Please include excel sheet on how to answer the following questions: What is the present value of the property, under each scenario, using a discounted cash flow analysis? What is the internal rate of return for the property? Which project scenario would you recommend to management, and why?

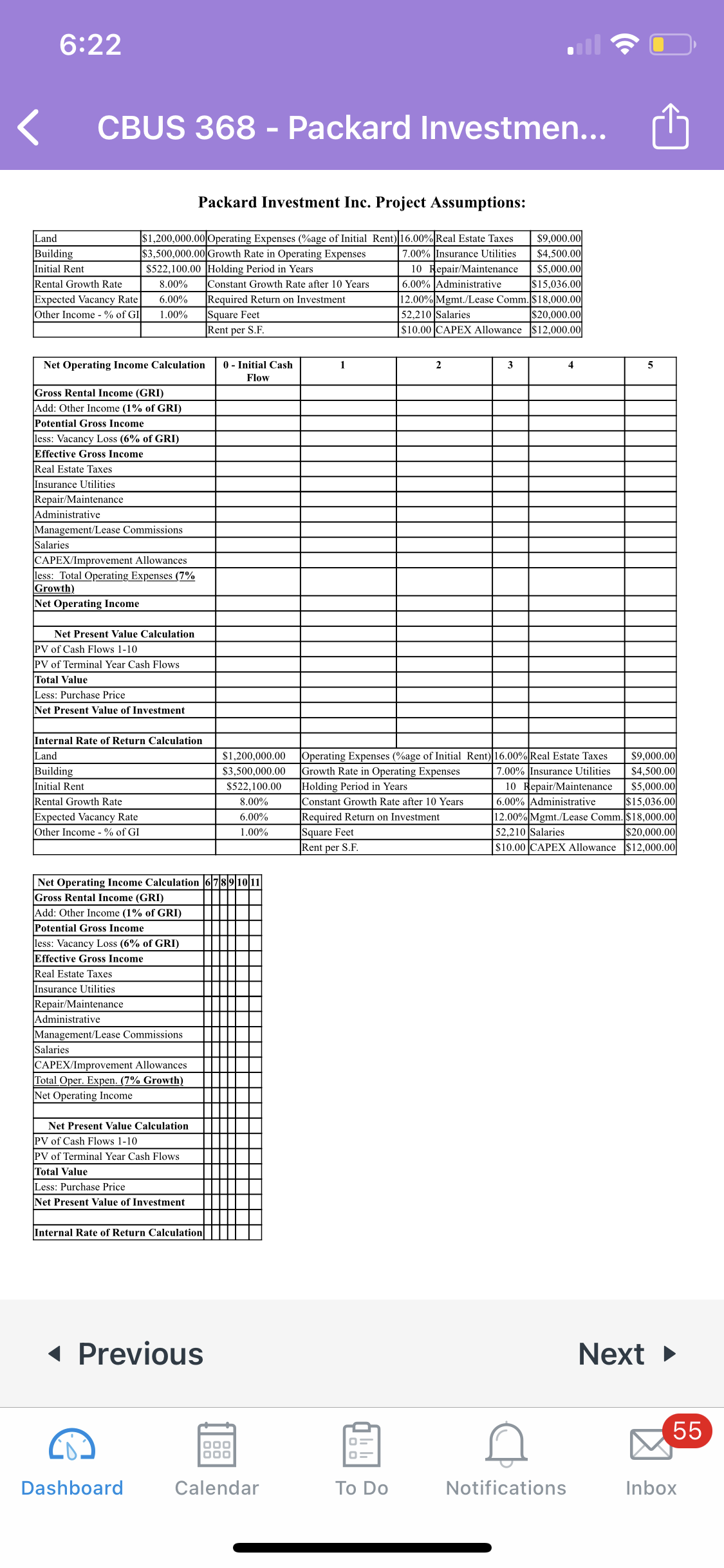

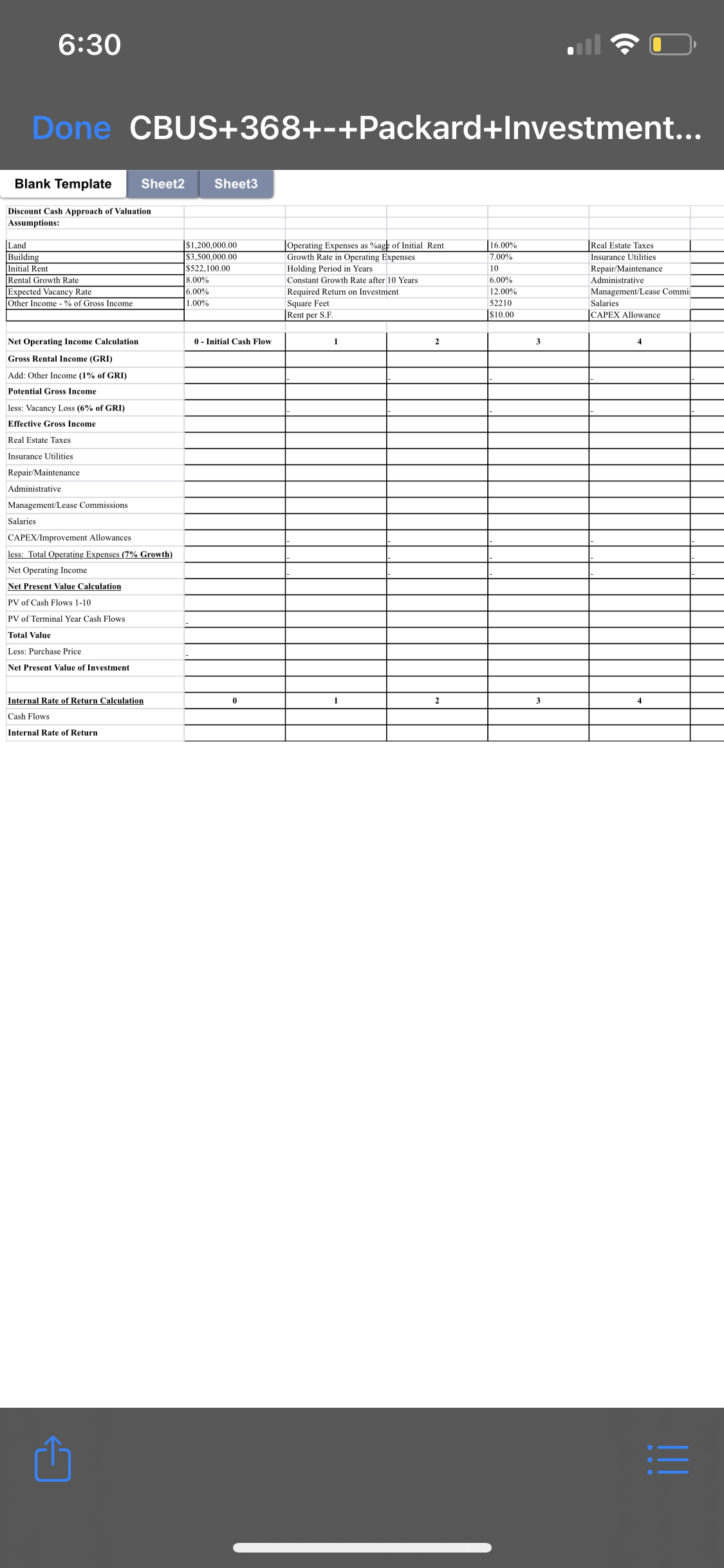

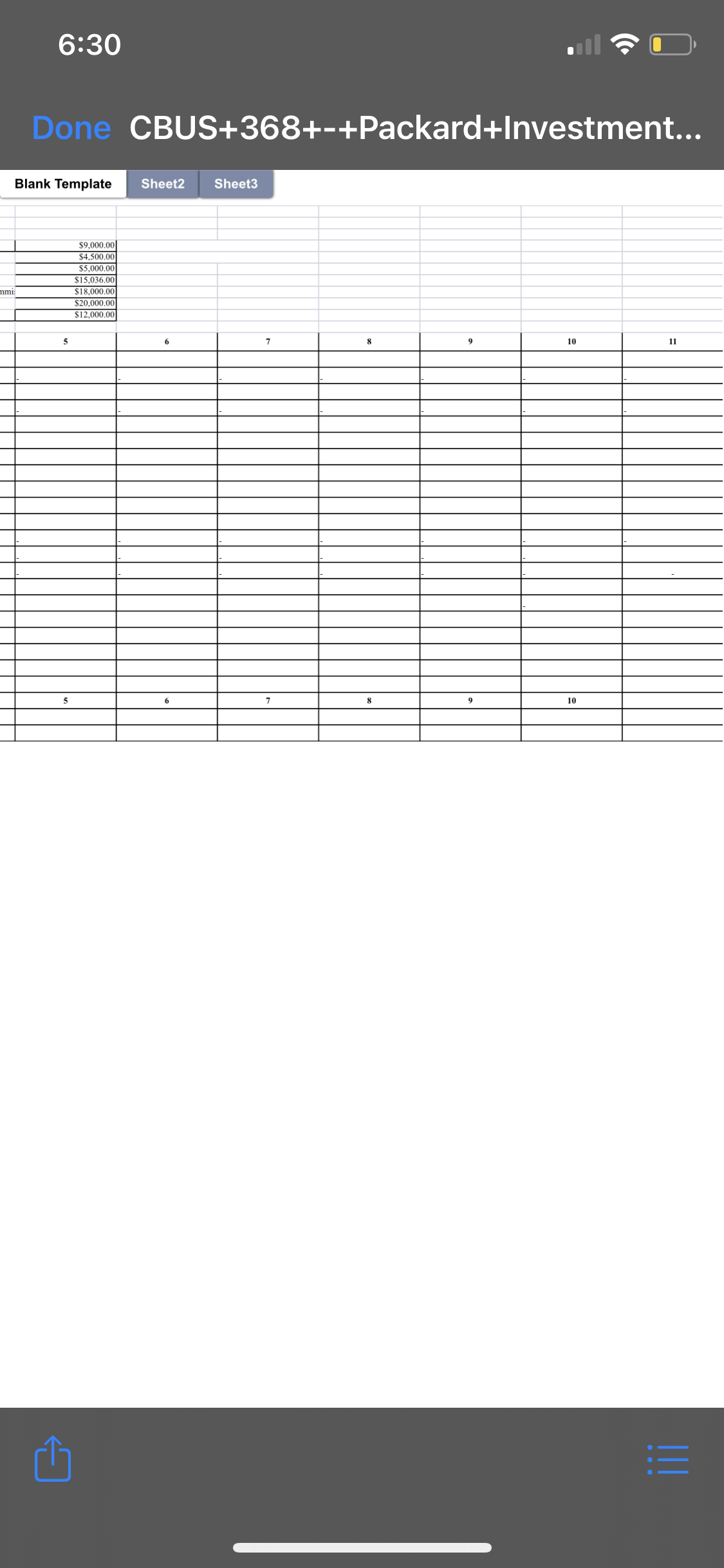

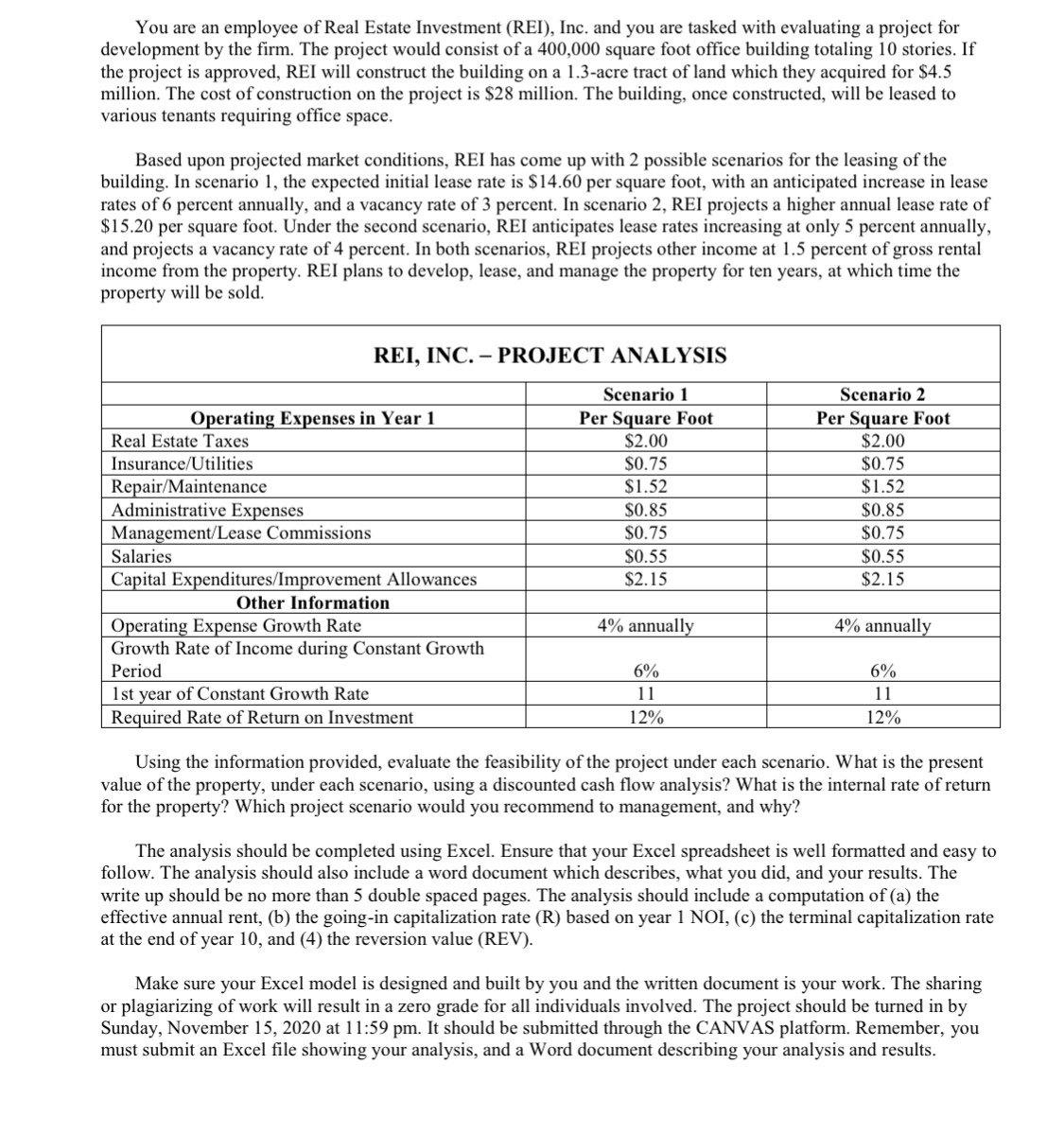

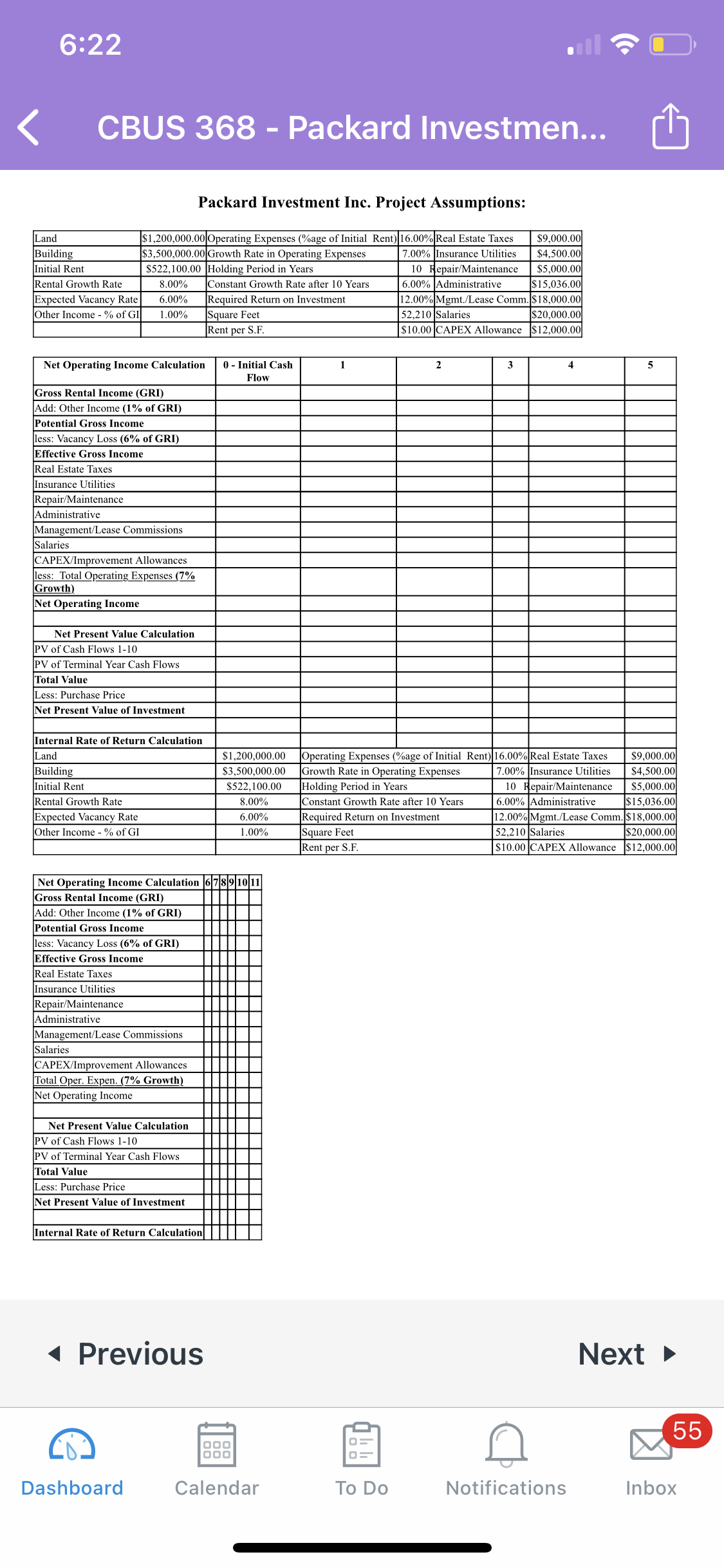

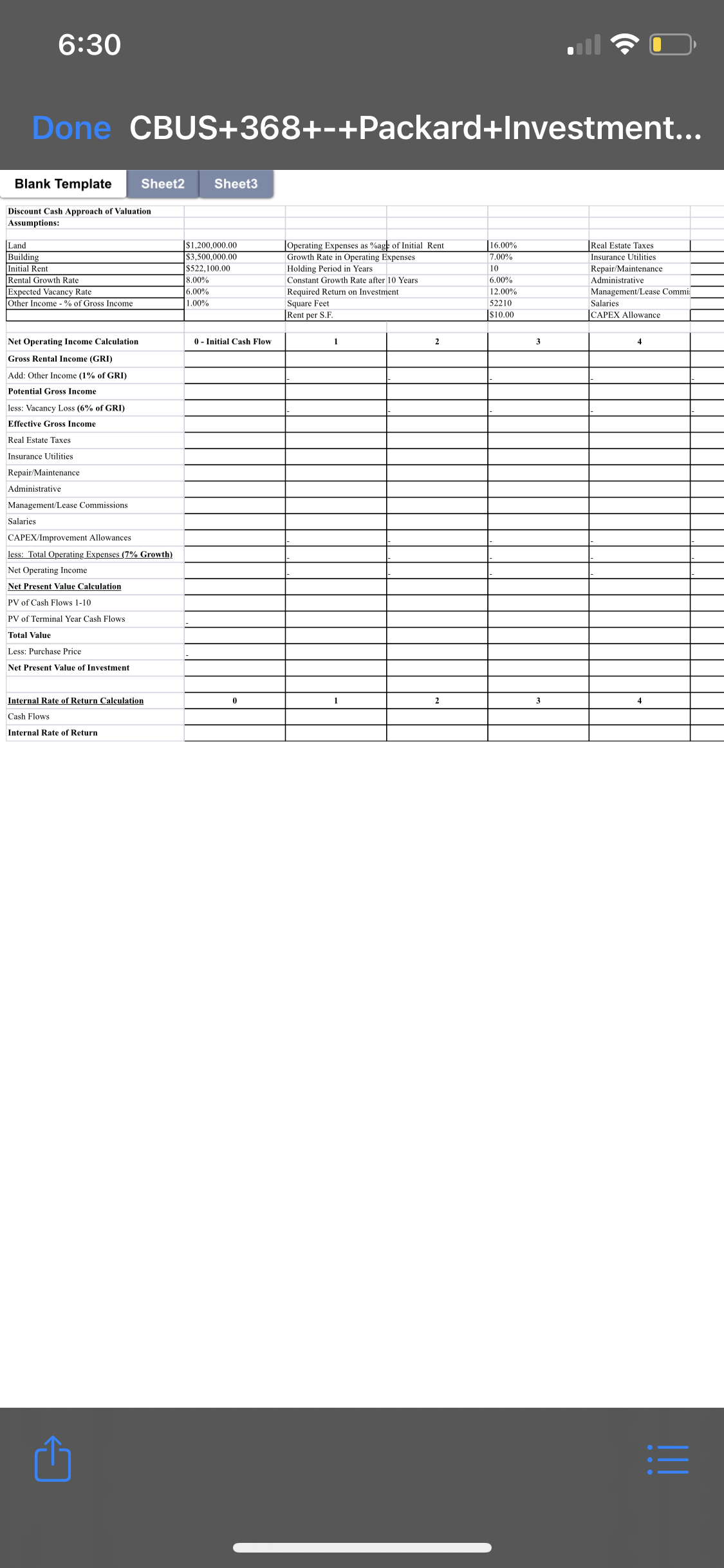

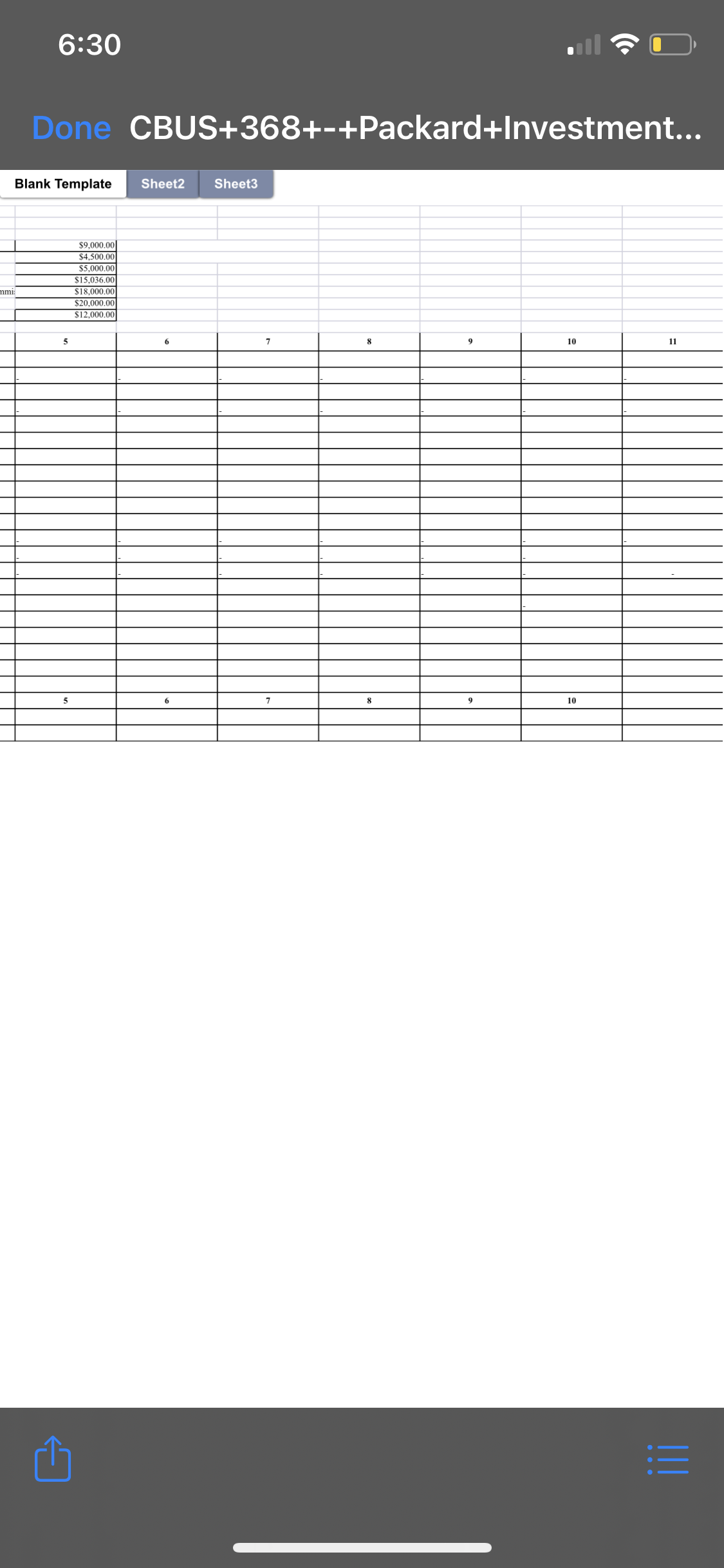

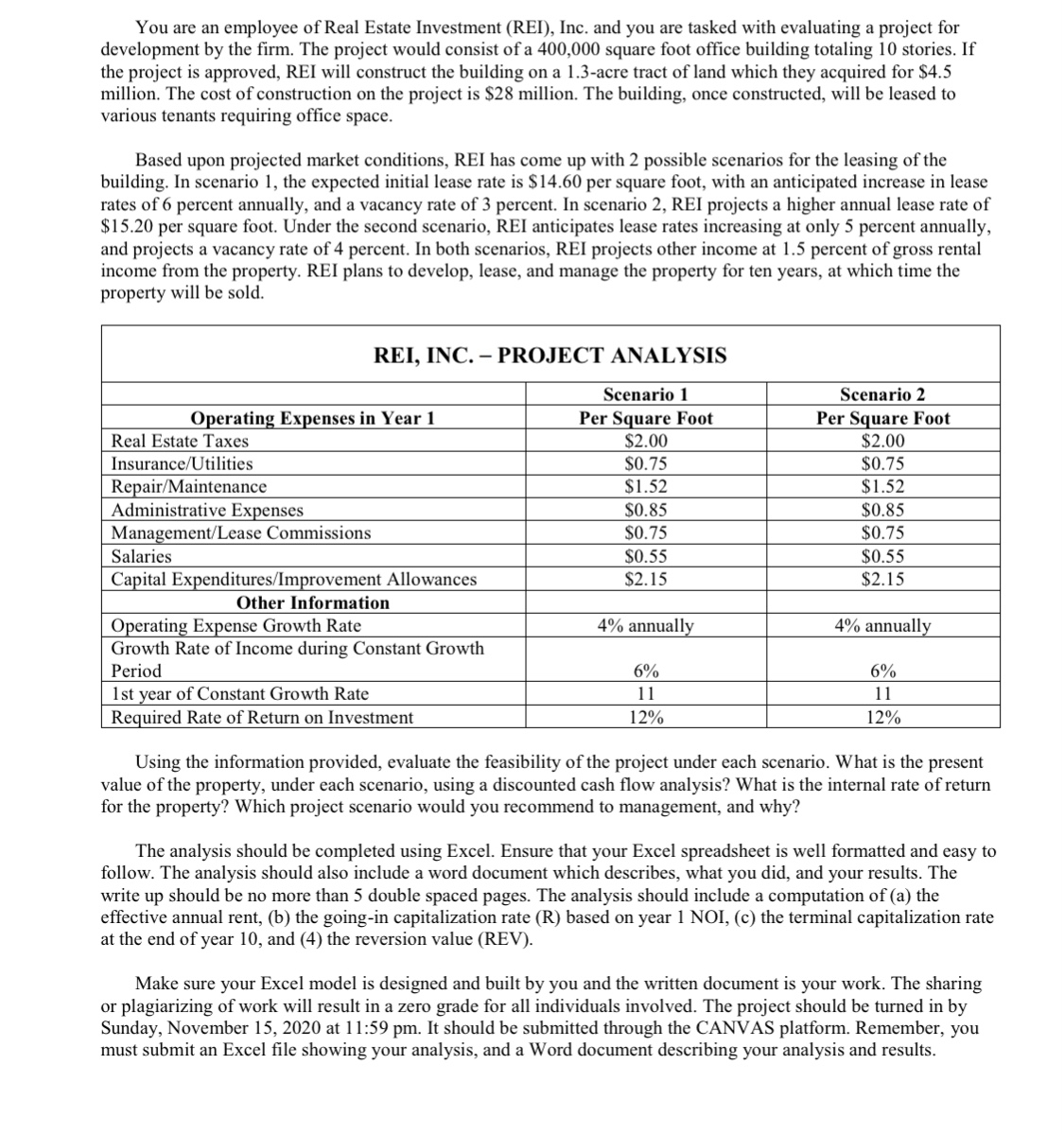

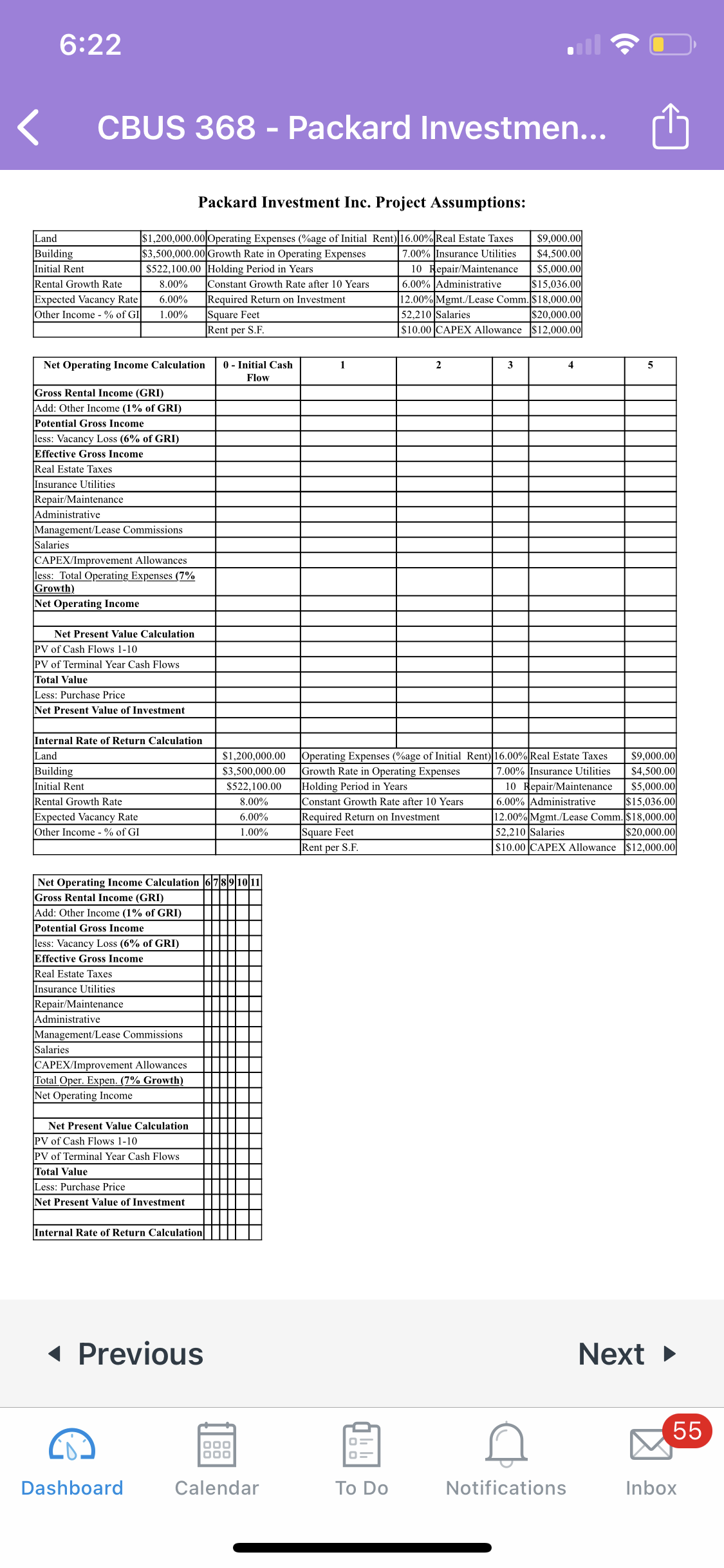

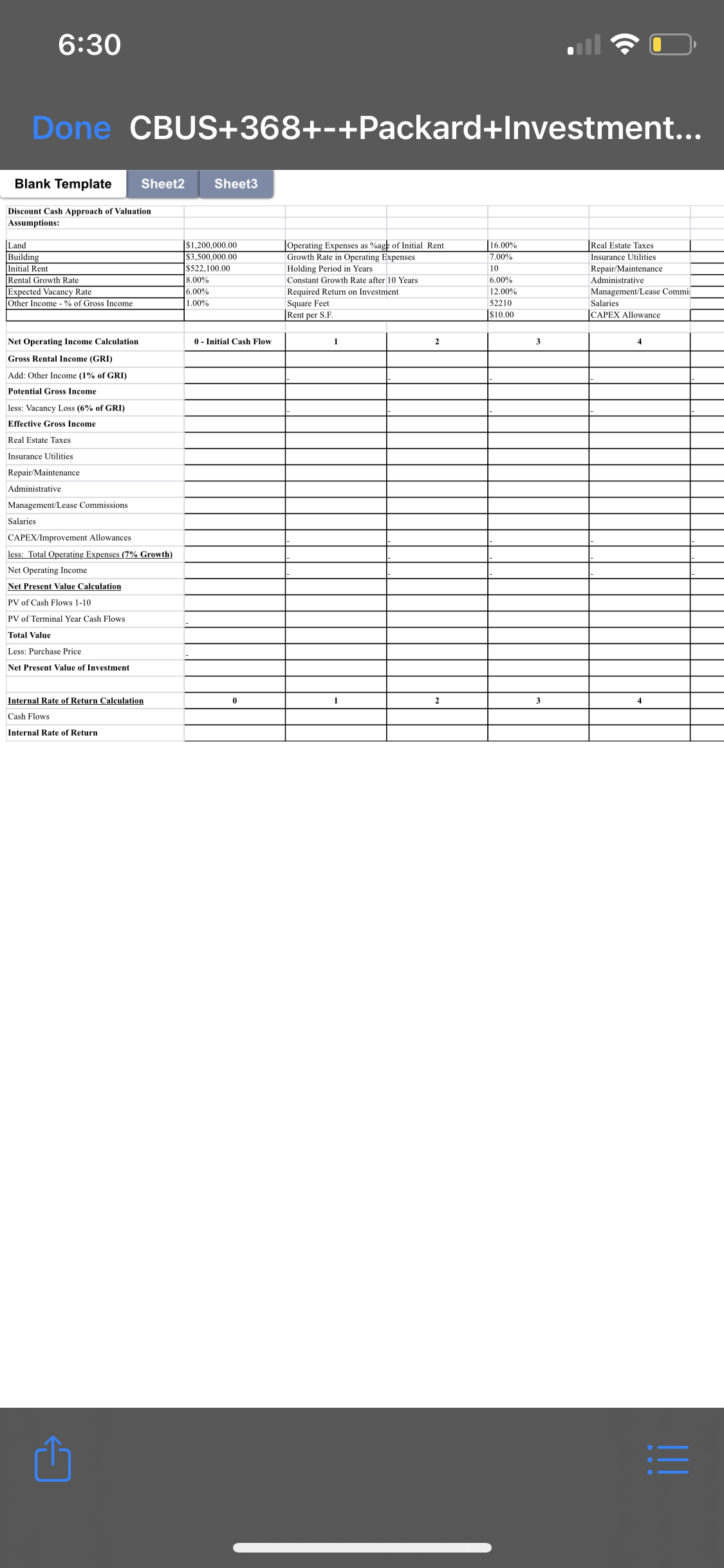

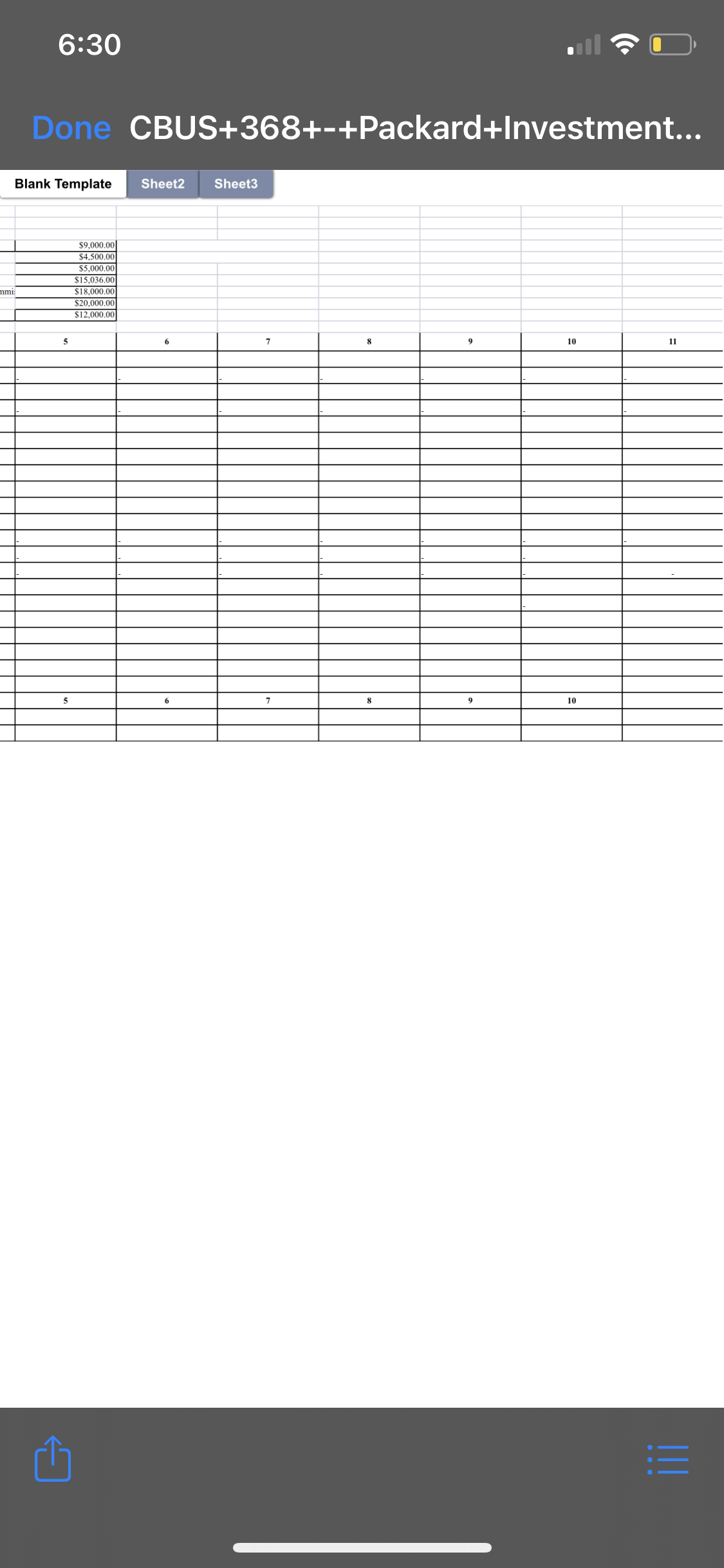

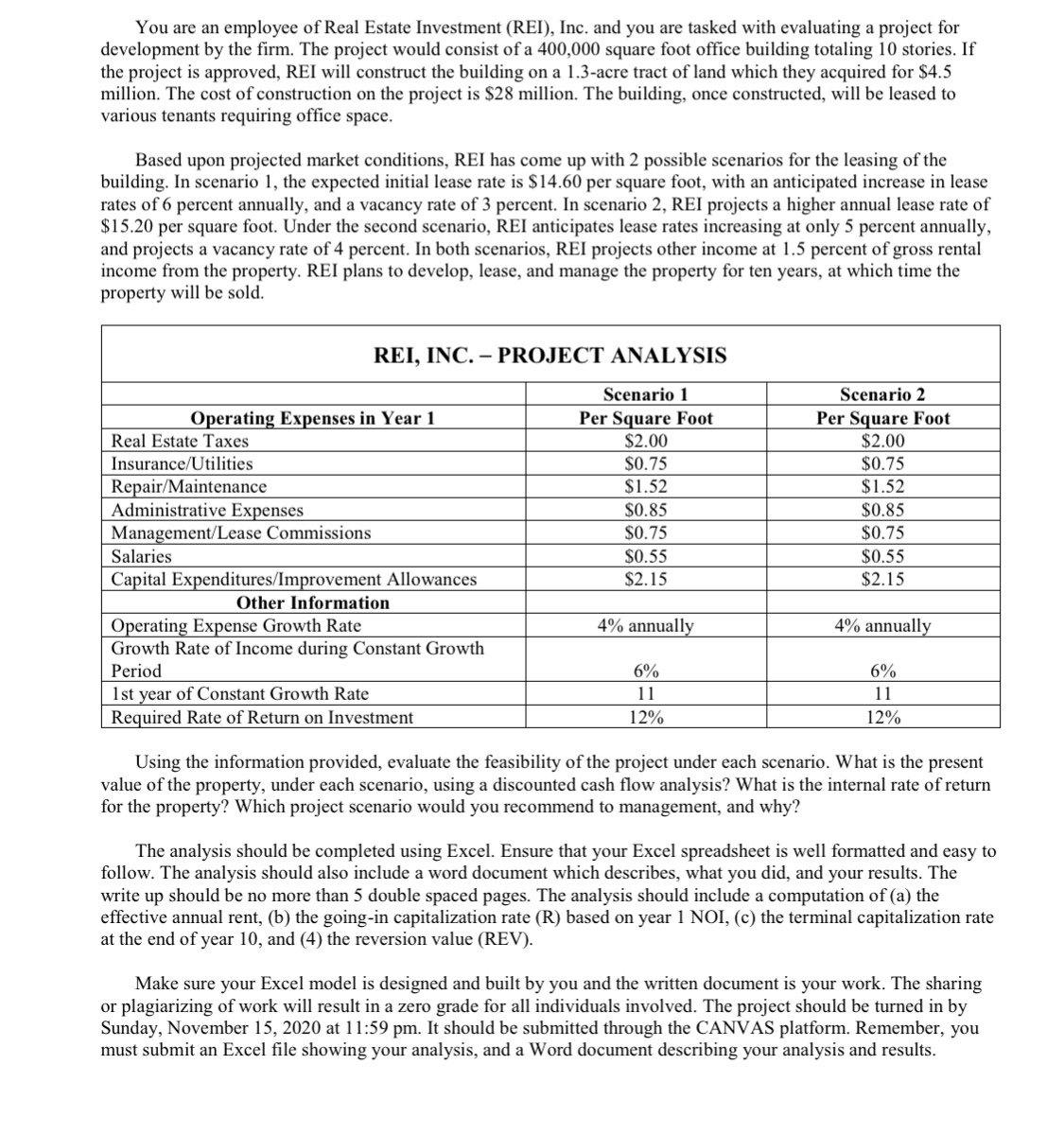

6:22 O K CBUS 368 - Packard Investmen... Packard Investment Inc. Project Assumptions: Land $1,200,000.00 Operating Expenses (oage of Initial Rent) 