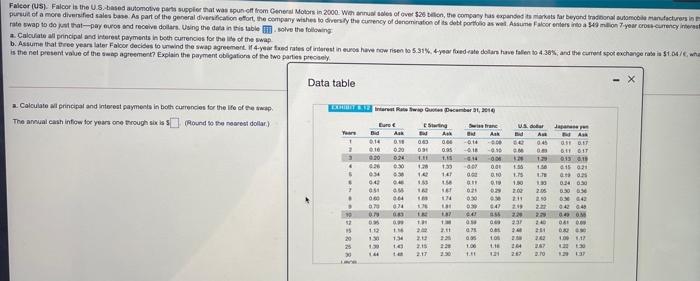

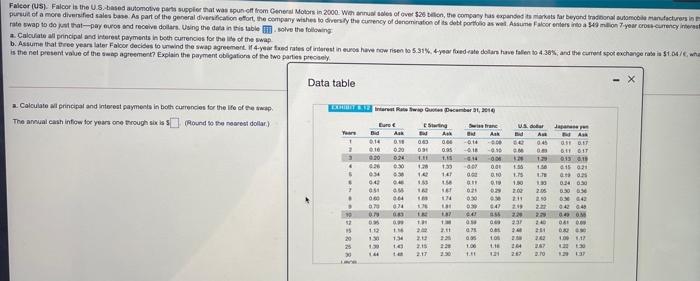

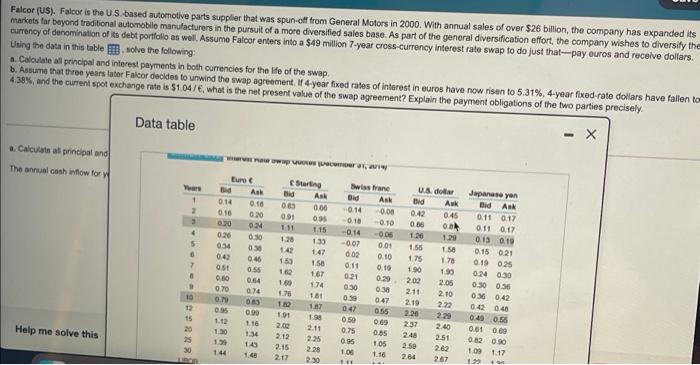

Falco (5) Falcor is the US-based automotive parts suppler that was sun off from General Motors in 2000. Wannual sales of over 526 billion, the company has expanded as far beyond traditional automobile manufacturers pursuit of a more diversified sales base. As part of the general diversification effort the company wishes to diversely the currency of denomination of ta del portfolio as wat Alune Falcor enters to a 549 million year crocurrency Intern rate swap to do that ay euros and receive dollars. Using the data in this table solve the following 2. Calculate al principal and rest payments in both currencies for the life of the wap b. Assume that the years later Falco decided to unwind the warment 4 portuodatus of interest in euros have to rise to 5.31% ya fede door have fun to 4.38%, and the current spot exchange rate a $1.00/6, is the nel present value of the swap agreement? Explain the payment obligations of the two parties precisely Data table LARRIL December 2, 2016 a. Calculate i principal and interest payments in both currencies for the life of the The annual cash now for years one through six s Round to a nearest dollar) van VS hed Euro B 0.14 16 0.20 30 5.24 050 14 04 Starting As 003 0.00 09 0.95 1.15 Aut 0.41 -614 -0.18 14 . -0. 000 00 0.10 19 As DET DIT DIT 01310 415 011 1 18 16 TE M 0.40 16 156 1.75 1. 2.00 211 200 22 237 2. 24 04 10 2.05 20 2 2 240 0.50 23 0 a. an cos 100 TM 2.1 92 15 20 25 > 44 0424 OM 08 DO 1.00 1.11 30 112 10 1:34 0. 100 1.16 120 27 3.10 14 2.62 Falco (US). Falcor is the USbased automotive parts supplier that was spun-off from General Motors in 2000. With annual sales of over $26 billion, the company has expanded its markets far beyond traditional automobile manufacturers in the pursuit of a more diversified sales base. As part of the general diversification effort, the company wishes to diversify the currency of denomination of its debt portfolio as well. Assume Falcor enters into a 549 million 7-year cross-currency interest rate swap to do just thal--pay euros and receive dollars. Using the data in this table solve the following a. Calculate all principal and interest payments in both currencies for the life of the swap B. Assume that three years later Falcor decides to unwind the swap agreement. 14-year fixed rates of interest in euros have now risen to 5.31%, 4-year fixed-rate dollars have fallen to 438%, and the current spot exchange rate is 51.04/, what is the net present value of the swap agreement? Explain the payment obligations of the two parties precisely. Data table Calculats al principal and The annual cash inflow for Eure Ash 1 2 Ask 0.10 0.20 0.24 0.30 US Bild 0.42 0.00 0.14 0.10 0.30 0.20 034 0.42 OSE 4 5 6 7 Starting tid 000 0.66 0.91 095 1.11 1.15 1.20 133 142 147 155 1.50 162 167 1.6 74 1.78 181 1.AT 191 1.98 2.02 2.11 2.12 225 2.15 2.29 2.17 2.30 0.46 055 0.64 0.74 Swiss Od AR -0.14 -0.00 0.10 0.10 -0.14 -0.00 -0.07 0.01 600 0.10 0.11 0.10 0.21 0.30 0.30 0.30 0.47 0.42 055 0.50 0.75 0.85 0.95 1.05 10 1.16 AR 0.45 0.01 1.99 158 1.70 1.99 2.05 2.10 222 1.26 1.55 175 1.90 2.02 2.11 0.29 Japanese yen Bid All 0.11 0.17 0.11 0.17 0.13 0.19 0.15 021 0.19 0.25 0.24 0.30 0.300.30 OM 0.42 0.42 0.40 0.43 0.56 0.61 069 20.30 1.09 1.17 1. 