Please include detailed calculations so I can understand how you arrived at the answers.

Please include detailed calculations so I can understand how you arrived at the answers.

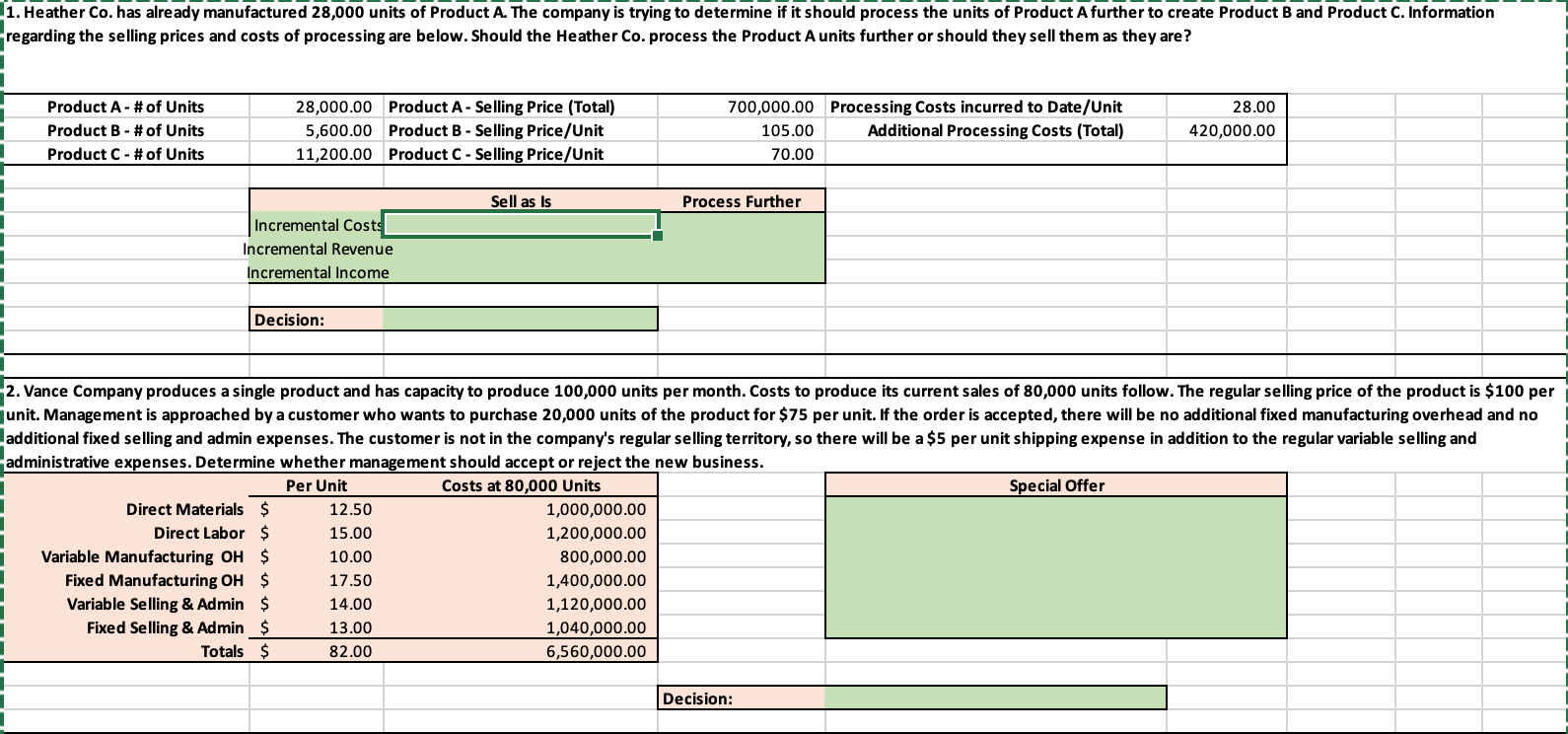

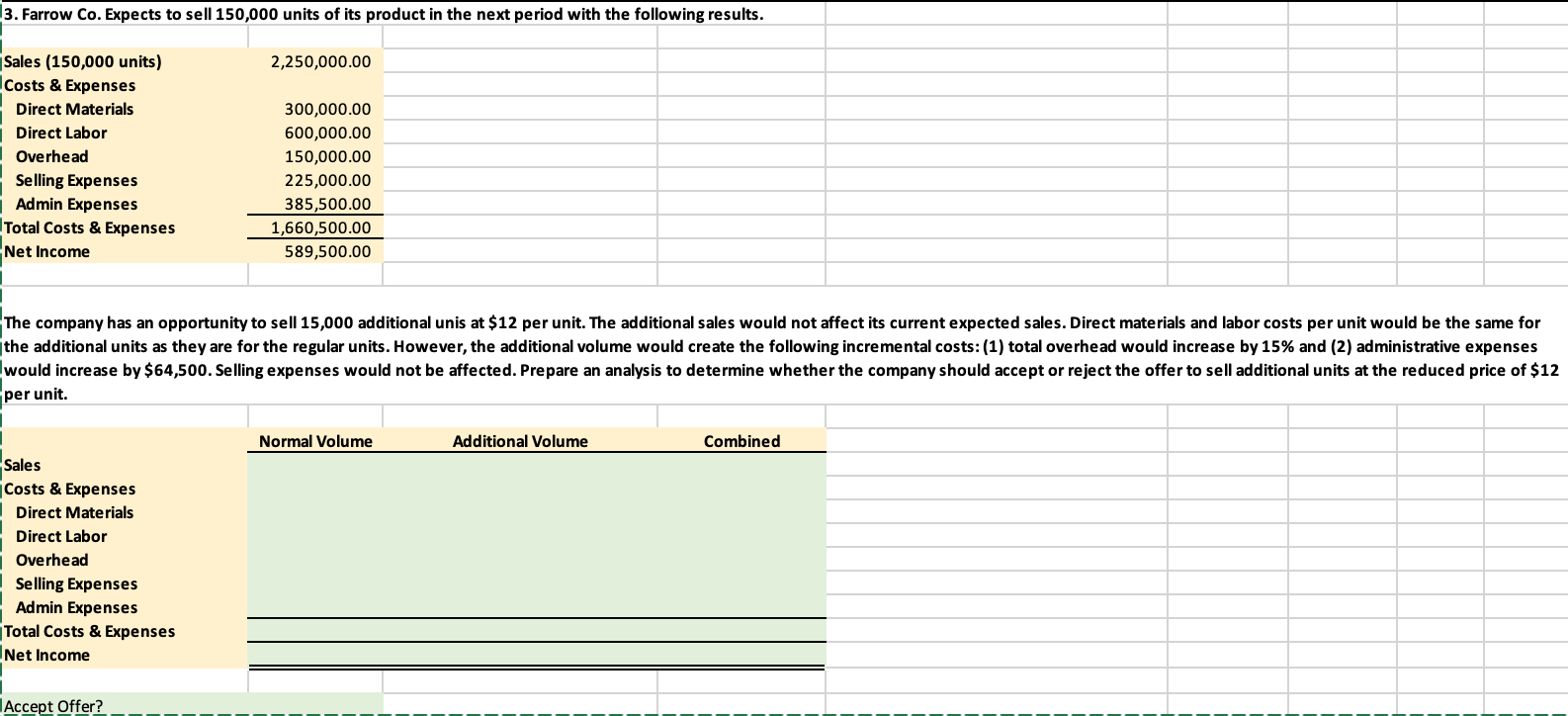

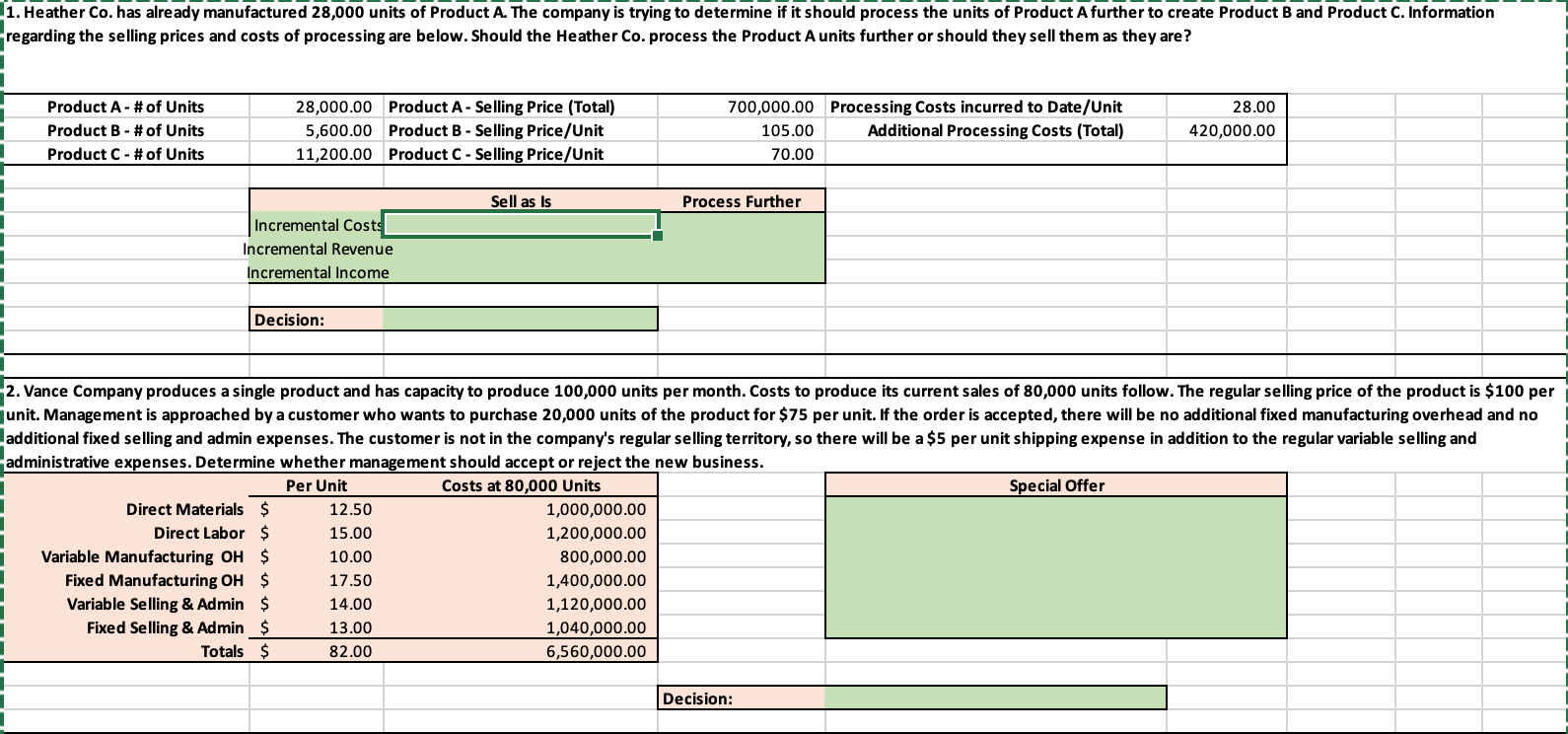

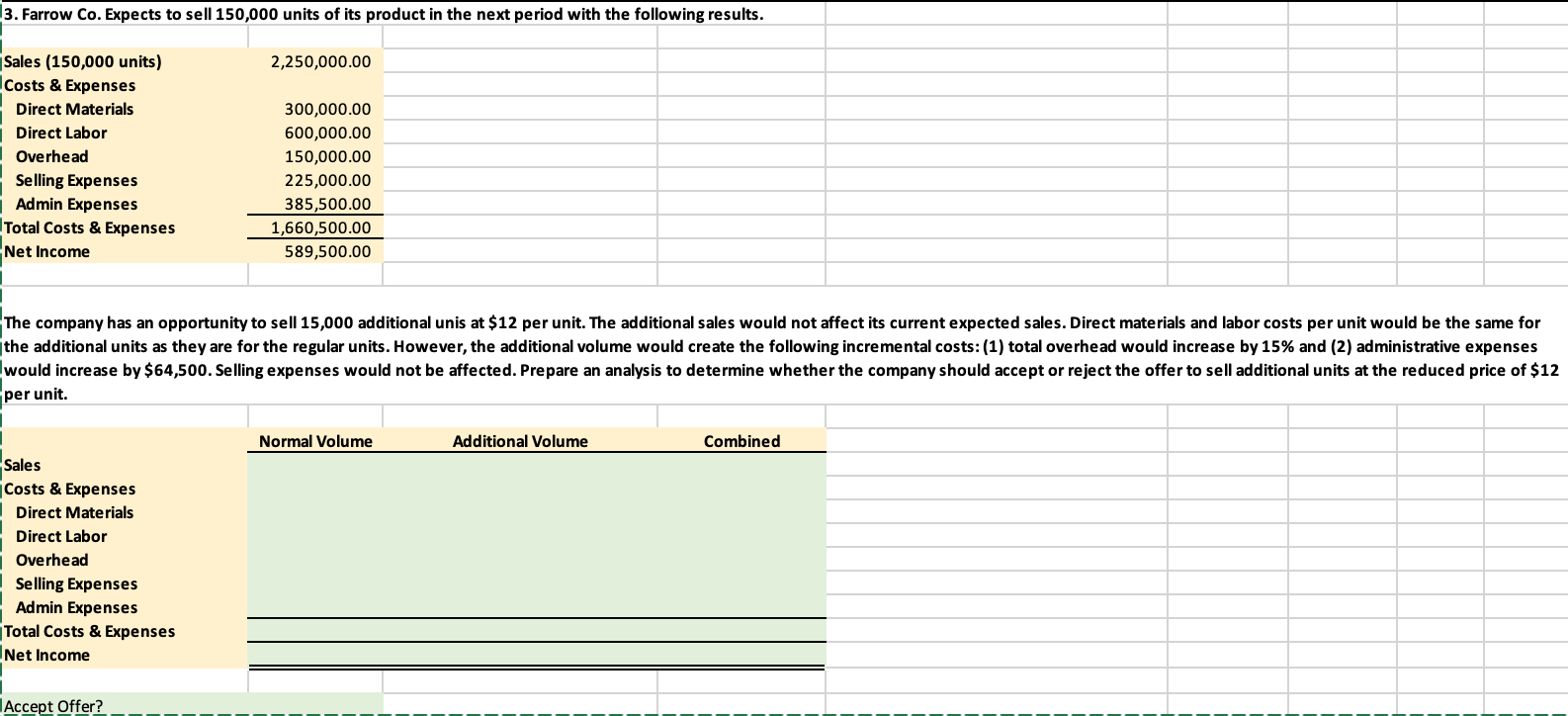

1. Heather Co. has already manufactured 28,000 units of Product A. The company is trying to determine if it should process the units of Product A further to create Product B and Product C. Information regarding the selling prices and costs of processing are below. Should the Heather Co. process the Product A units further or should they sell them as they are? Product A - # of Units Product B - # of Units Product C- # of Units 28,000.00 Product A - Selling Price (Total) 5,600.00 Product B - Selling Price/Unit 11,200.00 Product C-Selling Price/Unit 700,000.00 Processing Costs incurred to Date/Unit 105.00 Additional Processing Costs (Total) 70.00 28.00 420,000.00 Sell as Is Process Further Incremental Costs Incremental Revenue Incremental Income Decision: 2. Vance Company produces a single product and has capacity to produce 100,000 units per month. Costs to produce its current sales of 80,000 units follow. The regular selling price of