Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please include calculations. Thanks :) Asper Company has recently introduced budgeting as an integral part of its corporate planning process. An inexperienced member of the

Please include calculations. Thanks :)

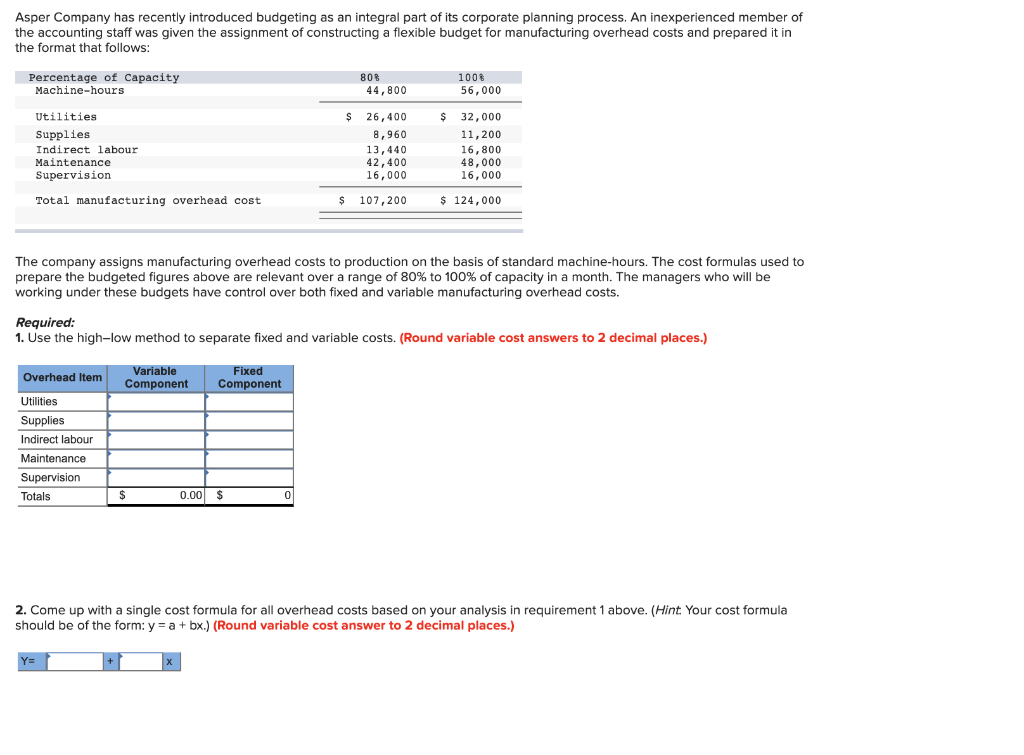

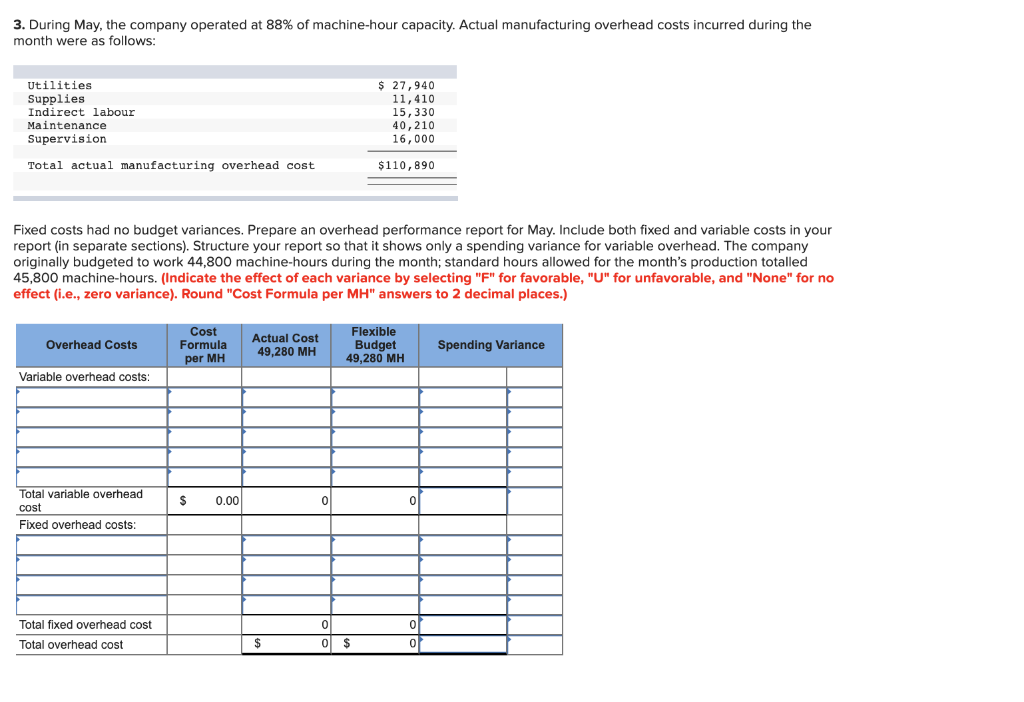

Asper Company has recently introduced budgeting as an integral part of its corporate planning process. An inexperienced member of the accounting staff was given the assignment of constructing a flexible budget for manufacturing overhead costs and prepared it in the format that follows: Percentage of Capacity Machine-hours 80% 44,800 100% 56,000 $ $ Utilities Supplies Indirect labour Maintenance Supervision 26,400 8,960 13,440 42, 400 16,000 32,000 11,200 16,800 48,000 16,000 Total manufacturing overhead cost $ 107,200 $ 124,000 The company assigns manufacturing overhead costs to production on the basis of standard machine-hours. The cost formulas used to prepare the budgeted figures above are relevant over a range of 80% to 100% of capacity in a month. The managers who will be working under these budgets have control over both fixed and variable manufacturing overhead costs. Required: 1. Use the high-low method to separate fixed and variable costs. (Round variable cost answers to 2 decimal places.) Variable Component Fixed Component Overhead Item Utilities Supplies Indirect labour Maintenance Supervision Totals $ 0.00 $ 0 2. Come up with a single cost formula for all overhead costs based on your analysis in requirement 1 above. (Hint Your cost formula should be of the form: y = a + bx.) (Round variable cost answer to 2 decimal places.) Y= + 3. During May, the company operated at 88% of machine-hour capacity. Actual manufacturing overhead costs incurred during the month were as follows: Utilities Supplies Indirect labour Maintenance Supervision $ 27,940 11,410 15,330 40,210 16,000 Total actual manufacturing overhead cost $110,890 Fixed costs had no budget variances. Prepare an overhead performance report for May. Include both fixed and variable costs in your report (in separate sections). Structure your report so that it shows only a spending variance for variable overhead. The company originally budgeted to work 44,800 machine-hours during the month; standard hours allowed for the month's production totalled 45,800 machine-hours. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Round "Cost Formula per MH" answers to 2 decimal places.) Overhead Costs Cost Formula per MH Actual Cost 49,280 MH Flexible Budget 49,280 MH Spending Variance Variable overhead costs: $ 0.00 0 Total variable overhead cost Fixed overhead costs: Total fixed overhead cost Total overhead costStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started