9 0.70 0.70 0.83 2.1 095 0.00 Help me solve this 12 15 20 25 3803838 1.12 1.30 1.99 144 0.99 1.16 1.34 145 1.48 2.20 2.37 245 2.50 2.64 2.40 250 2.62 2.67 Falco (5) Falcor is the US-based automotive parts suppler that was sun off from General Motors in 2000. Wannual sales of over 526 billion, the company has expanded as far beyond traditional automobile manufacturers pursuit of a more diversified sales base. As part of the general diversification effort the company wishes to diversely the currency of denomination of ta del portfolio as wat Alune Falcor enters to a 549 million year crocurrency Intern rate swap to do that ay euros and receive dollars. Using the data in this table solve the following 2. Calculate al principal and rest payments in both currencies for the life of the wap b. Assume that the years later Falco decided to unwind the warment 4 portuodatus of interest in euros have to rise to 5.31% ya fede door have fun to 4.38%, and the current spot exchange rate a $1.00/6, is the nel present value of the swap agreement? Explain the payment obligations of the two parties precisely Data table LARRIL December 2, 2016 a. Calculate i principal and interest payments in both currencies for the life of the The annual cash now for years one through six s Round to a nearest dollar) van VS hed Euro B 0.14 16 0.20 30 5.24 050 14 04 Starting As 003 0.00 09 0.95 1.15 Aut 0.41 -614 -0.18 14 . -0. 000 00 0.10 19 As DET DIT DIT 01310 415 011 1 18 16 TE M 0.40 16 156 1.75 1. 2.00 211 200 22 237 2. 24 04 10 2.05 20 2 2 240 0.50 23 0 a. an cos 100 TM 2.1 92 15 20 25 > 44 0424 OM 08 DO 1.00 1.11 30 112 10 1:34 0. 100 1.16 120 27 3.10 14 2.62 Falco (US). Falcor is the USbased automotive parts supplier that was spun-off from General Motors in 2000. With annual sales of over $26 billion, the company has expanded its markets far beyond traditional automobile manufacturers in the pursuit of a more diversified sales base. As part of the general diversification effort, the company wishes to diversify the currency of denomination of its debt portfolio as well. Assume Falcor enters into a 549 million 7-year cross-currency interest rate swap to do just thal--pay euros and receive dollars. Using the data in this table solve the following a. Calculate all principal and interest payments in both currencies for the life of the swap B. Assume that three years later Falcor decides to unwind the swap agreement. 14-year fixed rates of interest in euros have now risen to 5.31%, 4-year fixed-rate dollars have fallen to 438%, and the current spot exchange rate is 51.04/, what is the net present value of the swap agreement? Explain the payment obligations of the two parties precisely. Data table Calculats al principal and The annual cash inflow for Eure Ash 1 2 Ask 0.10 0.20 0.24 0.30 US Bild 0.42 0.00 0.14 0.10 0.30 0.20 034 0.42 OSE 4 5 6 7 Starting tid 000 0.66 0.91 095 1.11 1.15 1.20 133 142 147 155 1.50 162 167 1.6 74 1.78 181 1.AT 191 1.98 2.02 2.11 2.12 225 2.15 2.29 2.17 2.30 0.46 055 0.64 0.74 Swiss Od AR -0.14 -0.00 0.10 0.10 -0.14 -0.00 -0.07 0.01 600 0.10 0.11 0.10 0.21 0.30 0.30 0.30 0.47 0.42 055 0.50 0.75 0.85 0.95 1.05 10 1.16 AR 0.45 0.01 1.99 158 1.70 1.99 2.05 2.10 222 1.26 1.55 175 1.90 2.02 2.11 0.29 Japanese yen Bid All 0.11 0.17 0.11 0.17 0.13 0.19 0.15 021 0.19 0.25 0.24 0.30 0.300.30 OM 0.42 0.42 0.40 0.43 0.56 0.61 069 20.30 1.09 1.17 1. 9 0.70 0.70 0.83 2.1 095 0.00 Help me solve this 12 15 20 25 3803838 1.12 1.30 1.99 144 0.99 1.16 1.34 145 1.48 2.20 2.37 245 2.50 2.64 2.40 250 2.62 2.67