the product is $100 per unit. Management is approached by a customer who wants to purchase 20,000 units of the product for $75 per unit. If the order is accepted, there will be no additional fixed manufacturing overhead and no additional fixed selling and admin expenses. The customer is not in the company's regular selling territory, so there will be a $5 per unit shipping expense in addition to the regular variable selling and administrative expenses. Determine whether management should accept or reject the new business. Per Unit Costs at 80,000 Units Special Offer Direct Materials $ 12.50 1,000,000.00 Direct Labor $ 15.00 1,200,000.00 Variable Manufacturing OH $ 10.00 800,000.00 Fixed Manufacturing OH $ 17.50 1,400,000.00 Variable Selling & Admin $ 14.00 1,120,000.00 Fixed Selling & Admin $ 13.00 1,040,000.00 Totals $ 82.00 6,560,000.00 Decision: 13. Farrow Co. Expects to sell 150,000 units of its product in the next period with the following results. 2,250,000.00 Sales (150,000 units) Costs & Expenses Direct Materials Direct Labor Overhead Selling Expenses Admin Expenses Total Costs & Expenses Net Income 300,000.00 600,000.00 150,000.00 225,000.00 385,500.00 1,660,500.00 589,500.00 The company has an opportunity to sell 15,000 additional unis at $12 per unit. The additional