16.00% Real Estate Taxes $9,000.00 Building $3,500,000.00 Growth Rate in Operating Expenses 7.00% Insurance Utilities $4,500.00 Initial Rent $522, 100.00 Holding Period in Years 10 Repair/Maintenance $5,000.00 Rental Growth Rate 3.00% Constant Growth Rate after 10 Years 6.00% Administrative $15,036.00 Expected Vacancy Rate 6.00% Required Return on Investment 12.00% Mgmt./Lease Comm. $18,000.00 Other Income - % of GI 1.00% Square Feet 52,210 Salaries $20,000.00 Rent per S.F $10.00 CAPEX Allowance $12,000.00 Net Operating Income Calculation 0 - Initial Cash 2 Flow Gross Rental Income (GRI) Add: Other Income (1% of GRI) Potential Gross Income less: Vacancy Loss (6% of GRI) Effective Gross Income Real Estate Taxes Insurance Utilities Repair/Maintenance Administrative Management/Lease Commissions Salaries CAPEX/Improvement Allowances less: Total Operating Expenses (7% Growth) Net Operating Income Net Present Value Calculation PV of Cash Flows 1-10 PV of Terminal Year Cash Flows Total Value Less: Purchase Price Net Present Value of Investment Internal Rate of Return Calculation Land $1,200,000.00 Operating Expenses (%age of Initial Rent) 16.00% Real Estate Taxes $9,000.00 Building $3,500,000.00 Growth Rate in Operating Expenses 7.00% Insurance Utilities $4,500.00 Initial Rent $522, 100.00 Holding Period in Years 10 Repair/Maintenance $5,000.00 Rental Growth Rate 8.00% Constant Growth Rate after 10 Years 6.00% Administrative $15,036.00 Expected Vacancy Rate 6.00% Required Return on Investment 12.00% Mgmt./Lease Comm. $18,000.00 Other Income - % of GI 1.00% Square Feet 52,210 Salaries $20,000.00 Rent per S.F. $10.00 CAPEX Allowance $12,000.00 Net Operating Income Calculation 6 7 8 9 10 11 Gross Rental Income (GRI) Add: Other Income (1% of GRI) Potential Gross Income less: Vacancy Loss (6% of GRI) Effective Gross Income Real Estate Taxes Insurance Utilities