Answered step by step

Verified Expert Solution

Question

1 Approved Answer

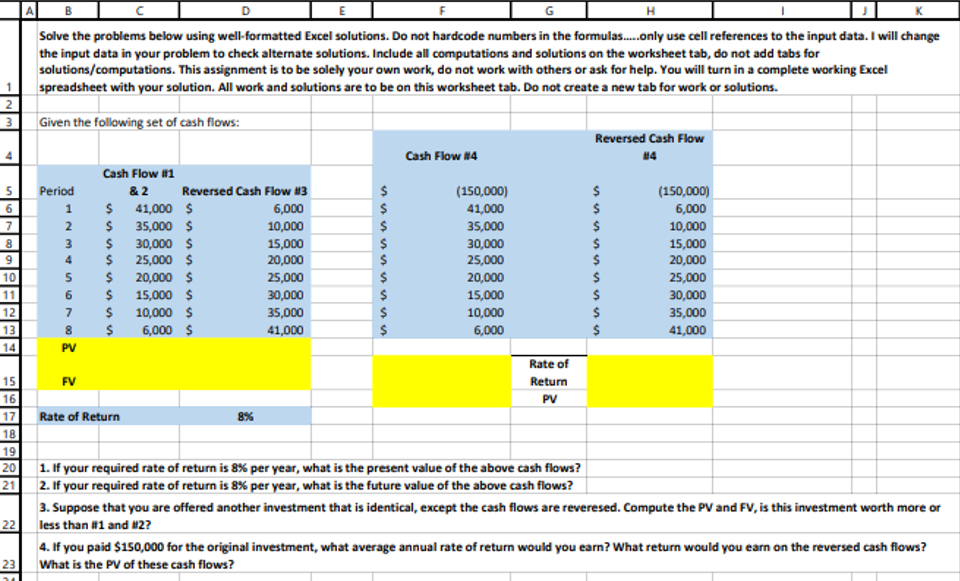

Please include excel references. Trying to check my work. I am specifically having the most trouble with question 4 H Solve the problems below using

Please include excel references. Trying to check my work. I am specifically having the most trouble with question 4

H Solve the problems below using well-formatted Excel solutions. Do not hardcode numbers in the formulas.....only use cell references to the input data. I will change the input data in your problem to check alternate solutions. Include all computations and solutions on the worksheet tab, do not add tabs for solutions/computations. This assignment is to be solely your own work, do not work with others or ask for help. You will turn in a complete working Excel spreadsheet with your solution. All work and solutions are to be on this worksheet tab. Do not create a new tab for work or solutions. 1 2 3 INIMO Given the following set of cash flows: Cash Flow #4 Reversed Cash Flow 14 $ $ $ $ $ $ $ 5 6 7 8 9 10 11 12 Cash Flow #11 Period & 2 Reversed Cash Flow #3 1 $ 41,000 $ 6,000 2 $ 35,000 $ 10,000 3 $ 30,000 $ 15,000 4 $ 25,000 $ 20,000 5 $ 20,000 $ 25,000 6 $ 15,000 $ 30,000 7 $ 10,000 $ 35,000 8 $ 6,000 $ 41,000 PV (150,000) 41,000 35,000 30,000 25,000 20,000 15,000 10,000 6,000 $ $ $ $ $ $ $ $ $ (150,000) 6,000 10,000 15,000 20,000 25,000 30,000 35,000 41,000 13 14 15 FV Rate of Return PV 16 17 Rate of Return 8% 18 19 20 21 22 1. If your required rate of return is 8% per year, what is the present value of the above cash flows? 2. If your required rate of return is 8% per year, what is the future value of the above cash flows? 3. Suppose that you are offered another investment that is identical, except the cash flows are reveresed. Compute the PV and FV, is this investment worth more or less than #1 and 12? 4. If you paid $150,000 for the original investment, what average annual rate of return would you earn? What return would you earn on the reversed cash flows? What is the PV of these cash flows? 23 H Solve the problems below using well-formatted Excel solutions. Do not hardcode numbers in the formulas.....only use cell references to the input data. I will change the input data in your problem to check alternate solutions. Include all computations and solutions on the worksheet tab, do not add tabs for solutions/computations. This assignment is to be solely your own work, do not work with others or ask for help. You will turn in a complete working Excel spreadsheet with your solution. All work and solutions are to be on this worksheet tab. Do not create a new tab for work or solutions. 1 2 3 INIMO Given the following set of cash flows: Cash Flow #4 Reversed Cash Flow 14 $ $ $ $ $ $ $ 5 6 7 8 9 10 11 12 Cash Flow #11 Period & 2 Reversed Cash Flow #3 1 $ 41,000 $ 6,000 2 $ 35,000 $ 10,000 3 $ 30,000 $ 15,000 4 $ 25,000 $ 20,000 5 $ 20,000 $ 25,000 6 $ 15,000 $ 30,000 7 $ 10,000 $ 35,000 8 $ 6,000 $ 41,000 PV (150,000) 41,000 35,000 30,000 25,000 20,000 15,000 10,000 6,000 $ $ $ $ $ $ $ $ $ (150,000) 6,000 10,000 15,000 20,000 25,000 30,000 35,000 41,000 13 14 15 FV Rate of Return PV 16 17 Rate of Return 8% 18 19 20 21 22 1. If your required rate of return is 8% per year, what is the present value of the above cash flows? 2. If your required rate of return is 8% per year, what is the future value of the above cash flows? 3. Suppose that you are offered another investment that is identical, except the cash flows are reveresed. Compute the PV and FV, is this investment worth more or less than #1 and 12? 4. If you paid $150,000 for the original investment, what average annual rate of return would you earn? What return would you earn on the reversed cash flows? What is the PV of these cash flows? 23Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started