sales would not affect its current expected sales. Direct materials and labor costs per unit would be the same for the additional units as they are for the regular units. However, the additional volume would create the following incremental costs: (1) total overhead would increase by 15% and (2) administrative expenses would increase by $64,500. Selling expenses would not be affected. Prepare an analysis to determine whether the company should accept or reject the offer to sell additional units at the reduced price of $12 per unit. Normal Volume Additional Volume al Volume Combined Sales Costs & Expenses Direct Materials Direct Labor Overhead Selling Expenses Admin Expenses Total Costs & Expenses Net Income Accept Offer? 1. Heather Co. has already manufactured 28,000 units of Product A. The company is trying to determine if it should process the units of Product A further to create Product B and Product C. Information regarding the selling prices and costs of processing are below. Should the Heather Co. process the Product A units further or should they sell them as they are? Product A - # of Units Product B - # of Units Product C- # of Units 28,000.00 Product A - Selling Price (Total) 5,600.00 Product B - Selling Price/Unit 11,200.00 Product C-Selling Price/Unit 700,000.00 Processing Costs incurred to Date/Unit 105.00 Additional Processing Costs (Total) 70.00 28.00 420,000.00 Sell as Is Process Further Incremental Costs Incremental Revenue Incremental Income Decision: 2. Vance Company produces a single product and has capacity to produce 100,000 units per month. Costs to produce its current sales of 80,000 units follow. The regular selling price of the product is $100 per unit. Management is approached by a customer who wants to purchase 20,000 units of the product for $75 per unit. If the order is accepted, there will be no additional fixed manufacturing overhead and no additional fixed selling and admin expenses. The customer is not in the company's regular selling territory, so there will be a $5 per unit shipping expense in addition to the regular variable selling and administrative expenses. Determine whether management should accept or reject the new business. Per Unit Costs at 80,000 Units Special Offer Direct Materials $ 12.50 1,000,000.00 Direct Labor $ 15.00 1,200,000.00 Variable Manufacturing OH $ 10.00 800,000.00 Fixed Manufacturing OH $ 17.50 1,400,000.00 Variable Selling & Admin $ 14.00 1,120,000.00 Fixed Selling & Admin $ 13.00 1,040,000.00 Totals $ 82.00 6,560,000.00 Decision: 13. Farrow Co. Expects to sell 150,000 units of its product in the next period with the following results. 2,250,000.00 Sales (150,000 units) Costs & Expenses Direct Materials Direct Labor Overhead Selling Expenses Admin Expenses Total Costs & Expenses Net Income 300,000.00 600,000.00 150,000.00 225,000.00 385,500.00 1,660,500.00 589,500.00 The company has an opportunity to sell 15,000 additional unis at $12 per unit. The additional sales would not affect its current expected sales. Direct materials and labor costs per unit would be the same for the additional units as they are for the regular units. However, the additional volume would create the following incremental costs: (1) total overhead would increase by 15% and (2) administrative expenses would increase by $64,500. Selling expenses would not be affected. Prepare an analysis to determine whether the company should accept or reject the offer to sell additional units at the reduced price of $12 per unit. Normal Volume Additional Volume al Volume Combined Sales Costs & Expenses Direct Materials Direct Labor Overhead Selling Expenses Admin Expenses Total Costs & Expenses Net Income Accept Offer

Please include detailed calculations so I can understand how you arrived at the answers.

Please include detailed calculations so I can understand how you arrived at the answers.