Repair/Maintenance Administrative Management/Lease Commissions Salaries CAPEX/Improvement Allowances Total Oper. Expen. (7% Growth Net Operating Income Net Present Value Calculation PV of Cash Flows 1-10 PV of Terminal Year Cash Flows Total Value Less: Purchase Price Net Present Value of Investment Internal Rate of Return Calculation Previous Next 55 OOO 0= O= Dashboard Calendar To Do Notifications Inbox6:30 Done CBUS+368+-+Packard+Investment... Blank Template Sheet2 Sheet3 Discount Cash Approach of Valuation Assumptions: Land $1,200,000.00 Building $3,500,000.00 Operating Expenses as %age of Initial Rent 16.00% Real Estate Taxes 7.00% Initial Rent $522,100.00 Growth Rate in Operating Expenses Holding Period in Years Insurance Utilities 10 Rental Growth Rate 8.00% Repair/Maintenance Constant Growth Rate after 10 Years 6.00% Administrative Expected Vacancy Rate 6.00% Required Return on Investment 12.00% Management/Lease Commi Other Income - % of Gross Income 1.00% Square Feet 52210 Salaries Rent per S.F. $10.00 CAPEX Allowance Net Operating Income Calculation 0 - Initial Cash Flow 2 3 Gross Rental Income (GRI) Add: Other Income (1% of GRI) Potential Gross Income less: Vacancy Loss (6% of GRI) Effective Gross Income Real Estate Taxes Insurance Utilities Repair/Maintenance Administrative Management/Lease Commissions Salaries CAPEX/Improvement Allowance less: Total Operating Expenses (7% Growth) Net Operating Income Net Present Value Calculation PV of Cash Flows 1-10 PV of Terminal Year Cash Flows Total Value Less: Purchase Price Net Present Value of Investment Internal Rate of Return Calculation 0 2 3 4 Cash Flows Internal Rate of Return E\fYou are an employee of Real Estate Investment (REI), Inc. and you are tasked with evaluating a project for development by the firm. The project would consist of a 400,000 square foot office building totaling 10 stories. If