Answered step by step

Verified Expert Solution

Question

1 Approved Answer

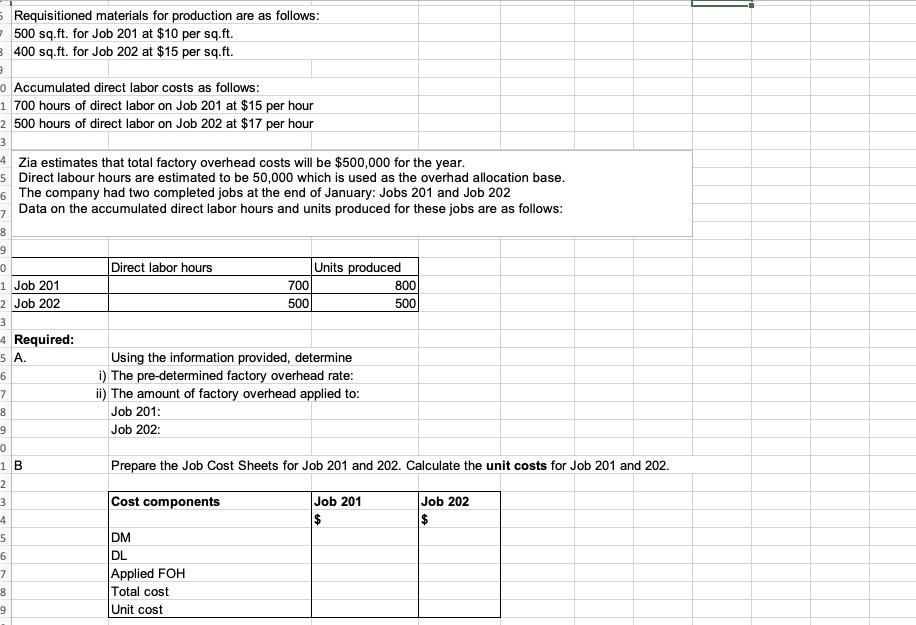

Please include formulas Requisitioned materials for production are as follows: 500 sq.ft. for Job 201 at $10 per sq.ft. 400 sq.ft. for Job 202 at

Please include formulas

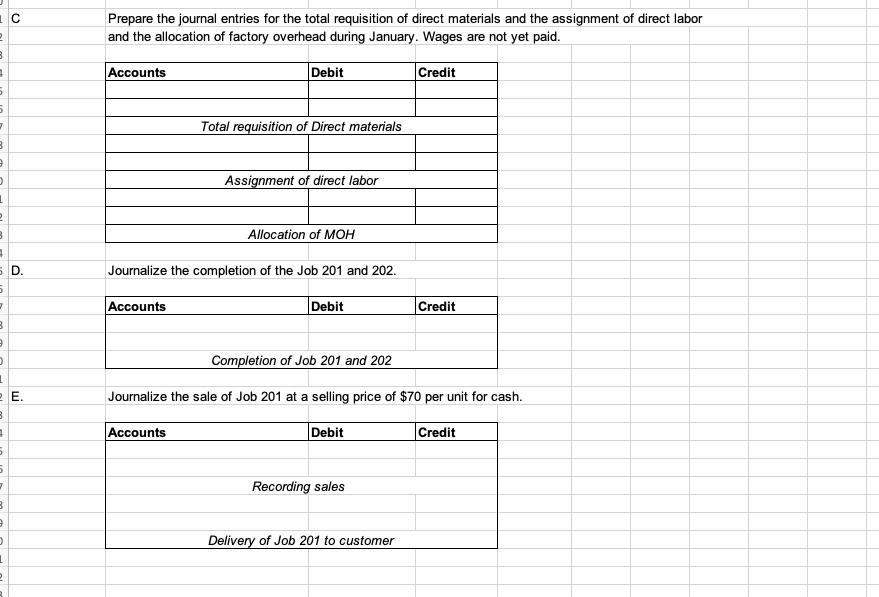

Requisitioned materials for production are as follows: 500 sq.ft. for Job 201 at $10 per sq.ft. 400 sq.ft. for Job 202 at $15 per sq.ft. 0 Accumulated direct labor costs as follows: 1 700 hours of direct labor on Job 201 at $15 per hour 2 500 hours of direct labor on Job 202 at $17 per hour 3 4 Zia estimates that total factory overhead costs will be $500,000 for the year. 5 Direct labour hours are estimated to be 50,000 which is used as the overhad allocation base. 6 The company had two completed jobs at the end of January: Jobs 201 and Job 202 Data on the accumulated direct labor hours and units produced for these jobs are as follows: 7 8 Direct labor hours 9 0 1 Job 201 2 Job 202 3 4 Required: 5 A. Units produced 700 800 500 500 6 7 Using the information provided, determine i) The pre-determined factory overhead rate: ii) The amount of factory overhead applied to: Job 201: Job 202: 8 9 0 1 B Prepare the Job Cost Sheets for Job 201 and 202. Calculate the unit costs for Job 201 and 202. 2 3 Cost components Job 201 $ Job 202 $ 4 5 6 7 DM DL Applied FOH Total cost Unit cost 8 9 Prepare the journal entries for the total requisition of direct materials and the assignment of direct labor and the allocation of factory overhead during January. Wages are not yet paid. 2 3 Accounts Debit Credit 5 5 7 Total requisition of Direct materials 3 Assignment of direct labor 1 2 B Allocation of MOH 5 D. Journalize the completion of the Job 201 and 202. Accounts Debit Credit 3 Completion of Job 201 and 202 E. Journalize the sale of Job 201 at a selling price of $70 per unit for cash. B Accounts Debit Credit 5 5 Recording sales 3 Delivery of Job 201 to customer 1 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started