the project is approved, REI will construct the building on a 1.3-acre tract of land which they acquired for $4.5 million. The cost of construction on the project is $28 million. The building, once constructed, will be leased to various tenants requiring office space. Based upon projected market conditions, REI has come up with 2 possible scenarios for the leasing of the building. In scenario 1, the expected initial lease rate is $14.60 per square foot, with an anticipated increase in lease rates of 6 percent annually, and a vacancy rate of 3 percent. In scenario 2, REI projects a higher annual lease rate of $15.20 per square foot. Under the second scenario, REI anticipates lease rates increasing at only 5 percent annually, and projects a vacancy rate of 4 percent. In both scenarios, REI projects other income at 1.5 percent of gross rental income from the property. REI plans to develop, lease, and manage the property for ten years, at which time the property will be sold. REI, INC. - PROJECT ANALYSIS Scenario 1 Scenario 2 Operating Expenses in Year 1 Per Square Foot Per Square Foot Real Estate Taxes $2.00 $2.00 Insurance/Utilities $0.75 $0.75 Repair/Maintenance $1.52 $1.52 Administrative Expenses $0.85 $0.85 Management/Lease Commissions $0.75 $0.75 Salaries $0.55 $0.55 Capital Expenditures/Improvement Allowances $2.15 $2.15 Other Information Operating Expense Growth Rate 4% annually 4% annually Growth Rate of Income during Constant Growth Period 6% 6% 1 st year of Constant Growth Rate 11 11 Required Rate of Return on Investment 12% 12% Using the information provided, evaluate the feasibility of the project under each scenario. What is the present value of the property, under each scenario, using a discounted cash flow analysis? What is the internal rate of return for the property? Which project scenario would you recommend to management, and why? The analysis should be completed using Excel. Ensure that your Excel spreadsheet is well formatted and easy to follow. The analysis should also include a word document which describes, what you did, and your results. The write up should be no more than 5 double spaced pages. The analysis should include a computation of (a) the effective annual rent, (b) the going-in capitalization rate (R) based on year 1 NOI, (c) the terminal capitalization rate at the end of year 10, and (4) the reversion value (REV). Make sure your Excel model is designed and built by you and the written document is your work. The sharing or plagiarizeng of work will result in a zero grade for all individuals involved. The project should be turned in by Sunday, November 15, 2020 at 1 1:59 pm. It should be submitted through the CANVAS platform. Remember, you must submit an Excel file showing your analysis, and a Word document describing your analysis and results